沪深市场调整已历时一个多月,那么经过这段时间调整后,市场整体估值水平发生了怎样的变化呢?

聚源数据研究所统计显示,截至7月6日,所有A股整体法计算的市销率、市盈率、市净率指标分别为3.23、49.33、5.23倍。经过一个多月的调整,相对前期估值水平有明显下降,部分行业估值相对偏低,但是目前总体估值水平并不低。相比之下,采掘业、金属非金属行业的市销率、市盈率处在较低的水平,处于相对估值洼地,投资者可以重点关注这两个行业内市盈率低于本行业平均水平的部分公司。

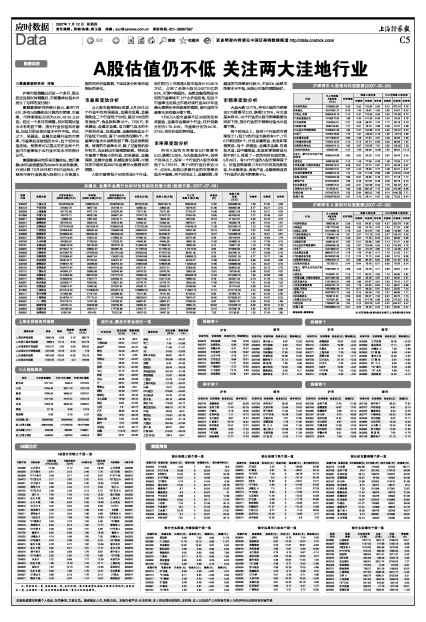

聚源数据研究所采用整体法、使用聚源e财讯系统提供的2006年末财务数据,分别计算了5月29日和7月6日这两天,沪深两市各行业流通A股和已上市流通A股的相对估值数据,下面具体分析各估值指标的变化。

市盈率变动分析

从A股市盈率指标来看,5月29日22个行业中仅有采掘业、金属非金属、金融保险业三个行业低于50倍,超过100倍的有房地产、食品饮料等10个。7月6日,有采掘业、金属非金属、电力燃气及水的生产和供应业、交通运输、金融保险业五个行业低于50倍,高于100倍的仅剩5个。市盈率估值水平虽然明显下降,但是依然较高。较高的市盈率水平,除了过度投机炒作有关,也反映出市场预期较高。特别是市盈率下降较小的行业,如采掘业、金融保险、金属非金属、机械设备仪表等,可能存在市场对其2007年业绩有大幅增长的预期。

A股市盈率低于50倍的这5个行业,他们的已上市流通A股市值合计10.2815万亿,占到了全部A股16.2457万亿的63%,可谓中流砥柱。虽然金融保险业48倍的市盈率谈不上什么价值洼地,但这个市盈率也反映出市场对该行业2007年业绩大幅增长存在较高的预期,该行业的市盈率未来有望大幅下降。

7月6日A股市盈率不足30倍的仅有采掘业、金属非金属两个行业,杠杆倍数分别为1.78、6.95,市盈率分别为24.76、27.62,相对估值优势明显。

市净率变动分析

所有A股的市净率由5.97滑落至5.23,跌幅12.29%,与大盘基本持平。但两个时间点上,没有一个行业的A股市净率低于3;7月6日,高于5的行业仍多达13个、占59%,反映出多数行业的市净率估值水平偏高。两个时间点上,金融保险、采掘业的市净率变化较小,不足5%;虽然市净率水平不低,反映出市场的预期较好。

市销率变动分析

大盘大跌12.77%,所有A股的市销率由3.70滑落至3.23,跌幅12.79%,与大盘基本持平。22个行业的A股市销率数据也同步下挫,部分行业的市销率估值水平显著下降。

两个时间点上,没有1个行业的市销率低于1;低于2的行业大跌前有4个,7月6日增加到6个,分别是建筑业、批发和零售贸易、电子、采掘业、金属非金属、信息技术业,其中建筑业、批发和零售贸易已经不到1.2,体现了一定的相对估值优势。5月29日,有10个行业的A股市销率高于5,估值显然偏高;7月6日仍有其他制造业、社会服务业、房地产业、金融保险业四个行业的A股市销率高于5。

采掘业、金属非金属行业相对估值偏低的潜力股(数据日期:2007-07-06)

股票 股票名称 主营业务收入 净利润 股东权益合计 总股本(万股) 流通A股(万股) 已上市 收盘价 流通A股 市销率 市盈率 市净率

代码 (2006末期)(万元) (2006末期)(万元) (2006末期)(万元) 流通A股(万股) (元) 市值

(万元)

600028 中国石化 104457900.00 5066400.00 25487500.00 8670243.90 6992195.10 358400.00 12.82 4594688.00 1.06 21.94 4.36

600123 兰花科创 225404.75 56077.35 252749.14 40800.00 40800.00 20576.25 31.90 656382.38 5.77 23.21 5.15

600508 上海能源 431722.90 44711.74 242070.48 72271.80 72271.80 27152.67 14.36 389912.29 2.40 23.21 4.29

601666 平煤天安 745773.12 86261.89 509921.04 107472.23 107472.23 37000.00 18.85 697450.00 2.72 23.48 3.97

600971 恒源煤电 118685.33 19613.94 100132.71 18840.00 18840.00 8375.90 25.23 211324.07 4.00 24.23 4.75

600231 凌钢股份 597229.54 35823.45 265513.98 52390.00 52390.00 28878.21 9.19 265390.78 0.81 13.44 1.81

600019 宝钢股份 15779146.56 1301026.45 8196054.59 1751200.00 1751200.00 473548.26 11.09 5251650.16 1.23 14.93 2.37

600362 江西铜业 2543505.84 460934.55 1256092.68 289503.82 150755.62 28252.08 25.19 711669.86 2.87 15.82 5.81

000898 鞍钢股份 5459600.00 684500.00 2983400.00 593298.57 504298.57 105305.72 18.47 1944996.62 2.01 16.01 3.67

600307 酒钢宏兴 1347143.94 44534.43 415685.52 87360.00 87360.00 33272.36 8.48 282149.64 0.55 16.63 1.78

000708 大冶特钢 454390.02 31765.93 132203.20 44940.85 44940.85 16902.00 12.05 203669.10 1.19 17.05 4.10

000761 本钢板材 2469145.79 165135.93 1603770.18 313600.00 273600.00 16080.00 9.14 146971.20 1.16 17.36 1.79

000932 华菱管线 3273401.13 106804.37 982962.46 221765.00 221765.00 112472.64 8.63 970638.85 0.58 17.92 1.95

600808 马钢股份 3431987.42 227658.59 2012210.69 645530.00 472237.00 89181.00 6.73 600188.13 1.27 19.08 2.16

600001 邯郸钢铁 2220088.42 89467.54 1100001.59 281645.66 281645.66 246885.23 6.09 1503531.03 0.77 19.17 1.56

600022 济南钢铁 2628134.71 87155.55 449101.37 135360.00 135360.00 49149.72 12.88 633048.42 0.66 20.00 3.88

000709 唐钢股份 2768781.78 142869.62 906754.49 226629.68 226629.68 110584.09 12.65 1398888.80 1.04 20.07 3.16

600102 莱钢股份 2432472.44 74604.07 547016.95 92227.31 92227.31 22308.00 16.30 363620.40 0.62 20.15 2.75

002110 三钢闽光 840942.57 35985.98 183540.98 53470.00 53470.00 10000.00 13.81 138100.00 0.88 20.52 4.02

600005 武钢股份 4131693.85 389700.62 2181715.37 783800.00 783800.00 283598.76 10.28 2915395.25 1.95 20.68 3.69

000717 韶钢松山 1240649.02 41672.77 532530.24 134112.00 134112.00 79963.20 6.76 540551.23 0.73 21.76 1.70

600961 株冶集团 929208.17 42628.80 128021.59 52745.79 52745.79 16200.00 17.85 289170.00 1.01 22.09 7.35

600126 杭钢股份 1259912.47 20482.90 327537.62 64533.75 64533.75 25768.69 7.44 191719.04 0.38 23.44 1.47

601600 中国铝业 6101513.40 1132895.60 4254513.70 1288660.79 894264.19 114807.74 21.01 2412110.53 4.44 23.90 6.36

600117 西宁特钢 317953.89 21147.34 202085.65 74121.93 74121.93 37155.01 6.94 257855.75 1.62 24.32 2.55

000039 中集集团 3316780.14 277172.31 1111744.60 266239.61 123191.55 79974.37 26.00 2079333.61 2.09 24.97 6.23

600581 八一钢铁 873718.15 15742.36 242280.92 58957.61 58957.61 27638.03 6.82 188491.37 0.46 25.54 1.66

600497 驰宏锌锗 445744.24 103646.89 233750.89 39000.00 39000.00 18984.18 69.64 1322058.18 6.09 26.20 11.62

000926 福星科技 245168.05 25819.27 177735.98 52522.77 52522.77 22606.86 13.15 297280.18 2.82 26.75 3.89

600992 贵绳股份 91981.64 4524.82 73313.36 16437.00 16437.00 10746.60 7.55 81136.82 1.35 27.43 1.69

沪深两市A股相对估值数据(2007-05-29)

行业 已上市流通 杠杆倍数 流通A股估值 已上市流通A股估值

A股市值

(万元)

市销率 市盈率 市净率 市销率 市盈率 市净率

A农林牧渔业 3763895.08 2.09 5.92 118.84 5.64 6.10 873.16 5.76

B采掘业 19167561.27 6.70 1.40 25.62 4.92 2.62 34.07 6.20

C0食品、饮料 28893430.16 2.10 5.37 119.93 9.05 4.64 143.89 8.73

C1纺织服装皮毛 14166372.64 1.86 4.34 141.93 6.99 2.34 76.33 3.76

C2木材家具 1552909.75 2.31 4.08 88.28 7.37 1.77 38.16 3.18

C3造纸印刷 6099139.85 1.77 3.01 76.18 4.98 3.00 70.37 4.86

C4石油化学塑胶塑料 42390991.99 1.90 3.47 134.86 6.54 3.34 135.37 6.34

C5电子 15282479.84 1.75 1.91 -85.90 5.18 1.62 -79.73 4.98

C6金属非金属 73712900.97 2.69 2.06 31.84 4.81 2.03 36.93 4.90

C7机械设备仪表 74262210.55 2.13 3.15 82.74 6.93 3.04 86.09 7.02

C8医药生物制品 28094224.10 1.84 4.97 125.85 7.61 4.92 128.35 7.53

C99其他制造业 905953.86 2.42 7.85 96.89 10.08 7.82 96.62 10.15

D电力、燃气及水的生产和供应业 40982024.66 2.60 5.62 54.35 5.24 5.97 59.43 5.20

E建筑业 4986188.58 2.15 1.45 77.98 5.26 1.56 79.03 5.12

F交通运输、仓储和物流业 38355913.21 3.55 6.91 57.74 5.61 6.10 55.46 5.42

G信息技术业 25728227.51 1.97 2.42 76.36 4.77 2.48 94.27 5.22

H批发和零售贸易 35388244.45 1.72 1.49 117.59 8.69 2.88 218.45 15.05

I金融、保险业 70305482.38 7.69 9.57 49.58 5.78 8.71 51.18 7.12

J房地产业 52232408.81 1.96 9.45 107.87 8.48 8.48 99.18 8.18

K社会服务业 10649974.31 2.05 8.31 102.96 9.40 7.75 103.52 9.31

L传播与文化产业 1615536.22 1.90 5.86 362.35 7.75 5.33 370.96 6.88

M综合类 24704579.52 1.54 5.84 465.02 7.65 6.14 1440.53 7.71

全部A股 618939750.82 2.97 3.70 56.14 5.97 3.50 75.03 6.44

沪深两市A股相对估值数据(2007-07-06)

行业 已上市流通 杠杆倍数 流通A股估值 已上市流通A股估值

A股市值

(万元)

市销率 市盈率 市净率 市销率 市盈率 市净率

A农林牧渔业 2689736.29 2.09 4.23 84.92 4.03 4.31 550.78 4.06

B采掘业 17877718.63 6.95 1.35 24.76 4.75 2.43 31.25 5.66

C0食品、饮料 25116398.13 2.16 4.44 101.57 7.94 3.88 120.66 7.49

C1纺织服装皮毛 11294431.49 1.81 3.37 110.13 5.43 3.47 109.76 5.49

C2木材家具 1316606.14 2.39 3.57 77.26 6.45 3.43 89.09 5.85

C3造纸印刷 4286129.25 1.85 2.21 55.86 3.65 2.14 51.41 3.48

C4石油化学塑胶塑料 32606465.48 1.90 2.67 103.46 5.03 2.53 102.69 4.79

C5电子 10473805.07 1.79 1.32 -61.07 3.60 1.10 -52.90 3.37

C6金属非金属 96649772.42 1.78 1.78 27.62 4.17 1.73 31.45 4.17

C7机械设备仪表 65165282.08 2.12 2.74 72.13 6.04 2.60 74.15 6.06

C8医药生物制品 22882049.72 1.81 3.96 99.48 6.05 3.96 101.82 6.02

C99其他制造业 737329.15 2.44 6.44 79.49 8.27 6.36 78.58 8.24

D电力、燃气及水的生产和供应业 31987559.17 2.66 4.48 43.28 4.17 4.60 46.02 4.01

E建筑业 3750937.16 2.19 1.11 60.02 4.05 1.16 58.95 3.82

F交通运输、仓储和物流业 33210587.90 3.65 4.92 49.48 4.67 4.97 46.32 4.51

G信息技术业 21313945.31 1.96 1.99 62.67 3.91 2.03 79.10 4.27

H批发和零售贸易 29326161.74 1.64 1.18 92.65 6.84 1.35 98.91 6.86

I金融、保险业 74976660.38 7.01 9.27 48.00 5.61 9.04 53.55 7.44

J房地产业 45267675.72 1.95 8.15 93.06 7.32 7.37 86.89 7.11

K社会服务业 7948214.52 2.09 6.53 83.07 7.43 5.91 80.75 7.15

L传播与文化产业 1187581.65 1.96 4.45 274.79 5.88 3.90 272.03 5.03

M综合类 17969972.36 1.50 4.14 329.79 5.42 4.32 944.57 5.47

全部A股 529306694.18 3.07 3.23 49.33 5.23 2.94 63.30 5.42

数据来源:聚源数据

注:杠杆倍数=流通A股总市值/已上市流通A股总市值