新华传媒的前身是“华联超市”,随着新华发行集团的入主,以及经过连续性资产整合与注入,一个旗舰级的传媒业上市公司已经呼之欲出。通过诸多机构的深度研究和实地调研报告看,新华传媒占据了上海本地主流的平面媒体广告和图书发行业务很大的分额。并且,借助于新华发行的平台,平面业务还将拓展和辐射于全国。同时,电视媒体、动漫业务等已在后续资产整合的规划之中。显然,新华传媒已经成为独树一帜的文化产业股,已经被诸多机构投资者高度看好。

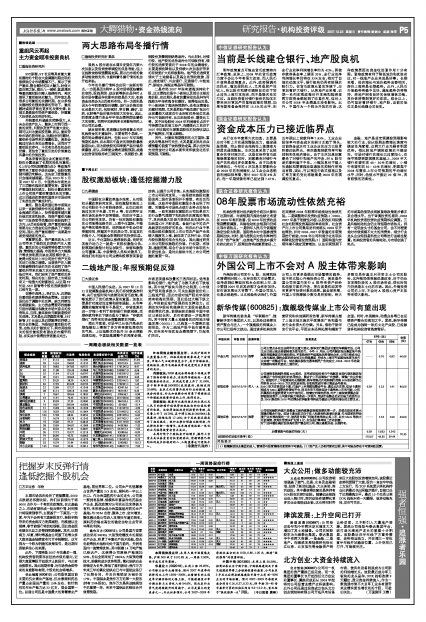

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS (元) | 估值 (元) |

| 07年 | 08年 | 09年 |

| 中金公司 | 2007/12/19 | 推荐 | 公司主营业务在过去两年发生重大变化,新华发行集团成功重组华联超市后,公司主业已经从商业连锁转变为图书发行。今年11月份,公司向解放报业集团和中润解放传媒集团定向增发获批,并收购相关平面媒体的经营性业务,公司已经成为以上海为基地,辐射全国的综合性文化传媒集团,并成为上海市平面媒体和图书发行业务唯一的整合平台。综合潜在税收优惠和新民广告的成立,2008-2009年的盈利预期均将有明显的上调空间。 | ---- | 0.70 | 0.82 | 60.00 |

| 安信证券 | 2007/12/19 | 买入-A | 公司增资收购新民传媒50%股权,在完成收购后将与中润解放目前代理的解放报业集团广告形成良好的协同效应,整合沪上平面媒体广告资源,增强广告议价能力。根据对沪上平面媒体的长期跟踪,新华传媒此次收购新民传媒50%股权即为公司带来8000~9000万元的权益利润,在收购完成时将计算成全年盈利。 | 0.28 | 1.23 | 1.41 | 86.00 | SMG单方注资炫动卡通,打造沪上电视媒体整合平台,通过此次注资,炫动卡通则将成为SMG重要的经营性平台,而且未来不排除炫动卡通单独上市的可能,公司所属股权有望获得更大的升值空间。随着定向增发获准,对沪上媒体资源整合紧锣密鼓地展开,公司盈利能力将获进一步提升,完成市场整合后定价能力的提升以及2008奥运和2010年世博会的积极影响将成为撬动公司盈利增长的主要支点。

| 国信证券 | 2007/12/19 | 推荐 | 公司收购新民传媒只是整合文新传媒集团传媒资源的第一步,后续应该还有更大规模的整合行动。炫动卡通目前正处于收入和盈利快速增长轨道,作为国家扶持动漫产业发展政策的一步,据悉有关部门可能有意单独让其上市,此次SMG 单独大比例增资,使其注册资本扩充到5 亿,应当是打算单独上市的前奏。 | ---- | 1.23 | 1.50 | 65.00 | 对于这样潜在确定性很高的资产整合的公司,建议逢低买进,长期持有。

| 业绩预测与估值的均值(元) | 0.28 | 1.053 | 1.243 | 70.33 |

| 目前股价的动态市盈率(倍) | 175.07 | 46.55 | 39.44 |

| 风 险 提 示 |

| (1) 随着解放报业集团的进入,管理层与经营策略的变更将不可避免;(2)资产注入仍有持续的过程,其中可能会存在不可预知性因素。 |