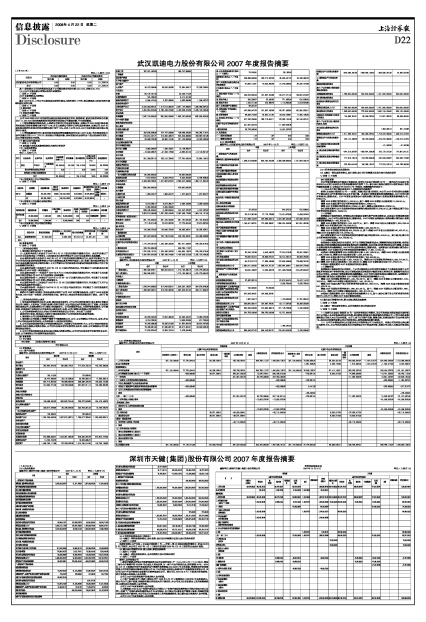

编制单位:深圳市天健(集团)股份有限公司 2007年12月31日 单位:(人民币)元

(上接D23版)

9.2.3 现金流量表

编制单位:深圳市天健(集团)股份有限公司 2007年1-12月 单位:(人民币)元

| 项目 | 本期 | 上年同期 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、经营活动产生的现金流量: | ||||

| 销售商品、提供劳务收到的现金 | 3,026,032,597.07 | 51,971,766.36 | 1,687,408,970.99 | 51,840,599.79 |

| 客户存款和同业存放款项净增加额 | ||||

| 向中央银行借款净增加额 | ||||

| 向其他金融机构拆入资金净增加额 | ||||

| 收到原保险合同保费取得的现金 | ||||

| 收到再保险业务现金净额 | ||||

| 保户储金及投资款净增加额 | ||||

| 处置交易性金融资产净增加额 | ||||

| 收取利息、手续费及佣金的现金 | ||||

| 拆入资金净增加额 | ||||

| 回购业务资金净增加额 | ||||

| 收到的税费返还 | ||||

| 收到其他与经营活动有关的现金 | 66,089,519.71 | 318,366,033.23 | 69,099,500.00 | 38,023,714.82 |

| 经营活动现金流入小计 | 3,092,122,116.78 | 370,337,799.59 | 1,756,508,470.99 | 89,864,314.61 |

| 购买商品、接受劳务支付的现金 | 2,547,502,567.67 | 27,025,514.28 | 1,833,937,008.79 | 14,655,465.20 |

| 客户贷款及垫款净增加额 | ||||

| 存放中央银行和同业款项净增加额 | ||||

| 支付原保险合同赔付款项的现金 | ||||

| 支付利息、手续费及佣金的现金 | ||||

| 支付保单红利的现金 | ||||

| 支付给职工以及为职工支付的现金 | 181,248,340.53 | 20,950,591.22 | 192,086,078.28 | 20,656,586.39 |

| 支付的各项税费 | 173,886,045.27 | 9,615,770.31 | 76,083,094.45 | 7,528,040.28 |

| 支付其他与经营活动有关的现金 | 90,958,366.80 | 42,250,679.42 | 103,330,245.53 | 145,316,284.32 |

| 经营活动现金流出小计 | 2,993,595,320.27 | 99,842,555.23 | 2,205,436,427.05 | 188,156,376.19 |

| 经营活动产生的现金流量净额 | 98,526,796.51 | 270,495,244.36 | -448,927,956.06 | -98,292,061.58 |

| 二、投资活动产生的现金流量: | ||||

| 收回投资收到的现金 | ||||

| 取得投资收益收到的现金 | 19,299,700.00 | 81,154,399.88 | 54,934,984.07 | 60,816,901.82 |

| 处置固定资产、无形资产和其他长期资产收回的现金净额 | 718,523.67 | 278,893.92 | 447,959.32 | 224,718.50 |

| 处置子公司及其他营业单位收到的现金净额 | 93,568,791.90 | |||

| 收到其他与投资活动有关的现金 | 4,001,641.58 | |||

| 投资活动现金流入小计 | 113,587,015.57 | 81,433,293.80 | 59,384,584.97 | 61,041,620.32 |

| 购建固定资产、无形资产和其他长期资产支付的现金 | 13,339,831.16 | 79,491.00 | 17,332,907.19 | 90,364.00 |

| 投资支付的现金 | 500,000,000.00 | 133,557,366.72 | 96,187,366.72 | |

| 质押贷款净增加额 | ||||

| 取得子公司及其他营业单位支付的现金净额 | ||||

| 支付其他与投资活动有关的现金 | 20,771,800.00 | |||

| 投资活动现金流出小计 | 34,111,631.16 | 500,079,491.00 | 150,890,273.91 | 96,277,730.72 |

| 投资活动产生的现金流量净额 | 79,475,384.41 | -418,646,197.20 | -91,505,688.94 | -35,236,110.40 |

| 三、筹资活动产生的现金流量: | ||||

| 吸收投资收到的现金 | 498,469,000.00 | 498,469,000.00 | ||

| 其中:子公司吸收少数股东投资收到的现金 | ||||

| 取得借款收到的现金 | 1,765,000,000.00 | 740,000,000.00 | 1,885,000,000.00 | 350,000,000.00 |

| 发行债券收到的现金 | ||||

| 收到其他与筹资活动有关的现金 | ||||

| 筹资活动现金流入小计 | 1,765,000,000.00 | 740,000,000.00 | 2,383,469,000.00 | 848,469,000.00 |

| 偿还债务支付的现金 | 1,530,000,000.00 | 220,000,000.00 | 1,250,000,000.00 | 270,000,000.00 |

| 分配股利、利润或偿付利息支付的现金 | 120,380,755.47 | 45,663,702.00 | 72,213,701.86 | 27,246,595.19 |

| 其中:子公司支付给少数股东的股利、利润 | ||||

| 支付其他与筹资活动有关的现金 | 727,933.46 | 727,933.46 | ||

| 筹资活动现金流出小计 | 1,650,380,755.47 | 265,663,702.00 | 1,322,941,635.32 | 297,974,528.65 |

| 筹资活动产生的现金流量净额 | 114,619,244.53 | 474,336,298.00 | 1,060,527,364.68 | 550,494,471.35 |

| 四、汇率变动对现金及现金等价物的影响 | ||||

| 五、现金及现金等价物净增加额 | 292,621,425.45 | 326,185,345.16 | 520,093,719.68 | 416,966,299.37 |

| 加:期初现金及现金等价物余额 | 843,925,947.54 | 679,721,021.01 | 323,832,227.86 | 262,754,721.64 |

| 六、期末现金及现金等价物余额 | 1,136,547,372.99 | 1,005,906,366.17 | 843,925,947.54 | 679,721,021.01 |

9.2.4 所有者权益变动表(见附表)

9.3 与最近一期年度报告相比,会计政策、会计估计和核算方法发生变化的具体说明

√ 适用 □ 不适用

| 根据财政部《关于印发<企业会计准则第1号--存货>等38项具体准则的通知》(财会[2006]3号)的规定,本公司自2007年1月1日起执行财政部2006年2月15日发布的企业会计准则。 |

9.4 重大会计差错的内容、更正金额、原因及其影响

□ 适用 √ 不适用

9.5 与最近一期年度报告相比,合并范围发生变化的具体说明

√ 适用 □ 不适用

| 3、天健集团2000年与广东海外建设总公司签订《广东海外建设发展有限公司部分股权出受让合同》,收购了广东海外建设发展有限公司60%的股权。由于该公司以前年度严重资不抵债、持续经营能力存在较大的不确定性,本公司也无计划在资金上支持其继续经营,故以前年度未将其纳入合并范围。 公司自2007年度将其纳入合并范围。 |

| 项 目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本 | 资本公积 | 减: | 盈余公积 | 一般风险准备 | 未分配 | 其他 | 实收资本(或股本) | 资本公积 | 减: | 盈余公积 | 一般风险准备 | 未分配 | 其他 |

| 一、上年年末余额 | 304,424,680.00 | 880,783,373.10 | 390,941,432.07 | 233,709,362.46 | 1,809,858,847.63 | 234,424,680.00 | 452,314,373.10 | 368,559,831.87 | 171,610,554.44 | 1,226,909,439.41 | |

| 加:会计政策变更 | 582,092.75 | 5,185,781.89 | 21,150,332.96 | 1,190,156.59 | 28,108,364.19 | ||||||

| 前期差错更正 | |||||||||||

| 二、本年年初余额 | 304,424,680.00 | 881,365,465.85 | 396,127,213.96 | 254,859,695.42 | 1,190,156.59 | 1,837,967,211.82 | 234,424,680.00 | 452,314,373.10 | 368,559,831.87 | 171,610,554.44 | 1,226,909,439.41 |

| 三、本年增减变动金额 | 1,193,482,582.66 | 34,658,613.10 | 92,970,750.39 | 1,426,517.51 | 1,322,538,463.66 | 70,000,000.00 | 428,469,000.00 | 22,381,600.20 | 62,098,808.02 | 582,949,408.22 | |

| (一)净利润 | 173,293,065.49 | 173,293,065.49 | 111,908,001.02 | 111,908,001.02 | |||||||

| (二)直接计入所有者权益 | 1,193,482,582.66 | 1,426,517.51 | 1,194,909,100.17 | 428,469,000.00 | 428,469,000.00 | ||||||

| 1.可供出售金融资产 | 1,193,482,582.66 | 1,193,482,582.66 | |||||||||

| 2.权益法下被投资单位 其他所有者权益变动的影响 | |||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | |||||||||||

| 4.其他 | 1,426,517.51 | 1,426,517.51 | 428,469,000.00 | 428,469,000.00 | |||||||

| 上述(一)和(二)小计 | 1,193,482,582.66 | 173,293,065.49 | 1,426,517.51 | 1,368,202,165.66 | 428,469,000.00 | 111,908,001.02 | 540,377,001.02 | ||||

| (三)所有者投入和 | 70,000,000.00 | 70,000,000.00 | |||||||||

| 1.所有者投入资本 | 70,000,000.00 | 70,000,000.00 | |||||||||

| 2.股份支付计入所有者 权益的金额 | |||||||||||

| 3.其他 | |||||||||||

| (四)利润分配 | 34,658,613.10 | -80,322,315.10 | -45,663,702.00 | 22,381,600.20 | -49,809,193.00 | -27,427,592.80 | |||||

| 1.提取盈余公积 | 34,658,613.10 | -34,658,613.10 | 22,381,600.20 | -22,381,600.20 | |||||||

| 2.提取一般风险准备 | -27,427,592.80 | -27,427,592.80 | |||||||||

| 3.对所有者(或股东)的分配 | -45,663,702.00 | -45,663,702.00 | |||||||||

| 4.其他 | |||||||||||

| (五)所有者权益内部结转 | |||||||||||

| 1.资本公积转增资本 (或股本) | |||||||||||

| 2.盈余公积转增资本 (或股本) | |||||||||||

| 3.盈余公积弥补亏损 | |||||||||||

| 4.其他 | |||||||||||

| 四、本期期末余额 | 304,424,680.00 | 2,074,848,048.51 | 430,785,827.06 | 347,830,445.81 | 2,616,674.10 | 3,160,505,675.48 | 304,424,680.00 | 880,783,373.10 | 390,941,432.07 | 233,709,362.46 | 1,809,858,847.63 |