自上证综指去年10月16日创出本轮牛市最高点后,沪深两市双双掉头向下。尽管上证综指在半年线附近组织了一次力度较大的反弹,但其后两市在再融资压力、解禁股压力以及美国次贷危机的重重困扰下,主流资金加快了出逃的步伐,基金重仓股遭遇到前所未有的抛售压力。

统计显示,从去年四季度以来至昨日,两市收盘价较去年四季度以来最高价腰斩的个股多达118只,而跌幅超过40%的也高达464只,有色金属、房地产和金融股成为机构重点甩卖的对象。

118只个股惨遭腰斩

据统计,去年四季度以来两市有118只个股惨遭腰斩,基金重仓股广济药业以69.37%的跌幅居跌幅榜首。石化明星股中国石油、中国石化,保险明星股中国平安、中国人寿、地产明星股招商地产、金地集团,有色明星股中国铝业、西部矿业等众多明星股均被腰斩。可以说,大牌明星股的集体重挫已明显折射出机构投资者的持股信心已严重缺失。在美国经济向衰退演变的恐慌心理驱使下,中国A股市场在全球资本市场的风声鹤唳中已难以独善其身。

可以说随着上周大盘跌穿4000点大关,市场估值系统已面临严峻考验。在大小非解禁和巨额融资等实质性资金压力之下,市场供求关系已经出现严重失衡,价值发现功能也出现严重障碍。

三大行业成重灾区

分行业看,在这118只股价被腰斩的个股当中,有色金属、房地产和金融板块成为三大重灾区。由于宏观调控压力持续加大、外围股市动荡加剧,加之市场各方持股心态持续脆弱,决定了有色金属、房地产等周期性行业个股的调整压力持续释放。而作为弱周期的金融业其面临更大的压力则是再融资。当1月21日中国平安拟申请增发不超过12亿股A股股票及发行不超过人民币412亿元分离交易可转债这一近1500亿元再融资方案的公告推出后,旋即引发市场对金融股再融资的强烈担忧,中国平安A股在公告发布后出现三个跌停,1月累计跌幅超过30%,换手超过65%,机构资金纷纷夺路而逃。

赎回压力引发基金重仓股集体杀跌

随着A股市场的近乎单边无抵抗的下跌,特别是沪指跌破4000点后,基金申赎形势变得日益严峻。由于公募基金一贯秉承的持股趋同性导致了公募基金在本轮暴跌中抗风险能力并没有充分显现,而赎回压力的加剧则引发了基金重仓品种的集体杀跌,这种恶性循环更助推的大盘加速下滑。而在基金重仓品种接二连三杀跌行为持续蔓延的恶劣环境下,A股市场的阶段底部构造也愈发艰难。

统计显示,去年四季度末仓位超过42%的39只开放式基金持有的前十大股票市值上周末合计为1415亿元,较前一周减少近200亿元;上周前十大股票市值萎缩较大的基金中,南方绩优成长、融通新蓝筹、景顺精选蓝筹、博时第三产业、中邮核心优选、南稳贰号、南方稳健成长、上投摩根成长先锋、大成财富管理、中国优势、南方高增长均超过6亿元以上,其中南方稳健成长市值萎缩多达23亿元,融通新蓝筹、景顺精选蓝筹市值萎缩分别为14亿元和10亿元。

尽管2006年以来价值投资理念持续得到市场深化,以内在价值和成长性来定价、以行业背景行业地位定价的新模式已经形成,但是事实上,基金对相关行业的增减持在一定程度上还是反映了基金对宏观环境变化的判断。在外围经济不确定性加大、通货膨胀压力增加背景下,基金逐步将行业配置重心向消费、内需和抵御通货膨胀能力较强的行业倾斜也是一种策略之需,从上述腰斩个股当中,医药、食品饮料和商贸等行业数量相对较少,也可看出基金在加紧转入防御阶段。

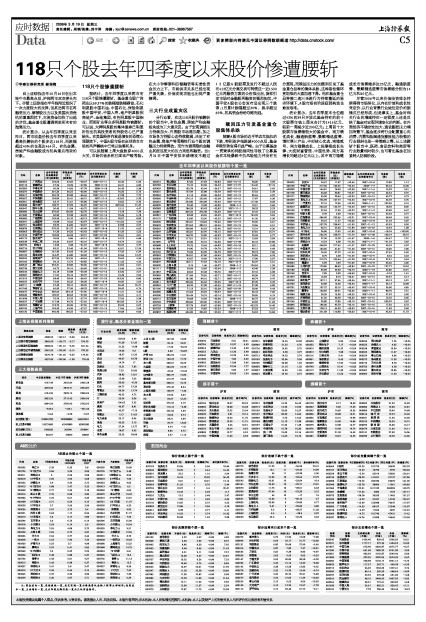

去年四季度以来股价被腰斩个股一览

| 代码 | 名称 | 去年四季度以来最高价(元)[后复权] | 昨收盘价(元) | 腰斩幅度(%) | 去年四季度以来区间最高价日 | 市盈率 | 市净率 [后复权] | (倍) (倍)

| 000952 | 广济药业 | 104.56 | 32.02 | -69.37 | 2007-10-11 | 26.26 | 6.50 |

| 002118 | 紫鑫药业 | 57.26 | 18.39 | -67.89 | 2008-2-19 | 46.21 | 6.83 |

| 002092 | 中泰化学 | 46.39 | 14.95 | -67.78 | 2008-2-18 | 36.43 | 3.38 |

| 600072 | 中船股份 | 201.33 | 66.52 | -66.96 | 2007-10-12 | 76.50 | 5.75 |

| 000617 | 石油济柴 | 246.79 | 82.83 | -66.44 | 2007-10-17 | 47.28 | 7.72 |

| 000657 | 中钨高新 | 104.82 | 35.41 | -66.21 | 2007-11-2 | -53.62 | 5.20 |

| 600961 | 株冶集团 | 63.17 | 21.61 | -65.80 | 2007-10-15 | 23.65 | 3.70 |

| 000838 | 国兴地产 | 108.77 | 37.99 | -65.07 | 2007-10-19 | 3670.55 | 21.37 |

| 900947 | 振华B股 | 30.43 | 11.04 | -63.72 | 2007-10-12 | 15.11 | 4.47 |

| 000686 | 东北证券 | 376.92 | 136.82 | -63.70 | 2007-10-16 | 14.18 | 7.39 |

| 601600 | 中国铝业 | 60.90 | 22.38 | -63.25 | 2007-10-15 | 29.36 | 5.18 |

| 600685 | 广船国际 | 149.43 | 55.10 | -63.13 | 2007-10-15 | 20.67 | 8.82 |

| 600591 | 上海航空 | 44.98 | 16.65 | -62.97 | 2007-10-17 | -116.56 | 4.59 |

| 000751 | 锌业股份 | 93.22 | 34.90 | -62.57 | 2007-11-8 | 52.98 | 3.57 |

| 000878 | 云南铜业 | 270.23 | 101.37 | -62.49 | 2007-10-8 | 31.22 | 6.62 |

| 600963 | 岳阳纸业 | 91.36 | 34.32 | -62.43 | 2007-10-10 | 81.22 | 2.53 |

| 601318 | 中国平安 | 150.03 | 56.69 | -62.21 | 2007-10-24 | 26.61 | 4.01 |

| 600173 | 卧龙地产 | 26.05 | 9.86 | -62.14 | 2007-10-8 | 24.73 | 6.88 |

| 600528 | 中铁二局 | 92.26 | 34.97 | -62.10 | 2007-10-17 | 34.74 | 3.66 |

| 200770 | 武锅B | 13.93 | 5.38 | -61.37 | 2007-10-8 | -26.57 | 2.27 |

| 000718 | 苏宁环球 | 83.31 | 32.46 | -61.04 | 2007-10-10 | 45.01 | 12.26 |

| 000807 | 云铝股份 | 161.43 | 62.93 | -61.02 | 2007-10-15 | 27.35 | 6.24 |

| 600109 | 国金证券 | 164.37 | 64.80 | -60.58 | 2007-10-16 | 35.66 | 13.37 |

| 000024 | 招商地产 | 337.93 | 133.35 | -60.54 | 2007-11-1 | 29.62 | 4.34 |

| 002160 | 常铝股份 | 39.15 | 15.72 | -59.85 | 2007-10-15 | 51.33 | 4.22 |

| 600549 | 厦门钨业 | 232.31 | 93.85 | -59.60 | 2007-10-15 | 44.94 | 5.01 |

| 000728 | 国元证券 | 64.72 | 26.15 | -59.60 | 2007-10-31 | 13.46 | 5.94 |

| 000543 | 皖能电力 | 56.18 | 22.88 | -59.28 | 2007-10-16 | 43.50 | 2.67 |

| 600307 | 酒钢宏兴 | 71.57 | 29.15 | -59.27 | 2007-10-12 | 19.49 | 2.95 |

| 601919 | 中国远洋 | 68.40 | 28.44 | -58.42 | 2007-10-25 | 143.56 | 8.80 |

| 000625 | 长安汽车 | 72.93 | 30.35 | -58.38 | 2007-10-8 | 29.85 | 2.65 |

| 600711 | ST雄震 | 67.43 | 28.15 | -58.25 | 2007-10-17 | 36.44 | 76.21 |

| 601168 | 西部矿业 | 65.50 | 27.36 | -58.23 | 2007-10-15 | 38.42 | 6.74 |

| 600675 | 中华企业 | 485.63 | 204.18 | -57.96 | 2007-10-8 | 21.21 | 4.43 |

| 000630 | 铜陵有色 | 190.97 | 80.53 | -57.83 | 2007-10-19 | 25.31 | 4.11 |

| 601628 | 中国人寿 | 76.24 | 32.22 | -57.74 | 2007-10-31 | 27.56 | 5.38 |

| 000537 | 广宇发展 | 117.48 | 49.76 | -57.65 | 2007-10-8 | 295.83 | 8.18 |

| 000762 | 西藏矿业 | 118.75 | 50.36 | -57.59 | 2007-10-15 | 69.53 | 6.67 |

| 600104 | 上海汽车 | 149.33 | 63.36 | -57.57 | 2007-10-15 | 17.66 | 2.58 |

| 600150 | 中国船舶 | 446.40 | 190.52 | -57.32 | 2007-10-11 | 29.08 | 9.06 |

| 代码 | 名称 | 去年四季度以来最高价(元)[后复权] | 昨收盘价(元) | 腰斩幅度(%) | 去年四季度以来区间最高价日 | 市盈率 | 市净率 [后复权] | (倍) (倍)

| 600219 | 南山铝业 | 87.06 | 37.58 | -56.84 | 2007-10-15 | 20.06 | 2.99 |

| 000783 | 长江证券 | 75.10 | 32.58 | -56.62 | 2007-12-27 | -54.45 | -27.19 |

| 600459 | 贵研铂业 | 105.78 | 45.94 | -56.57 | 2007-10-15 | 34.61 | 5.69 |

| 600531 | 豫光金铅 | 127.84 | 55.88 | -56.29 | 2007-10-15 | 27.53 | 5.29 |

| 000962 | 东方钽业 | 91.13 | 40.06 | -56.04 | 2007-10-12 | 85.64 | 4.07 |

| 000060 | 中金岭南 | 576.12 | 253.60 | -55.98 | 2007-10-15 | 17.87 | 6.30 |

| 000652 | 泰达股份 | 553.80 | 244.08 | -55.93 | 2007-10-10 | 117.40 | 8.58 |

| 600029 | 南方航空 | 29.40 | 12.98 | -55.85 | 2008-1-2 | 19.51 | 4.66 |

| 600383 | 金地集团 | 186.59 | 82.43 | -55.82 | 2007-11-1 | 28.23 | 3.23 |

| 600881 | 亚泰集团 | 849.22 | 376.28 | -55.69 | 2007-10-15 | 27.47 | 5.64 |

| 600831 | 广电网络 | 98.38 | 43.69 | -55.59 | 2007-10-8 | 154.25 | 3.62 |

| 002175 | 广陆数测 | 53.00 | 23.56 | -55.55 | 2007-10-12 | 61.26 | 5.30 |

| 600320 | 振华港机 | 265.01 | 118.04 | -55.46 | 2007-10-12 | 23.35 | 6.91 |

| 000623 | 吉林敖东 | 873.63 | 389.19 | -55.45 | 2007-10-19 | 10.66 | 6.51 |

| 000562 | 宏源证券 | 209.89 | 93.62 | -55.40 | 2007-10-31 | 13.19 | 6.36 |

| 002097 | 山河智能 | 140.01 | 62.79 | -55.15 | 2007-10-17 | 57.81 | 13.71 |

| 600595 | 中孚实业 | 168.70 | 75.89 | -55.02 | 2007-10-15 | 23.33 | 5.77 |

| 200024 | 招商局B | 117.61 | 52.91 | -55.01 | 2007-11-1 | 13.93 | 2.04 |

| 601099 | 太平洋 | 49.00 | 22.10 | -54.90 | 2007-12-28 | 65.10 | 19.89 |

| 600688 | S上石化 | 29.75 | 13.44 | -54.82 | 2007-10-18 | 33.11 | 3.48 |

| 601808 | 中海油服 | 54.80 | 24.78 | -54.78 | 2007-10-15 | 49.15 | 6.68 |

| 002155 | 辰州矿业 | 75.50 | 34.20 | -54.70 | 2007-10-15 | 99.74 | 7.60 |

| 600362 | 江西铜业 | 104.91 | 47.60 | -54.62 | 2007-10-15 | 24.84 | 6.24 |

| 600028 | 中国石化 | 43.07 | 19.69 | -54.28 | 2007-11-5 | 17.90 | 3.97 |

| 000027 | 深圳能源 | 169.11 | 77.62 | -54.10 | 2007-10-8 | 33.27 | 5.51 |

| 900920 | 上柴B股 | 3.19 | 1.46 | -54.07 | 2008-1-7 | 124.53 | 1.33 |

| 601111 | 中国国航 | 29.99 | 13.82 | -53.94 | 2008-1-2 | 43.40 | 5.38 |

| 601857 | 中国石油 | 48.62 | 22.48 | -53.76 | 2007-11-5 | 27.10 | 6.98 |

| 000983 | 西山煤电 | 171.84 | 79.55 | -53.71 | 2007-10-17 | 40.36 | 7.93 |

| 600888 | 新疆众和 | 181.80 | 84.16 | -53.71 | 2007-10-15 | 48.74 | 9.47 |

| 600811 | 东方集团 | 206.05 | 95.63 | -53.59 | 2007-10-8 | 87.29 | 3.23 |

| 600052 | *ST广厦 | 60.22 | 27.98 | -53.55 | 2007-11-19 | 37.38 | 6.00 |

| 601166 | 兴业银行 | 71.13 | 33.16 | -53.38 | 2007-10-29 | 20.46 | 4.44 |

| 600585 | 海螺水泥 | 115.63 | 53.92 | -53.37 | 2007-10-12 | 35.18 | 7.05 |

| 600500 | 中化国际 | 159.49 | 74.74 | -53.14 | 2007-10-16 | 30.05 | 6.19 |

| 600115 | 东方航空 | 29.68 | 13.95 | -53.00 | 2008-1-2 | 36.72 | 12.23 |

| 000758 | 中色股份 | 338.06 | 159.06 | -52.95 | 2007-10-15 | 49.82 | 11.04 |

| 600733 | S前锋 | 107.78 | 50.87 | -52.80 | 2007-10-19 | 453.23 | 16.40 |

| 002102 | 冠福家用 | 31.22 | 14.82 | -52.53 | 2008-1-3 | 37.53 | 4.21 |

| 600837 | 海通证券 | 646.00 | 306.93 | -52.49 | 2007-11-2 | 24.52 | 14.84 |

| 代码 | 名称 | 去年四季度以来最高价(元)[后复权] | 昨收盘价(元) | 腰斩幅度(%) | 去年四季度以来区间最高价日 | 市盈率 | 市净率 [后复权] | (倍) (倍)

| 200625 | 长安B | 24.97 | 11.87 | -52.46 | 2007-10-8 | 12.89 | 1.14 |

| 600158 | 中体产业 | 217.50 | 103.45 | -52.44 | 2008-1-2 | 95.44 | 14.20 |

| 600030 | 中信证券 | 164.81 | 78.48 | -52.38 | 2007-11-5 | 15.02 | 3.61 |

| 002128 | 露天煤业 | 64.68 | 30.81 | -52.37 | 2007-10-10 | 43.44 | 9.75 |

| 002171 | 精诚铜业 | 43.30 | 20.64 | -52.33 | 2007-10-15 | 43.72 | 4.73 |

| 000539 | 粤电力A | 225.98 | 107.72 | -52.33 | 2007-10-8 | 34.29 | 2.76 |

| 000927 | 一汽夏利 | 27.16 | 12.96 | -52.28 | 2008-1-11 | 102.05 | 4.19 |

| 002019 | 鑫富药业 | 263.33 | 125.79 | -52.23 | 2007-10-10 | 18.39 | 8.05 |

| 000150 | *ST宜地 | 37.53 | 17.93 | -52.22 | 2007-11-2 | 42.90 | 6.47 |

| 900933 | 华新B股 | 9.78 | 4.69 | -52.02 | 2007-10-16 | 22.34 | 3.77 |

| 000046 | 泛海建设 | 486.90 | 233.65 | -52.01 | 2007-10-8 | 58.48 | 9.45 |

| 600808 | 马钢股份 | 24.10 | 11.57 | -52.00 | 2007-10-8 | 21.22 | 2.07 |

| 000069 | 华侨城A | 537.78 | 258.42 | -51.95 | 2007-11-12 | 62.53 | 9.50 |

| 200539 | 粤电力B | 46.41 | 22.33 | -51.89 | 2007-10-22 | 13.43 | 1.08 |

| 000498 | *ST丹化 | 26.80 | 12.92 | -51.80 | 2007-10-8 | -18.24 | -100.90 |

| 600617 | 联华合纤 | 536.70 | 258.72 | -51.79 | 2007-12-28 | 130.19 | 58.72 |

| 000971 | 湖北迈亚 | 27.30 | 13.20 | -51.67 | 2008-1-8 | -34.47 | 7.01 |

| 200011 | 深物业B | 12.54 | 6.08 | -51.56 | 2007-11-1 | -41.24 | 2.82 |

| 000402 | 金融街 | 448.03 | 217.45 | -51.47 | 2007-10-29 | 43.32 | 6.32 |

| 000951 | 中国重汽 | 104.96 | 51.01 | -51.40 | 2007-10-15 | 19.05 | 7.06 |

| 000410 | 沈阳机床 | 76.50 | 37.22 | -51.35 | 2007-10-9 | 57.55 | 5.50 |

| 200022 | 深赤湾B | 8.79 | 4.28 | -51.29 | 2007-10-9 | 8.54 | 2.43 |

| 000006 | 深振业A | 212.73 | 103.64 | -51.28 | 2007-10-8 | 27.91 | 3.54 |

| 200054 | 建摩B | 5.99 | 2.93 | -51.09 | 2007-10-8 | 54.46 | 4.06 |

| 000685 | 公用科技 | 179.86 | 88.43 | -50.84 | 2007-10-22 | 127.77 | 10.24 |

| 002183 | 怡亚通 | 93.98 | 46.30 | -50.73 | 2008-1-18 | 44.86 | 14.91 |

| 200160 | 帝贤B | 7.89 | 3.90 | -50.63 | 2007-10-8 | -2.18 | 1.61 |

| 601872 | 招商轮船 | 16.58 | 8.19 | -50.61 | 2007-10-15 | 29.37 | 3.12 |

| 600048 | 保利地产 | 197.11 | 97.65 | -50.46 | 2007-11-1 | 40.13 | 5.01 |

| 002203 | 海亮股份 | 32.88 | 16.30 | -50.43 | 2008-1-17 | 36.13 | 10.08 |

| 600791 | 天创置业 | 107.27 | 53.19 | -50.42 | 2007-10-8 | 26.00 | 4.85 |

| 600804 | 鹏博士 | 140.82 | 69.91 | -50.36 | 2008-1-11 | 80.70 | 7.31 |

| 002084 | 海鸥卫浴 | 30.39 | 15.09 | -50.33 | 2007-10-8 | 27.92 | 3.90 |

| 600022 | 济南钢铁 | 61.56 | 30.58 | -50.33 | 2007-10-16 | 13.25 | 3.30 |

| 002145 | 中核钛白 | 25.80 | 12.85 | -50.19 | 2007-10-15 | 539.32 | 3.62 |

| 600840 | 新湖创业 | 186.00 | 92.70 | -50.16 | 2007-10-10 | 17.56 | 6.73 |

| 000825 | 太钢不锈 | 128.13 | 64.03 | -50.03 | 2007-10-16 | 11.83 | 3.48 |

| 000960 | 锡业股份 | 221.68 | 110.80 | -50.02 | 2007-10-8 | 45.63 | 11.73 |