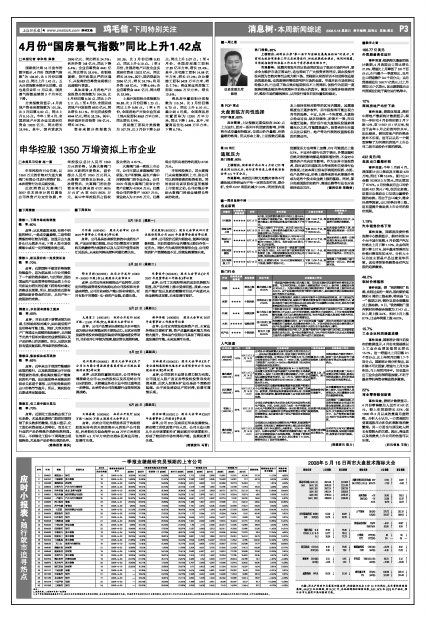

一季报业绩超研究员预期的上市公司

2008年05月18日 来源:上海证券报 作者:

一季报业绩超研究员预期的上市公司

| 序号 | 代码 | 简称 | 所属行业 | 3月内 | 最新财务报表发布日 | 1季度净利润/全年净利润 | 一致预期EPS | 一致预期PE | 最新价格 | 最新财报发布日至今涨幅 | 同期沪深300涨幅 | |||||||

| 关注机构数 | 2006A | 2007A | 报表前1日2008E | 统计日2008E | 2008E | 2009E | 2010E | 2008E | 2009E | 2010E | ||||||||

| 1 | 000001 | 深发展A | 银行 | 18 | 2008-4-24 | 16.93% | 20.19% | 24.38% | 24.37% | 1.712 | 2.228 | 2.666 | 15.881 | 12.201 | 10.195 | 27.18 | -1.13% | 4.60% |

| 2 | 000157 | 中联重科 | 资本货物 | 16 | 2008-4-30 | 14.96% | 15.86% | 21.07% | 20.87% | 2.282 | 2.937 | 3.605 | 18.483 | 14.361 | 11.7 | 42.18 | 0.00% | -0.28% |

| 3 | 000488 | 晨鸣纸业 | 原材料 | 19 | 2008-4-29 | 23.87% | 17.83% | 34.50% | 31.84% | 0.811 | 0.906 | 1.13 | 20.959 | 18.774 | 15.043 | 17 | 1.61% | 4.53% |

| 4 | 000550 | 江铃汽车 | 汽车与汽车零部件 | 16 | 2008-4-24 | 36.59% | 18.41% | 22.70% | 22.15% | 1.016 | 1.169 | 1.363 | 15.785 | 13.708 | 11.764 | 16.03 | 4.09% | 4.60% |

| 5 | 000568 | 泸州老窖 | 食品、饮料与烟草 | 25 | 2008-4-19 | 30.59% | 18.33% | 35.84% | 35.64% | 1.646 | 2.197 | 2.829 | 39.721 | 29.772 | 23.119 | 65.4 | 13.64% | 20.64% |

| 6 | 000651 | 格力电器 | 耐用消费品与服装 | 18 | 2008-4-23 | 17.85% | 12.92% | 25.66% | 24.26% | 2.141 | 2.876 | 3.511 | 21.761 | 16.204 | 13.274 | 46.6 | 6.66% | 14.31% |

| 7 | 000800 | 一汽轿车 | 汽车与汽车零部件 | 15 | 2008-4-28 | 30.07% | 15.62% | 37.29% | 33.84% | 0.581 | 0.711 | 0.807 | 26.719 | 21.82 | 19.232 | 15.52 | 7.18% | 5.87% |

| 8 | 000983 | 西山煤电 | 能源 | 23 | 2008-4-21 | 26.25% | 26.62% | 29.68% | 26.19% | 1.489 | 1.807 | 2.316 | 37.986 | 31.3 | 24.412 | 56.55 | 33.40% | 20.83% |

| 9 | 002024 | 苏宁电器 | 零售业 | 16 | 2008-4-29 | 4.83% | 8.62% | 17.23% | 16.66% | 1.731 | 2.474 | 3.205 | 32.259 | 22.569 | 17.421 | 55.83 | 8.30% | 4.53% |

| 10 | 002029 | 七匹狼 | 耐用消费品与服装 | 16 | 2008-4-23 | 31.19% | 22.58% | 40.57% | 38.05% | 0.524 | 0.776 | 1.054 | 40.038 | 27.033 | 19.906 | 20.98 | 18.40% | 14.31% |

| 11 | 600000 | 浦发银行 | 银行 | 29 | 2008-4-26 | 19.76% | 17.79% | 27.22% | 25.27% | 1.77 | 2.244 | 2.73 | 16.994 | 13.405 | 11.02 | 30.08 | 2.59% | 3.81% |

| 12 | 600016 | 民生银行 | 银行 | 21 | 2008-4-25 | 19.68% | 17.45% | 24.13% | 23.25% | 0.555 | 0.711 | 0.904 | 14.371 | 11.231 | 8.828 | 7.98 | -6.78% | 3.81% |

| 13 | 600026 | 中海发展 | 运输 | 21 | 2008-4-23 | 26.49% | 22.82% | 26.54% | 25.92% | 1.901 | 2.092 | 2.466 | 16.515 | 15.004 | 12.731 | 31.39 | 10.65% | 14.31% |

| 14 | 600030 | 中信证券 | 综合金融 | 25 | 2008-4-28 | 3.98% | 10.13% | 20.03% | 21.05% | 1.83 | 2.15 | 2.465 | 20.017 | 17.035 | 14.863 | 36.63 | 4.30% | 5.87% |

| 15 | 600036 | 招商银行 | 银行 | 22 | 2008-4-23 | 18.48% | 16.15% | 27.53% | 26.97% | 1.597 | 2.048 | 2.519 | 20.011 | 15.603 | 12.685 | 31.96 | -1.42% | 14.31% |

| 16 | 600066 | 宇通客车 | 资本货物 | 19 | 2008-4-24 | 15.63% | 11.80% | 47.78% | 48.07% | 1.009 | 1.025 | 1.157 | 20.605 | 20.284 | 17.972 | 20.8 | 17.34% | 4.60% |

| 17 | 600089 | 特变电工 | 资本货物 | 23 | 2008-4-23 | 33.75% | 14.02% | 29.61% | 28.28% | 0.801 | 1.102 | 1.659 | 32.118 | 23.351 | 15.512 | 25.73 | 23.23% | 14.31% |

| 18 | 600150 | 中国船舶 | 资本货物 | 17 | 2008-4-25 | 21.96% | 3.46% | 18.93% | 19.23% | 7.644 | 10.675 | 14.037 | 16.133 | 11.552 | 8.785 | 123.32 | 12.02% | 3.81% |

| 19 | 600535 | 天士力 | 制药与生物科技 | 16 | 2008-4-19 | 13.16% | 11.45% | 15.46% | 15.77% | 0.525 | 0.654 | 0.753 | 33.827 | 27.162 | 23.598 | 17.77 | 6.83% | 20.64% |

| 20 | 600585 | 海螺水泥 | 原材料 | 21 | 2008-4-22 | 10.88% | 8.52% | 11.83% | 11.58% | 2.354 | 3.031 | 3.732 | 27.602 | 21.439 | 17.413 | 64.98 | 19.65% | 19.77% |

| 21 | 600596 | 新安股份 | 原材料 | 19 | 2008-4-25 | 14.80% | 16.01% | 34.14% | 31.41% | 3.582 | 4.007 | 4.41 | 19.812 | 17.709 | 16.089 | 70.96 | 12.26% | 3.81% |

| 22 | 600686 | 金龙汽车 | 资本货物 | 16 | 2008-4-28 | 16.35% | 14.28% | 29.21% | 28.35% | 1.204 | 1.313 | 1.497 | 19.394 | 17.785 | 15.602 | 23.35 | 9.57% | 5.87% |

| 23 | 600754 | 锦江股份 | 消费者服务 | 19 | 2008-4-30 | 22.16% | 21.18% | 25.11% | 24.57% | 0.463 | 0.52 | 0.593 | 31.777 | 28.244 | 24.786 | 14.7 | -1.87% | -0.28% |

| 24 | 600875 | 东方电气 | 资本货物 | 20 | 2008-4-30 | 16.49% | 10.71% | 17.33% | 18.16% | 2.757 | 3.263 | 4.287 | 16.266 | 13.744 | 10.462 | 44.85 | 2.37% | -0.28% |

| 25 | 600966 | 博汇纸业 | 原材料 | 18 | 2008-4-16 | 22.92% | 15.28% | 23.85% | 23.07% | 0.71 | 0.819 | 1.045 | 21.034 | 18.233 | 14.297 | 14.94 | 9.81% | 13.00% |

| 26 | 601111 | 中国国航 | 运输 | 19 | 2008-4-25 | -- | 10.38% | 15.34% | 18.33% | 0.474 | 0.595 | 0.881 | 29.367 | 23.397 | 15.82 | 13.93 | -2.31% | 3.81% |

| 27 | 601166 | 兴业银行 | 银行 | 21 | 2008-4-25 | -- | 16.40% | 24.74% | 24.73% | 2.496 | 3.202 | 4.035 | 14.496 | 11.304 | 8.969 | 36.19 | -9.43% | 3.81% |

| 28 | 601169 | 北京银行 | 银行 | 17 | 2008-4-30 | -- | 16.44% | 32.81% | 31.11% | 0.832 | 1.038 | 1.243 | 20.042 | 16.066 | 13.414 | 16.67 | -3.42% | -0.28% |

| 29 | 601318 | 中国平安 | 保险 | 22 | 2008-4-30 | -- | 26.24% | 29.26% | 31.92% | 1.998 | 2.347 | 2.651 | 30.88 | 26.287 | 23.27 | 61.7 | -10.58% | -0.28% |

| 30 | 601398 | 工商银行 | 银行 | 24 | 2008-4-30 | -- | 23.02% | 28.50% | 27.86% | 0.356 | 0.436 | 0.542 | 17.43 | 14.258 | 11.454 | 6.21 | -6.76% | -0.28% |

备注:

1、数据来源:上海朝阳永续一致预期

2、由于季报预测数据覆盖率不足,我们利用年报预期推算出季报的预测,再与实际季报数据进行比较。考虑到季节性因素对公司业绩的影响,我们利用上市公司历史报表的收入及利润构成进行考查和比较,筛选超出历史同期水平的股票,以作为超预期股票池。