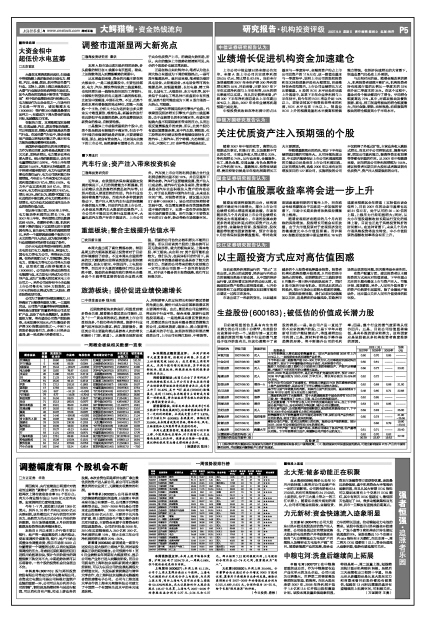

评级机构 评级日期 股票评级 EPS (元) 估值

投资要点 (元)

2007年 2008年 2009年

申银万国 2007/08/30 买入 上半年销售收入增长超过销售量增长,估计产品均价较2006 年上升10%以上,一直根据成本状况调整产品价格。 0.50 0.70 0.85 -----

中金公司 2007/08/30 推荐 下半年松山湖二期新增产能250-300万平方米,在旺季效应和原材料价格支撑下,预计下半年覆铜板价格处于高位,毛利率稳中有升。 0.50 0.61 ---- -----

中信证券 2007/08/30 买入 随着7 月份松山湖2 期和10 月份苏州2 期的相继投产,产能不足将缓解,并奠定下半年和明年的业绩增长基础。 0.56 0.77 ---- 23.20

海通证券 2007/08/30 买入 2007、2008年是公司的旺年,是历史产能扩充最快的两年,预计2007、2008年产量分别为3200、4300 万平方米,增长率分别为25.49%和34.38%。 0.52 0.72 ---- -----

安信证券 2007/08/30 增持—A 今年PCB行业保持了快速增长,特别是三季度后PCB的旺盛需求促使上游产品纷纷涨价,因此公司下半年业绩将出现较大改观。 0.52 0.69 0.88 21.00

长江证券 2007/08/30 推荐 基于行业景气平稳复苏的判断,如果行业景气明显好转,最乐观情况下2008 年EPS 还有20%左右的上调空间。 0.48 0.65 0.71 22.68

长城证券 2007/08/31 推荐 二季度机构进行了大幅增持,前十大流通股股东中基金共持有5017.78万股,较一季度增加了2281.1万股,显示出机构预期良好。 0.52 0.65 ---- -----

西南证券 2007/08/30 增持 从历史数据看,下半年营业收入对全年的贡献均超过55%,加上下半年部分新产能开出,及毛利率回升等因素,调升公司业绩预期。 0.53 0.72 0.85 -----

世纪证券 2007/08/30 买入 在行业景气趋升、公司新增产能陆续释放以及投资收益提高拉动下,下半年至2008 年公司高速增长之势已相当清晰。 0.59 0.83 ---- 25.00

渤海证券 2007/08/31 强烈推荐 销售额增长大于销售量增长并伴随毛利率的下降,说明公司产品价格同比有所提高,实现了部分成本的转嫁。 0.50 0.73 ---- 21.90

~25.55

财富证券 2007/08/31 推荐 看好公司在产能、技术以及管理上的优势,随着公司产能的释放,预计2007-2009年公司将保持年均30%的增长率。 0.66 0.79 19.80

~23.10

上海证券 2007/08/30 跑赢大市 公司上半年产能一直处于满产状态,虽然公司调动了各项产能,但产量增长有限。下半年新增项目投产,将缓解公司产能不足的压力。 0.51 0.71 ---- 20.40

业绩预测与估值的均值(元) 0.52 0.70 0.82 22.49

目前股价的动态市盈率(倍) 30.79 22.87 19.52

风 险 提 示

(1)原材料价格大幅波动以及国家为压缩外汇顺差继续采取各项出口紧缩政策。(2)随着国家对环保重视度的提高,可能会影响国际PCB 产业向中国转移的进程,并延缓国内覆铜板产业的扩张速度。