大盘自10月17日步入调整以来,截至11月9日,累积下跌幅度已达到12.75%,有色、钢铁、煤炭等前期涨幅较大的板块,跌幅居前。其实进入十月份之后,在大盘股上涨带动上证指数快速上升的同时,许多个股已经率先进入了调整的走势。

数据显示,10月份以来,截至11月9日,上证指数下跌4.26%,同时期仅石化、金融两个行业指数实现上涨,房地产行业指数下跌2.41%,跌幅低于上证指数,其余32个天相行业指数,下跌幅度均超过上证指数。同时期有交易的1417只A股当中,仅136只实现上涨,而出现下跌的个股高达1281只,占有交易A股总数的90%,其中,超过半数的个股下跌幅度在20%以上,121只个股跌幅超过30%,*ST阿继、广济药业等六只个股下跌幅度在40%以上。

可以看到,在大盘持续调整之中,绝大部分个股难逃下跌的命运。然而这些下跌的个股当中也不乏像贵研铂业、唐钢股份等基本面良好,三季度末被基金、QFII等机构投资者大量持有的品种,在泥沙俱下的下跌过程当中,这些个股或许会逐渐显现出投资的价值。

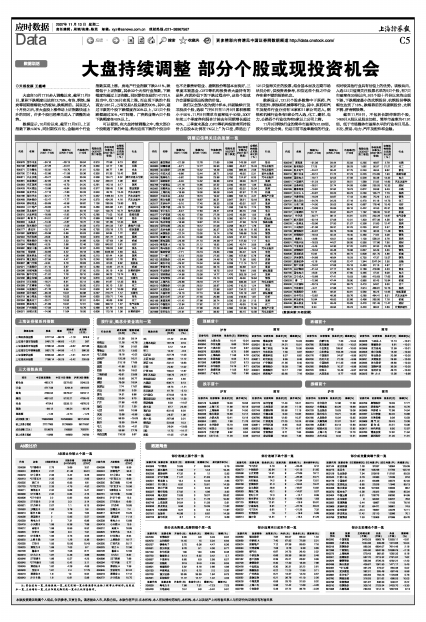

我们以全部A股为统计样本,并剔除掉ST及非股改个股,选取“7月6日至11月9日累积涨幅小于50%、11月9日简单市盈率低于40倍,2007年前三个季度净利润合计较去年同期增长超过40%,三季度末基金、QFII等机构投资者所持股份占总股本比例在1%以上”为口径,筛选出了121只值得关注的股票,结合基本面及近期市场状况分析,供投资者参考,相信这些个股之中会存在着不错的投资机会。

数据显示,121只个股多数集中于医药、汽车及配件、钢铁和机械等等行业,其中,医药和汽车及配件行业分别有16家和11家公司进入,钢铁和机械行业各有9家公司入选,化工、建材、电力、公路四个行业也均有5家以上公司上榜。

11月9日钢铁行业的简单市盈率为21.09倍,按天相行业分类,仍是目前市盈率最低的行业,相对较其他行业具有估值上的优势。该板块内,入选121只值得关注股票名单的9只个股,有7只市盈率在20倍以内,9只个股十月份以来均出现下跌,下跌幅度最小的武钢股份、杭钢股份等跌幅也达到了18%,跌幅靠前的有唐钢股份、太钢不锈、济南钢铁等。

截至11月9日,不包括长期停牌的个股,1469只A股以总股本加权,简单市盈率为41.91倍,低于市场整体市盈率水平的行业有日用品、石化、贸易、电力、汽车及配件和金融。

调整后值得关注的股票一览

| 代码 | 名称 | 涨幅(%)[1001-1109] | 涨幅(%)[0706-1109] | 市盈率(倍)[1109] | 每股收益(元)[2007第三季度] | 净利润增长率(%)[2007第三季度] | 全部机构持股占总股本比例(%) | 行业 |

| 600978 | 宜华木业 | -34.16 | -28.13 | 39.04 | 0.310 | 72.56 | 9.13 | 建材 |

| 600106 | 重庆路桥 | -27.26 | -24.51 | 31.20 | 0.330 | 44.17 | 1.90 | 公路 |

| 600371 | 万向德农 | -25.92 | -19.70 | 31.01 | 0.230 | 99.77 | 1.88 | 农业 |

| 600750 | 江中药业 | -22.86 | -11.58 | 30.36 | 0.330 | 81.35 | 15.42 | 医药 |

| 600611 | 大众交通 | -25.27 | -10.68 | 35.55 | 0.356 | 104.71 | 6.32 | 城市交通与仓储 |

| 600881 | 亚泰集团 | -32.85 | -9.78 | 33.75 | 0.402 | 439.31 | 2.06 | 建材 |

| 000963 | 华东医药 | -18.58 | -9.70 | 34.20 | 0.261 | 145.19 | 9.17 | 医药 |

| 000428 | 华天酒店 | -13.86 | -8.64 | 30.93 | 0.377 | 266.45 | 2.58 | 酒店旅游 |

| 600686 | 金龙汽车 | -17.18 | -7.80 | 30.33 | 0.540 | 49.70 | 13.44 | 汽车及配件 |

| 600166 | 福田汽车 | -32.21 | -7.78 | 22.77 | 0.352 | 1469.34 | 4.73 | 汽车及配件 |

| 600469 | 风神股份 | -22.47 | -7.77 | 24.04 | 0.370 | 434.28 | 4.16 | 汽车及配件 |

| 600459 | 贵研铂业 | -35.69 | -6.58 | 36.62 | 1.100 | 260.55 | 13.83 | 有色 |

| 600053 | 中江地产 | -20.65 | -5.73 | 26.00 | 0.460 | 805.86 | 4.91 | 房地产开发 |

| 600588 | 用友软件 | -7.05 | -3.34 | 33.16 | 1.001 | 100.75 | 10.71 | 软件及服务 |

| 000910 | 大亚科技 | -16.69 | -2.92 | 34.70 | 0.280 | 71.03 | 10.81 | 造纸包装 |

| 000507 | 粤 富 华 | -24.51 | -2.87 | 22.75 | 0.369 | 248.86 | 1.92 | 综合 |

| 600993 | 马应龙 | -14.40 | -2.67 | 18.72 | 2.140 | 141.60 | 12.34 | 医药 |

| 000608 | 阳光股份 | -10.07 | -2.08 | 34.58 | 0.470 | 344.33 | 7.87 | 房地产开发 |

| 600177 | 雅戈尔 | -10.12 | 0.44 | 24.99 | 0.755 | 220.18 | 2.75 | 纺织服装 |

| 002082 | 栋梁新材 | -25.98 | 0.69 | 30.03 | 0.330 | 84.84 | 1.72 | 建材 |

| 002004 | 华邦制药 | -6.08 | 0.83 | 18.84 | 0.970 | 201.72 | 2.83 | 医药 |

| 600710 | 常林股份 | -28.10 | 2.33 | 34.66 | 0.200 | 157.63 | 1.08 | 机械 |

| 002064 | 华峰氨纶 | -9.29 | 2.68 | 22.46 | 1.530 | 840.52 | 3.81 | 化纤 |

| 600962 | 国投中鲁 | -33.76 | 2.98 | 32.97 | 0.420 | 109.53 | 5.82 | 食品 |

| 600790 | 轻纺城 | -20.69 | 3.22 | 29.18 | 0.289 | 3349.38 | 2.83 | 食品 |

| 600666 | 西南药业 | -27.95 | 4.06 | 36.80 | 0.210 | 82.44 | 4.38 | 医药 |

| 600619 | 海立股份 | -27.56 | 4.47 | 29.78 | 0.240 | 163.82 | 1.76 | 家电 |

| 600897 | 厦门空港 | -9.34 | 5.16 | 28.83 | 0.429 | 42.05 | 8.92 | 民航业 |

| 002021 | 中捷股份 | -21.10 | 5.97 | 38.14 | 0.280 | 44.82 | 22.14 | 机械 |

| 000066 | 长城电脑 | -19.55 | 6.56 | 37.00 | 0.220 | 50.19 | 4.00 | 计算机硬件 |

| 600785 | 新华百货 | -21.02 | 7.76 | 26.10 | 0.600 | 58.23 | 13.74 | 商业 |

| 002056 | 横店东磁 | -20.96 | 8.07 | 37.94 | 0.670 | 44.65 | 7.04 | 元器件 |

| 000516 | 开元控股 | -18.21 | 8.91 | 25.14 | 0.360 | 81.87 | 12.35 | 商业 |

| 600589 | 广东榕泰 | -7.69 | 9.36 | 30.50 | 0.310 | 50.10 | 2.92 | 化工 |

| 000680 | 山推股份 | -21.76 | 9.99 | 24.52 | 0.500 | 84.12 | 10.69 | 机械 |

| 000636 | 风华高科 | -35.45 | 10.01 | 30.96 | 0.237 | 213.77 | 1.12 | 元器件 |

| 600219 | 南山铝业 | -26.95 | 10.53 | 28.64 | 0.850 | 229.71 | 7.49 | 有色 |

| 002054 | 德美化工 | -20.21 | 10.53 | 32.51 | 0.434 | 40.65 | 6.36 | 化工 |

| 000939 | 凯迪电力 | -21.89 | 10.91 | 12.51 | 1.090 | 300.12 | 1.37 | 电气设备 |

| 600098 | 广州控股 | -17.09 | 11.29 | 19.76 | 0.468 | 82.76 | 2.49 | 电力 |

| 000021 | 长城开发 | -14.96 | 11.64 | 18.95 | 0.608 | 113.18 | 1.06 | 计算机硬件 |

| 代码 | 名称 | 涨幅(%)[1001-1109] | 涨幅(%)[0706-1109] | 市盈率(倍)[1109] | 每股收益(元)[2007第三季度] | 净利润增长率(%)[2007第三季度] | 全部机构持股占总股本比例(%) | 行业 |

| 600622 | 嘉宝集团 | -21.36 | 12.76 | 21.65 | 0.398 | 143.38 | 6.87 | 综合 |

| 600660 | 福耀玻璃 | -6.71 | 12.77 | 35.93 | 0.660 | 45.37 | 15.43 | 汽车及配件 |

| 600565 | 迪马股份 | -22.66 | 13.42 | 18.48 | 0.590 | 369.35 | 2.58 | 汽车及配件 |

| 600410 | 华胜天成 | -8.86 | 13.44 | 38.71 | 0.432 | 46.35 | 5.31 | 软件及服务 |

| 000338 | 潍柴动力 | -5.82 | 13.99 | 23.86 | 2.780 | 124.57 | 8.33 | 汽车及配件 |

| 600511 | 国药股份 | -9.40 | 14.52 | 39.86 | 0.810 | 58.00 | 20.72 | 医药 |

| 600798 | 宁波海运 | -21.16 | 14.65 | 32.52 | 0.230 | 99.28 | 1.39 | 航运业 |

| 600062 | 双鹤药业 | -14.34 | 15.42 | 33.42 | 0.492 | 65.32 | 10.34 | 医药 |

| 600835 | 上海机电 | -18.99 | 16.00 | 36.06 | 0.543 | 62.97 | 11.70 | 机械 |

| 600641 | 万业企业 | -8.54 | 16.15 | 19.02 | 0.860 | 182.14 | 4.47 | 房地产开发 |

| 000651 | 格力电器 | -10.61 | 16.87 | 30.51 | 0.947 | 58.21 | 10.44 | 家电 |

| 002017 | 东信和平 | -9.10 | 17.45 | 38.35 | 0.238 | 60.32 | 9.57 | 通信 |

| 000825 | 太钢不锈 | -28.13 | 17.58 | 15.93 | 1.036 | 158.75 | 7.74 | 钢铁 |

| 600900 | 长江电力 | -6.47 | 17.64 | 28.21 | 0.518 | 83.70 | 2.93 | 电力 |

| 600377 | 宁沪高速 | -20.43 | 17.83 | 27.28 | 0.245 | 43.56 | 1.03 | 公路 |

| 600896 | 中海海盛 | -25.65 | 17.93 | 29.18 | 0.380 | 80.74 | 2.39 | 航运业 |

| 600125 | 铁龙物流 | -18.96 | 18.67 | 37.24 | 0.247 | 47.58 | 10.18 | 铁路运输 |

| 600420 | 现代制药 | -20.44 | 19.12 | 31.09 | 0.256 | 64.27 | 1.76 | 医药 |

| 000527 | 美的电器 | -13.31 | 19.32 | 30.37 | 0.790 | 139.16 | 11.65 | 家电 |

| 600282 | 南钢股份 | -22.24 | 20.30 | 15.14 | 0.790 | 188.66 | 15.35 | 钢铁 |

| 600075 | 新疆天业 | -24.24 | 20.96 | 24.49 | 0.520 | 51.22 | 13.55 | 综合 |

| 600969 | 郴电国际 | -23.46 | 21.10 | 29.56 | 0.217 | 147.30 | 1.11 | 电力 |

| 000429 | 粤高速A | -19.79 | 21.12 | 18.92 | 0.340 | 40.74 | 3.09 | 公路 |

| 000572 | 海马股份 | -23.94 | 21.96 | 22.28 | 0.480 | 534.49 | 1.40 | 汽车及配件 |

| 600497 | 驰宏锌锗 | -7.71 | 23.19 | 23.63 | 2.599 | 64.22 | 3.25 | 有色 |

| 600031 | 三一重工 | -3.13 | 23.53 | 27.35 | 1.390 | 157.82 | 5.78 | 机械 |

| 600153 | 建发股份 | -25.44 | 23.66 | 24.48 | 0.730 | 71.06 | 9.80 | 贸易 |

| 000401 | 冀东水泥 | -29.32 | 24.04 | 34.39 | 0.338 | 111.14 | 15.12 | 建材 |

| 600487 | 亨通光电 | -13.10 | 24.04 | 33.13 | 0.395 | 50.56 | 3.41 | 通信 |

| 600626 | 申达股份 | -20.83 | 24.25 | 18.75 | 0.312 | 78.64 | 2.83 | 纺织服装 |

| 000513 | 丽珠集团 | -14.88 | 25.38 | 14.77 | 1.470 | 303.28 | 3.42 | 医药 |

| 600569 | 安阳钢铁 | -22.93 | 25.64 | 23.10 | 0.323 | 49.00 | 16.64 | 钢铁 |

| 600104 | 上海汽车 | -25.69 | 26.18 | 27.77 | 0.593 | 339.39 | 3.47 | 汽车及配件 |

| 600010 | 包钢股份 | -21.06 | 26.22 | 33.67 | 0.240 | 110.22 | 1.24 | 钢铁 |

| 600827 | 友谊股份 | -9.44 | 26.57 | 22.86 | 0.557 | 134.22 | 6.22 | 商业 |

| 600233 | 大杨创世 | -15.13 | 27.15 | 16.56 | 0.475 | 120.18 | 4.87 | 纺织服装 |

| 000949 | 新乡化纤 | -27.37 | 27.55 | 20.68 | 0.440 | 419.64 | 1.81 | 化纤 |

| 600196 | 复星医药 | -21.42 | 27.66 | 39.74 | 0.230 | 51.09 | 2.13 | 医药 |

| 600426 | 华鲁恒升 | -12.84 | 27.82 | 31.17 | 0.701 | 45.35 | 12.45 | 化工 |

| 000616 | 亿城股份 | -3.54 | 27.96 | 25.93 | 0.590 | 102.89 | 12.50 | 房地产开发 |

| 001696 | 宗申动力 | -22.91 | 28.67 | 39.62 | 0.360 | 83.15 | 10.56 | 汽车及配件 |

| 代码 | 名称 | 涨幅(%)[1001-1109] | 涨幅(%)[0706-1109] | 市盈率(倍)[1109] | 每股收益(元)[2007第三季度] | 净利润增长率(%)[2007第三季度] | 全部机构持股占总股本比例(%) | 行业 |

| 600548 | 深高速 | -31.36 | 29.44 | 25.93 | 0.295 | 48.67 | 2.78 | 公路 |

| 600596 | 新安股份 | 17.25 | 30.37 | 36.29 | 1.062 | 50.97 | 21.21 | 化工 |

| 600580 | 卧龙电气 | -24.47 | 30.42 | 37.75 | 0.240 | 49.54 | 8.62 | 家电 |

| 600210 | 紫江企业 | -23.12 | 31.72 | 27.23 | 0.225 | 214.65 | 1.93 | 造纸包装 |

| 600886 | 国投电力 | -19.17 | 32.05 | 27.56 | 0.526 | 50.38 | 13.32 | 电力 |

| 000951 | 中国重汽 | -21.23 | 32.51 | 28.51 | 1.569 | 51.92 | 14.83 | 汽车及配件 |

| 600586 | 金晶科技 | -26.51 | 32.74 | 34.58 | 0.688 | 250.55 | 10.33 | 建材 |

| 600269 | 赣粤高速 | -10.62 | 32.92 | 18.23 | 0.672 | 53.98 | 9.49 | 公路 |

| 000522 | 白云山A | -24.87 | 33.20 | 30.23 | 0.250 | 105.77 | 7.79 | 医药 |

| 000932 | 华菱管线 | -19.28 | 33.67 | 17.43 | 0.463 | 75.26 | 3.44 | 钢铁 |

| 000422 | 湖北宜化 | -24.76 | 34.23 | 27.16 | 0.470 | 81.16 | 14.73 | 化工 |

| 000755 | 山西三维 | -14.00 | 35.03 | 36.40 | 0.667 | 176.46 | 15.43 | 化纤 |

| 600557 | 康缘药业 | -13.30 | 35.85 | 38.16 | 0.422 | 42.50 | 20.31 | 医药 |

| 000157 | 中联重科 | 10.17 | 35.91 | 30.27 | 1.192 | 136.35 | 10.51 | 机械 |

| 600202 | 哈空调 | -20.77 | 36.12 | 24.81 | 0.575 | 230.28 | 13.87 | 电气设备 |

| 600677 | 航天通信 | -32.18 | 37.06 | 12.01 | 1.303 | 877.39 | 4.56 | 综合 |

| 000028 | 一致药业 | -20.96 | 37.50 | 31.07 | 0.358 | 51.60 | 12.47 | 医药 |

| 000151 | 中成股份 | -31.06 | 39.31 | 32.25 | 0.235 | 62.81 | 3.57 | 贸易 |

| 000709 | 唐钢股份 | -34.97 | 39.75 | 16.99 | 0.750 | 46.33 | 11.48 | 钢铁 |

| 600126 | 杭钢股份 | -18.43 | 40.44 | 16.40 | 0.460 | 71.62 | 3.06 | 钢铁 |

| 600380 | 健康元 | -3.86 | 43.01 | 13.96 | 1.100 | 558.22 | 3.76 | 医药 |

| 600801 | 华新水泥 | -16.53 | 44.07 | 36.95 | 0.590 | 117.86 | 7.90 | 建材 |

| 600479 | 千金药业 | -5.49 | 44.30 | 37.20 | 0.670 | 92.30 | 23.26 | 医药 |

| 600005 | 武钢股份 | -18.34 | 45.46 | 16.98 | 0.637 | 94.49 | 5.55 | 钢铁 |

| 600806 | 昆明机床 | 15.92 | 45.75 | 38.74 | 0.608 | 401.70 | 4.86 | 机械 |

| 600022 | 济南钢铁 | -24.68 | 46.64 | 18.29 | 0.730 | 47.37 | 13.57 | 钢铁 |

| 000562 | 宏源证券 | -5.16 | 47.06 | 22.47 | 1.344 | 2247.04 | 2.50 | 金融 |

| 600352 | 浙江龙盛 | -19.32 | 47.06 | 25.18 | 0.463 | 81.15 | 4.87 | 化工 |

| 600778 | 友好集团 | -21.44 | 47.17 | 39.13 | 0.169 | 418.80 | 4.33 | 商业 |

| 600795 | 国电电力 | -8.09 | 47.28 | 27.60 | 0.495 | 47.32 | 6.08 | 电力 |

| 600739 | 辽宁成大 | -10.68 | 47.41 | 19.03 | 1.980 | 410.83 | 17.65 | 贸易 |

| 000528 | 柳 工 | -12.66 | 47.44 | 26.90 | 0.960 | 62.43 | 15.84 | 机械 |

| 600500 | 中化国际 | -20.19 | 47.84 | 36.73 | 0.410 | 54.61 | 5.30 | 化工 |

| 000623 | 吉林敖东 | -3.21 | 47.86 | 18.21 | 2.914 | 466.81 | 10.75 | 医药 |

| 002003 | 伟星股份 | 4.83 | 48.32 | 30.81 | 0.590 | 60.25 | 14.95 | 纺织服装 |

| 600991 | 长丰汽车 | -13.62 | 48.36 | 39.76 | 0.280 | 484.41 | 8.31 | 汽车及配件 |

| 600499 | 科达机电 | 10.84 | 49.00 | 32.66 | 0.498 | 265.95 | 7.18 | 机械 |

| 600449 | 赛马实业 | 3.26 | 49.45 | 25.83 | 0.470 | 231.45 | 11.47 | 建材 |

| 000062 | 深圳华强 | 5.34 | 49.94 | 26.23 | 0.420 | 98.02 | 2.69 | 计算机硬件 |

(数据来源:天相投顾)