中海发展作为航运龙头公司之一,自然从中享受到丰厚的利益。根据诸多机构的深度研究,该公司的业绩水平与复合增长率十分显著,而目前的估值水平却仍较为低廉,从而使机构投资者具有了配置的价值与配置机会,也使行情具备了走好的条件。

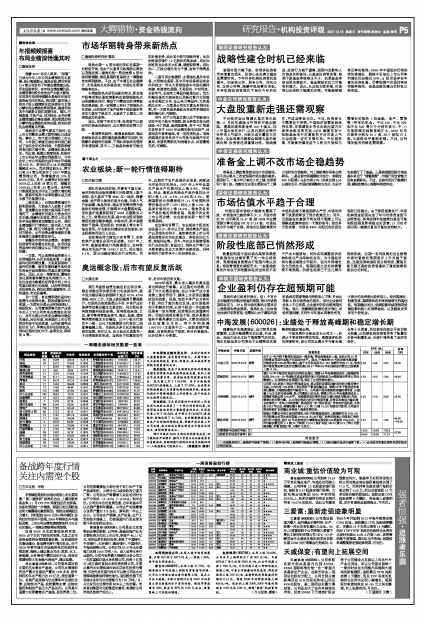

| 评级机构 | 评级日期 | 股票评级 | EPS (元) | 估值 投资要点 | (元)|||

| 07年 | 08年 | 09年 | |||||

| 中金公司 | 2007/12/10 | 推荐 | 由于07年外贸干散货市场运价一路走高,带动沿海运价上涨,目前公司07年内贸煤合同运价远低于市场运价水平。因此,中海发展08年的沿海电煤运输价格将达到20%的同比增长;基于今年到目前为止WS 指数平均为71 点,考虑到中海发展还享受运价优惠的机制,则07年和08年的油轮运价要比之前预测上调11.2%。 | 1.38 | 1.68 | 2.03 | 42.00 |

| 国泰君安 | 2007/12/10 | 增持 | 预计08年干散货市场运价仍将处在高位,预期08年沿海煤炭运价上涨幅度将达到20%;09-10 年油轮市场运价回升和公司油轮运力大幅度增长带来公司业绩增长。公司两块业务周期不同,保证了公司持续的增长。 | 1.35 | 1.60 | 1.80 | 45.00 |

| 天相投顾 | 2007/12/10 | 增持 | 公司有24%的收入来自外贸油运业务,将从现阶段国际油轮运价的大幅反弹中受益;公司约有12%的收入来自国际干散货运输业务,预期08年干散货运价将高位震荡,大幅度回落的可能性不大。公司是中国沿海煤炭运输的领导者,占据着31%左右的市场份额,是公司最核心的业务,预期公司08年沿海煤炭运价上涨幅度可能达到20%水平。沿海煤炭运价提升和运力增长将成为驱动公司业绩增长的主要力量。从公司定单运力的交付情况来看,在保证沿海运力稳定增长的情况下,未来公司将把握“国油国运”和“国矿国运”带来的市场机遇,尤其是2009年以后,随着在建8艘VLCC和12艘VLOC陆续交付使用,公司进口原油和铁矿石运输业务将进入高速发展阶段。 | 1.35 | 1.70 | 2.00 | 42.50 |

| 联合证券 | 2007/12/07 | 增持 | 根据公司最近与货主谈判的情况,估计内贸煤基准运价上涨幅度约为20%,08年内贸煤业务同比将多贡献EPS0.35元;由于船厂效率的提高公司原有订单投放时间大提前,估计09年总有效运力增幅将由原来的6%提高到15%左右。公司可能在最近再下4艘30万吨级VLOC(铁矿石船)和10艘5.73万吨(内贸煤运输)的散货船订单,大幅扩大运力。 | 1.37 | 1.75 | 1.90 | 40.00 ~44.00 |

| 业绩预测与估值的均值(元) | 1.363 | 1.683 | 1.933 | 42.88 | |||

| 目前股价的动态市盈率(倍) | 24.64 | 19.95 | 17.37 | ||||

| 风 险 提 示 | |||||||

| (1)沿海煤炭运价上涨幅度可能低于预期;(2)燃料油价格上涨幅度可能超过预期;(3)油轮运输市场运价继续下跌;(4)全球经济显著放缓带来国际航运价格的波动。 |