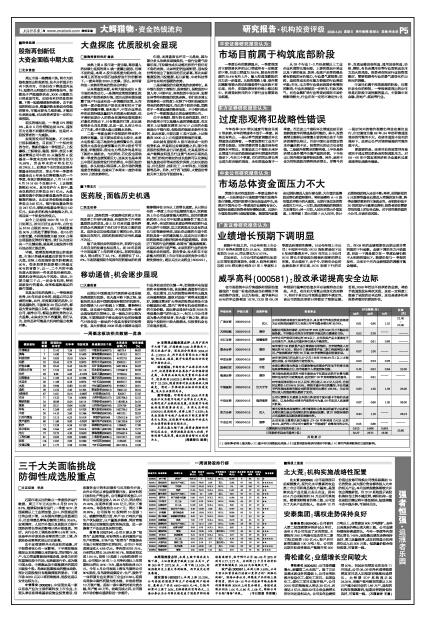

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) | ||

| 08年 | 09年 | 10年 | |||||

| 广发证券 | 2008/04/16 | 公司利润格局将发生根本性变化,来自博世汽柴投资收益将成为公司利润贡献的主力未来三年平均复合增长率39.78%。 | 21.40 买入 | 0.61 0.85 1.10 ~ ||||

| 天相投顾 | 2008/04/15 | 增持 | 根据公司股改时承诺,公司08年EPS达到0.93元才不触动送股条款。不排除公司采用非常规性手段达到业绩承诺目标。 | ---- | 0.52 | 0.78 -----||

| 长江证券 | 2008/04/15 | 谨慎推荐 | 07年公司产能利用率达到95%以上,公司相关产品主要通过子公司来生产,未来公司盈利存在较大不确定性。 | 0.53 | 0.61 0.68 -----|||

| 联合证券 | 2008/04/15 | 增持 | 08年博世DS的欧Ⅲ产品订单情况非常饱和,全年销售收入有望达到45亿元,预计在2 季度欧Ⅲ产品二期工程就将投入使用,产能将渐进扩充到70 万套,08年销售和盈利前景乐观。 | 0.57 | 1.05 ---- -----|||

| 平安证券 | 2008/04/15 | 推荐 | 08年净利润只有达到5.27亿元(对应EPS0.93元)以上才能避免送股,公司送股的可能性很大。 | 0.53 | 0.73 0.76 -----|||

| 国泰君安 | 2008/04/15 | 中性 | 未来业绩在很大程度上仍要依靠包括联合汽车电子和博世柴油系统等参股企业,但市场新介入者使竞争加剧。 | 0.45 | 0.52 0.59 15.00|||

| 海通证券 | 2008/04/15 | 增持 | 博世柴油系统此前的亏损主要是由于初期过高的开办费用摊销和过高的折旧政策造成,因此预计08年其将继续保持盈利。 | ---- | ----- | ||

| 中银国际 | 2008/04/15 | 优大于市 | 07年实现净利润2.3 亿人民币,营业收入31.2 亿人民币,分别同比增长147.5%与16.9%。得益于重卡行业的繁荣,子公司威孚汽车柴油系统有限公司经营利润同比增长106.3%,为公司营业收入的强劲增长提供了支持。 | 0.83 | 1.20 1.33 24.00|||

| 中投证券 | 2008/04/15 | 强烈推荐 | 公司业绩增长主要源自本部业务受益于国内重卡市场的高速增长,以及合资公司博世汽柴的扭亏为盈,08 年起进入高速增长阶段。 | 0.67 | 0.86 1.26 28.00|||

| 东方证券 | 2008/04/15 | 买入 | 博世投资收益高速增长、博世零部件业务启动和威孚力达的巨大增长潜力是公司高增长的主要驱动因素。欧III 排放标准的正式实施和实现股改承诺是催化剂。 | ---- | 0.94 | 1.16 28.13||

| 中金公司 | 2008/04/15 | 推荐 | 公司未来业绩增长较为确定,07-09 年净利润CAGR达到45.5%,是汽车上市公司中最符合“节能减排”政策导向的公司。 | ---- | ----- | ||

| 业绩预测与估值的均值(元) | 0.613 | 0.866 | 0.953 | 23.60 | |||

| 目前股价的动态市盈率(倍) | 32.27 | 23.71 | 18.30 | ||||

| 风 险 提 示 | |||||||

| (1)原材料价格上涨风险;(2)重卡行业周期波动风险;(3)国Ⅲ排放标准执行情况不明确;(4)博世汽柴垄断地位已受到影响。 |

|

| 上海证券报网络版郑重声明 | |||

|

|||

|

|

|

威孚高科(000581):股改承诺提高安全边际 2008年04月20日 来源:上海证券报 作者: 在市场恐慌中以行情超跌和预期估值超低的"双超"标准买跌是当前着眼于将来的操作良策。以此为标准,威孚高科以55%的单边跌幅及18.76、13.28倍08、09年预期市盈率的估值水平应该能符合此标准。并且,在目前大背景出现变化的形势下,相对于其它公司预期业绩的不确定性,该公司的股改承诺已经锁定了预期业绩。否则,2008年若达不到承诺的业绩,将给予流通股股东再次送股,这在一定程度上提高了该股的安全边际,这也是诸多机构投资者看好的原因所在。

|