今日沪深两市将迎来首份年报,上市公司年报披露工作也正式拉开帷幕,与此同时,二级市场上投资者对上市公司业绩的关注也逐渐进入高潮,招商银行、两面针等上市公司发布业绩超预期增长公告时,都曾一度带动相关板块活跃。年报行情中,投资者在跟踪上市公司业绩成长性,发现业绩超预期增长个股的同时,关注送转题材,寻找有望实施高比例送转的个股无疑也是另一个重要的方面。

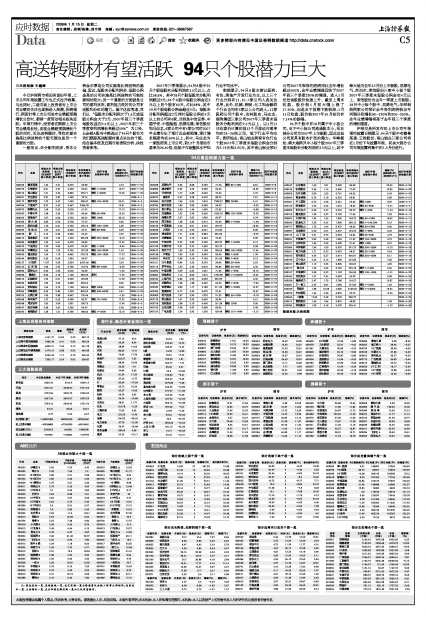

一般而言,未分配利润多、资本公积金丰厚是公司实施高比例送转的基础,因此,每股未分配利润多、每股公积金高的公司实施高比例送转的可能性要相对较大;另一个重要的方面就是公司的盈利状况,盈利能力良好的公司有送股和分红的潜力。基于这些考虑,我们以“每股未分配利润大于1.5元或每股公积金大于2元、2007年前三个季度每股收益在0.4元以上、2007年前三个季度净利润增长率超过50%”为口径,从全部A股当中筛选出了94只个股作为我们跟踪高送配题材重点关注的个股,结合基本面及近期市场表现分析,供投资者参考。

2007年三季报显示,94只A股中55只个股每股未分配利润在1.5元以上,占比58.5%,其中28只个股每股未分配利润超过2元;94个A股中每股公积金在2元以上的个股有60只,占比68%,其中19只个股每股公积金超过4元;每股未分配利润超过2元同时每股公积在4元以上的公司有6家,分别是中信证券、中国平安、中国船舶、思源电器、荣信股份和马应龙,6家公司中有4家公司对2007年业绩作出了预计且全部预增,预计增长幅度均在50%以上,其中,马应龙为一家医药类上市公司,前12个月滚动市盈率为26.40倍,远低于市场整体水平和行业平均水平。

数据显示,94只A股主要以医药、有色、房地产开发行业为主,以上三个行业分别有11、10、7家公司入选关注名单,此外,机械、钢铁、化工和金融四个行业也均有5家以上公司进入。11家医药公司个股中,吉林敖东、马应龙、丽珠集团三家公司2007年三季度末每股未分配利润在2.5元以上,以1月11日收盘价计算的前12个月滚动市盈率均在23-26倍之间,低于行业平均水平。贵研铂业、南山铝业两家有色行业个股2007年三季度末每股公积金分别为3.73元和3.25元,其中南山铝业预计公司2007年报净利润将同比去年增长超过500%,全年业绩增速远快于2007年前三个季度230%的增速,进入1月份后该股股价快速上升,截至上周末收盘,股价较1月初大幅上涨了17.50%,但是由于前期下跌较深,1月11日收盘,股价较2007年10月初仍有7.14%的跌幅。

94只个股中有18只属于中小板公司,由于中小板公司流通股本小,而且部分公司为2007年上市新股,因此这些公司更具有股本扩张的潜力。华峰氨纶、绿大地两只中小板个股2007年三季度末每股未分配利润在2.5元以上,其中绿大地为去年12月份上市新股,思源电气、苏泊尔、荣信股份三家中小板个股2007年三季度末每股公积金在4元以上,荣信股份为去年一季度上市新股。18只中小板个股中,思源电气、华邦制药两家公司预计全年净利润将较去年同期分别增长80-120%和200-250%,全年业绩增幅将高于去年前三个季度的增长幅度。

沪深交易所发布的上市公司年报预约披露日期显示,94只个股中有赣粤高速、云推股份、南山铝业三家公司将在1月份下旬披露年报,其余大部分公司年报披露将集中在2、3月份进行。

94只高送转潜力股一览

| 代码 | 名称 | 每股未分配利润(元)[2007 | 每股公积金(元)[2007 | 每股收益 | 净利润增长率(%)[2007第三季度] | 2007年报 | 涨幅(%) | 2007年报预约披露日期 |

| 600269 | 赣粤高速 | 1.42 | 2.41 | 0.672 | 53.98 | 4.19 | 2008-1-19 | |

| 600725 | 云维股份 | 0.61 | 2.97 | 0.458 | 92.04 | 增长>=150% | 13.77 | 2008-1-23 |

| 600219 | 南山铝业 | 1.21 | 3.25 | 0.850 | 229.71 | 增长>=500% | 17.50 | 2008-1-29 |

| 600331 | 宏达股份 | 2.37 | 2.87 | 1.260 | 70.74 | 2008-2-1 | ||

| 002172 | 澳洋科技 | 1.22 | 3.47 | 1.240 | 208.47 | 增长150~200% | 25.51 | 2008-2-4 |

| 600246 | 万通地产 | 0.57 | 5.52 | 0.467 | 2464.20 | 12.91 | 2008-2-5 | |

| 600075 | 新疆天业 | 1.58 | 0.55 | 0.520 | 51.22 | 17.12 | 2008-2-15 | |

| 002092 | 中泰化学 | 1.98 | 2.34 | 0.750 | 90.68 | 增长60~90% | 15.54 | 2008-2-16 |

| 000024 | 招商地产 | 1.07 | 6.06 | 0.703 | 83.23 | 增长100% | 20.10 | 2008-2-19 |

| 002200 | 绿 大 地 | 2.83 | 0.52 | 0.720 | 77.74 | 9.66 | 2008-2-19 | |

| 000527 | 美的电器 | 1.70 | 0.31 | 0.790 | 139.16 | 增长100~150% | 5.09 | 2008-2-19 |

| 002032 | 苏 泊 尔 | 1.27 | 4.61 | 0.540 | 65.71 | 增长60~80% | 3.32 | 2008-2-20 |

| 000528 | 柳 工 | 2.14 | 0.94 | 0.960 | 62.43 | 4.37 | 2008-2-20 | |

| 000513 | 丽珠集团 | 2.50 | 1.55 | 1.470 | 303.28 | 增长250~300% | -6.19 | 2008-2-21 |

| 600383 | 金地集团 | 1.23 | 6.61 | 0.470 | 50.89 | 17.25 | 2008-2-23 | |

| 600479 | 千金药业 | 1.32 | 2.03 | 0.670 | 92.30 | 增长>=50% | -9.54 | 2008-2-23 |

| 002038 | 双鹭药业 | 1.65 | 1.25 | 0.749 | 167.20 | 增长150~200% | 1.42 | 2008-2-26 |

| 000960 | 锡业股份 | 1.54 | 1.10 | 0.845 | 276.73 | 增长150~180% | 11.72 | 2008-2-26 |

| 600596 | 新安股份 | 2.35 | 0.60 | 1.062 | 50.97 | 11.35 | 2008-2-26 | |

| 600137 | ST浪莎 | -1.97 | 2.06 | 5.034 | 3627.66 | 增长 | 2.54 | 2008-2-27 |

| 002165 | 红 宝 丽 | 1.08 | 2.92 | 0.790 | 118.70 | 增长80~100% | -0.29 | 2008-2-28 |

| 600886 | 国投电力 | 0.40 | 2.35 | 0.526 | 50.38 | -1.26 | 2008-2-28 | |

| 600380 | 健康元 | 0.93 | 2.18 | 1.100 | 558.22 | 盈利 | -1.76 | 2008-2-28 |

| 000616 | 亿城股份 | 1.55 | 0.21 | 0.590 | 102.89 | 11.28 | 2008-2-29 | |

| 600586 | 金晶科技 | 1.05 | 4.95 | 0.688 | 250.55 | 0.96 | 2008-2-29 | |

| 600459 | 贵研铂业 | 1.56 | 3.73 | 1.100 | 260.55 | 增长200% | 8.58 | 2008-2-29 |

| 002064 | 华峰氨纶 | 3.54 | 0.84 | 1.530 | 840.52 | 增长500~600% | 6.51 | 2008-2-29 |

| 000755 | 山西三维 | 1.43 | 2.80 | 0.667 | 176.46 | -1.53 | 2008-3-4 | |

| 600048 | 保利地产 | 1.27 | 6.55 | 0.500 | 83.27 | 增长70~100% | 17.25 | 2008-3-4 |

| 600588 | 用友软件 | 1.05 | 3.60 | 1.001 | 100.75 | 11.44 | 2008-3-5 | |

| 600497 | 驰宏锌锗 | 2.98 | 2.62 | 2.599 | 64.22 | 5.28 | 2008-3-6 | |

| 600282 | 南钢股份 | 1.58 | 1.21 | 0.790 | 188.66 | 增长>=100% | 13.16 | 2008-3-6 |

| 代码 | 名称 | 每股未分配利润(元)[2007 | 每股公积金(元)[2007 | 每股收益 | 净利润增长率(%)[2007第三季度] | 2007年报 | 涨幅(%) | 2007年报预约披露日期 |

| 002028 | 思源电气 | 2.06 | 8.08 | 0.750 | 71.70 | 增长80~120% | 8.81 | 2008-3-8 |

| 600000 | 浦发银行 | 0.99 | 2.29 | 0.900 | 59.45 | 16.65 | 2008-3-8 | |

| 600582 | 天地科技 | 1.77 | 0.38 | 0.540 | 72.54 | 7.47 | 2008-3-8 | |

| 600572 | 康恩贝 | 0.67 | 2.58 | 0.470 | 88.79 | 7.61 | 2008-3-11 | |

| 000686 | 东北证券 | 1.99 | 0.53 | 1.810 | 7288.57 | 增长7500% | 6.41 | 2008-3-12 |

| 600785 | 新华百货 | 1.83 | 2.06 | 0.600 | 58.23 | -3.33 | 2008-3-13 | |

| 600519 | 贵州茅台 | 3.49 | 1.46 | 1.690 | 57.63 | -6.08 | 2008-3-13 | |

| 000046 | 泛海建设 | 1.35 | 2.58 | 0.650 | 1056.25 | 增长150~200% | 12.53 | 2008-3-15 |

| 600585 | 海螺水泥 | 2.37 | 2.02 | 1.040 | 60.97 | 6.34 | 2008-3-15 | |

| 600100 | 同方股份 | 1.38 | 4.36 | 0.412 | 92.69 | 增长>=100% | -1.48 | 2008-3-18 |

| 600150 | 中国船舶 | 2.46 | 9.01 | 4.410 | 192.47 | 10.33 | 2008-3-18 | |

| 600558 | 大西洋 | 1.13 | 2.70 | 0.541 | 110.02 | 8.98 | 2008-3-18 | |

| 000609 | 绵世股份 | 1.71 | 0.99 | 0.850 | 396.39 | -0.79 | 2008-3-18 | |

| 000932 | 华菱管线 | 1.51 | 2.10 | 0.463 | 75.26 | 9.30 | 2008-3-18 | |

| 600030 | 中信证券 | 2.92 | 9.89 | 2.520 | 558.22 | 增长>=400% | 6.12 | 2008-3-20 |

| 601318 | 中国平安 | 2.31 | 9.74 | 1.650 | 145.72 | 3.38 | 2008-3-20 | |

| 000612 | 焦作万方 | 1.53 | 0.30 | 1.168 | 198.93 | 增长150~200% | 11.64 | 2008-3-20 |

| 600138 | 中青旅 | 1.04 | 3.42 | 0.402 | 83.40 | 增长>=50% | 1.20 | 2008-3-21 |

| 600993 | 马应龙 | 3.98 | 4.18 | 2.140 | 141.60 | 增长>=85% | 0.13 | 2008-3-24 |

| 002151 | 北斗星通 | 0.84 | 2.59 | 0.570 | 58.06 | 增长30~60% | 2.55 | 2008-3-25 |

| 002114 | 罗平锌电 | 1.52 | 2.45 | 0.810 | 90.86 | 增长30~40% | 5.26 | 2008-3-25 |

| 600026 | 中海发展 | 2.39 | 0.65 | 1.031 | 71.66 | 增长>=50% | 13.10 | 2008-3-26 |

| 600864 | 哈投股份 | 1.15 | 8.60 | 1.016 | 1292.89 | 增长>=16600% | 13.45 | 2008-3-27 |

| 600104 | 上海汽车 | 0.86 | 3.24 | 0.593 | 339.39 | 5.36 | 2008-3-27 | |

| 600062 | 双鹤药业 | 1.58 | 1.38 | 0.492 | 65.32 | 增长>=50% | -7.69 | 2008-3-27 |

| 600432 | 吉恩镍业 | 3.86 | 1.17 | 2.180 | 211.33 | 增长>=200% | 12.57 | 2008-3-27 |

| 600299 | 蓝星新材 | 0.77 | 5.29 | 0.670 | 97.91 | 10.37 | 2008-3-28 | |

| 000900 | 现代投资 | 1.97 | 3.94 | 1.070 | 91.52 | 增长50~100% | -0.18 | 2008-3-28 |

| 002170 | 芭田股份 | 1.61 | 2.25 | 0.650 | 50.04 | 5.61 | 2008-3-28 | |

| 600718 | 东软股份 | 1.08 | 2.10 | 0.460 | 161.28 | 增长150% | 0.26 | 2008-3-28 |

| 002193 | 山东如意 | 2.28 | 0.97 | 0.400 | 60.03 | 5.48 | 2008-3-28 | |

| 002152 | 广电运通 | 1.54 | 3.93 | 1.250 | 158.48 | 增长110~140% | -5.15 | 2008-3-29 |

| 代码 | 名称 | 每股未分配利润(元)[2007 | 每股公积金(元)[2007 | 每股收益 | 净利润增长率(%)[2007第三季度] | 2007年报 | 涨幅(%) | 2007年报预约披露日期 |

| 600547 | 山东黄金 | 1.53 | 1.81 | 0.950 | 86.98 | 23.43 | 2008-3-29 | |

| 600126 | 杭钢股份 | 2.49 | 1.14 | 0.460 | 71.62 | 10.03 | 2008-3-29 | |

| 600058 | 五矿发展 | 2.09 | 1.03 | 0.761 | 69.23 | 5.43 | 2008-3-29 | |

| 600600 | 青岛啤酒 | 0.76 | 2.18 | 0.532 | 60.81 | 3.09 | 2008-3-31 | |

| 002051 | 中工国际 | 0.73 | 2.28 | 0.561 | 65.60 | 增长<30% | 0.95 | 2008-4-3 |

| 002123 | 荣信股份 | 2.22 | 4.26 | 1.010 | 78.93 | 增长50~80% | -4.31 | 2008-4-9 |

| 600900 | 长江电力 | 0.69 | 2.47 | 0.518 | 83.70 | 增长>=50% | -1.44 | 2008-4-10 |

| 600153 | 建发股份 | 1.00 | 4.22 | 0.730 | 71.06 | 7.33 | 2008-4-11 | |

| 000825 | 太钢不锈 | 1.95 | 1.43 | 1.036 | 158.75 | 增长50~100% | 10.62 | 2008-4-11 |

| 000939 | 凯迪电力 | 2.50 | 0.26 | 1.090 | 300.12 | 增长>=168.29% | 2.19 | 2008-4-11 |

| 000717 | 韶钢松山 | 1.73 | 1.64 | 0.475 | 68.36 | 增长50~100% | 9.36 | 2008-4-16 |

| 600827 | 友谊股份 | 0.90 | 4.57 | 0.557 | 134.22 | 增长>=80% | 0.22 | 2008-4-17 |

| 002173 | 山 下 湖 | 2.31 | 3.73 | 0.594 | 54.05 | 增长30~60% | 4.73 | 2008-4-18 |

| 000951 | 中国重汽 | 2.05 | 2.48 | 1.569 | 51.92 | 增长150~200% | 6.79 | 2008-4-18 |

| 002157 | 正邦科技 | 1.06 | 2.36 | 0.400 | 51.61 | 增长<30% | 0.91 | 2008-4-18 |

| 002004 | 华邦制药 | 1.96 | 1.09 | 0.970 | 201.72 | 增长200~250% | -2.10 | 2008-4-18 |

| 000651 | 格力电器 | 1.71 | 0.22 | 0.947 | 58.21 | 增长50~100% | 9.42 | 2008-4-18 |

| 000623 | 吉林敖东 | 4.24 | 0.57 | 2.914 | 466.81 | 增长350~450% | 8.11 | 2008-4-19 |

| 600739 | 辽宁成大 | 2.34 | 0.13 | 1.980 | 410.83 | 7.05 | 2008-4-19 | |

| 000541 | 佛山照明 | 1.19 | 2.36 | 0.820 | 130.67 | 4.99 | 2008-4-21 | |

| 600177 | 雅戈尔 | 1.25 | 4.36 | 0.755 | 220.18 | 增长>=140% | 6.56 | 2008-4-22 |

| 000157 | 中联重科 | 2.58 | 0.32 | 1.192 | 136.35 | 增长100~150% | -1.91 | 2008-4-22 |

| 600456 | 宝钛股份 | 1.67 | 2.24 | 0.950 | 55.29 | 9.08 | 2008-4-23 | |

| 000338 | 潍柴动力 | 5.47 | 1.70 | 2.780 | 124.57 | 12.07 | 2008-4-24 | |

| 600031 | 三一重工 | 2.24 | 0.87 | 1.390 | 157.82 | 增长>=100% | 1.65 | 2008-4-25 |

| 600249 | 两面针 | 1.88 | 10.38 | 2.082 | 3109.03 | 增长>=1860% | 18.34 | 2008-4-26 |

| 600970 | 中材国际 | 1.44 | 2.48 | 0.870 | 92.73 | -4.55 | 2008-4-26 | |

| 600643 | S爱建 | -2.06 | 2.48 | 0.723 | 280.77 | 2008-4-29 | ||

| 600511 | 国药股份 | 1.66 | 1.86 | 0.810 | 58.00 | 1.28 | 2008-4-30 | |

| 600285 | 羚锐股份 | 1.00 | 3.18 | 0.470 | 305.41 | -1.27 | 2008-4-30 |

数据来源:天相投顾