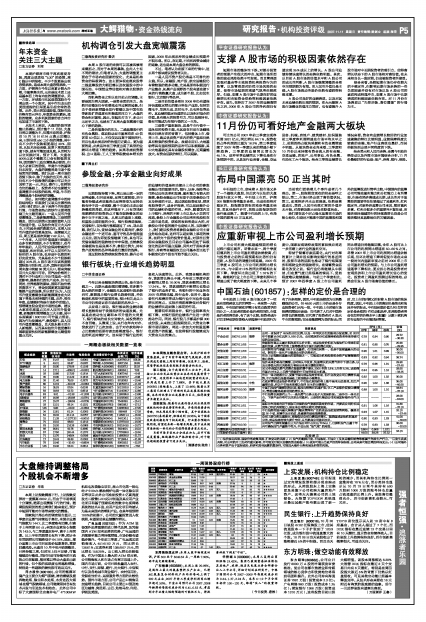

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS (元) | 估值 (元) | ||

| 07年 | 08年 | 09年 | |||||

| 中金公司 | 2007/11/05 | 推荐 | 公司一直保持了45%的分红比例,以及一年两次分红的股利分配政策,至2007年中期累计分红达到3,055亿元,公司稳定的分红政策将给投资者带来持续可观的现金回报。 | 0.79 | 0.94 | 0.95 | 29.72 ~36.30 |

| 联合证券 | 2007/11/05 | ---- | 资源税有望从从量计税改革至从价计税、成品油定价机制为炼油行业带来明朗盈利前景,天然气价格上涨等都成为中国石油的潜在利好。 | 0.81 | 0.80 | 0.75 | 25.90 ~29.95 |

| 安信证券 | 2007/11/03 | ---- | 公司拥有油气储量205.3亿当量桶,在亚洲位居第一,也是中国储量最大的公司。拥有的一体化产业链是公司的优势所在。 | 0.90 | 1.01 | 0.99 | 30.00 ~35.00 |

| 国泰君安 | 2007/11/05 | ---- | 作为上证指数权重最大的蓝筹股之一,可能成为机构投资组合资产配置策略的核心选择。 | 0.83 | 0.92 | 0.94 | 38.74 |

| 长江证券 | 2007/11/05 | 推荐 | 油价未来仍将高位震荡,公司将从中收益,快速增长的天然气和中下游业务,以及自身强大的抗风险能力将保证未来业绩稳定增长。 | 0.79 | 0.96 | 1.01 | 29.90 ~37.40 |

| 兴业证券 | 2007/10/31 | ---- | 2010年我国天然气消费在能源消费中要从2005年的2.8%上升到5.3%,这给拥有国内85%以上天然气资源的中石油带来巨大机遇。 | 0.84 | 0.95 | 1.16 | 28.50 ~33.25 |

| 东方证券 | 2007/11/02 | ---- | 作为一体化能源企业,受累于国内成品油定价机制,但不会改变公司业绩增长趋势,中石油将在高盈利基础上实现稳步小幅增长。 | 0.92 | 1.00 | 1.02 | 35.00 |

| 国信证券 | 2007/10/29 | 中性 | 在政府管制成品油价格背景下,中石油在原油价格上涨中基本无法受益,加之产量增长低,所以中石油未来难以保持20%的业绩增长。 | 0.90 | 1.02 | 1.08 | 35.00 ~40.50 |

| 银河证券 | 2007/10/30 | 推荐 | 中国石油油气勘探利润丰厚;炼油与销售在迅速扩张;化工产品涨价促使业绩增长;管道运输将是新利润的增长点。 | 0.89 | 1.00 | 1.10 | 33.64 ~37.18 |

| 招商证券 | 2007/10/28 | ---- | 中石油增长来源有三个:一是天然气业务正处于大发展阶段;二是作为一体化企业,下游产品价格可以决定公司盈利;三是依托集团公司拓展国际海外油气业务。 | ---- | ---- | ---- | 28.00 ~32.00 |

| 渤海证券 | 2007/11/01 | ---- | 国际化布局将有利于获取可持续的油气资源和稳定的市场,并提高公司的长远竞争力和抗风险能力,保证本公司的长期可持续发展。 | 0.91 | 1.06 | 1.16 | 31.80 ~37.10 |

| 中投证券 | 2007/11/02 | ---- | 中石油拥有国内最大规模油气输送管网和广泛的成品油批发销售网络,覆盖全国26个省、直辖市及自治区,是重要的基础战略资源。 | 0.93 | 1.07 | 1.15 | 32.10 ~37.45 |

| 国海证券 | 2007/11/02 | ---- | 公司上游业务比重较大,将能保证公司业绩良好增长。随我国成品油机制逐步完善,成品油将有较大提升空间,从而提高公司盈利水平。 | 0.80 | 0.93 | 1.03 | 41.00 ~45.00 |

| 西南证券 | 2007/10/30 | ---- | 公司油气已探明储量在三大石油公司中占比达70%以上,已探明油气出量十年内可确保油气产量稳中有升,不会出现“油气荒”的局面。 | 0.79 | 0.93 | 1.03 | 30.00 ~32.00 |

| 业绩预测与估值的均值(元) | 0.854 | 0.968 | 1.021 | 34.15 | |||

| 目前股价的动态市盈率(倍) | 44.50 | 39.26 | 37.22 | ||||

| 风 险 提 示 | |||||||

| (1)油价波动风险、国家价格政策风险、汇率变动的风险;(2)油气的勘探开发、石油炼制、石油化工及其运输和销售等都属于危险生产行业,一旦发生此类风险,对公司的开工负荷有重大影响,并可能支付较大金额的资金赔偿;(3)政府可能出台更严厉的环保标准,公司未来可能会增加环保支出;(4)公司海外业务和资产由于国际政治、经济和其他因素的复杂性,可能加大海外业务拓展及经营的风险。 |

|

| 上海证券报网络版郑重声明 | |||

|

|||

|

|

|

中国石油(601857):怎样的定价是合理的 2007年11月11日 来源:上海证券报 作者: 中石油的上市使A股市场又多了一项具有里程碑意义的世界第一:全球第一大权重股。中石油的营收尽管只有埃克森美孚的四分之一,但前者的股价是后者的四倍,市值是后者的两倍多,有了这个比较,投资者或许对巴非特前期在香港大举抛售中石油的行为有了许多理解。因而,中石油虽然贵为亚洲最赚钱的公司,但48.60元的上市价还是令专业投资者们大吃一惊,中石油上市时被市场热捧的原因应该是:它代表了人们对中国经济增长的高预期;它代表了投资者对A股大牛市的高预期;它还是能源稀为贵的标志;同时,它上市的时候又折射着A股市场的泡沫程度。因此,中石油上市的高定价是荣光和泡沫并存的标志。中石油到底价值几何?怎样的定价是合理的?作位必配品种,机构投资者将会在怎样的价格水平上配置?从数十家机构的专业报告中应能找到答案。

|