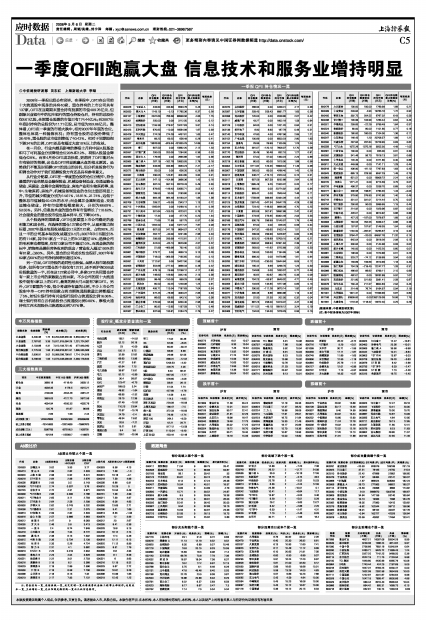

2008年一季报已经公布完毕,在季报中,QFII在公司前十大流通股中现身的共有40家,重仓持有的上市公司共有137家,QFII在当期期末重仓持有股票的市值409.76亿元,但剔除兴业银行中的恒生银行的重仓持股仓后,持有的总股份仅8.61亿股,全部重仓股票的市值只有174.44亿元;而2007年年底时持有的总股份为11.71亿股,总市值为292.86亿元。整体看,QFII在一季度的市场大跌中,相对2007年年底的仓位,整体也体现一种抛售状况;持有重仓股的总股份降低了26.49%,重仓股的总市值则降低了40.43%。相对于同期股指下跌34%的比例,QFII还是有超过大盘10%以上的收益。

在一月份,行业内颇具影响的摩根士丹利中国A股基金和马丁可利基金分别降低仓位20%和12%,荷银A股基金降低仓位8%。而在4月份QFII成功抄底,更说明了QFII能对大市有较好的把握,这也是QFII明显跑赢大盘的根本原因。虽然我们不能及时把握QFII的进出的时机,但分析其投资行为和调仓动作对于我们把握投资方向还是具有参考意义。

从行业分配看,QFII在一季度重仓股的仓位分配中,持仓最重的行业依然是金融保险业、机械设备制造业、交通运输仓储业、采掘业、金属非金属制造业、房地产业和生物医药等,其中:生物医药、房地产、机械设备制造业的仓位比重还明显上升,市值的减少幅度分别为14.61%、18.91%、21.74%,远低于整体总市值减低40.43%的水平;而金属非金属制造业、交通运输仓储业,持有市值降低幅度较大,分别为68.69%、52.55%。另外,信息技术业的重仓持有市值增长了110.62%,社会服务业的重仓股市值也基本持平,仅下降3.04%。

从个股选择的策略看,QFII也更看重上市公司稳定的盈利能力和成长性。在选择的重仓137家公司中,从盈利能力指标看,2007年基本每股收益超过0.1元的121家,占约90%,而且一半的公司基本每股收益超过0.4元;2007年ROE超过5%的有114家,其中81家占一半以上的ROE超过10%;选择公司的毛利率也都很高,仅有13家公司不超过10%。而现金流的指标中,销售商品提供劳务收到的现金/营业收入超过100%的有81家,占60%。另外,重仓的公司成长性也很好,2007年有82家占60%的公司净利润增长超过30%。

另一方面,QFII持股的趋同性也较强。虽然A股市场股票很多,但所有QFII重仓的个股仅有137只,还不到沪深300成份股数量的一半,而在这137家公司中,多家QFII共同重仓持有一家上市公司的家数就占到38家,不少公司的前十大流通股中就有4家以上的QFII,最高的深天马A就有7家QFII。另外,QFII看重的个股,很少考虑持有量的比例,不少上市公司股东中单一QFII持有股数占到当期流通股数量比例都超过了5%,如恒生银行持有兴业银行股份占流通股比例16.06%、瑞士银行持有白云机场股份占流通股比例9.80%、摩根大通持有江西水泥股份占流通股比例7.87%等。

一季报QFII持仓情况一览

| 代码 | 名称 | QFII | QFII持仓 | QFII | QFII持仓数量占流通股比例(%) | 每股收益(元) |

| 000026 | 飞亚达A | 433.80 | 433.80 | 6593.78 | 5.45 | 0.24 |

| 000050 | 深天马A | 1143.10 | -3.13 | 11785.36 | 8.37 | 0.26 |

| 000157 | 中联重科 | 2022.69 | 786.58 | 88998.56 | 4.85 | 1.75 |

| 000301 | 丝绸股份 | 250.00 | 0.00 | 2212.50 | 0.30 | 0.12 |

| 000410 | 沈阳机床 | 1155.36 | 278.37 | 15227.63 | 3.81 | 0.14 |

| 000423 | 东阿阿胶 | 670.65 | -10.00 | 16564.99 | 1.67 | 0.39 |

| 000428 | 华天酒店 | 274.28 | 274.28 | 4437.81 | 1.63 | 0.47 |

| 000507 | 粤富华 | 69.25 | 69.25 | 656.49 | 0.28 | 0.41 |

| 000527 | 美的电器 | 13626.86 | -829.54 | 431835.29 | 14.89 | 0.95 |

| 000528 | 柳工 | 607.50 | 0.00 | 15892.20 | 2.12 | 1.20 |

| 000557 | ST银广夏 | 200.00 | 200.00 | 1284.00 | 0.36 | 0.03 |

| 000560 | 昆百大A | 179.99 | 0.00 | 2665.66 | 1.92 | 0.56 |

| 000565 | 渝三峡A | 287.19 | -162.78 | 10853.05 | 2.78 | 0.16 |

| 000566 | 海南海药 | 333.89 | 333.89 | 3953.23 | 2.41 | -0.17 |

| 000572 | 海马股份 | 55.00 | 0.00 | 636.35 | 0.28 | 0.60 |

| 000582 | 北海港 | 290.05 | 143.61 | 4034.60 | 3.84 | 0.01 |

| 000597 | 东北制药 | 247.13 | -104.86 | 3966.36 | 1.45 | 0.16 |

| 000602 | 金马集团 | 597.24 | 597.24 | 26278.43 | 5.49 | 0.30 |

| 000612 | 焦作万方 | 879.65 | -146.40 | 23565.71 | 3.05 | 1.42 |

| 000630 | 铜陵有色 | 189.50 | 30.00 | 3183.60 | 0.34 | 0.80 |

| 000651 | 格力电器 | 984.48 | 984.48 | 44193.22 | 1.84 | 1.58 |

| 000708 | 大冶特钢 | 209.21 | -45.35 | 2343.17 | 1.13 | 0.72 |

| 000715 | 中兴商业 | 1265.64 | 0.00 | 14289.10 | 9.11 | 0.28 |

| 000731 | 四川美丰 | 301.64 | -105.25 | 4223.01 | 0.79 | 1.01 |

| 000777 | 中核科技 | 17.34 | 0.00 | 477.70 | 0.20 | 1.34 |

| 000788 | 西南合成 | 71.69 | 71.69 | 557.75 | 0.57 | 0.06 |

| 000789 | 江西水泥 | 1264.50 | 0.00 | 13277.22 | 7.87 | 0.09 |

| 000799 | 酒鬼酒 | 607.55 | 241.78 | 8694.07 | 4.72 | 0.21 |

| 000826 | 合加资源 | 264.77 | -30.00 | 5231.80 | 2.96 | 0.43 |

| 000833 | 贵糖股份 | 299.99 | 299.99 | 4115.81 | 2.11 | 0.21 |

| 000836 | 鑫茂科技 | 424.04 | -63.10 | 6029.90 | 4.57 | 0.22 |

| 000852 | 江钻股份 | 51.99 | -469.98 | 792.40 | 0.52 | 0.30 |

| 000861 | 海印股份 | 273.71 | 0.00 | 4850.15 | 3.10 | 0.26 |

| 000882 | 华联股份 | 718.00 | -369.59 | 7165.65 | 6.02 | 0.10 |

| 000931 | 中关村 | 1112.97 | 0.00 | 16427.50 | 2.56 | 0.13 |

| 000959 | 首钢股份 | 554.66 | -277.33 | 3666.33 | 0.46 | 0.22 |

| 000987 | 广州友谊 | 478.19 | 29.99 | 13198.12 | 4.17 | 0.80 |

| 002025 | 航天电器 | 146.60 | 146.60 | 3342.40 | 2.13 | 0.56 |

| 002031 | 巨轮股份 | 98.46 | -150.00 | 999.33 | 0.96 | 0.37 |

| 002032 | 苏泊尔 | 60.50 | 30.25 | 1248.06 | 1.24 | 0.91 |

| 002037 | 久联发展 | 495.71 | 113.04 | 7187.83 | 7.04 | 0.34 |

| 002045 | 广州国光 | 372.45 | -76.36 | 4093.22 | 2.85 | 0.39 |

| 002046 | 轴研科技 | 66.65 | 66.65 | 943.10 | 1.04 | 0.36 |

| 002056 | 横店东磁 | 270.99 | 95.99 | 8430.40 | 2.96 | 0.96 |

| 002061 | 江山化工 | 80.92 | -15.65 | 1197.59 | 1.72 | 0.48 |

| 002067 | 景兴纸业 | 537.99 | 135.81 | 5164.73 | 2.79 | 0.27 |

| 代码 | 名称 | QFII | QFII持仓 | QFII | QFII持仓数量占流通股比例(%) | 每股收益(元) |

| 002070 | 众和股份 | 268.93 | 0.00 | 3458.41 | 4.17 | 0.36 |

| 002097 | 山河智能 | 259.43 | 259.43 | 6991.77 | 1.63 | 0.56 |

| 002098 | 浔兴股份 | 120.00 | 0.00 | 2038.80 | 2.07 | 0.42 |

| 002111 | 威海广泰 | 43.27 | 0.00 | 1602.18 | 1.59 | 0.64 |

| 002129 | 中环股份 | 84.00 | 0.00 | 1201.20 | 0.84 | 0.31 |

| 002139 | 拓邦电子 | 8.90 | 8.90 | 187.79 | 0.49 | 0.51 |

| 002140 | 东华科技 | 47.80 | 4.00 | 4767.56 | 2.85 | 1.21 |

| 002152 | 广电运通 | 100.89 | 0.00 | 8500.23 | 2.80 | 1.95 |

| 002154 | 报喜鸟 | 29.99 | 29.99 | 1105.55 | 1.25 | 1.04 |

| 002164 | 东力传动 | 381.07 | -120.10 | 7606.07 | 12.70 | 0.56 |

| 002170 | 芭田股份 | 30.48 | 30.48 | 832.10 | 1.27 | 0.81 |

| 002206 | 海利得 | 57.00 | 57.00 | 1390.23 | 2.23 | 0.89 |

| 002218 | 拓日新能 | 60.00 | 60.00 | 1815.00 | 1.88 | 0.58 |

| 600004 | 白云机场 | 5711.82 | 123.35 | 79908.34 | 11.49 | 0.36 |

| 600007 | 中国国贸 | 285.00 | 85.00 | 4286.40 | 1.43 | 0.29 |

| 600012 | 皖通高速 | 346.27 | -173.13 | 2323.44 | 0.74 | 0.31 |

| 600017 | 日照港 | 607.59 | 607.59 | 8232.88 | 2.64 | 0.28 |

| 600018 | 上港集团 | 1585.48 | 9.25 | 11003.22 | 0.20 | 0.17 |

| 600066 | 宇通客车 | 889.93 | 0.00 | 22274.92 | 3.08 | 0.94 |

| 600114 | 东睦股份 | 803.42 | 0.00 | 7849.44 | 7.46 | 0.11 |

| 600115 | 东方航空 | 1759.99 | 399.99 | 22334.28 | 4.44 | 0.12 |

| 600125 | 铁龙物流 | 2507.43 | -347.34 | 24547.78 | 4.28 | 0.36 |

| 600129 | 太极集团 | 723.40 | -148.30 | 9896.09 | 4.70 | 0.25 |

| 600138 | 中青旅 | 620.06 | 301.81 | 16592.68 | 2.42 | 0.52 |

| 600150 | 中国船舶 | 273.95 | 273.95 | 33304.49 | 2.03 | 5.53 |

| 600166 | 福田汽车 | 930.79 | 296.99 | 10145.57 | 1.79 | 0.48 |

| 600175 | 美都控股 | 67.00 | 0.00 | 846.20 | 0.59 | 0.34 |

| 600176 | 中国玻纤 | 347.32 | -95.65 | 9103.14 | 1.51 | 0.72 |

| 600188 | 兖州煤业 | 299.99 | 299.99 | 5426.87 | 0.83 | 0.55 |

| 600192 | 长城电工 | 923.20 | -228.89 | 10709.10 | 6.38 | 0.21 |

| 600196 | 复星医药 | 1508.92 | 998.94 | 22301.84 | 2.39 | 0.51 |

| 600258 | 首旅股份 | 263.00 | -41.62 | 9725.89 | 2.53 | 0.53 |

| 600265 | 景谷林业 | 100.00 | 100.00 | 1194.95 | 1.46 | 0.26 |

| 600269 | 赣粤高速 | 999.30 | 0.00 | 14479.86 | 1.61 | 0.94 |

| 600283 | 钱江水利 | 1270.00 | -230.00 | 15544.84 | 8.05 | 0.12 |

| 600284 | 浦东建设 | 195.42 | 9.99 | 3296.70 | 1.23 | 0.50 |

| 600303 | 曙光股份 | 134.66 | 0.00 | 1633.37 | 0.77 | 0.48 |

| 600318 | 巢东股份 | 40.62 | 40.62 | 390.79 | 0.33 | 0.09 |

| 600323 | 南海发展 | 704.23 | -53.87 | 9549.32 | 4.71 | 0.45 |

| 600359 | 新农开发 | 134.65 | 134.65 | 1877.08 | 0.85 | 0.13 |

| 600360 | 华微电子 | 290.93 | -111.26 | 5673.14 | 1.92 | 0.67 |

| 600377 | 宁沪高速 | 485.36 | 8.66 | 3683.86 | 1.19 | 0.32 |

| 600379 | 宝光股份 | 22.50 | 22.50 | 202.50 | 0.32 | 0.04 |

| 600406 | 国电南瑞 | 667.25 | 256.00 | 14319.22 | 4.47 | 0.58 |

| 600438 | 通威股份 | 1111.52 | -49.10 | 18918.12 | 3.24 | 0.19 |

| 600468 | 百利电气 | 134.00 | 134.00 | 1676.29 | 0.95 | 0.10 |

| 代码 | 名称 | QFII | QFII持仓 | QFII | QFII持仓数量占流通股比例(%) | 每股收益(元) |

| 600478 | 力元新材 | 100.00 | 100.00 | 1789.99 | 1.89 | 0.21 |

| 600489 | 中金黄金 | 249.84 | 4.93 | 19765.16 | 1.72 | 0.92 |

| 600495 | 晋西车轴 | 392.75 | 204.55 | 6767.02 | 6.43 | 0.59 |

| 600496 | 长江精工 | 105.99 | 105.99 | 1263.44 | 0.64 | 0.43 |

| 600521 | 华海药业 | 259.83 | -22.29 | 5799.49 | 1.64 | 0.57 |

| 600523 | 贵航股份 | 80.00 | 80.00 | 1101.60 | 0.77 | 0.18 |

| 600540 | 新赛股份 | 160.00 | 160.00 | 2104.00 | 1.36 | 0.11 |

| 600547 | 山东黄金 | 146.45 | 1.20 | 20706.57 | 1.89 | 1.21 |

| 600550 | 天威保变 | 297.84 | 297.84 | 15728.95 | 0.83 | 0.62 |

| 600556 | *ST北生 | 1075.26 | 1075.26 | 9505.30 | 4.49 | -1.05 |

| 600561 | 江西长运 | 100.00 | 0.00 | 855.00 | 0.91 | 0.30 |

| 600592 | 龙溪股份 | 341.46 | 56.73 | 7816.13 | 3.81 | 0.66 |

| 600595 | 中孚实业 | 145.40 | 0.00 | 2471.80 | 0.40 | 0.88 |

| 600611 | 大众交通 | 449.98 | 0.00 | 7141.11 | 1.28 | 0.44 |

| 600616 | 第一食品 | 406.90 | -81.10 | 7767.63 | 1.63 | 0.45 |

| 600643 | 爱建股份 | 685.13 | 228.38 | 8557.29 | 1.48 | 0.79 |

| 600663 | 陆家嘴 | 651.51 | 0.00 | 16906.72 | 2.24 | 0.40 |

| 600720 | 祁连山 | 1271.41 | 0.00 | 9713.59 | 3.75 | 0.01 |

| 600726 | 华电能源 | 498.37 | 0.00 | 2536.70 | 0.69 | 0.04 |

| 600727 | 鲁北化工 | 336.56 | 198.61 | 2783.35 | 1.43 | -0.03 |

| 600736 | 苏州高新 | 379.80 | 379.80 | 5742.60 | 1.40 | 0.48 |

| 600744 | 华银电力 | 331.01 | 331.01 | 2214.44 | 0.70 | 0.02 |

| 600754 | 锦江股份 | 250.00 | 50.00 | 3999.95 | 1.15 | 0.44 |

| 600800 | SST磁卡 | 214.92 | 0.00 | 1929.96 | 0.82 | 0.02 |

| 600801 | 华新水泥 | 426.01 | 0.00 | 9610.82 | 5.66 | 0.88 |

| 600804 | 鹏博士 | 427.25 | -197.00 | 7976.67 | 1.89 | 0.32 |

| 600808 | 马钢股份 | 784.55 | 784.55 | 5358.47 | 0.66 | 0.38 |

| 600809 | 山西汾酒 | 157.97 | 157.97 | 3148.35 | 1.04 | 0.83 |

| 600820 | 隧道股份 | 1194.50 | -282.91 | 15265.67 | 3.19 | 0.32 |

| 600823 | 世茂股份 | 3794.47 | -20.00 | 64657.76 | 11.32 | 0.14 |

| 600824 | 益民商业 | 645.04 | 0.00 | 5818.26 | 2.08 | 0.15 |

| 600838 | 上海九百 | 300.84 | 0.00 | 2144.98 | 0.93 | 0.02 |

| 600855 | 航天长峰 | 140.00 | 0.00 | 1425.20 | 0.60 | 0.01 |

| 600861 | 北京城乡 | 106.00 | 0.00 | 1570.88 | 0.51 | 0.25 |

| 600869 | 三普药业 | 329.27 | -74.12 | 5136.69 | 3.94 | 0.05 |

| 600888 | 新疆众和 | 159.69 | 159.69 | 2610.99 | 1.18 | 0.40 |

| 600895 | 张江高科 | 734.28 | -218.40 | 12247.77 | 1.26 | 0.31 |

| 600966 | 博汇纸业 | 466.62 | 66.62 | 9799.11 | 2.15 | 0.69 |

| 600971 | 恒源煤电 | 462.01 | 0.00 | 16262.69 | 5.52 | 1.07 |

| 600973 | 宝胜股份 | 221.80 | 221.80 | 5081.41 | 2.58 | 0.87 |

| 600978 | 宜华木业 | 730.44 | 211.57 | 8604.63 | 2.94 | 0.45 |

| 600993 | 马应龙 | 214.49 | 76.74 | 9164.97 | 5.94 | 2.19 |

| 601001 | 大同煤业 | 1941.31 | 0.00 | 77399.99 | 5.87 | 0.60 |

| 601166 | 兴业银行 | 63909.00 | 0.00 | 2353129.38 | 16.06 | 1.75 |

| 601991 | 大唐发电 | 1118.32 | 1118.32 | 14672.40 | 0.25 | 0.29 |

(数据来源:中信建投研发部)

(注:表中财务指标为2007年指标)