截至目前,披露年报上市公司数已超过沪深两市全部公司总数的一半,尽管整体业绩相比2006年有大幅提升,但是仍有137家公司盈利同比出现下降。在2007年上市公司充分分享中国经济高速增长的大背景下,这些公司业绩却出现下滑值得深思。

多数公司盈利能力下降幅度不大

统计显示,在137家盈利能力同比下降的公司中,有20家公司净利润同比下降超过100%以上,其中复牌后涨幅惊人的ST盐湖,去年每股亏损0.85元,不过注入钾肥资产以后,公司盈利前景当然是今非昔比。而诸如飞亚股份、ST科苑等个股因2006年盈利基数较低,盈利下降幅度也是惊人。

在137家公司中有半数公司盈利能力下降幅度不大,业绩下降不到30%以上公司68家。业绩下降不到10%公司27家,其中,深圳惠程、宝钢股份、中国石油、东方电气等均因2006年基数过大而榜上有名,尽管如此,几家公司2007年每股收益均超过0.70元。

股权激励成新因素

在引起盈利水平下降的诸多因素中,股权激励引人瞩目。以往大家多注意到股权激励对上市公司的长期利多因素,但是随着年报的披露,股权激励成本对短期业绩的杀伤力终于为投资者所见识。伊利股份的例子尤为典型。该公司作为市场公认的食品饮料行业优质公司,2006年公司实现每股收益0.67元。而2007年公司年报显示,公司竟每股亏损0.22元。1月31日,伊利股份曾发布公告,称预计公司2007年公司净利润将出现亏损,当日该股放量跌停。一个前三季还实现净利润3.3亿元的蓝筹公司为何一夜之间出现巨亏?3月11日公司披露年报后迷雾彻底揭开,原来是股权激励惹的祸。由于该公司大幅计提了5.51亿元的股权激励费用,导致其2007年度出现了1.15亿元的亏损。此前,市场对伊利的股权激励预期是8年均匀行权,但公司却在2年内集中计提了全部行权费用,伊利股份董秘办相关人士对此也作出解释,认为计入成本的期权公允价值只是一个会计符号,实际上并不影响现金流、不影响股东权益,不影响公司价值,更不影响公司实际经营业绩,对股东、对公司没有任何损失。

业内人士认为,伊利股份这样处理是为合法规避税负。根据新企业会计准则,实施股权激励的费用计入成本费用可以抵补税收。2007年伊利的所得税率为33%,2008年为25%,提前摊销公司缴纳的所得税将大幅减少。但是伊利股份的做法合法但不合情,显然是利用了行权条件的漏洞,巨额计提股权激励费用造成了其2007年度的巨额亏损,让长期看好公司发展前景的投资者心灰意冷。

值得关注的是海南海药也如出一辙,尽管其仍未公布年报,但是3月6日公司已公告因公司实施股票期权激励计划2007年预亏约5000万元,成为继伊利股份之后第二家因股权激励导致亏损的上市公司。海南海药的预亏公告也重挫了其二级市场股价。

三大行业盈利下降公司数量较多

在137家盈利能力同比下降的公司中,化工、纺织、医药生物等行业数量比较多。其中化工行业公司占据17家,纺织行业占据12家。化工行业因为子行业众多,因此行业内公司表现也是良莠不齐。整体而言,化工行业普遍面临着原、燃料价格上涨对生产成本的压力,但是不同的子行业对于成本压力的转嫁能力是不一样的,我们看到,化纤、部分化学原料药等子行业公司去年产品价格的上涨速度远远快于成本上涨速度,这种趋势在一些子行业今年仍然保持延续,比如,新和成最近公布的第一季度业绩预告称:主导产品维生素E、维生素A、维生素H 等受市场供需变化影响,出现了较大幅度的涨价,有效抵消了由于原材料上涨等不利因素的影响。业绩将明显增长。但是另外一些如炼油、家化、农化等子行业公司由于转嫁成本压力的能力不强,毛利率下降、盈利滑坡也就在情理之中了。对于纺织行业来说人民币加速升值、劳动力成本及原料成本上升造成了这些公司业绩滑坡,如何实现产业升级、提高产品的附加值、利用多种手段减少汇兑损失成为他们的重中之重。

值得注意的是,一些2006年财报靓丽的公司如江西铜业、中国铝业、株冶集团等,去年业绩也出现滑坡势头,个别有色类公司甚至出现去年第四季度一个季度的亏损,就吃掉前三个季度大部分利润的情况,充分暴露了这类绩优公司的风险。

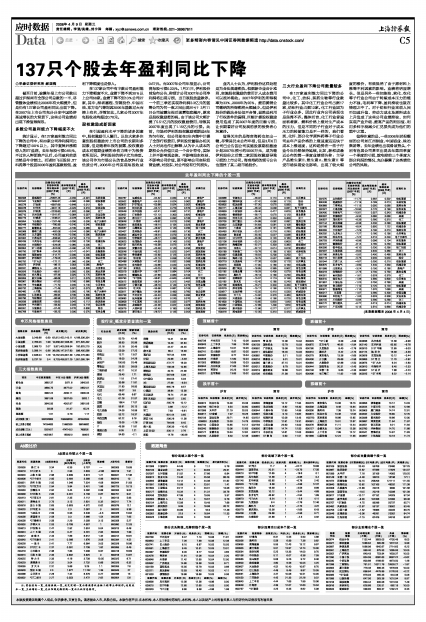

去年盈利同比下降的个股一览

| 证券代码 | 证券简称 | 归属母公司股东的净利润 | 基本每股收益[2007年度](元) | 基本 | 所属行业 |

| 600506 | 香梨股份 | -25587.45 | -0.200 | -0.001 | 农林牧渔 |

| 002042 | 飞亚股份 | -7695.87 | -0.580 | 0.080 | 纺织服装 |

| 000578 | ST盐湖 | -6997.69 | -0.846 | 0.012 | 综合 |

| 600076 | ST华光 | -3331.15 | -0.420 | 0.010 | 信息设备 |

| 000979 | ST科苑 | -2226.60 | -1.920 | 0.090 | 化工 |

| 000710 | 天兴仪表 | -1241.47 | -0.084 | 0.007 | 交运设备 |

| 600773 | ST雅砻 | -1236.01 | -0.226 | 0.025 | 医药生物 |

| 600654 | 飞乐股份 | -1167.48 | -0.280 | 0.030 | 电子元器件 |

| 600448 | 华纺股份 | -780.99 | -0.240 | 0.040 | 纺织服装 |

| 600777 | 新潮实业 | -552.00 | -0.180 | 0.060 | 综合 |

| 000068 | 赛格三星 | -482.08 | -0.244 | 0.060 | 电子元器件 |

| 000065 | 北方国际 | -429.59 | -0.290 | 0.090 | 建筑建材 |

| 002002 | 江苏琼花 | -358.94 | -0.210 | 0.110 | 化工 |

| 600435 | 中兵光电 | -357.90 | -0.260 | 0.100 | 机械设备 |

| 600633 | 白猫股份 | -329.08 | -0.060 | 0.030 | 化工 |

| 600604 | ST二纺机 | -324.09 | -0.490 | -0.120 | 机械设备 |

| 000750 | SST集琦 | -254.26 | -0.147 | -0.041 | 金融服务 |

| 600483 | 福建南纺 | -212.77 | -0.030 | 0.030 | 纺织服装 |

| 600887 | 伊利股份 | -179.05 | -0.220 | 0.280 | 食品饮料 |

| 600792 | *ST马龙 | -172.11 | -1.080 | -0.390 | 化工 |

| 000975 | 科学城 | -96.12 | 0.003 | 0.080 | 房地产 |

| 000531 | 穗恒运A | -93.14 | 0.040 | 0.530 | 公用事业 |

| 600826 | 兰生股份 | -89.81 | 0.050 | 0.500 | 商业贸易 |

| 600530 | 交大昂立 | -87.49 | 0.020 | 0.170 | 医药生物 |

| 600855 | 航天长峰 | -86.68 | 0.011 | 0.079 | 信息设备 |

| 600961 | 株冶集团 | -81.00 | 0.160 | 0.980 | 有色金属 |

| 600726 | 华电能源 | -71.70 | 0.040 | 0.140 | 公用事业 |

| 600732 | 上海新梅 | -71.49 | 0.021 | 0.073 | 房地产 |

| 600460 | 士兰微 | -69.95 | 0.050 | 0.180 | 电子元器件 |

| 000650 | 仁和药业 | -69.94 | 0.180 | 0.590 | 医药生物 |

| 000790 | 华神集团 | -66.98 | 0.012 | 0.036 | 医药生物 |

| 000639 | 金德发展 | -59.63 | 0.045 | 0.112 | 建筑建材 |

| 000929 | 兰州黄河 | -59.30 | 0.045 | 0.118 | 食品饮料 |

| 600051 | 宁波联合 | -57.43 | 0.270 | 0.630 | 综合 |

| 600768 | 宁波富邦 | -56.25 | 0.030 | 0.070 | 有色金属 |

| 证券代码 | 证券简称 | 归属母公司股东的净利润 | 基本每股收益[2007年度](元) | 基本 | 所属行业 |

| 600767 | 运盛实业 | -54.52 | 0.050 | 0.110 | 房地产 |

| 000502 | 绿景地产 | -54.33 | 0.024 | 0.062 | 房地产 |

| 000622 | S*ST恒立 | -53.68 | 0.024 | 0.052 | 机械设备 |

| 000551 | 创元科技 | -53.12 | 0.270 | 0.570 | 公用事业 |

| 000546 | 光华控股 | -52.41 | 0.062 | 0.131 | 房地产 |

| 000852 | 江钻股份 | -51.13 | 0.300 | 0.620 | 机械设备 |

| 000791 | 西北化工 | -49.56 | 0.092 | 0.183 | 化工 |

| 600648 | 外高桥 | -48.62 | 0.010 | 0.030 | 房地产 |

| 600824 | 益民商业 | -48.14 | 0.154 | 0.323 | 商业贸易 |

| 600567 | 山鹰纸业 | -48.02 | 0.140 | 0.280 | 轻工制造 |

| 000407 | 胜利股份 | -46.81 | 0.060 | 0.130 | 化工 |

| 600803 | 威远生化 | -46.24 | 0.070 | 0.130 | 医药生物 |

| 002035 | 华帝股份 | -46.17 | 0.090 | 0.210 | 家用电器 |

| 600823 | 世茂股份 | -44.69 | 0.140 | 0.250 | 房地产 |

| 600151 | 航天机电 | -43.58 | 0.072 | 0.128 | 综合 |

| 600502 | 安徽水利 | -43.48 | 0.140 | 0.250 | 建筑建材 |

| 600546 | 中油化建 | -43.22 | 0.023 | 0.041 | 建筑建材 |

| 000739 | 普洛康裕 | -42.90 | 0.125 | 0.244 | 医药生物 |

| 600190 | 锦州港 | -42.10 | 0.058 | 0.100 | 交通运输 |

| 600488 | 天药股份 | -41.93 | 0.052 | 0.099 | 医药生物 |

| 600379 | 宝光股份 | -40.96 | 0.040 | 0.070 | 机械设备 |

| 002136 | 安纳达 | -40.25 | 0.180 | 0.360 | 有色金属 |

| 600319 | 亚星化学 | -38.77 | 0.064 | 0.104 | 化工 |

| 000515 | 攀渝钛业 | -37.69 | 0.060 | 0.100 | 化工 |

| 600793 | *ST宜纸 | -36.61 | -0.840 | -0.620 | 轻工制造 |

| 600012 | 皖通高速 | -36.54 | 0.312 | 0.492 | 交通运输 |

| 002057 | 中钢天源 | -36.19 | 0.140 | 0.270 | 有色金属 |

| 000525 | 红太阳 | -35.56 | 0.067 | 0.105 | 化工 |

| 000911 | 南宁糖业 | -34.68 | 0.490 | 0.760 | 食品饮料 |

| 600738 | 兰州民百 | -34.43 | 0.059 | 0.090 | 商业贸易 |

| 000683 | 远兴能源 | -33.97 | 0.240 | 0.370 | 化工 |

| 000809 | 中汇医药 | -33.23 | 0.052 | 0.077 | 医药生物 |

| 600853 | 龙建股份 | -32.46 | 0.022 | 0.028 | 建筑建材 |

| 600079 | 人福科技 | -32.40 | 0.180 | 0.290 | 医药生物 |

| 000023 | 深天地A | -28.72 | 0.145 | 0.204 | 建筑建材 |

| 证券代码 | 证券简称 | 归属母公司股东的净利润 | 基本每股收益[2007年度](元) | 基本 | 所属行业 |

| 000966 | 长源电力 | -28.02 | 0.110 | 0.160 | 公用事业 |

| 600883 | 博闻科技 | -27.42 | 0.080 | 0.110 | 综合 |

| 600805 | 悦达投资 | -27.20 | 0.070 | 0.090 | 综合 |

| 600171 | 上海贝岭 | -26.44 | 0.038 | 0.051 | 电子元器件 |

| 000839 | 中信国安 | -26.40 | 0.417 | 0.620 | 信息服务 |

| 600683 | 银泰股份 | -26.17 | 0.070 | 0.120 | 商业贸易 |

| 600230 | 沧州大化 | -25.72 | 0.304 | 0.409 | 化工 |

| 000705 | 浙江震元 | -24.88 | 0.062 | 0.082 | 医药生物 |

| 000802 | 北京旅游 | -24.63 | 0.081 | 0.108 | 餐饮旅游 |

| 600370 | 三房巷 | -23.96 | 0.191 | 0.266 | 纺织服装 |

| 600493 | 凤竹纺织 | -23.57 | 0.218 | 0.285 | 纺织服装 |

| 600306 | 商业城 | -23.45 | 0.027 | 0.036 | 商业贸易 |

| 600241 | 辽宁时代 | -23.39 | 0.120 | 0.160 | 商业贸易 |

| 002108 | 沧州明珠 | -23.31 | 0.350 | 0.600 | 化工 |

| 000619 | 海螺型材 | -22.27 | 0.303 | 0.390 | 建筑建材 |

| 600720 | 祁连山 | -22.12 | 0.014 | 0.018 | 建筑建材 |

| 600189 | 吉林森工 | -19.78 | 0.160 | 0.190 | 农林牧渔 |

| 600367 | 红星发展 | -19.54 | 0.200 | 0.250 | 化工 |

| 002084 | 海鸥卫浴 | -18.75 | 0.537 | 0.860 | 轻工制造 |

| 600719 | 大连热电 | -17.26 | 0.095 | 0.115 | 公用事业 |

| 600575 | 芜湖港 | -17.00 | 0.160 | 0.190 | 交通运输 |

| 600549 | 厦门钨业 | -16.85 | 0.385 | 0.502 | 有色金属 |

| 002182 | 云海金属 | -16.29 | 0.400 | 0.570 | 有色金属 |

| 600510 | 黑牡丹 | -16.13 | 0.190 | 0.230 | 纺织服装 |

| 000301 | 丝绸股份 | -15.57 | 0.119 | 0.158 | 纺织服装 |

| 002162 | 斯米克 | -15.45 | 0.180 | 0.240 | 建筑建材 |

| 002156 | 通富微电 | -15.21 | 0.340 | 0.450 | 电子元器件 |

| 002079 | 苏州固锝 | -15.17 | 0.190 | 0.310 | 电子元器件 |

| 000617 | 石油济柴 | -15.05 | 0.410 | 0.530 | 机械设备 |

| 600535 | 天士力 | -14.92 | 0.370 | 0.460 | 医药生物 |

| 600330 | 天通股份 | -13.86 | 0.190 | 0.220 | 有色金属 |

| 601600 | 中国铝业 | -13.65 | 0.820 | 1.040 | 有色金属 |

| 600362 | 江西铜业 | -12.89 | 1.400 | 1.620 | 有色金属 |

| 600649 | 原水股份 | -12.66 | 0.277 | 0.317 | 公用事业 |

| 600416 | 湘电股份 | -12.35 | 0.310 | 0.420 | 机械设备 |

| 证券代码 | 证券简称 | 归属母公司股东的净利润 | 基本每股收益[2007年度](元) | 基本 | 所属行业 |

| 002070 | 众和股份 | -11.72 | 0.362 | 0.502 | 纺织服装 |

| 600438 | 通威股份 | -11.19 | 0.189 | 0.213 | 农林牧渔 |

| 600869 | 三普药业 | -11.13 | 0.050 | 0.060 | 医药生物 |

| 002027 | 七喜控股 | -10.90 | 0.170 | 0.190 | 信息设备 |

| 000400 | 许继电气 | -10.61 | 0.307 | 0.343 | 机械设备 |

| 600397 | 安源股份 | -9.34 | 0.060 | 0.060 | 采掘 |

| 000637 | 茂化实华 | -8.39 | 0.280 | 0.310 | 化工 |

| 002144 | 宏达经编 | -8.36 | 0.230 | 0.280 | 纺织服装 |

| 002168 | 深圳惠程 | -8.04 | 0.950 | 1.122 | 机械设备 |

| 600055 | 万东医疗 | -7.29 | 0.190 | 0.210 | 医药生物 |

| 600292 | 九龙电力 | -7.27 | 0.180 | 0.190 | 公用事业 |

| 002189 | 利达光电 | -7.22 | 0.210 | 0.240 | 电子元器件 |

| 000793 | 华闻传媒 | -6.96 | 0.096 | 0.104 | 信息服务 |

| 002072 | 德棉股份 | -6.14 | 0.160 | 0.250 | 纺织服装 |

| 600356 | 恒丰纸业 | -6.10 | 0.230 | 0.290 | 轻工制造 |

| 002037 | 久联发展 | -6.00 | 0.340 | 0.360 | 化工 |

| 002166 | 莱茵生物 | -5.82 | 0.400 | 0.460 | 医药生物 |

| 600119 | 长江投资 | -5.73 | 0.040 | 0.040 | 综合 |

| 002044 | 江苏三友 | -4.67 | 0.200 | 0.210 | 纺织服装 |

| 600875 | 东方电气 | -3.90 | 2.440 | 2.530 | 机械设备 |

| 601588 | 北辰实业 | -3.24 | 0.100 | 0.160 | 房地产 |

| 600019 | 宝钢股份 | -2.75 | 0.730 | 0.750 | 黑色金属 |

| 600301 | 南化股份 | -1.61 | 0.328 | 0.379 | 化工 |

| 600310 | 桂东电力 | -1.39 | 0.590 | 0.600 | 公用事业 |

| 601857 | 中国石油 | -1.20 | 0.750 | 0.760 | 采掘 |

| 000158 | 常山股份 | -1.10 | 0.120 | 0.120 | 纺织服装 |

| 600971 | 恒源煤电 | -1.10 | 1.070 | 1.080 | 采掘 |

| 600017 | 日照港 | -1.07 | 0.280 | 0.400 | 交通运输 |

| 600990 | 四创电子 | -1.00 | 0.333 | 0.336 | 交运设备 |

| 000155 | 川化股份 | -0.94 | 0.290 | 0.290 | 化工 |

| 600172 | 黄河旋风 | -0.77 | 0.213 | 0.214 | 机械设备 |

| 002101 | 广东鸿图 | -0.13 | 0.510 | 0.690 | 机械设备 |

(本表数据截至2008年4月4日)