因为,牛市行情的最大受益者就是券商。尤其是去年以来场外资金排着队入市,行情天量频爆,券商的佣金收益由此日日增长。同时,IPO与增发业务及投研项目也四处开花结果,集合理财与自营投资收益更是丰硕,大牛市行情中的券商正处在黄金岁月。

股市历来是个强者得益的市场,所以选择券商股自然要选择“头牌”,目前券商中的“头牌”无疑是中信证券。并且,机构深度研究报告已经告诉我们,中信证券与其他券商相比,其强者的地位在进一步被强化。业绩指标也告诉我们,在所有的券商股和券商概念股中,中信证券当前是最为低估的。

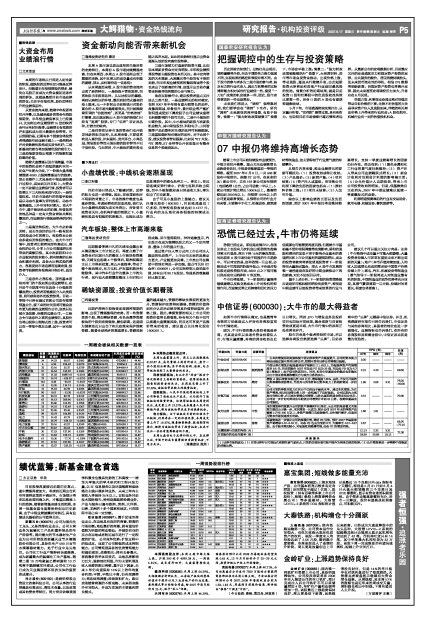

评级机构 评级日期 股票评级 投资要点 EPS (元) 估值

(元)

07年 08年 09年

中金公司 2007/06/05 ----- 一旦本次增发顺利实施将使中信证券净资产大幅度提升,公司的资本实力将远远超过国内其他证券公司,短期内其他证券公司将难以超越。 2.00 ---- ---- ----

招商证券 2007/06/05 强烈推荐 中信证券在增发后每股盈利保守预测在2.1 元以上,而每股净资产有望增厚至9.5 元,而当前股价2007 年动态PE 仅为25 倍,而动态PB 仅为5.7 倍(增发后),处于低估的区间内。同时,私有化华夏基金的做法也明确显示出中信证券想要称霸买方与卖方业务的决心。 2.10 2.40 ---- 69.00

国泰君安 2007/06/05 增持 增发A 股后净资本将达到293 亿元,增厚幅度180%。由此,不仅可开展的业务规模将成倍增长,而且其与其他券商在资本实力上的差距将进一步拉大。 1.99 2.66 3.31 75.00

~80.00

申银万国 2007/06/05 增持 公司目前的净资本实力在同业中已经处于最高水平。通过本次增发,为在资产管理、权证创设等业务上进一步拓展打下良好基础。 公司近期大力拓展非传统业务,在完成对香港公司增资、与胜达国际组建合资直投公司后,公司进一步计划对深圳金牛期货公司增资并申请IB业务、收购华夏基金公司股权。 2.34 ---- ---- 70.00

东方证券 2007/06/05 中性 本次增发将有效提升公司的资产规模和行业地位,从公司的角度看又向蓝筹之路迈出正确一步。本次增发一旦成功,预计公司2007 年末的净资产总额将上升至300 亿以上,净资产规模已向浦发银行、民生银行看齐,创造利用资本市场快速成长奇迹。 1.68 1.91 ---- ----

国信证券 2007/06/05 推荐 再融资将进一步强化公司的规模优势,降低PB 估值。预计2007年每股净资产将增厚5.22-5.48 元,动态PB 也由当前的8.71 大幅降至4.57-4.67 倍。由于股本增加较小,对每股收益摊薄有限,动态PE 的增加有限。 2.57 ---- ---- 68.75

~77.10

业绩预测与估值的均值(元) 2.113 2.32 3.31 72.36

目前股价的动态市盈率(倍) 28.39 25.86 18.12

风 险 提 示

(1)证券市场的波动;(2)目前证券行业可能处在周期性景气度高点,目前的估值标准可能不能作为将来估值的依据;(3)公开增发将进一步稀释中信集团的持股比例。