贵州茅台的顶级品牌价值、稀缺性价值、垄断性价值、资源性价值、成长性价值等已经被所有投资者所认同,理当给予投资性溢价与高估值标准也被投资者所认可。尽管近期出现了高管风波,但市场反而从中看到了其产品进一步提价的空间,进而更清晰地认识了其业绩增长的潜力。

所以,本次高管风波不改变贵州茅台的投资价值,反而高管风波导致的股价波动是一次长期投资策略中买入的机会。

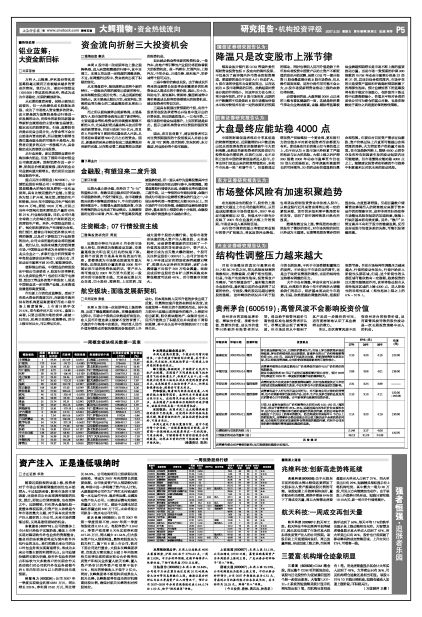

评级机构 评级日期 股票评级 投资要点 EPS (元) 估值

(元)

07年 08年 09年

国泰君安 2007/05/15 增持 茅台酒品牌影响力大,已得到消费者认可;市场上茅台酒供需矛盾还将延续,茅台的经销商队伍比较稳定,普通茅台的出厂价和终端零售价差100-150 元,远远高于同类其它白酒,经销商销售茅台获利丰厚,所以即使高管调离,公司经销商渠道受影响的可能性较小。 2.10 3.20 4.10 122.00

申银万国 2007/05/14 增持 高管事件使得公司通过提高出厂价来降低市场价与出厂价的差价的预期提高。 2.08 3.08 4.01 139.00

建议长线投资者90 元以下或附近逐渐配置并耐心持有,预计2007 年四季度至2008 年一季度股价跑赢市场的概率较大。

平安证券 2007/05/14 强烈推荐 高管的更迭不会改变茅台酒资源稀缺属性,同时也很难使其近几年坚持的成功发展策略发生改变,不会对茅台今后的发展造成负面影响。 2.31 3.24 3.99 -----

招商证券 2007/05/15 强烈推荐 高管事件是个人行为而不是公司行为,并不影响公司正常的经营管理,也不应该影响茅台股份的产品、技术、生产以及茅台酒的品质及其在消费者心目中的形象。亦不影响茅台股票的投资价值。 2.10 3.10 4.11 120.00

~160.00

国信证券 2007/05/11 推荐 目前,53 度茅台酒的出厂价和零售价之间有大约100-150 元/瓶的价差,相当于零售价的25%-35%,远超过国内其他同价位白酒的水平,这不仅无益于解决茅台酒的普遍性的缺货问题,还给公司每年带来超过7 亿元以上的净利润流失,给当地政府带来每年5 个亿以上的税收流失。高管事件必然会促使公司去着力解决这不合理的差价问题,也会使地方政府更加重视茅台管理层的激励问题,有利于公司未来的提价策略和管理层股权激励的实施。 2.14 3.23 4.19 130.00

业绩预测与估值的均值(元) 2.146 3.17 4.08 132.75

目前股价的动态市盈率(倍) 46.13 31.23 24.26

风 险 提 示

高管事件使公司声誉受到影响;也可能使股权激励计划推后。