价值抗跌是股市投资的股谚之一。其意是只要股票有投资价值,就能抵御行情的系统性风险。衡量价值股的标准分别是:业绩优良、增长可持续,且估值低廉。从这些标准看,尽管绝对股价较高,但潍柴动力仍是标准的价值股之一。潍柴动力的优异之处在于,它在重卡行业居于有绝对话语权的地位,它拥有国内最完整的整车及零部件产业链。完全可以这样认为:只要我们继续看好中国的经济,看好我国的投资规模,看好城镇化建设的进程,看好工程机械行业,就值得继续看好潍柴动力。

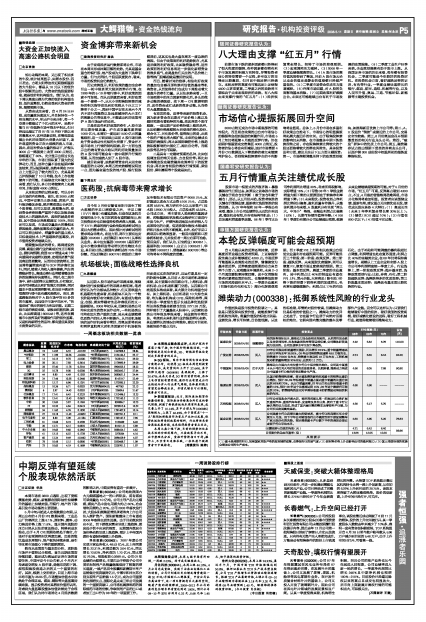

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) |

| 08年 | 09年 | 10年 |

| 国泰君安 | | | 相关财务指标显示,潍柴动力现金是相当充裕的。从经营性现金流以及存货周转率、应收帐款周转率等营运指标看,公司整体经营是较为良好的。公司负债率水平呈现下降态势。 | 4.92 | 5.82 | 6.76 | 110.00 | 2008/04/30 谨慎增持

| 广发证券 | 2008/05/05 | 买入 | 07年公司发动机销量增长强劲,同比增长67.9%;重卡销量增速高出行业平均水平38.05%。08年公司将销售变速箱49.5 万套左右,销售重卡72000 台左右,销售重卡发动机18 万台左右,工程机械发动机销量将增加30%左右,达到约11 万台。 | 4.74 | 5.55 | 6.44 | 82.20 |

| 中银国际 | 2008/05/05 | 优于大市 | 潍柴动力在国内大吨位重卡行业中保持领先地位。公司是中国重卡从小吨位向大吨位转变的直接受益者。长期来看,潍柴动力将成为中国重卡行业领先的垂直整合生产商。 | 4.56 | 6.05 | 7.88 | 90.80 |

| 海通证券 | 2008/05/05 | 买入 | 从国内销售结构来看,受计重收费的影响标准重卡的销售比重仍在增加,预计08、09年标准重卡销量占国内重卡销量的比重分别达到66%和70%。从出口销量来看,07年出口约占到标准重卡销量的10%,预计08年这个比重将达到15%,09 年这个数据有可能达到20%。销售结构的变化对平滑标准重卡的销售波动将起到积极的作用。 | 4.66 | 4.96 | ---- | ----- |

| 天相投顾 | 2008/04/30 | 买入 | 07年公司吸收合并湘火炬,将经营范围从单一的发动机业务扩展到重型汽车、重型汽车车桥、变速箱及其他业务,拥有了重卡行业最优秀的动力总成,形成了国内最完整的整车及零部件产业链,为公司长远发展奠定基础。 | 4.56 | 5.17 | 5.70 | ----- |

| 国金证券 | 2008/04/29 | 买入 | 公司是重卡行业高增长最大的受益者,重卡行业的高增长至少持续至5 月底,但下半年公司将面临行业不确定性和下游配套整车厂家出现分化的风险,预计潍柴重卡产业链下半年的表现会接近或低于行业平均水平。 | 4.80 | 4.95 | 5.20 | 76.83 |

| 业绩预测与估值的均值(元) | 4.71 | 5.42 | 6.40 | 89.96 |

| 目前股价的动态市盈率(倍) | 13.86 | 12.05 | 10.20 |

| 风 险 提 示 |

| (1)重卡是周期性行业,如果国家采取严格的宏观调控政策,会降低行业的景气度;(2)原材料价格上升会影响公司的盈利能力;(3)国三排放标准的实施会增加公司的生产成本。 |