随着第三季度季报的公布日临近,上市公司全年的业绩增长情况也越来越趋向明晰,因此机构在对原先的盈利预测作出调整的同时,也吸引了市场资金的注意力。从统计结果可以看到,近一个月来业绩预测调整较大的个股的涨幅是相当明显的,比如上电股份(600627),现有的预测数据几乎比原先的增长了一倍,反映在股价上就是涨幅接近1.5倍,类似的股票还很多,东方航空近期的暴涨可以说也有这个因素在。

从选股角度出发,我们认为企业自身的内生性业绩增长才是价值投资的主要依据,由于多种因素综合,这种增长方式是温和并且累进的,其阶段性的增幅并不会过于吸引市场眼球,但反而会使其股价得到长线资金的关注,股价也细水长流式地上涨。如处于排行中段位置的三一重工、中国玻纤等个股,虽然短期内涨幅不明显,但业绩预测的调整是稳定增长的,而且动态市盈率始终维持在30多倍,低于整个市场的平均水平。打开二级市场股价走势图,我们发现股价基本都是处在稳定的上升通道中,累计涨幅已经相当可观。

从基本面来分析,业绩预测调整较大的品种基本都存在着外生性的增长刺激,以上电股份为例,8月初刊登公告停牌,复牌后公布换股合并方案,其整体上市的题材促使机构对其业绩进行调整,还有调整幅度最大的*ST东方,也是在复牌后公布重大资产重组方案,之后涨势就一飞冲天。所以,这些个股从具体操作来看,实际是由于其拥有足够市场想象的题材,因而得到了短线资金的极力推动,换句话说,投机性大于投资性,因此对普通投资者来说并不具备可操作性。

由于大盘蓝筹股的上涨,以工行、中行等为代表的一线品种的市盈率已经明显偏高,因此在当前市场进入调整期的同时,相对短线涨幅滞后并且市盈率比较合理的二线蓝筹已经开始成为吸引主流资金的价值洼地。从统计结果中我们可以看到,近一个月涨幅在20%左右的二线品种的动态PE大多在20倍-30倍左右,并且业绩向上调整幅度大多比较低,可见动态的市盈率依然是衡量个股的一个重要标准,如处在统计结果末端的大多是金属、能源、医药等二线蓝筹的温床。

总而言之,市场进入高位震荡后,短线操作的难度也在相应增加,投机性质较重的题材炒作仍然有丰厚的收益,但把握起来没有具体标准,所以作为普通投资者,笔者仍然建议从行业自身业绩增长着手,挖掘可持续投资的中线机会,选择价值被低估的蓝筹品种。

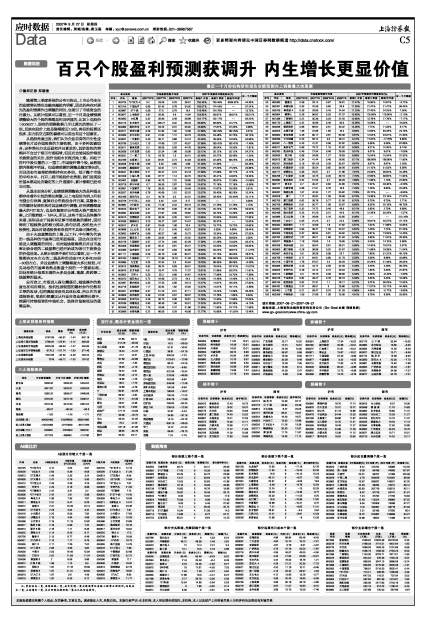

最近一个月份机构研究报告业绩预测向上调整最大的股票

基本资料 市场最新预测平均值 2007年预测净利调整变动(%) 近一个月涨幅

序号 代码 简称 2007*EPS 2007*PE 2008*EPS 2008*PE 最新/1月前 最新/1季前 最新/半年前

1 000725 *ST东方A 0.2 53.09 0.29 36.91 730.49% 730.49% 9359.92% 44.36%

2 601919 中国远洋 0.69 62.43 0.78 54.92 165.07% 174.43% -- 97.24%

3 000887 ST中鼎 0.56 27.6 0.79 19.4 116.46% 124.79% -- 13.73%

4 600627 上电股份 2.62 26.83 4.8 14.64 103.83% 99.61% 99.61% 150.51%

5 600830 大红鹰 0.32 56.89 0.49 36.66 102.17% 102.17% -- 65.20%

6 600115 东方航空 0.09 236.27 0.32 68.43 68.80% 68.80% 42.21% 126.67%

7 600363 联创光电 0.21 53.23 0.31 35.92 49.89% 77.61% 37.43% 5.89%

8 002011 盾安环境 0.28 91.83 1.92 13.36 47.68% 182.29% 182.29% 0.51%

9 002065 东华合创 0.91 41.64 1.12 33.73 45.29% 53.48% 52.73% 40.10%

10 000927 一汽夏利 0.43 39.71 0.68 24.74 43.46% 39.55% 24.53% 54.98%

11 600739 辽宁成大 1.15 47.66 1.37 40.07 37.68% 163.42% 163.42% -7.46%

12 000511 银基发展 0.2 58.09 0.26 44.78 36.04% 36.04% 18.35% -7.61%

13 600058 五矿发展 0.92 52.34 1.66 29.08 35.12% 35.12% 35.12% 54.27%

14 600031 三一重工 1.15 43.76 1.5 33.41 32.48% 54.27% 59.48% -1.33%

15 600169 太原重工 0.52 62.61 0.74 44.03 32.35% 32.35% 68.25% 22.36%

16 900948 伊泰B股 2.65 5.45 3.65 3.96 31.39% 31.39% -- 64.46%

17 002068 黑猫股份 0.9 34.31 1.11 27.81 27.23% 27.23% 27.23% 20.88%

18 000541 佛山照明 0.71 35.47 0.74 34.18 27.08% 27.08% 28.11% -0.12%

19 601628 中国人寿 0.85 67.77 1.14 50.75 26.41% 26.41% 44.62% 18.35%

20 000402 金融街 0.86 40.75 1.22 28.85 25.32% 30.67% 31.36% -10.99%

21 000718 苏宁环球 0.7 59.55 2.67 15.59 24.67% 72.18% 72.18% -3.08%

22 000951 中国重汽 1.78 39.53 2.38 29.49 24.35% 41.67% 53.26% 5.91%

23 000527 美的电器 0.78 45.69 1.01 35.25 23.57% 28.40% 60.28% 10.24%

24 600166 福田汽车 0.4 40.76 0.5 32.31 23.56% 28.43% 122.84% 10.11%

25 000728 S*ST化二 4.02 3.32 4.22 3.17 22.94% -- -- 0.00%

26 600682 S宁新百 0.34 77.49 0.44 59.74 21.79% 21.79% 21.79% 1.15%

27 600570 恒生电子 0.41 87.56 0.58 61.35 20.74% 20.74% 37.78% 53.02%

28 600594 益佰制药 0.52 27.87 0.55 26.62 20.70% 33.73% 10.49% -8.95%

29 600010 包钢股份 0.26 38.59 0.35 28.21 20.65% 20.65% 20.65% 27.83%

30 000338 潍柴动力 3.23 29.27 3.87 24.47 20.45% 26.37% -- 10.00%

31 000912 泸天化 0.87 25.06 1.06 20.4 19.77% 19.77% 19.72% 24.63%

32 600688 S上石化 0.38 51.3 0.45 43.51 18.83% 0.03% 4.68% 28.44%

33 000655 金岭矿业 0.68 56.57 1.86 20.73 18.34% 18.34% 18.34% 57.55%

34 002054 德美化工 0.66 33.94 0.88 25.32 18.02% 50.55% 59.60% 3.50%

35 600176 中国玻纤 0.57 47.74 0.84 32.28 17.58% 21.26% 15.00% 35.47%

36 600408 安泰集团 0.43 50.41 0.61 35.41 17.07% 44.50% 44.50% 35.93%

37 002063 远光软件 0.47 41.32 0.63 30.95 16.63% 35.24% 39.61% -11.27%

38 601111 中国国航 0.29 95.75 0.46 60.27 16.49% 47.15% 56.55% 78.37%

39 600150 中国船舶 7.1 31.96 10.79 21.03 16.28% 96.16% 258.53% 24.38%

40 000989 九芝堂 0.33 42.54 0.3 45.54 16.28% 68.39% 68.39% -0.08%

41 000513 丽珠集团 0.83 38.24 0.83 38.01 16.04% 16.04% 107.81% -10.07%

42 600875 东方电机 4.51 18.47 4.79 17.37 15.91% 21.89% 53.37% 11.81%

43 000002 万科A 0.55 55.3 0.88 34.61 14.61% 17.98% 23.70% -7.89%

44 600310 桂东电力 0.72 44.89 0.73 44.5 14.49% 14.49% 14.49% -0.71%

45 002067 景兴纸业 0.33 47.55 0.56 28.13 14.47% 14.81% 26.23% 27.90%

46 600718 东软股份 1.17 35.84 1.62 25.84 14.07% 14.07% 16.11% -4.69%

47 600201 金宇集团 0.37 51.25 0.51 37.11 13.24% 13.24% 14.39% 35.49%

48 000608 阳光股份 0.38 57.09 0.57 38.57 12.76% 12.76% -1.69% 5.94%

49 600006 东风汽车 0.28 36.73 0.36 28.61 12.50% 12.50% 12.96% 22.09%

50 002038 双鹭药业 0.83 46.59 1.08 35.51 12.02% 35.67% 52.38% -9.10%

51 600459 贵研铂业 1.79 43.68 2.47 31.66 11.93% 11.93% 24.17% 11.98%

52 000066 长城电脑 0.22 66.06 0.29 49.08 11.77% 10.69% -21.92% 13.46%

基本资料 市场最新预测平均值 2007年预测净利调整变动(%) 近一个月涨幅

序号 代码 简称 2007*EPS 2007*PE 2008*EPS 2008*PE 最新/1月前 最新/1季前 最新/半年前

53 600380 健康元 0.59 33.14 0.67 28.81 11.47% 10.90% 74.67% -0.72%

54 600357 承德钒钛 0.53 42.56 0.85 26.8 11.35% 21.47% 21.47% 58.44%

55 000429 粤高速A 0.39 26.89 0.43 24.04 11.23% 27.43% 24.25% 7.00%

56 600804 鹏博士 0.26 96.62 0.53 47.37 10.83% 119.56% 119.56% -2.10%

57 601398 工商银行 0.22 30.36 0.29 22.45 10.60% 15.78% 17.78% -7.17%

58 600170 上海建工 0.42 40.88 0.48 35.9 10.58% 10.58% -- 19.00%

59 600858 银座股份 0.68 66.64 0.91 50.02 10.38% 7.74% 11.03% 6.17%

60 000825 太钢不锈 1.39 22.88 1.65 19.3 9.89% 14.63% 63.26% 23.73%

61 600600 青岛啤酒 0.46 80.17 0.61 60.56 9.67% 12.04% 33.81% 31.50%

62 000559 万向钱潮 0.23 59.12 0.3 46.41 9.47% 17.52% -17.76% 6.85%

63 600581 八一钢铁 0.45 41.31 0.56 32.82 9.38% 9.38% 9.38% 87.66%

64 600517 置信电气 0.69 73.72 1.18 42.82 9.36% 8.21% 10.30% 6.14%

65 600260 凯乐科技 0.49 27.54 0.48 28.59 9.07% 9.07% 9.07% -7.08%

66 000635 英力特 0.68 34.96 1.27 18.83 8.86% 15.54% 15.54% 22.52%

67 600815 厦工股份 0.34 41.44 0.48 28.85 8.71% 196.98% 196.98% 11.90%

68 600251 冠农股份 0.16 161.29 0.28 93.67 8.67% 8.67% 8.67% 2.29%

69 002003 伟星股份 0.62 50.04 0.85 36.26 8.29% 21.10% 31.03% 6.58%

70 000717 韶钢松山 0.59 25.57 0.7 21.66 7.87% 24.59% 36.82% 44.48%

71 600256 广汇股份 0.38 44.75 0.45 38.19 7.70% 47.85% 38.62% 11.94%

72 600690 青岛海尔 0.52 51.53 0.7 38.28 7.68% 11.99% 1.10% 24.60%

73 600177 雅戈尔 0.7 40.47 0.64 44.85 7.52% 7.52% 48.40% -5.26%

74 000932 华菱管线 0.66 21.51 0.76 18.8 7.28% 7.28% 8.60% 25.08%

75 600837 海通证券 1.07 42.34 1.27 35.82 7.28% 20.72% -- -8.95%

76 000528 柳工 1.11 35.92 1.38 28.99 6.73% 13.36% 23.19% 27.57%

77 600755 厦门国贸 0.62 39.78 0.77 31.95 6.70% 6.70% 6.70% 2.71%

78 000709 唐钢股份 0.91 30.77 1.08 25.97 6.69% 8.35% 20.19% 48.70%

79 600895 张江高科 0.32 74.72 0.49 48.8 6.21% 3.83% 2.70% 8.89%

80 600498 烽火通信 0.23 61.29 0.31 44.6 6.12% 12.26% 30.26% -1.57%

81 000686 东北证券 1.78 28.68 2.16 23.65 6.08% -- -- 213.18%

82 600409 三友化工 0.55 31.25 0.7 24.3 5.96% 16.81% 40.57% 47.12%

83 600000 浦发银行 1.17 42.69 1.8 27.62 5.87% 7.02% 11.86% 10.64%

84 000831 关铝股份 0.93 36.47 1.33 25.37 5.82% 2.48% 7.72% 61.20%

85 600509 天富热电 0.37 88.84 0.81 40.92 5.81% 5.81% 13.03% 14.45%

86 000792 盐湖钾肥 1.37 38.21 1.66 31.64 5.78% 5.60% 11.02% 28.30%

87 000027 深能源A 1.18 23.69 1.4 19.95 5.75% 0.45% 14.10% 3.98%

88 600206 有研硅股 0.5 59.04 0.81 36.51 5.66% 14.40% 75.07% 0.37%

89 000905 厦门港务 0.28 36.86 0.32 32.67 5.65% 11.98% 18.39% 11.04%

90 600087 南京水运 0.6 39.58 0.99 23.7 5.63% 7.85% 31.22% 49.10%

91 000758 中色股份 0.71 64.81 0.89 51.79 5.59% 5.59% 8.68% 43.86%

92 601318 中国平安 1.76 67.07 2.4 49.29 5.53% 22.29% 41.49% 28.04%

93 600069 银鸽投资 0.45 44.72 0.58 34.59 5.49% 5.49% 4.49% 58.25%

94 000625 长安汽车 0.49 44.14 0.74 29.34 5.49% 1.90% 5.50% 22.87%

95 002013 中航精机 0.3 76.75 0.39 58.95 5.39% 5.39% -6.40% -7.59%

96 600479 千金药业 0.62 48.47 0.78 38.19 5.39% 5.33% 5.45% 10.08%

97 600153 建发股份 0.92 31.31 1.1 26.17 5.22% 5.22% 36.29% 12.92%

98 600432 吉恩镍业 2.47 36.51 3 29.96 5.01% 11.07% 16.17% 44.48%

99 600460 士兰微 0.21 59.47 0.24 51.03 4.96% 4.96% -0.77% -3.69%

100 600308 华泰股份 1.09 31.88 1.38 25.06 4.91% 8.79% 8.36% 33.93%

统计周期:2007-08-21~2007-09-21

数据来源:上海朝阳永续投资咨询有限公司 (Go-Goal业绩 预测系统)

www.go-goal.com;www.china-yjy.com