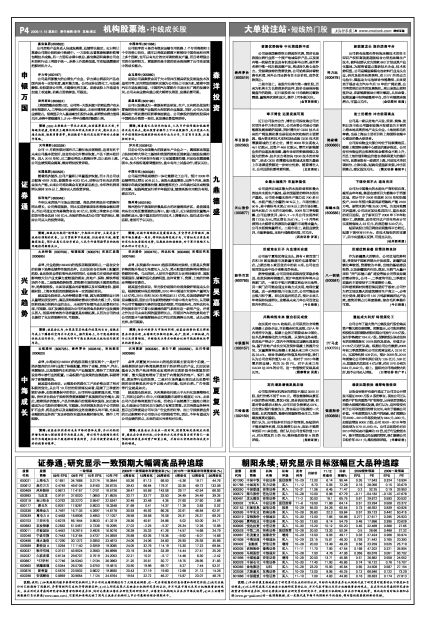

| 申银万国 | 嘉宝集团(600622) | 中国神华(601088) | 森洋投资 | 公司房地产业务进入快速发展期,业绩增长稳定。近日转让高泰公司部分股权给中核建中,一方面标志着高泰核燃料锆管包鞘技术成熟,另一方面标志着中核总、嘉宝集团和高泰公司在利益和行动上将趋于统一。走势上升趋势加速,可在短线震荡时把握时机介入。 公司独享的4条自有煤炭运输专用铁路、1个专用海港和3个专用港口泊位,既可以将煤炭源源不断销往中国各地和世界上多个国家,也可以有充分的空间调控煤炭产量,而且将增强公司的市场控制力,更重要的是丰富的现金流保障了公司在逆境中的成长能力。

伊力特(600197) 金马股份(000980)

公司是西部最大的白酒生产企业,伊力牌白酒系列产品在国内具有一定知名度,盈利能力强。公司还涉足煤化工、电池碳酸锂、持股期货公司等,主题催化剂丰富。走势该股上升通道有加速上攻迹象,前高点面临解放,可跟进。 前期公司募集资金用于大中型冲压模具研发及制造技术改造项目等,定向增发的顺利实施为公司抢占市场先机,随着中国汽车市场发展迅猛,中国的汽车零配件市场还有广阔的发展空间,公司未来业绩有望出现大幅增长局面,发展前景可期。

益民商业(600824) 复星医药(600196)

上海国资整合政策已定,公司同一大股东旗下的商业资产在未来有预期注入,三季报公布业绩增长稳定,未来世博商机更有提升业绩看点。报表显示介入基金减仓但股价未跌,新增资金潜力值得关注,走势中期稳健向上,9元一带平台整理后酝酿上突。 公司已发展成为一家既有药品研发、生产,又有药品批发和零售的拥有完整产业链的大型医药企业集团。同时,公司大力发展具备广阔前景的医药零售连锁业,公司参股的国药控股保持中国药品分销第一地位,其发展前景值得期待。

| 策略:3200点整数关一带压力显现,权重蓝筹裹足不前,市场避实就虚,有现实主题催化的品种成为做多方向,建议关注上海本地股、酒类消费类等。轻指数重个股仍是近期市场的主要操作策略。 | 策略:随着奥巴马访华的临近,人民币升值问题和低碳将再次成为热点。建议投资者操作上可以波段操作,关注受益人民币升值预期和低碳经济相关的行业与公司,不宜盲目追高,注意控制仓位。 |

| 证券通 | 天利高新(600339) | 泸天化(000912) | 九鼎德盛 | 公司11月商务部对国外己二酸征收反倾销税,这将有利于未来公司基本面变好,这会拉动化纤需求恢复,产品下游开始好转。进入2010年初,己二酸也将进入销售旺季,加上油价上涨,公司业绩预期会提高,维持增持投资评级。 目前公司为全国最大的尿素生产企业之一,属国家政策重点扶持的特大型化工基地和我国西部地区国家重点鼓励发展的产业。近几个月来在半年线下方反复震荡拉锯,目前处在震荡整固中,技术指标逐渐调整到位,盘中有向上试盘动作,建议关注。

长园集团(600525) 中国石化(600028)

随着经济复苏,公司产量和订单量逐步恢复,而8月公司成功配售4929万股,募集资金4023亿元,使得公司有充足的资金加大产能,未来公司将陆续会有更多新品推出,全年净利润将增长保持30%以上,维持买入的投资评级。 公司是世界级规模的一体化能源化工公司,预计2009年业绩将同比增长50%以上。该股大盘蓝筹股,近两个月来,该股围绕半年线反复震荡拉锯,蓄势整理充分,半年线对其形成较强的支撑。短线再度运行至半年线区域,继续杀跌空间较为有限,建议关注。

保利地产(600048) 锦州港(600190)

今年以来房地产市场出现回暖,商品房和商品住宅销售均同比增长,公司表现强势,同比实现销售面积和销售金额双增长,而公司通过定向募集资金达80亿元,使得三季度末公司帐面货币资金达到166亿元,充裕的资金成为公司扩张的保证,维持公司买入的投资评级。 锦州港位于我国经济最具活力的环渤海经济区,是我国通向东北亚地区最便捷的出海口。盘口显示,近日该股低位量能开始温和放大,鉴于基本面尚可且技术上调整充分,低位成交开始活跃,逢低可予以关注。

| 策略:短线我们期待“超预期”,中期依旧看好,主要是基于流动性预期的改善。10月贷款季节性放缓,但流动性不减,储蓄搬家恢复。预计在奥巴马访华前后,人民币升值预期带来的热钱问题值得继续关注。 | 策略:近期市场维持反复震荡状态,多空争夺异常激烈,短期市场在横盘一周后,将伺机选择突破方向,可密切关注消息面的变化和权重股的走势。近期板块轮动较快,对于累计涨幅不大的品种以守仓为主。 |

| 兴业趋势 | 大冶特钢(000708)、恒瑞医药(600276)和双汇发展(000895) | 华光股份(600475)、科达机电(600499)和福田汽车(600166) | 东吴嘉禾 |

点评:兴业趋势(163402)的选股思路强调两点,一是在安全的前提下选择业绩弹性强的品种。比如说在仓位结构上配置医药股、食品饮料业等防御性品种的同时,也积极关注受经济周期影响较大但产业支撑力度较强的煤炭、房地产、保险、钢铁等板块的个股。二是强势趋势投资,即根据市场的活跃主题类投资品种,选择强势股。比如说该基金对新能源以及环保概念股、重组题材股、上海本地股的挖掘就具有一定的超前意识。 点评:东吴嘉禾(165801)选股思路相对独特,主要是从资源价格的涨升推动力角度切入,认为,美元贬值的趋势将持续推动资源的价格。与此同时,人民币升值的压力还将持续存在、通胀预期强烈、储蓄的活化趋势明显,这种背景下,资源、土地的价格还将维持在高位。

就其重仓股来说,大冶特钢前景不错,因为我国钢铁业已经从量增到质变时代,高品质特殊钢材需求比例将大幅上升。恒瑞医药则是仿制药企业的龙头,未来的可持续性成长前景相对乐观,可跟踪。双汇发展则是因为公司所处的食品饮料行业发展势头喜人,低温冷鲜肉的市场容量更是持续拓展,从而为公司的成长提供了充足的驰骋空间,可跟踪。 就其重仓股来说,华光股份是国内垃圾焚烧炉制造龙头企业,根据国家环保总局预测,2010年中国城市垃圾年产量将为1.52亿吨,2015年和2020年将达到2.1亿吨,垃圾焚烧锅炉将迎来爆发期,因此公司在新增焚烧炉市场中将大有作为,从而赋予公司节能减排先锋的估值溢价预期,可低吸持有。而科达机电的优势则在于正着力发展清洁煤气系统化这一新型产业,并将之作为公司未来利润的重要增长点。而福田汽车的优势则在于公司的重卡与新能源混合动力汽车的发展势头乐观,成长动能充沛,故可跟踪。

| 策略:该基金认为,如果没有其他意外政策的出台,指数在年底上下腾落的空间并不是很大。操作策略上,尽可能选择阶段性热点进行参与,并积极为明年可能出现的热点板块进行提前布局。 | 策略:结合对经济与市场的判断,该基金投资的重点将配置在估值合理,业绩确定性强的金融、地产、能源、工程机械、汽车以及消费领域,并继续关注哥本哈根会议给节能减排板块带来的投资机会。 |

| 中海成长 | 云维股份(600725)、贵州茅台(600519)、吉林敖东(000623) | 天利高新(600339)、老白干酒(600559)、北巴传媒(600386) | 华夏复兴 |

点评:中海成长(163901)的选股思路主要有两个,一是对于经济复苏的先导行业做了积极配置,增持了金融、房地产、汽车、采掘板块,以及围绕汽车和房地产产业链复苏,维持了工程机械设备等中游行业的配置。二是根据产业政策的发展趋势,积极增持了新能源板块。 点评:华夏复兴(160312)的选股思路主要有两个前提,一是根据经济运行格局选择受益于经济增长的产业,比如说该基金认为资产泡沫将推动宏观经济实现阶段性持续复苏的判断,最大限度地增持了受益于内需复苏的地产、银行、钢铁、煤炭等行业的股票。二是对市场容量乐观且成长前景明朗的泛消费类品种也予以极大的兴趣,包括白酒、广告传媒等行业就是如此。

就其重仓股来说,云维股份的煤化工产品价格出现了相对积极的变化,从公司10月份的经营情况来看,延续了三季度的较好走势,如按照最保守的估计,公司明年业绩更显乐观,可跟踪。贵州茅台则由于独特的资源禀赋赋予其强势的定价能力,因此,随着经济的复苏,产品价格提升的预期再次强烈,如此就有望成为公司股价的催化剂,可跟踪。而吉林敖东则由于公司的铁矿石业务、药品业务以及金融股权业务发展势头均不错,尤其是金融股权业务的广发证券股权有望迎来题材催化剂,操作上可跟踪。 就其重仓股来说,天利高新依托独山子大石化发展精细化工,而在过去的5年中,中国聚氨酯市场增长幅度近15%,未来公司产品价格将更趋于乐观。而老白干虽然属于二线地方酒企业,但是该公司在河北市场的占有率非常高。北巴传媒业务特性显示出四季度是公司车身广告业务的旺季,加上亏损旅游业务的正式剥离和子公司变分公司的税收节约,因此,今年有望成为公司业绩的拐点,未来的成长性将相对乐观。

| 策略:该基金依然看好未来市场的整体走势,并以此轮经济增长的核心驱动因素作为配置主线,将以明年业绩增长确定性作为构建组合和个股选择的首要因素,力求为投资者谋求更好的投资回报率。 | 策略:该基金认为未来一段时间,投资策略是要做反向投资,建议在合适的时机、以合适的方式逐步偏离当前市场已一致预期的经济复苏的资产配置主线,并转向与宏观经济相关度不高的领域。 |