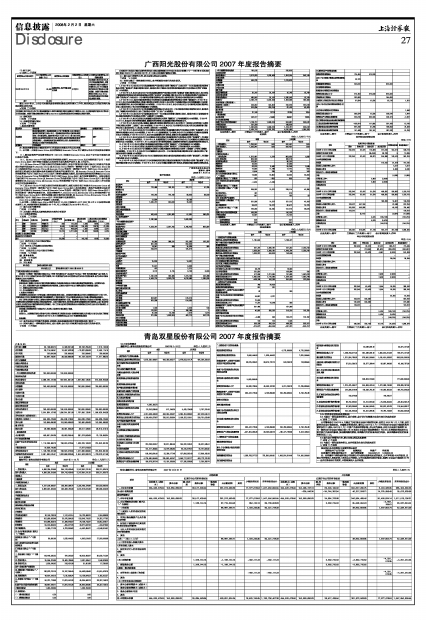

青岛双星股份有限公司2007年度报告摘要

2008年02月02日 来源:上海证券报 作者:

附表:编制单位:青岛双星股份有限公司 2007年12月31日 单位:(人民币)元

(上接26版)

■

9.2.2 利润表

编制单位:青岛双星股份有限公司 2007年1-12月 单位:(人民币)元

■

9.2.3 现金流量表

编制单位:青岛双星股份有限公司 2007年1-12月 单位:(人民币)元

■

■

■

9.2.4 所有者权益变动表(见附表)

9.3 与最近一期年度报告相比,会计政策、会计估计和核算方法发生变化的具体说明

√ 适用 □ 不适用

■

9.4 重大会计差错的内容、更正金额、原因及其影响

□ 适用 √ 不适用

9.5 与最近一期年度报告相比,合并范围发生变化的具体说明

√ 适用 □ 不适用

■

| 项目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 455,028,478.00 | 153,860,680.83 | 38,517,439.50 | 381,972,583.69 | 17,677,618.53 | 1,047,056,800.55 | 455,028,478.00 | 154,095,727.13 | 69,429,105.82 | 300,647,280.75 | 6,204,964.65 | 985,405,556.35 |

| 加:会计政策变更 | -235,046.30 | -34,744,381.94 | 46,317,208.71 | 14,275,859.49 | 25,613,639.96 | |||||||

| 前期差错更正 | ||||||||||||

| 二、本年年初余额 | 455,028,478.00 | 153,860,680.83 | 38,517,439.50 | 381,972,583.69 | 17,677,618.53 | 1,047,056,800.55 | 455,028,478.00 | 153,860,680.83 | 34,684,723.88 | 346,964,489.46 | 20,480,824.14 | 1,011,019,196.31 |

| 三、本年增减变动金额(减少以“-”号填列) | 1,168,144.15 | 87,719,340.56 | 852,122.12 | 89,739,606.83 | 3,832,715.62 | 35,008,094.23 | -2,803,205.61 | 36,037,604.24 | ||||

| (一)净利润 | 88,887,484.71 | 1,334,233.35 | 90,221,718.06 | 38,840,809.85 | 1,487,804.74 | 40,328,614.59 | ||||||

| (二)直接计入所有者权益的利得和损失 | ||||||||||||

| 1.可供出售金融资产公允价值变动净额 | ||||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | ||||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||||||||

| 4.其他 | ||||||||||||

| 上述(一)和(二)小计 | 88,887,484.71 | 1,334,233.35 | 90,221,718.06 | 38,840,809.85 | 1,487,804.74 | 40,328,614.59 | ||||||

| (三)所有者投入和减少资本 | ||||||||||||

| 1.所有者投入资本 | ||||||||||||

| 2.股份支付计入所有者权益的金额 | ||||||||||||

| 3.其他 | ||||||||||||

| (四)利润分配 | 1,168,144.15 | -1,168,144.15 | -482,111.23 | -482,111.23 | 3,832,715.62 | -3,832,715.62 | -4,291,010.35 | -4,291,010.35 | ||||

| 1.提取盈余公积 | 1,168,144.15 | -1,168,144.15 | 3,832,715.62 | -3,832,715.62 | ||||||||

| 2.提取一般风险准备 | ||||||||||||

| 3.对所有者(或股东)的分配 | -482,111.23 | -482,111.23 | -4,291,010.35 | -4,291,010.35 | ||||||||

| 4.其他 | ||||||||||||

| (五)所有者权益内部结转 | ||||||||||||

| 1.资本公积转增资本(或股本) | ||||||||||||

| 2.盈余公积转增资本(或股本) | ||||||||||||

| 3.盈余公积弥补亏损 | ||||||||||||

| 4.其他 | ||||||||||||

| 四、本期期末余额 | 455,028,478.00 | 153,860,680.83 | 39,685,583.65 | 469,691,924.25 | 18,529,740.65 | 1,136,796,407.38 | 455,028,478.00 | 153,860,680.83 | 38,517,439.50 | 381,972,583.69 | 17,677,618.53 | 1,047,056,800.55 |