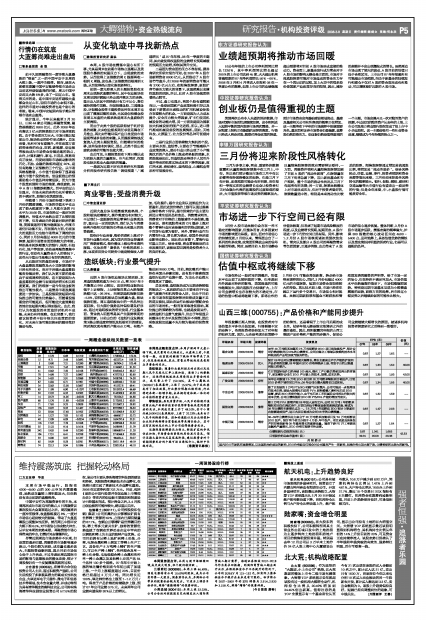

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS (元) | 估值 (元) | ||

| 07年 | 08年 | 09年 | |||||

| 联合证券 | 2008/03/05 | 增持 | 08年20万吨粗苯加氢和7.5万吨顺酐法BDO 项目将陆续投产,预计公司仍然能维持近50%的业绩增长。公司在煤化工领域以较难的技术水平和较高的产品附加值而独具特色。 | 0.87 | 1.27 1.62 --|||

| 海通证券 | 2008/03/04 | 买入 | 预计08年公司业绩将继续大幅增长,增长主要来自产于产能的扩张和产品价格的回暖,08年国内BDO价格将稳步上扬,有助于山西三维盈利能力的提升。 | 0.87 | 1.33 1.52 45.00|||

| 国泰君安 | 2008/03/05 | 增持 | 在目前国际油价已经突破100美元、煤化工产业链优势更加突出的背景下,更加看好公司在BDO 产业链上的技术、规模、成本优势。 | 0.87 | 1.39 1.93 42.00|||

| 广发证券 | 2008/03/04 | 持有 | 08年公司新建7.5万吨BDO项目和20万吨粗苯精制项目将投产,目前BDO价格下调空间已不大,08年公司业绩大幅增长已成定局。 | 0.87 | 1.34 1.55 40.00|||

| 中金公司 | 2008/03/04 | 推荐 | 除了计划建的3万吨PTMEG和煤气化制氢外,公司可能进一步发挥现有技术优势,建设大规模电石法的PVA 原料醋酸乙烯和电石法BDO装置,提高BDO 的定价能力,由于电石法工艺和国际公司相比有很大的成本优势,公司业绩将随着BDO和PTMEG产能的增加而成长。 | 0.87 | 1.32 1.59 --|||

| 国信证券 | 2008/03/04 | 推荐 | 除2 万吨PVA 新增产能08年投入运行之外,公司20万吨/年的粗苯精制项目仍在调试当中,目前已经处于整体设备贯通调试阶段,将成为08 年业绩的主要增长点之一。7.5 万吨/年顺酐法BDO预计3季度左右能够建成投产,这三大项目将成为公司08 年的业绩增量。 | 0.87 | 1.47 2.03 --|||

| 申银万国 | 2008/03/04 | 增持 | 08-09年业绩增长动力来自于20万吨粗苯加氢项目及7.5 万吨顺酐法BDO投产。预计两个项目分别于4月份、年中投产。项目进度及具体投产时间将是影响08 年盈利增长的重要变量。随着下游PU 开工率提高及氨纶产量增长,BDO价格可能季节性反弹。 | 0.87 | 1.27 1.54 --|||

| 业绩预测与估值的均值(元) | 0.87 | 1.341 | 1.683 | 42.33 | |||

| 目前股价的动态市盈率(倍) | 39.31 | 25.58 | 20.38 | ||||

| 风 险 提 示 | |||||||

| 国内BDO市场供应逐渐增加,以及国际油价波动的影响,BDO价格波动可能会对公司盈利产生一定影响,如果价格出现大幅下跌,业绩将受到比较大的影响。 |