油价上涨与船价的上涨必然会促使运价的上涨,结合公司运力规模的扩张,在稳定已有业绩之余,也给公司股票价格赋予了新的增长空间。因此,公司稳妥的业绩与显著的增长有望促进股票进入蓝筹行列。

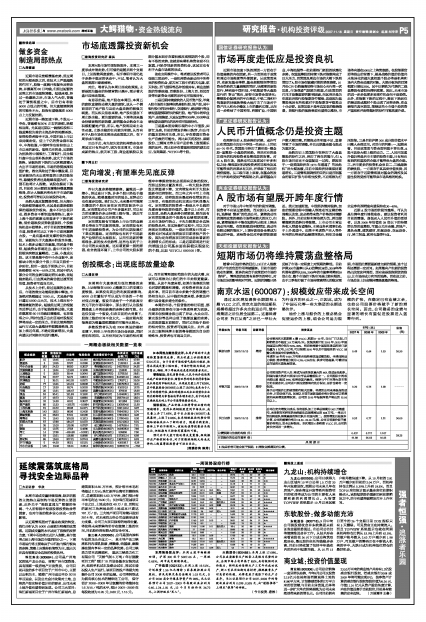

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS (元) | 估值 (元) | ||

| 2007年 | 2008年 | 2009年 | |||||

| 联合证券 | 2007/11/13 | 增持 | 公司将再次长期期租6 艘VLCC,租期8-12年,自出厂日之起,日期租租金不超过3.8 万美元/天。按发改委计划2010年、2015年国油国运比例分别为50%、80%,相应地需要中国船东承运的进口原油量为1亿吨、2亿吨,可以预期2010 年以后中国船东的VlCC 运输业务发展空间依然很大。 | 0.49 | 0.64 | 1.03 | 26.50 |

| 申银万国 | 2007/11/14 | 增持 | 公司实现资产注入后,将成为远东地区最大的MR型成品油船队,和国内最大的进口原油与化学品运输船队之一。公司船队中的双壳船比重(超过95%)也将是国内最高。根据与中石化等大货主签订的长期合同,公司进口原油货源将有充分保证,运价也将有一定保底。 | 0.30 | 0.74 | 1.08 | ----- |

| 长江证券 | 2007/11/13 | 推荐 | 公司在定向增发完成后,现有船队加上订单总规模为502万载重吨,未来拥有和控制的油轮船队总规模将达到688万吨,一举从目前油轮船队规模最弱的地位跃升至国内第二。按照增发后总股本计算,公司的重置价格为18.30-20.00元/股,公司目前股价低于重置价格附近,安全边际很高。本次增加6条租期VLCC后,公司的成长空间进一步增大。 | 0.52 | 0.77 | 1.21 | 30.00 |

| 业绩预测与估值的均值(元) | 0.437 | 0.717 | 1.107 | 28.25 | |||

| 目前股价的动态市盈率(倍) | 41.88 | 25.52 | 16.53 | ||||

| 风 险 提 示 | |||||||

| (1)油运价格可能会低于预期;(2)增发会摊薄现有业绩。 |