天 士 力(600535):中医药行业的“新星”

2008年02月17日 来源:上海证券报 作者:

基于对医改预期和扩大内需的看好,医药股已经成为各类投资者关注的重点。但是,考察各医药股目前的估值普遍不低,在此市态下,公司将来的成长性、新产品推出的进度、受益于医改的程度、产品的稀缺性与定价权等成为衡量公司潜质的主要依据。综合这些依据为标准,天士力无疑是医药行业的重点公司之一,并已得到诸多机构投资者的高度看好。

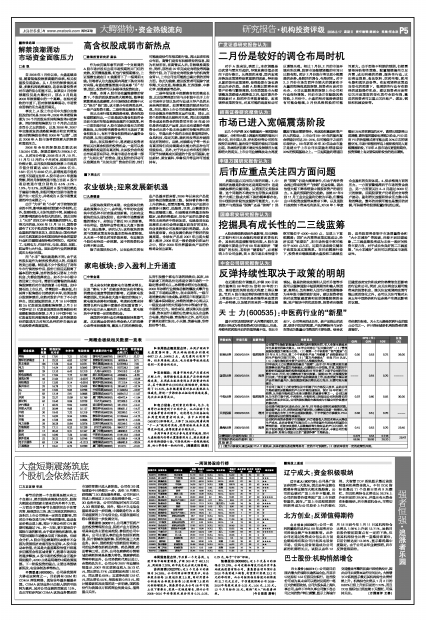

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS (元) | 估值 (元) | ||

| 08年 | 09年 | 10年 | |||||

| 公司首开生物制药领域大比例引进外资的先河,引入全球主流技术平台具备里程碑式意义。08年公司存在“四大催化剂”:(1)管理层股权激励方案推出在即。(2)继第一个中药粉针“益气复脉”在07年9月上市后,第二个中药粉针产品“丹酚酸B”获得新药证书和生产批件已指日可待。(3)“复方丹参滴丸”申报FDA认证。(4)上海生物制药全资子公司引入战略投资者。 | 招商证券 | 2008/02/04 强烈推荐 0.35 0.53 0.72 35.00||||||

| 07年是天士力业绩表现的最后“低潮”,由于07年业绩只能主要依靠拳头老产品复方丹参滴丸,业绩增长十分有限。并且,前期对中药粉针和基因药物的投资按新准则07年计提了2家子公司的开办费计5441万元,对业绩构成了较大拖累。展望08 年,大规模投资已完成,“含金量”较高的新产品陆续获准上市,医改背景下拳头老产品有望价量齐升,股权激励实施后增长动力充分,业绩可能大幅弹升。 | 国信证券 | 2008/02/04 推荐 ---- 0.54 0.70 -----||||||

| 子公司上海天士力的合资协议中明确了外方将投入技术,由此公司生物药重组尿激酶原的产业化有望加速推进,预计09年有望上市销售,从而使生物药成为未来业绩增长的重要引擎之一。公司以滴丸为主的口服中药、中药粉针、生物制药三轮驱动公司利润增长的态势已经初步显现。公司的股权激励方案将成为引爆公司价值重估的催化剂。 | 中投证券 | 2008/02/04 强烈推荐 0.37 0.60 0.92 30.00||||||

| 公司是中药现代化龙头企业,06年、07年是公司相对困难的时期,随着新产品上市,经营状况将不断好转,业绩将呈现新一轮增长。预计公司将在今年上半年完成股权激励,下半年复方丹参滴丸FDA二期临床认证有望传来喜讯。 | 天相投顾 | 2008/02/04 增持 0.36 0.51 0.70 ----||||||

| 公司和外商的合资终于尘埃落定,外方准备投入的技术将大大降低生产成本。此次合资将不仅能为天士力带来国外先进技术和国际化管理经验,还能加快重组人尿激酶原等生物制品的产业化进程,有助于促进我国大规模哺乳动物细胞培养的技术进步,丰富公司生物药品品种,培育出我国自己的“重磅炸弹”生物药品。 | 渤海证券 | 2008/02/05 推荐 0.41 0.52 0.70 23.40||||||

| 业绩预测与估值的均值(元) | 0.373 | 0.54 | 0.748 | 29.47 | |||

| 目前股价的动态市盈率(倍) | 56.55 | 39.06 | 28.20 | ||||

| 风 险 提 示 | |||||||

| (1)复方丹参滴丸通过美国FDA II期临床、具体的新医改政策等具有一定的不可预测性;(2)新药审批有一定的政策性风险。 |