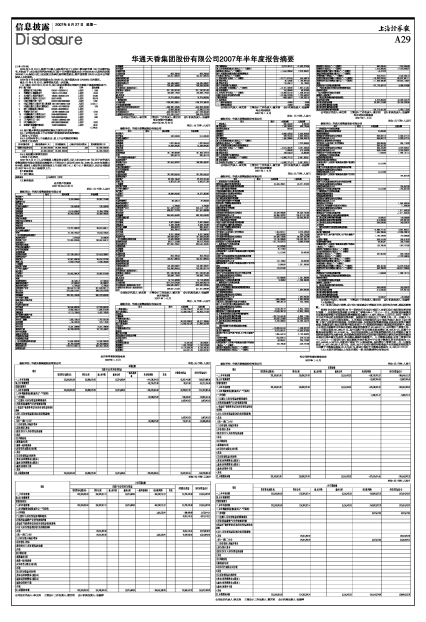

2007年1-6月

编制单位: 华通天香集团股份有限公司单位:元 币种:人民币

项目 本期金额

归属于母公司所有者权益 少数股东权益 所有者权益合计

实收资本(或股本) 资本公积 减:库存股 盈余公积 一般风险准备 未分配利润 其他

一、上年年末余额 221,100,001.00 135,838,179.02 15,274,682.84 -644,538,194.02 12,267,442.80 -260,057,888.36

加:会计政策变更 -81,734,071.20 22,574.90 -81,711,496.30

前期差错更正

二、本年年初余额 221,100,001.00 135,838,179.02 15,274,682.84 -726,272,265.22 12,290,017.70 -341,769,384.66

三、本年增减变动金额(减少以“-”号填列)

(一)净利润 -12,928,073.29 -968,468.27 -13,896,541.56

(二)直接计入所有者权益的利得和损失 1,687,843.03 1,687,843.03

1.可供出售金融资产公允价值变动净额

2.权益法下被投资单位其他所有者权益变动的影响

3.与计入所有者权益项目相关的所得税影响

4.其他 1,687,843.03 1,687,843.03

上述(一)和(二)小计 -12,928,073.29 719,374.76 -12,208,698.53

(三)所有者投入和减少资本

1.所有者投入资本

2.股份支付计入所有者权益的金额

3.其他

(四)利润分配

1.提取盈余公积

2.提取一般风险准备

3.对所有者(或股东)的分配

4.其他

(五)所有者权益内部结转

1.资本公积转增资本(或股本)

2.盈余公积转增资本(或股本)

3.盈余公积弥补亏损

4.其他

四、本期期末余额 221,100,001.00 135,838,179.02 15,274,682.84 -739,200,338.51 13,009,392.46 -353,978,083.19

单位:元 币种:人民币

项目 上年同期金额

归属于母公司所有者权益 少数股东权益 所有者权益合计

实收资本(或股本) 资本公积 减:库存股 盈余公积 一般风险准备 未分配利润 其他

一、上年年末余额 221,100,001.00 135,309,217.44 15,274,682.84 -260,122,714.17 31,790,400.18 143,351,587.29

加:会计政策变更

前期差错更正

二、本年年初余额 221,100,001.00 135,309,217.44 15,274,682.84 -260,122,714.17 31,790,400.18 143,351,587.29

三、本年增减变动金额(减少以“-”号填列)

(一)净利润 1,661,533.94 -188,489.80 1,473,044.14

(二)直接计入所有者权益的利得和损失 -8,241,443.11 -8,241,443.11

1.可供出售金融资产公允价值变动净额

2.权益法下被投资单位其他所有者权益变动的影响

3.与计入所有者权益项目相关的所得税影响

4.其他 19,014,291.90 -8,241,443.11 10,772,848.79

上述(一)和(二)小计 19,014,291.90 1,661,533.94 -8,429,932.91 12,245,892.93

(三)所有者投入和减少资本

1.所有者投入资本

2.股份支付计入所有者权益的金额

3.其他

(四)利润分配

1.提取盈余公积

2.提取一般风险准备

3.对所有者(或股东)的分配

4.其他

(五)所有者权益内部结转

1.资本公积转增资本(或股本)

2.盈余公积转增资本(或股本)

3.盈余公积弥补亏损

4.其他

四、本期期末余额 221,100,001.00 154,323,509.34 15,274,682.84 -258,461,180.23 23,360,467.27 155,597,480.22

公司法定代表人:李文棠 主管会计工作负责人:董艺明 会计机构负责人:张丽萍

母公司所有者权益变动表

2007年1-6月

编制单位: 华通天香集团股份有限公司单位:元 币种:人民币

项目 本期金额

实收资本(或股本) 资本公积 减:库存股 盈余公积 未分配利润 所有者权益合计

一、上年年末余额 221,100,001.00 135,838,179.02 15,116,402.33 -658,750,993.57 -286,696,411.22

加:会计政策变更 -13,887,909.62 -13,887,909.62

前期差错更正

二、本年年初余额 221,100,001.00 135,838,179.02 15,116,402.33 -672,638,903.19 -300,584,320.84

三、本年增减变动金额(减少以“-”号填列)

(一)净利润 -4,980,771.47 -4,980,771.47

(二)直接计入所有者权益的利得和损失

1.可供出售金融资产公允价值变动净额

2.权益法下被投资单位其他所有者权益变动的影响

3.与计入所有者权益项目相关的所得税影响

4.其他

上述(一)和(二)小计

(三)所有者投入和减少资本

1.所有者投入资本

2.股份支付计入所有者权益的金额

3.其他

(四)利润分配

1.提取盈余公积

2.对所有者(或股东)的分配

3.其他

(五)所有者权益内部结转

1.资本公积转增资本(或股本)

2.盈余公积转增资本(或股本)

3.盈余公积弥补亏损

4.其他

四、本期期末余额 221,100,001.00 135,838,179.02 15,116,402.33 -677,619,674.66 -305,565,092.31

单位:元 币种:人民币

项目 上年同期金额

实收资本(或股本) 资本公积 减:库存股 盈余公积 未分配利润 所有者权益合计

一、上年年末余额 221,100,001.00 135,309,217.44 15,116,402.33 -263,891,027.70 107,634,593.07

加:会计政策变更

前期差错更正

二、本年年初余额 221,100,001.00 135,309,217.44 15,116,402.33 -263,891,027.70 107,634,593.07

三、本年增减变动金额(减少以“-”号填列)

(一)净利润 2,247,647.81 2,247,647.81

(二)直接计入所有者权益的利得和损失

1.可供出售金融资产公允价值变动净额

2.权益法下被投资单位其他所有者权益变动的影响

3.与计入所有者权益项目相关的所得税影响

4.其他 19,014,291.90 19,014,291.90

上述(一)和(二)小计 19,014,291.90 2,247,647.81 21,261,939.71

(三)所有者投入和减少资本

1.所有者投入资本

2.股份支付计入所有者权益的金额

3.其他

(四)利润分配

1.提取盈余公积

2.对所有者(或股东)的分配

3.其他

(五)所有者权益内部结转

1.资本公积转增资本(或股本)

2.盈余公积转增资本(或股本)

3.盈余公积弥补亏损

4.其他

四、本期期末余额 221,100,001.00 154,323,509.34 15,116,402.33 -261,643,379.89 128,896,532.78

公司法定代表人:李文棠 主管会计工作负责人:董艺明 会计机构负责人:张丽萍

(上接A28版)

2006年5月23日,福州市中级人民法院下达了(2006)榕民初字第166号民事判决书,判决如下:本公司应在判决生效之日起十日内偿还借款本金3709236.83元及相应利息392936.7元;保证人就上述还款义务承担连带清偿责任;案件受理费30520元由本公司和保证人共同承担。

2006年9月公司归还借款本金236.83元,尚欠借款本金3709000元未偿还。

截止07年6月30日,该事项尚无进一步进展。

(三)截止2007年6月30日,因上述诉讼事项公司银行存款账户被冻结情况如下:

序号 账户名称 账号 币种 期末余额

1 浦发银行虹口区办事处 076347-4292024141 人民币 1 13.68

2 华夏银行上海杨浦支行 135819-819133635 人民币 82.43

3 光大银行上海北外滩支行 106204-00304013721 人民币 210.95

4 招商银行上海分行川北支行 55821497001 人民币 583.79

5 中国工商银行第一支行 9333310350700058803 人民币 12.66

6 中国工商银行上海分行第二营业部 1001190719004617339 人民币 3,672.11

7 中国民生银行上海分行黄埔支行 144978-04210005239 人民币 2.25

8 农行上海浦东洪山营业所 033485-0040008043 人民币 -

9 华夏银行闵行支行 135796-00080812332 人民币 47.84

10 中国建设银行上海第五支行 5505400020005055 人民币 5.51

11 中国建设银行上海第五支行 5505400020004595 人民币 0.66

12 工行福州市五一支行 1402021109004631064 人民币 -

13 中行福建省分行 800100822308093001 人民币 33.62

14 农业银行福清镜洋营业所 152801040000249 人民币 29.32

合计 4,794.82

6.5 其它重大事项及其影响和解决方案的分析说明

6.5.1 公司持有其他上市公司发行的股票和证券投资情况

□适用 √不适用

6.5.2 公司持有非上市金融企业、拟上市公司股权的情况

√适用 □不适用

6.5.3 其他重大事项的说明

√适用 □不适用

2007年5月21日,公司接到上海证券交易所上证上字[2007]106号《关于对华通天香集团股份有限公司股票实施暂停上市的决定》:因公司2004年、2005年、2006年连续三年亏损,根据《上海证券交易所股票上市规则》第14.1.1和14.1.7条的规定,决定公司股票自2007年5月25日起暂停上市。

§7 财务报告

7.1 审计意见

7.2 财务报表

合并资产负债表

2007年06月30日

单位: 元 币种:人民币

编制单位: 华通天香集团股份有限公司

公司法定代表人:李文棠 主管会计工作负责人:董艺明 会计机构负责人:张丽萍母公司资产负债表

2007年06月30日

单位: 元 币种:人民币

编制单位: 华通天香集团股份有限公司

公司法定代表人:李文棠 主管会计工作负责人:董艺明 会计机构负责人:张丽萍

合并利润表

2007年1-6月

单位: 元 币种:人民币

编制单位: 华通天香集团股份有限公司

公司法定代表人:李文棠 主管会计工作负责人:董艺明 会计机构负责人:张丽萍

母公司利润表

2007年1-6月

单位: 元 币种:人民币

编制单位: 华通天香集团股份有限公司

公司法定代表人:李文棠 主管会计工作负责人:董艺明 会计机构负责人:张丽萍

合并现金流量表

2007年1-6月

单位:元 币种:人民币

编制单位: 华通天香集团股份有限公司

公司法定代表人:李文棠 主管会计工作负责人:董艺明 会计机构负责人:张丽萍

母公司现金流量表

2007年1-6月

单位:元 币种:人民币

编制单位: 华通天香集团股份有限公司

公司法定代表人:李文棠 主管会计工作负责人:董艺明 会计机构负责人:张丽萍

7.3 报表附注

7.3.1 如果出现会计政策、会计估计变更或会计差错更正的,说明有关内容、原因及影响数。

根据《企业会计准则第38 号—首次执行企业会计准则》,对新旧会计准则股东差异进行调整: 1、长期股权投资差额 公司截至二零零六年十二月三十一日止,采用权益法核算的长期股权投资借方长期股权投资差额账面金额为13,887,909.62人民币元,为同一控制下企业合并形成的长期股权投资差额,根据新会计准则应于二零零七年一月一日减少13,887,909.62人民币元股东权益。 2、所得税 公司按照现行会计准则的规定,制定了会计政策,计提了应收款项坏账准备、存货跌价准备、长期股权投资减值准备及其他长期资产减值准备,根据新会计准则应将资产账面价值小于计税基础的差额计算递延所得税资产,据此子公司四川盛裕种业有限公司确认递延所得税资产60,980.27元,由此增加二零零七年一月一日股东权益60,980.27元,其中归属于母公司股东权益增加38,405.37元,归属于少数股东权益增加22,574.90元。 母公司及其他纳入合并报表范围内的子公司或处于盈亏临界状态或存在大额亏损,没有确凿证据表明未来期间很可能获得足够的应纳税所得额用来抵扣可抵扣暂时性差异,故未确认递延所得税资产。 3、少数股东权益 公司二零零六年十二月三十一日按现行会计准则编制的合并报表中子公司少数股东享有的权益为12,267,442.80人民币元,在新会计准则下计入股东权益,由此增加二零零七年一月一日股东权益12,267,442.80人民币元。此外,由于子公司计提的坏帐准备产生的递延所得税资产中归属于少数股东权益22,574.90元,新会计准则下少数股东权益为12,290,017.70元

7.3.2 本期并表范围比上年期末增加一家:南充隆盛种业有限公司