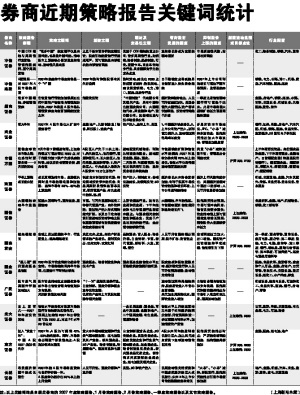

名称 标题 交易性主题 发展的因素 上涨的因素 或目标点位

中信 中国ODI崛起与周期性行业重估; “做多中国”的主题不仅是内涵式的,也将是外延式的。推动股市上涨的核心因素是业绩推动,流动性只是表象 立足于基本面分析的主题投资;股改引起的重估行情接近尾声,更可能的是内部板块的内部估值调整 受益于ODI崛起的重点公司:诸多周期性行业,如钢铁、装备制造、船舶制造、石化、重型卡车、商务车等细分行业;具备国际竞争力的龙头企业 业绩增长将成为主要的驱动因素 市场系统性风险,宏观政策调控 ——— 化工、装备制造、钢铁、汽车、通信

证券 警惕指数崇拜,坚守周期重估

中信 V型预期———对2007年A股市场的展望 2007年的整体市场走势将是一个“V”型 2007年选时和选股都有其生存空间 选时策略,建议在3000点附近适当减持;选股策略,建议侧重钢铁、电力、港口、医药、煤炭等行业 由于赚钱效应导致的居民储蓄流入势头将会继续 2007年上市公司利润增长可能达不到市场预期;监管层的态度 ——— 钢铁、电力、公路、港口、机场、航空、汽车制造、医药、煤炭

建投

招商 做多中国崛起,穿越理性繁荣 价值重估行情的加速发展正在把中国资产估值推向理性泡沫状态,2007年将是A股市场从理性繁荣走向全面沸腾的过渡之年 指数化投资 “中国制造”代表型公司及相关产业;具有中国特色的消费类公司;大国崛起代表,即金融和地产;溢价型公司,如基础设施与技术装备类公司 经济繁荣趋势确立、人民币升值速度加快、奥运会催生大国情结、资产需求快速释放、投资者情绪趋于乐观 一季度之后估值驱动型行情可能趋于结束。此后市场将因大规模扩容压力而呈现强势震荡 ——— 金融、房地产、钢铁、煤炭、水泥、饮料、交运设备,机械设备、生物医药、通信、软件

证券

兴业 似火牛年 2007年A股市场在大扩容中震荡前行 金融地产、先进制造业(装备、科技股)、健康产业 资产注入、整体上市、奥运 1、中国经济健康增长。2、上市公司资产注入,获利能力提升。3、流动性过剩格局难以改变 多层次资本市场建设、IPO、“小非”减持分流资金;股指期货推出加大市场波动;管理层加强监管 上证综指: 银行、证券、保险、房地产、汽车汽配、机械、铁路、医药、食品饮料、旅游酒店、3G通讯电子科技股

证券 2500-3500

申银 通往全球资本市场之路; 2月市场下跌幅度有限,上证综指低点可能出现在2550点;对于指数快速下跌产生恐惧感的时候,建议投资者逐渐贪婪,提高仓位 A股巨人产生于三块土壤:1,天生的巨人,包括银行、能源和通讯;2,长大的巨人,包括保险、医药和零售;3,资产的巨人,中央企业入场将为A股带来10万亿总资产 战略配置机械装备;利润从制造流向服务,战略配置金融、服务、消费。 市值规模的扩张和估值水平的提高;2007年业绩仍将实现20%以上的增长。估值水平仍将得到流动性泛滥的支撑 天量“小非”减持流通市值;管理层出台调控政策 沪深300:2700 上半年看好投资品,高价消费品和金融,下半年看好服务,金融地产。目前超配金融(特别是股份制银行),超配消费品,超配轿车,标配火电,标配交通,低配地产,低配钢铁

万国 在恐慌时逐渐贪婪———2月投资策略 二月选择:年报超预期;估值比较具吸引力的;业绩复合增长率较高的

海通 不尽上涨路 成长蓝筹助推市场,金融板块同时是市场的稳定器和加速器;整体市场有30%-50%的上涨空间 制度变革创造投资机遇;特定领域投资带来的机会;商品周期阶段性休整而非见顶,看好能源产品,有色金属中的锌、镍、铜 资产注入;税制改革;基础设施建设,如铁路投资;3G投资 经济增长未来将会重新加速;有利于股票市场投资者的温和增长环境;上市公司盈利的推动 经济上行风险依然存在:美国经济放缓对中国出口的影响;人民币升值是否会加速 ——— 机械、交通运输、金融、汽车及配件、传媒、商业贸易、信息设备、信息服务

证券 成长意未犹

国信 大国崛起奏响牛市最强音 迎接大蓝筹时代,坚持主流、兼顾轮动 节能、可再生能源和煤化工等替代能源产业;内外资并购;通过资产注入等实现跨越式扩张,以及由于定向增发引进战略投资者和确立股权激励而能够有效促进经营绩效改善的公司 上游资源品行业,如有色金属和贵金属;下半年煤炭和电力等能源行业将迎来拐点。与消费相关的制造业和服务业;受惠于产业政策扶持的行业;走出低谷的钢铁行业 大国崛起,牛市的根基。 股指期货推出预期,市场可能冲高回落;估值优势逐步消失;资金推动性上涨可能超越业绩增长预期;限售股份大量解禁带来压力 上证综指: 食品饮料、金融、地产、机械装备、钢铁、化工新材料

证券 市值驱动因素:估值提升和业绩增长齐飞 3600-3800

国泰 越高端越增长 宏观上无法阻挡的牛市;行业配置上:越高端越增长 满足政府、企业、高资产阶层需求的产业增长、盈利更突出;政府支持;政策红利 品牌消费;富人服务;装备升级、自主创新;节能,替代能源、新材料;大盘、蓝筹、低价 人民币升值强势超出预期;股市扩容;财富效应 宏观调控压力加大;出口增速,固定资产投资增速持平或减缓;估值吸引力下降 沪深300:3000 第一季度:消费零售、通信设备、家用电器、酒店等;第二季度:运输、电力、电脑、媒体等;第三季度:银行、纺织品、服装与奢侈品等;第四季度:石油天然气、煤炭与消费用燃料等

君安

国金 “婴儿潮”提升消费服务业估值 2007年股市资金供给仍然非常宽裕,市场将继续保持牛市基调,在震荡中不断创出新高 消费服务、装备制造业和高技术产业 消费服务业的估值水平正面临着系统性提升的机遇 股改完成和股权激励启动;经济稳定运行和人民币升值预期增强;流动性充裕依旧 ——— ——— 医药、食品饮料、旅游餐饮、家庭和个人用品、金融、房地产、百货零售、信息技术、交运设施、通用设备、煤化工、水产养殖、林业

证券

广发 股市景气周期延伸伴随波动加大 股市资金推动效应的强化将导致市场由估值合理向估值泡沫方向发展; “十一五”规划受益类行业、自主创新、消费升级和服务业等投资主题; ——— 流动性过剩格局继续维持,股改后资金入市信心全面增强; 由估值合理向估值泡沫方向发展;股指期货和融资融券推出为市场引入做空机制之后,短期波动加剧 ——— 机械设备、输变电设备、石油和化工、食品饮料、医药、银行、房地产、零售

证券 关注阶段性波动风险 优质资产整体上市及股权激励等相关主题 美元加息周期将结束,国际资金流入增加

光大 直上重霄九———2007年年度投资策略 估值水平的变化对股票市场的运行方向起着决定性作用。 ——— 一条长期主线:消费品,两条中期主线:金融和地产,三个短期主题:有色金属、能源和装备 估值水平上升的主要动力来源于实体经济的剩余储蓄;升值预期将进一步压低国内利率水平,加速推进资产重估 ——— 上证综指:3500 百货、旅游、传媒、交通运输、有色金属、电力、石油、装备

证券 预期上证综指2007年目标位置可达3500点,对应PE水平30倍左右

东方 迈入“黄金十年”; 2007年,A股仍可提供40%-50%的收益率。同时,市场将会出现数个阶段性高点;A股泡沫化难以避免 重大事件驱动型主题和行业景气驱动型主题;煤电油运及其产业链,新兴消费品、3G产业链、装备制造业、资源型地产、医药商业和电解铝 自主创新型龙头企业、3G受益企业、奥运受益企业、医改受益企业和行业景气驱动型企业,如金融企业、装备制造业优质企业、新兴消费品优质企业、部分供求关系紧张的金属企业、煤电油运及相关企业。 A股未来两年的盈利增长潜力巨大,加上美元减息背景下全球流动性依旧充裕 股指期货的推出时点;严厉的宏观调控措施;结构性的局部泡沫 沪深300:2900 金融、医药、煤电油、地产

证券 中国A股2007:泡沫化生存 上证综指:3500

长城 寻找经济转型中的成长溢价 2007年的A股市场将是繁荣与曲折并存的一年。 人民币升值、消费升级和产业升级 奥运、3G和资产注入 长期流动性充裕背景和中国虚拟经济的巨大成长潜力;未来2年上市公司依然强劲的业绩增长 “大非”、“小非”减持、新股发行、股指期货的推出引发市场震荡加剧 上证综指: 地产、金融、机械、汽车、商业、旅游、通信、家电、交通运输

证券 A股整体仍然存在30%以上的上升空间 2500-3500

注:以上关键词均采自相关券商的2007年度策略报告、1月份策略报告、2月份策略报告、一季度策略报告以及其它策略报告。(上海朝阳永续)