我们知道,行情的表现是有周期性的,上市公司的景气度也是有周期性的,人们在高度重视那些高度景气的行业与公司时往往会忽视掉另外一些景气度处于低谷,且正在或者正待景气回升的公司。后一类公司正是更有投资价值的,一方面,此类被忽视的公司往往处于估值最低状态;另一方面,只要行业景气度一回升,此类公司的行情就会迎来艳阳天,行情的估值标准也会获得显著的提升。在投资要略上,如果要买底部的股票不正是应该在股票处于最低谷的时候买入。当然,按照价值投资理念,要投资于这样的股票也理当选择行业龙头股,从机构的深度研究报告来看,生益科技较为符合这样的标准。

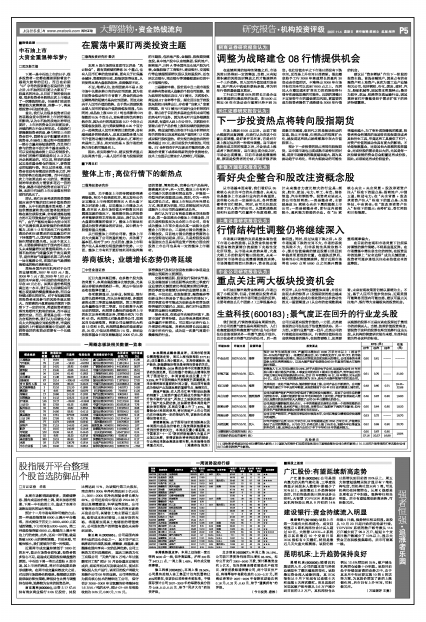

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS (元) | 估值 (元) |

| 07年 | 08年 | 09年 |

| 中金公司 | 2007/10/31 | 推荐 | 预计08年生益科技CCL 产量同比增加在1000 万平方米以上(相当于30-40%的产能扩张),考虑到在奥运会、3G 订单的支持下,08年CCL的市场需求有望维持较大的增长,推动公司营收双双实现较大的增长。公司具备的全球竞争力和优秀管理能力,以及大幅产能扩张使得公司08年盈利有很大可能性超出预期。 | 0.50 | 0.61 | ---- | ----- |

| 申银万国 | 2007/10/31 | 买入 | 销售收入7-9 月同比增长为29%,好于大部分电子公司,这是因为公司07 年有松山湖2 期开始投产所致。4 季度公司的苏州2 期项目也将投产,到年底公司生产能力将比年初时候提高约60%。估计07年销售约45 亿,08年增长20%达到54 亿。过去8年公司的复合增长率为25%,是电子元器件领域中的优质公司。 | 0.51 | 0.70 | ---- | 21.00 |

| 长江证券 | 2007/10/31 | 推荐 | 生益科技一直处于满产状态,随着铜价快速上涨,公司产品在不断提价。公司新增产能主要在下半年及明年释放,乐观的情况下08年EPS还有继续上调空间。 | 0.48 | 0.65 | 0.71 | 19.44~ 22.68 |

| 兴业证券 | 2007/10/31 | 强烈推荐 | 公司在新增产能扩产的同时仍保持了费用率没大幅增长,反映了公司优良的费用控制水平。后续可能提价使08年毛利率还有上扬可能,产能扩张带来收入增长以及费用的良好控制大大增强了公司08年业绩增长的信心。 | 0.46 | 0.67 | 0.80 | 19.00 |

| 财富证券 | 2007/10/31 | 推荐 | 公司是国内覆铜板的龙头企业,十年的稳健成长表明公司是一个值得信赖的企业,公司在管理、技术和产能上有优势,尽管有出口退税率下调的不利影响,但今明两年产能的释放将使公司的增长有所保证。 | 0.50 | 0.64 | 0.80 | 19.20 |

| 西南证券 | 2007/10/31 | 增持 | 公司目前产销两旺,产能利用率保持在较高水平,公司四季度业绩将保持快速增长的趋势。 | 0.53 | 0.72 | ---- | 18.70 |

| 天相投顾 | 2007/10/31 | 买入 | 07年产能预计达到3100万平方米,08年预期将达到3750万平方米,产能增长保证了公司销售增长。9月份CCL价格已经上涨13%左右,预期今年四季度及明年仍有上涨,这将会大大提升公司07年下半年和08 年的盈利能力。 | 0.52 | 0.69 | 0.90 | 20.70 |

| 业绩预测与估值的均值(元) | 0.50 | 0.67 | 0.80 | 19.94 |

| 目前股价的动态市盈率(倍) | 27.16 | 20.27 | 16.98 |

| 风 险 提 示 |

| (1)原材料价格波动对公司业绩有较大影响;(2)国家为压缩外汇顺差采取各项出口紧缩政策对公司业务有影响;(3)人民币升值带来的汇率风险对公司出口业务利润率产生影响。 |