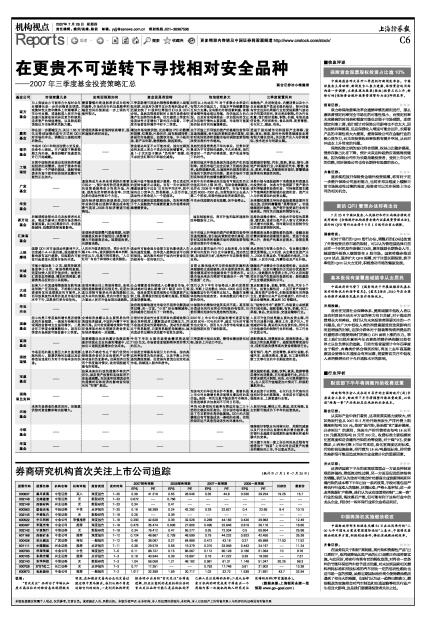

基金公司 市场变量几多 宏观面预期如何 资金面是否逆转 泡泡能吹多大 三季度配置风向

南方 向上突破动力可能来自中报对全年业绩增长进一步的明确甚至调高,或集体性注资和整体上市潮增厚上市公司业绩,或通胀或人民币升值加速升温驱动国内居民更为积极地追求资产的保值增值,以及股指期货推出为市场带来活跃力量。 需要警惕的是通胀是否成为结构性趋势,市场对央行的加息频率和幅度空间的预期进一步上调的可能性很大。 三季度新增可流通的限售股数量进入短暂低谷期,但政府为调节过分充裕的流动性,近期加快了H股和红筹股回归以及QDII步伐。虽然这很难即刻对A股市场资金环境产生扭转性的影响,但无疑使三季度市场流动性方面增加了新的压力因素,三季度市场资金环境并不好于二季度。 30倍以上的动态PE对于多数企业来说已有很大的估值压力,估值水平持续攀高缺乏有力支撑。没有新的外部因素刺激,依靠资金惯性推动难以持续,而估值压力的凸现,以及对宏观调控进一步加强的担忧正成为压制行情的主要因素,市场很可能要经历较长时间的震荡整固。 金融地产、先进制造业、内需消费以及中小企业板是富产高成长股的板块;部分估值有安全边际的周期行业经受短期景气波动后仍有重估空间,突出者如钢铁。作为行业配置,我们看好金融、钢铁、机械、电信及通信设备、汽车和配件、食品饮料、商贸零售、石化化工、煤炭、有色。

基金

嘉实 存在进一步紧缩压力,关注1.55万亿元特别国债的发行方式和QDII对市场的冲击,调整出口退税的滞后效应。 宏观经济基本会保持较高增长、温和通胀的良好局面。 增加市场有效供给,比如增加IPO的数量和规模;红筹股、H股回归、国有股减持等;多层次市场建设,如债权市场、中小板市场;新产品创新、融资融券、股指期货。 由于币值上升导致的资产价格重估会传导至通货膨胀,会引起决策制定者的重视,但针对实体经济和金融市场的调控政策很难改变当前的牛市格局。 受益于国内城市化和国际产业转移,金融、商业、物流、软件外包等高级服务业将有很大增长空间。关注资产注入与并购重组、技术进步与创新主题。

基金

银华 市场对QDII和特别国债心里没底,还会令人困扰。开户速度下降是预期之内的事、基金份额扩张速度也许已开始减缓。 ——— 资金驱动局面不太可能改观,国内过剩流动性本质上来自于高企的国民储蓄率。升息1-2次无助于解决“负利率”预期,也不必担忧红筹回归和国企减持。 虽然优质股昂贵是不争的事实,但贵和更贵成为不可逆转的趋势。不久的将来,我们将面对一个资产价格高昂、资产收益率低下的时代。 ———

基金

工银 目前中国经济呈现出实体经济和虚拟经济的双繁荣,这对于资本市场来讲是一个严峻的挑战,通胀导致资本市场下跌和实体经济放缓的可能性正在加大。 ——— ——— 当前估值水平高企是因为流动性产生的低利率,然而市场已完全反映了充裕的流动性。值得提醒的是,从通胀率的提高到资本市场的下跌存在时间差,资本市场的下跌到实体经济的放缓也需要时间差。 短期看好钢铁、汽车、医药、食品、银行、房地产和保险行业,中期看好汽车、零售、食品、医药、机械。这都是相对看好,要警惕通胀带来的系统性风险。

瑞信

广发 ——— 通胀将成为未来宏观调控的重要目标之一,预计政府防范通货膨胀的政策措施将至少包括升值、升息、提高法定存款准备金率、分流过多的流动性等四个方面。 如果升值不能显著减少顺差,那么流动性的逆转也就无从谈起。当有一天中国经济增速显著低于过去10年的平均水平,则中国的出口竞争力、贸易顺差、人民币币值、流动性才将会进入一个逆循环。 本轮牛市的高峰动态估值有可能达到历史估值区间的上限35倍。泡沫会继续膨胀,也许在2008年中期或更早,市场可能会达到6000-7000点。当前泡沫化正在进入第二个阶段,即股价推动经济发展阶段。 消费升级与通胀趋势下消费服务和资源品的投资机会;加息与升值周期下资产重估或利率敏感性投资机会;可持续发展主题下节能降耗创新领域的投资机会;资产注入与并购重组的投资主题。

基金

华安 ——— 国内经济短期仍表现强劲,2007年总体仍将以强势平稳完成本轮景气筑顶,2008年经济增速可能降低。 流动性过剩局面短期难扭转,负利率背景下个人金融资产的重新配置为市场带来持续增量资金。 牛市步伐短期内虽有放缓,但不会停止。 未来绩优蓝筹主导的价值投资理念重回市场主流,但同样需警惕“蓝筹泡沫”。长线继续看好金融、地产等升值受益行业的市场表现。同时关注煤炭和钢铁行业。

基金

易方达 后续调控政策的走向及投资者的反应,将成为影响三季度市场走势的重要因素。关注红筹股回归、非流通股减持、指数期货等因素影响。 ——— ——— 国际经验表明,货币升值和温和通胀往往伴随股市上升。 选择收益稳步增长、估值水平较低的蓝筹股、绩优股,或者以资产注入等方式带来外延式增长的股票。同时建议适当控制仓位以防范政策调控风险。

基金

汇添富 ——— 宏观经济短期景气度超预期,长期双顺差反映本币被低估,消费增长潜力开始逐渐启动。短期看投资,长期看消费。 ——— 由于币值上升导致的资产价格重估会传导至通货膨胀,会引起决策制定者的重视,但针对实体经济和金融市场的调控政策很难改变当前的牛市格局。 消费服务业是长期投资的选择;金融业因价量双重驱动因素提升盈利,受益于收益率上升;房地产的基本面是本,政策面是纲。

基金

上投 短期QDII对市场流动性影响不大,但会减小A-H股价差。股指期货不影响原有运行趋势,但短期内可能会引起资金从现货市场的分流。 人民币升值进程加快,预计全年升幅4%-5%。通货膨胀的基本判断:存在压力,但属可控范围内,“人口红利”有助于抑制核心通货膨胀。 流动性可能会因为政策方面的影响流入市场的速度放缓,但净流入趋势应该可以得到保持。国内股市相对于国内外资金而言仍然具有一定的吸引力。 从全球主要市场的PEG比较来看,仅仅俄罗斯与印度的PEG比中国要低。流动性过剩、宏观经济向好,结构性牛市走势将得到支持。 热点将转向有核心竞争力、有业绩支撑的绩优蓝筹股。三大机会:央企整合及资产注入、2008年奥运会、节能减排的推进。三条线索:人民币升值、内需拉动及产业升级。

摩根

长城 可能小幅加息1-2次、提高存款准备金率2-3次、取消存款利息税、适度加快人民币升值步伐、放宽外汇资金运用渠道、增加对高耗能、资源类商品征收出口关税等。 ——— ——— 目前A股估值水平与所处经济环境和未来预期相比虽然偏高,但只是阶段性的,随着业绩高成长估值就会处于合理水平。A股市场未来走向将更可能是处于一种“理性通道”之内。 继续在产业整合中寻找投资机会,比如央企整合,以定向增发的方式进行优质资产注入、收购兼并与借壳上市。IPO之后的新项目开始产生效益的投资机会;股权激励产生业绩超预期的公司。

基金

大成 如果大小非流通限售股股东获利退场形势广泛而彻底,不排除引发投资者担忧的连锁效应的可能性,从而导致系统性风险并波及市场估值水平下行,这是我们更为担忧的。 宏观环境总体上将保持稳定,宏观调控措施稳健而有预见性,适度加息以抑制可能抬头的通货膨胀已成为共同的预期,受内外部升值压力驱动人民币升值呈现加速趋势。 公众储蓄资金持续流入公募基金市场,中美战略对话确认新增QFII额度200亿美元,保监会宣布提高保险公司股票资产比例上限,蓝筹股供给面临增长瓶颈,受限股流通规模猛增。 我们认为下半年市场将进入新的发展阶段,判断上证指数在3500-5000点区间宽幅震荡运行的可能性比较大。随着市场整体结构的彻底改变,未来指数运行将打开新的空间。 重点配置设备、金融、钢铁、有色、汽车5个行业。投资主题包括:人民币资产持续升值、股东资产证券化、创新政策催生世界级企业、资源与公共产品价格提升、内外动力驱动业绩释放、奥运和3G等题材。

基金

华宝 ——— ——— 政府将持续地通过市场化手段来化解流动性过剩,另一方面,“小非”还在继续减持,这种减持已经成为了一种常态。 中国股市的整体估值其实并不高,甚至部分高成长的行业和公司的股价有低估,目前所谓的泡沫仅仅是结构性泡沫。 在“结构化牛市”趋势下,市场重心必然要回归成长股。超配金融、有色、机械、化工、采掘、食品、交运设备、交通运输等行业。

兴业

国泰 担心的是三季度盈利增长是否能够达到市场预期,一是因为持续的宏观调控会影响企业盈利增长,二是去年三季度业绩基数较大,因而四季度市场表现可能会弱于三季度。 全球经济放缓以及主要贸易伙伴美国经济减速,中国的外需下半年将回落。另外宏观紧缩政策和节能环保采取的相关措施还是会使实体经济增速有一定减缓。 目前针对流动性过多而采取的紧缩政策只能在某种程度上缓解流动性过剩压力,并不会造成流动性紧缩状态。流动性的根源在于贸易顺差,只要贸易顺差持续增加,国内流动性过剩的状态就不会发生逆转。 2007年上市公司中期盈利增长速度有望达到50%-70%的水平,超过70%的可能性也比较大,因而8、9月份市场有望在盈利超预期支持下续创新高。 人民币升值仍然是最主要的投资主题,同时关注消费升级、整体上市、资产注入、节能减排环保、奥运相关的投资机会。同时关注估值最低的钢铁行业和机械、化工行业中优质公司。

基金

富国 ——— 政策密集出台后的累计负效应将逐步体现在企业的盈利增速中,比如出口退税直接增加企业成本。 今年下半年A股市场资金需求将达到7100亿元,市场资金面短期将承受非常大的压力。 三季度是中报出台期,静待业绩明朗化过程,股价上升动力不足。 超配资源品、消费服务业,看淡制造业。通胀压力和加息周期下,超配保险等受益行业,低配有息负债率高的资金密集型行业。

基金

国投 市场面临的最主要压力来自通货膨胀的担心、股票供给的加速以及证券违法违规行为对于市场本身的伤害。 主要的不确定性在于银行信贷的控制是否会对企业投资和产出带来明显的负面影响。如果经济出现两个季度偏冷情况,政府调控就可能有所松弛。 中国是全球最具有吸引力的市场,国内真实利率经常为负的事实,以及不断上升的通货膨胀预期,促使国内资流出固定收益市场,持续流入股市和房市。 ——— 看好银行、地产、批发零售、多样化金融、机械汽车、品牌消费品、资源、化工新材料和新工艺等行业的中长期投资机会。

瑞银

宝盈 ——— 如果未来的行政性措施不再次严厉化,固定资产投资和实体经济不会急速减缓。而加息和收缩流动性的措施对实体经济的影响会有较长的“时滞”效应。 ——— ——— 建议超配机械、金融,饮料、家具、旅游等稳定增长的消费类、石化能源等行业。并在三季度末期关注钢铁、有色、石化等周期性行业。在人民币升值幅度加大情况下,积极配置航空业。

基金

国海 ——— ——— ——— 泡沫有无的争论其实并不重要,重要的是上市公司业绩增长是否能够支撑这样的高估值。虽然一两次加息不能改变牛市格局,但是连续多次加息则不可同日而语。 重点投资于以钢铁、石化行业为代表的估值相对安全的蓝筹股,未来成长可期的高端服务业、上游资源行业等。

富兰克林

天治 未来市场资金仍是充沛的,但股票供给对资金需求将明显增大。 ——— ——— 平均40多倍的市盈率与周边市场二三十倍相比确实有所高估,但中国市场环境决定了它目前存在高估值基础。QDII的大规模推出有可能造成这一基础的动摇,但现阶段还远不具备泡沫消失的环境条件。 人民币升值、整体上市、奥运、交叉持股、自主创新可能成为下半年的投资热点。

基金

中欧 ——— ——— ——— ——— 继续看好钢铁业的持续向好、周期性减弱以及行业内存在显著的购并整合趋势,看好银行业超越市场预期的盈利增长和盈利模式的变革。

基金

华富 ——— ——— ——— ——— 对于旗下只有一家上市公司的央企很有可能借这个“独苗”上市公司完成资产的整合和整体的上市,予以重点关注。

基金