对新股,有两个统计数据:一个是以首日收盘价为基准,在未来一到两年内的平均表现弱于同期指数。这一数据来自美国股市,也得到了沪深股市的印证。比如,1997年沪深共上市了178只新股,以首日收盘价计算,其未来一年的平均跌幅达33.14%。而上证指数1998与1997年的年平均值分别是1198点和1212点,基本持平;而深综指的年平均值仅下跌了8.29%。

再如,2004年上市的新股以首日收盘价计算,在未来一年内的平均跌幅高达50.76%,而同期上证指数以全年的平均点位计算,跌幅仅18.71%;深综指的跌幅为23.06%。

造成这一现象的主要原因是新股上市的首日效应所产生的过高上市溢价。比如,以首日收盘计算,1997年上市新股的平均涨幅高达150.43%,而同期上证指数的平均涨幅从1995年的661点到1997年的1198点,仅81.24%。即便是2004这样的大调整年份,新股首日平均涨幅依然高达70.14%。换言之,新股在上市1-2年内的平均表现弱于同期指数,与过高的上市溢价有关。这种由首日效应产生的高溢价,使新股在预支未来业绩方面比老股更甚。

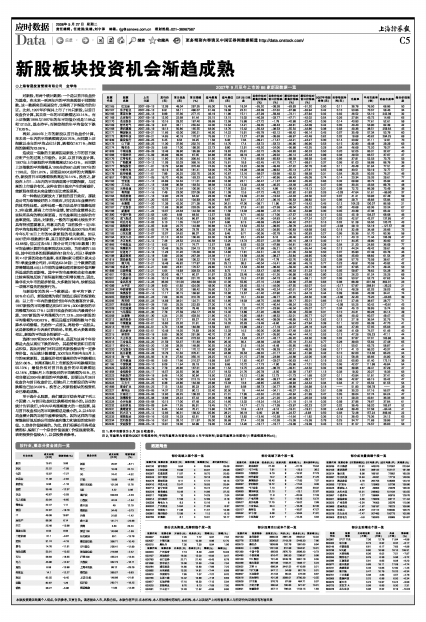

有一种做法无疑放大了新股的首日效应,那就是公司为取得较好的上市效应,对过去3年业绩所作的技术性处理。这种处理一般方法是尽可能摊低前2、3年业绩,提高上市当年业绩,使它的业绩增长比实际所具有的增长率更高,而市盈率则比实际的市盈率更低。因此,对新股,一般的市盈率比较法并不具有特别重要意义,有意义的是“当前股价÷近4年的平均每股税后利润”。表中所列的是2007年9月到今年5月16日上市的86家新股的相关数据。如以2007的年报数据计算,其目前的算术平均市盈率为43.88倍,但以过去4年(部分公司只有3年数据)的平均业绩计算的市盈率则达68.23倍,为前者的1.55倍。其中相当多的股票差距在1倍左右。而以1季度净利×4计算的动态市盈率,在扣除6家亏损和1家未公布1季度业绩公司后,平均达62.34倍!三个数据的差异清楚地显示出上市前的业绩处理对新股价值判断所造成的负面影响。其中平均市盈率和动态市盈率比较客观地反映了实际盈利能力和增长能力。因此,除非在大牛市的起步阶段,大多数时间内,炒新股是一项得不偿失的投资行为。

与新股有关的另一个数据是:在平均下跌了50%左右后,新股就能为我们创造出良好的投资收益:以上市一年内的最低价到3年内的最高价计算,1997新股的平均涨幅达到287.39%;2004新股的平均涨幅为902.17%!以首日收盘价到3年内最高价计算,1997新股的平均涨幅为171.12%;2004新股的平均涨幅为420.83%。都远远超过同期指数与个股算术平均涨幅。先给你一点苦头,再给你一点甜头。这是新股统计告诉我们的结论。毕竟,和大多数老股相比,新股的平均成长性要好一点。

选择1997和2004年为样本,是因为这两个年份都是大盘从高位下跌的年份,其趋势背景和目前有点相似,因此对我们评判当前次新股板块有一定参考价值。而从统计数据看,2007年9月到今年5月上市的86家新股,其最低价相对最高价的平均跌幅已达51.66%,如果扣除5月上市新股的平均跌幅则达55.13%;最低价相对首日收盘价的平均跌幅达42.18%,扣除5月上市新股后的平均跌幅为45%,已相当接近2004年新股的平均跌幅。即便以5月26日收盘价与首日收盘价比,扣除5月上市新股后的平均跌幅也已达34.08%。换言之,次新股板块的投资机会已渐趋成熟。

至于选什么股票,我们建议可综合考虑下列三个因素:1、与首日收盘相比跌幅相对较小的。以往的统计告诉我们,3年内平均涨幅最大的一批股票,其与首日收盘相比的平均跌幅总是最小的。2、以4年平均业绩计算的当前市盈率较低的。因为这样的市盈率能较好地反映公司实际盈利能力和该股的实际价值。3、综合价值较高的。为此,我们根据公司各项业绩指标,编制了一个综合价值强度(价值强度较高,表明投资价值较大),以供投资者参考。

2007年9月至今上市的86家新股数据一览

| 股票 | 股票 | 上市 | 发行价(元) | 首日收盘(元) | 首日涨幅(%) | 迄今最高(元) | 迄今最低(元) | 5月26日收盘 | 当前价相对最高价涨跌(%) | 当前价相对首日价涨跌(%) | 最低价相对最高价涨跌(%) | 最低价相对首日价涨跌(%) | 2007年每股净利(元) | 当季每股净利(元) | 市盈率 | 平均市盈率(倍) | 动态市盈率 | 综合价值强度 |

| 002165 | 红宝丽 | 2007-09-13 | 12.09 | 48.04 | 297.35 | 65.00 | 15.49 | 19.24 | -55.20 | -39.39 | -63.93 | -51.20 | 0.50 | 0.11 | 38.78 | 76.50 | 68.86 | 50 |

| 002167 | 东方锆业 | 2007-09-13 | 8.91 | 53.11 | 496.07 | 61.49 | 19.68 | 22.51 | -63.39 | -57.62 | -67.99 | -62.94 | 0.42 | 0.10 | 53.86 | 73.57 | 58.46 | 34 |

| 002166 | 莱茵生物 | 2007-09-13 | 9.89 | 37.30 | 277.15 | 46.19 | 11.96 | 15.11 | -67.29 | -59.49 | -74.11 | -67.94 | 0.32 | 0.02 | 46.52 | 54.10 | 242.39 | 32 |

| 601169 | 北京银行 | 2007-09-19 | 12.50 | 22.68 | 81.44 | 25.15 | 13.15 | 15.02 | -40.28 | -33.77 | -47.71 | -42.02 | 0.54 | 0.26 | 27.94 | 43.72 | 14.66 | 65 |

| 002170 | 芭田股份 | 2007-09-19 | 10.16 | 29.20 | 187.40 | 39.68 | 12.58 | 15.88 | -27.72 | -1.78 | -42.89 | -22.40 | 0.36 | 0.14 | 43.83 | 77.61 | 52.61 | 59 |

| 002169 | 智光电气 | 2007-09-19 | 9.31 | 33.11 | 255.64 | 42.00 | 12.64 | 14.21 | -59.35 | -48.43 | -63.81 | -54.09 | 0.42 | 0.05 | 40.40 | 53.90 | 82.39 | 42 |

| 002168 | 深圳惠程 | 2007-09-19 | 19.13 | 50.80 | 165.55 | 63.00 | 13.76 | 15.42 | -50.43 | -38.53 | -55.54 | -44.86 | 0.38 | 0.03 | 40.36 | 38.51 | 259.64 | 45 |

| 002171 | 精诚铜业 | 2007-09-21 | 11.66 | 42.00 | 260.21 | 46.50 | 14.22 | 15.91 | -65.78 | -62.12 | -69.42 | -66.14 | 0.45 | 0.07 | 35.49 | 57.34 | 53.78 | 60 |

| 002172 | 澳洋科技 | 2007-09-21 | 14.85 | 40.18 | 170.57 | 76.68 | 11.51 | 12.27 | -67.88 | -38.69 | -69.87 | -42.49 | 0.62 | 0.02 | 19.68 | 40.62 | 294.25 | 69 |

| 601939 | 建设银行 | 2007-09-25 | 6.45 | 8.53 | 32.25 | 11.58 | 6.46 | 7.04 | -39.21 | -17.47 | -44.21 | -24.27 | 0.30 | 0.14 | 23.82 | 31.11 | 12.81 | 70 |

| 002173 | 山下湖 | 2007-09-25 | 11.30 | 37.60 | 232.74 | 37.60 | 14.70 | 17.4 | -53.72 | -53.72 | -60.90 | -60.90 | 0.53 | 0.15 | 32.90 | 49.48 | 29.29 | 63 |

| 002174 | 梅花伞 | 2007-09-25 | 5.68 | 17.00 | 199.30 | 22.73 | 9.80 | 12.91 | -43.20 | -24.06 | -56.89 | -42.35 | 0.28 | 0.04 | 46.69 | 72.20 | 79.27 | 44 |

| 601808 | 中海油服 | 2007-09-28 | 13.48 | 39.90 | 195.99 | 54.80 | 19.82 | 25.91 | -52.72 | -35.06 | -63.83 | -50.33 | 0.50 | 0.20 | 52.05 | 95.31 | 32.67 | 40 |

| 601088 | 中国神华 | 2007-10-09 | 36.99 | 69.30 | 87.35 | 94.88 | 37.82 | 49.19 | -48.16 | -29.02 | -60.14 | -45.43 | 0.99 | 0.33 | 49.50 | 66.57 | 37.67 | 47 |

| 002176 | 江特电机 | 2007-10-12 | 11.80 | 51.50 | 336.44 | 51.50 | 15.66 | 17.6 | -65.83 | -65.83 | -69.59 | -69.59 | 0.46 | 0.06 | 37.91 | 52.53 | 73.75 | 53 |

| 002175 | 广陆数测 | 2007-10-12 | 11.09 | 52.03 | 369.16 | 53.00 | 15.81 | 19.9 | -62.45 | -61.75 | -70.17 | -69.61 | 0.37 | 0.06 | 81.03 | 58.88 | 88.78 | 38 |

| 002177 | 御银股份 | 2007-11-01 | 13.79 | 64.88 | 370.49 | 74.65 | 15.80 | 16.22 | -56.09 | -49.48 | -57.22 | -50.78 | 0.40 | 0.11 | 40.48 | 81.64 | 77.51 | 40 |

| 002179 | 中航光电 | 2007-11-01 | 16.19 | 45.56 | 181.41 | 53.00 | 15.79 | 18.28 | -48.09 | -39.62 | -55.13 | -47.81 | 0.55 | 0.09 | 33.51 | 50.19 | 72.77 | 57 |

| 002178 | 延华智能 | 2007-11-01 | 7.89 | 26.25 | 232.70 | 29.00 | 10.87 | 12.16 | -58.07 | -53.68 | -62.52 | -58.59 | 0.31 | 0.04 | 39.25 | 50.55 | 76.27 | 46 |

| 601857 | 中国石油 | 2007-11-05 | 16.70 | 43.96 | 163.23 | 48.62 | 15.35 | 17.16 | -64.71 | -60.96 | -68.43 | -65.08 | 0.74 | 0.14 | 23.34 | 25.33 | 29.61 | 77 |

| 002183 | 怡亚通 | 2007-11-13 | 24.89 | 52.52 | 111.01 | 93.98 | 16.80 | 23.11 | -50.47 | -11.37 | -63.82 | -35.26 | 0.66 | 0.32 | 69.99 | 33.72 | 35.92 | 42 |

| 002180 | 万力达 | 2007-11-13 | 13.88 | 36.58 | 163.54 | 38.68 | 14.32 | 14.32 | -43.49 | -40.25 | -43.49 | -40.25 | 0.47 | 0.06 | 30.44 | 43.03 | 89.76 | 48 |

| 002182 | 云海金属 | 2007-11-13 | 10.79 | 21.64 | 100.56 | 42.10 | 17.50 | 22.6 | -46.10 | 4.86 | -58.43 | -19.13 | 0.31 | 0.08 | 72.72 | 86.39 | 73.49 | 38 |

| 002181 | 粤传媒 | 2007-11-16 | 7.49 | 23.00 | 207.08 | 29.80 | 11.08 | 12.6 | -57.72 | -45.22 | -62.82 | -51.83 | 0.26 | -0.03 | 47.64 | 51.61 | -96.90 | 37 |

| 002184 | 海得控制 | 2007-11-16 | 12.90 | 23.78 | 84.34 | 28.38 | 15.80 | 19.49 | -31.32 | -18.04 | -44.33 | -33.56 | 0.47 | 0.07 | 41.21 | 50.93 | 67.48 | 59 |

| 002185 | 华天科技 | 2007-11-20 | 10.55 | 21.62 | 104.93 | 26.30 | 8.67 | 9.21 | -47.47 | -36.10 | -50.53 | -39.82 | 0.31 | 0.06 | 29.71 | 46.83 | 55.84 | 65 |

| 002186 | 全聚德 | 2007-11-20 | 11.39 | 42.30 | 271.38 | 78.56 | 34.51 | 47.36 | -39.71 | 11.96 | -56.07 | -18.42 | 0.45 | 0.12 | 104.23 | 130.07 | 96.59 | 21 |

| 002187 | 广百股份 | 2007-11-22 | 11.68 | 38.90 | 233.05 | 48.50 | 25.20 | 27.9 | -41.92 | -27.58 | -48.04 | -35.22 | 0.69 | 0.30 | 40.68 | 63.36 | 23.24 | 67 |

| 002188 | 新嘉联 | 2007-11-22 | 10.07 | 24.63 | 144.59 | 26.00 | 11.58 | 13.03 | -49.88 | -47.10 | -55.46 | -52.98 | 0.30 | 0.05 | 43.39 | 47.36 | 66.42 | 57 |

| 601390 | 中国中铁 | 2007-12-03 | 4.80 | 8.09 | 68.54 | 12.57 | 6.59 | 6.71 | -46.62 | -17.06 | -47.57 | -18.54 | 0.15 | 0.02 | 45.19 | 104.37 | 68.08 | 46 |

| 002190 | 成飞集成 | 2007-12-03 | 9.90 | 18.50 | 86.87 | 23.96 | 9.59 | 11.52 | -41.96 | -24.83 | -51.54 | -37.24 | 0.27 | 0.03 | 42.57 | 42.07 | 137.95 | 47 |

| 002189 | 利达光电 | 2007-12-03 | 5.10 | 11.05 | 116.67 | 15.97 | 6.96 | 8.15 | -48.69 | -25.84 | -56.42 | -37.01 | 0.16 | 0.02 | 51.29 | 55.50 | 120.70 | 43 |

| 002192 | 路翔股份 | 2007-12-05 | 9.29 | 22.75 | 144.89 | 30.88 | 12.73 | 13.54 | -55.54 | -39.65 | -58.78 | -44.04 | 0.47 | -0.03 | 29.10 | 54.18 | -127.57 | 49 |

| 002191 | 劲嘉股份 | 2007-12-05 | 17.78 | 30.90 | 73.79 | 35.39 | 17.40 | 20.1 | -43.20 | -34.95 | -50.83 | -43.69 | 0.62 | 0.19 | 32.48 | 34.48 | 26.66 | 73 |

| 002193 | 山东如意 | 2007-12-07 | 13.07 | 24.62 | 88.37 | 28.00 | 9.46 | 9.71 | -30.36 | -20.79 | -39.18 | -30.83 | 0.27 | 0.06 | 35.36 | 51.70 | 83.36 | 58 |

| 002194 | 武汉凡谷 | 2007-12-07 | 21.10 | 43.52 | 106.26 | 62.30 | 19.30 | 23.1 | -25.84 | 6.16 | -48.46 | -26.22 | 0.54 | 0.11 | 43.13 | 71.44 | 106.39 | 47 |

| 002196 | 方正电机 | 2007-12-12 | 7.48 | 23.52 | 214.44 | 30.58 | 12.20 | 13.74 | -55.07 | -41.58 | -60.10 | -48.13 | 0.40 | 0.11 | 34.35 | 49.90 | 30.00 | 67 |

| 601866 | 中海集运 | 2007-12-12 | 6.62 | 11.57 | 74.77 | 12.57 | 5.68 | 6.03 | -52.03 | -47.88 | -54.81 | -50.91 | 0.28 | 0.04 | 21.20 | 24.83 | 36.09 | 77 |

| 002195 | 海隆软件 | 2007-12-12 | 10.49 | 35.05 | 234.13 | 37.28 | 12.99 | 15.7 | -57.89 | -55.21 | -58.10 | -55.44 | 0.46 | 0.13 | 44.24 | 49.42 | 29.61 | 48 |

| 002197 | 证通电子 | 2007-12-18 | 11.28 | 31.20 | 176.60 | 38.00 | 14.80 | 17.81 | -52.51 | -42.16 | -61.05 | -52.56 | 0.50 | 0.07 | 35.90 | 67.49 | 60.78 | 46 |

| 002198 | 嘉应制药 | 2007-12-18 | 5.99 | 22.00 | 267.28 | 24.38 | 11.01 | 13.58 | -44.30 | -38.27 | -54.84 | -49.95 | 0.30 | 0.06 | 45.60 | 68.82 | 61.54 | 28 |

| 601918 | 国投新集 | 2007-12-19 | 5.88 | 13.89 | 136.22 | 17.78 | 8.40 | 12.81 | -27.95 | -7.78 | -52.76 | -39.52 | 0.22 | 0.08 | 57.75 | 73.59 | 38.61 | 47 |

| 002200 | 绿大地 | 2007-12-21 | 16.49 | 45.82 | 177.87 | 63.88 | 25.12 | 38.3 | -40.04 | -16.41 | -60.68 | -45.18 | 0.77 | 0.23 | 49.91 | 70.58 | 40.82 | 42 |

| 002199 | 东晶电子 | 2007-12-21 | 8.80 | 23.81 | 170.57 | 29.80 | 12.10 | 14.53 | -50.83 | -38.46 | -59.40 | -49.18 | 0.38 | 0.07 | 37.95 | 47.73 | 49.44 | 53 |

| 601999 | 出版传媒 | 2007-12-21 | 4.64 | 19.93 | 329.53 | 24.50 | 9.72 | 11.4 | -53.47 | -42.80 | -60.33 | -51.23 | 0.19 | 0.05 | 59.97 | 78.62 | 54.28 | 36 |

| 601601 | 中国太保 | 2007-12-25 | 30.00 | 48.17 | 60.57 | 51.97 | 22.35 | 23.48 | -54.82 | -51.26 | -56.99 | -53.60 | 0.90 | 0.23 | 26.23 | 91.24 | 25.25 | 69 |

| 002201 | 九鼎新材 | 2007-12-26 | 10.19 | 33.80 | 231.70 | 36.36 | 13.82 | 15.3 | -57.92 | -54.73 | -61.99 | -59.11 | 0.37 | 0.06 | 53.57 | 52.72 | 67.63 | 54 |

| 002202 | 金风科技 | 2007-12-26 | 36.00 | 131.00 | 263.89 | 160.00 | 41.00 | 55.65 | -37.10 | -14.98 | -53.66 | -37.36 | 0.63 | 0.08 | 88.39 | 201.69 | 362.31 | 23 |

| 601099 | 太平洋 | 2007-12-28 | 8.00 | 41.92 | 424.00 | 49.00 | 15.90 | 23.45 | -52.14 | -44.06 | -67.55 | -62.07 | 0.41 | -0.17 | 57.87 | 268.91 | -35.22 | 21 |

| 002204 | 华锐铸钢 | 2008-01-16 | 10.78 | 31.20 | 189.42 | 35.60 | 13.31 | 17.89 | -49.38 | -42.24 | -62.61 | -57.34 | 0.36 | 0.16 | 49.28 | 92.03 | 28.03 | 49 |

| 002203 | 海亮股份 | 2008-01-16 | 11.17 | 30.15 | 169.92 | 32.88 | 10.80 | 12.57 | -61.40 | -57.90 | -67.15 | -64.18 | 0.44 | 0.09 | 28.86 | 43.38 | 34.41 | 74 |

| 002205 | 国统股份 | 2008-01-23 | 7.69 | 32.05 | 316.78 | 34.20 | 11.68 | 16.1 | -52.92 | -49.77 | -65.85 | -63.56 | 0.38 | -0.06 | 42.40 | 75.20 | -64.85 | 39 |

| 002206 | 海利得 | 2008-01-23 | 14.69 | 33.01 | 124.71 | 35.50 | 14.85 | 18.03 | -48.75 | -44.89 | -58.17 | -55.01 | 0.66 | 0.16 | 27.46 | 38.67 | 28.77 | 71 |

| 002207 | 准油股份 | 2008-01-28 | 7.85 | 25.35 | 222.93 | 27.30 | 11.40 | 15 | -44.70 | -40.44 | -58.24 | -55.03 | 0.27 | -0.09 | 55.25 | 50.42 | -40.81 | 43 |

| 002208 | 合肥城建 | 2008-01-28 | 15.60 | 28.00 | 79.49 | 33.88 | 18.18 | 21.32 | -37.07 | -23.86 | -46.34 | -35.07 | 0.71 | 0.34 | 45.10 | 38.85 | 15.74 | 65 |

| 002210 | 飞马国际 | 2008-01-30 | 7.79 | 27.59 | 254.17 | 28.50 | 12.40 | 13.89 | -51.26 | -49.66 | -56.49 | -55.06 | 0.31 | 0.10 | 44.31 | 80.28 | 34.14 | 49 |

| 002209 | 达意隆 | 2008-01-30 | 4.24 | 21.35 | 403.54 | 21.90 | 10.51 | 10.95 | -49.81 | -48.52 | -52.01 | -50.77 | 0.27 | 0.06 | 40.42 | 60.57 | 49.47 | 45 |

| 002212 | 南洋股份 | 2008-02-01 | 15.12 | 27.71 | 83.27 | 31.49 | 15.76 | 16.88 | -46.40 | -39.08 | -49.95 | -43.13 | 0.62 | 0.13 | 27.18 | 36.54 | 32.75 | 75 |

| 601898 | 中煤能源 | 2008-02-01 | 16.83 | 22.20 | 31.91 | 24.89 | 16.02 | 20.29 | -18.48 | -8.60 | -35.64 | -27.84 | 0.39 | 0.11 | 52.03 | 85.39 | 47.70 | 41 |

| 002213 | 特尔佳 | 2008-02-01 | 4.70 | 13.38 | 184.68 | 16.59 | 9.61 | 10.99 | -33.21 | -17.19 | -42.07 | -28.18 | 0.23 | 0.04 | 47.33 | 57.05 | 65.03 | 43 |

| 002211 | 宏达新材 | 2008-02-01 | 10.49 | 18.35 | 74.93 | 29.00 | 12.33 | 14.5 | -50.00 | -20.98 | -57.48 | -32.81 | 0.35 | 0.06 | 41.09 | 74.57 | 61.46 | 40 |

| 002215 | 诺普信 | 2008-02-18 | 9.95 | 39.00 | 291.96 | 40.70 | 21.80 | 25 | -38.57 | -35.90 | -46.44 | -44.10 | 0.53 | 0.13 | 47.26 | 105.23 | 47.11 | 44 |

| 002214 | 大立科技 | 2008-02-18 | 6.80 | 25.40 | 273.53 | 33.94 | 11.81 | 14.33 | -57.47 | -43.17 | -65.20 | -53.50 | 0.38 | 0.02 | 37.87 | 57.01 | 165.96 | 34 |

| 002216 | 三全食品 | 2008-02-20 | 21.59 | 54.37 | 151.83 | 58.90 | 26.40 | 30.4 | -48.39 | -44.09 | -55.18 | -51.44 | 0.77 | 0.28 | 39.63 | 55.62 | 27.48 | 65 |

| 002217 | 联合化工 | 2008-02-20 | 11.39 | 28.35 | 148.90 | 30.55 | 14.20 | 21.6 | -19.34 | -8.49 | -55.85 | -49.91 | 0.43 | 0.11 | 50.01 | 65.73 | 58.87 | 41 |

| 002220 | 天宝股份 | 2008-02-28 | 17.07 | 46.11 | 170.12 | 49.80 | 23.80 | 28 | -43.78 | -39.28 | -52.21 | -48.38 | 0.68 | 0.17 | 41.10 | 86.20 | 40.37 | 44 |

| 002218 | 拓日新能 | 2008-02-28 | 10.79 | 51.62 | 378.41 | 57.60 | 24.80 | 35.53 | -38.32 | -31.17 | -56.94 | -51.96 | 0.43 | 0.10 | 82.00 | 116.60 | 86.20 | 24 |

| 002219 | 独一味 | 2008-03-06 | 6.18 | 27.82 | 350.16 | 29.25 | 16.12 | 21.15 | -27.69 | -23.98 | -44.89 | -42.06 | 0.36 | 0.12 | 58.46 | 93.66 | 44.90 | 30 |

| 002221 | 东华能源 | 2008-03-06 | 5.69 | 17.66 | 210.37 | 19.99 | 9.87 | 11.82 | -40.87 | -33.07 | -50.63 | -44.11 | 0.19 | 0.02 | 60.90 | 91.40 | 172.15 | 39 |

| 601186 | 中国铁建 | 2008-03-10 | 9.08 | 11.64 | 28.19 | 13.03 | 9.66 | 10.72 | -17.73 | -7.90 | -25.86 | -17.01 | 0.25 | 0.06 | 42.07 | 111.98 | 46.84 | 54 |

| 002222 | 福晶科技 | 2008-03-19 | 7.79 | 20.80 | 167.01 | 22.90 | 11.54 | 12.75 | -44.32 | -38.70 | -49.61 | -44.52 | 0.32 | 0.09 | 39.96 | 49.41 | 37.29 | 47 |

| 601958 | 金钼股份 | 2008-04-17 | 16.57 | 22.55 | 36.09 | 27.47 | 18.52 | 21.76 | -20.79 | -3.50 | -32.58 | -17.87 | 1.13 | 0.33 | 19.32 | 20.27 | 16.33 | 63 |

| 002223 | 鱼跃医疗 | 2008-04-18 | 9.48 | 14.30 | 50.84 | 18.50 | 12.63 | 16.12 | -12.86 | 12.73 | -31.73 | -11.68 | 0.37 | 0.11 | 43.84 | 51.81 | 37.41 | 60 |

| 002225 | 濮耐股份 | 2008-04-25 | 4.79 | 15.00 | 213.15 | 15.43 | 9.90 | 9.11 | -40.96 | -39.27 | -40.96 | -39.27 | 0.21 | 0.06 | 42.87 | 66.15 | 35.42 | 47 |

| 002224 | 三力士 | 2008-04-25 | 9.38 | 24.80 | 164.39 | 26.98 | 15.03 | 13.8 | -48.85 | -44.35 | -48.93 | -44.44 | 0.34 | 0.04 | 41.17 | 65.52 | 91.55 | 54 |

| 601899 | 紫金矿业 | 2008-04-25 | 7.13 | 13.92 | 95.23 | 22.00 | 9.61 | 9.08 | -58.73 | -34.77 | -58.86 | -34.99 | 0.18 | —— | 51.83 | 106.79 | —— | 29 |

| 002227 | 奥特迅 | 2008-05-06 | 14.37 | 27.32 | 90.12 | 32.40 | 20.50 | 18 | -44.44 | -34.11 | -45.37 | -35.21 | 0.51 | 0.08 | 35.23 | 57.16 | 56.07 | 48 |

| 002226 | 江南化工 | 2008-05-06 | 12.60 | 26.25 | 108.33 | 31.28 | 21.01 | 17.95 | -42.62 | -31.62 | -42.84 | -31.89 | 0.47 | 0.05 | 38.04 | 57.74 | 84.24 | 47 |

| 002229 | 鸿博股份 | 2008-05-08 | 13.88 | 23.24 | 67.44 | 26.00 | 18.89 | 17.38 | -21.26 | -21.26 | -26.03 | -26.03 | 0.59 | 0.13 | 29.23 | 40.81 | 36.33 | 63 |

| 002228 | 合兴包装 | 2008-05-08 | 10.15 | 17.00 | 67.49 | 20.20 | 14.60 | 13.32 | -18.24 | -18.24 | -21.18 | -21.18 | 0.35 | 0.09 | 37.96 | 78.67 | 37.84 | 61 |

| 002232 | 启明信息 | 2008-05-09 | 9.44 | 17.55 | 85.91 | 19.45 | 15.71 | 14.17 | -21.15 | -17.38 | -23.87 | -20.23 | 0.37 | 0.02 | 38.45 | 59.20 | 183.67 | 52 |

| 002231 | 奥维通信 | 2008-05-12 | 8.46 | 14.40 | 70.21 | 15.96 | 12.70 | 12.9 | -9.10 | -9.10 | -19.31 | -19.31 | 0.33 | -0.04 | 39.40 | 57.58 | -84.44 | 41 |

| 002230 | 科大讯飞 | 2008-05-12 | 12.66 | 30.31 | 139.42 | 35.90 | 28.21 | 36.18 | 0.00 | 23.39 | -24.57 | -6.93 | 0.50 | 0.03 | 72.48 | 157.24 | 309.40 | 22 |

| 002233 | 塔牌集团 | 2008-05-16 | 10.03 | 16.33 | 62.81 | 17.89 | 13.80 | 13.82 | -13.46 | -10.59 | -14.64 | -11.82 | 0.36 | 0.15 | 38.43 | 75.36 | 24.12 | 63 |

| 002234 | 民和股份 | 2008-05-16 | 10.61 | 33.10 | 211.97 | 35.00 | 26.69 | 27.4 | -10.39 | -10.39 | -15.38 | -15.38 | 0.79 | 0.25 | 34.77 | 71.69 | 29.96 | 57 |

| 002235 | 安妮股份 | 2008-05-16 | 10.91 | 18.00 | 64.99 | 19.30 | 14.26 | 14.26 | -18.17 | -18.17 | -19.39 | -19.39 | 0.45 | 0.10 | 31.57 | 74.57 | 36.60 | 53 |

注1:表中当前价为5月26日收盘价;

注2:市盈率为当前价/2007年每股净利;平均市盈率为当前价/过去4年平均净利;动态市盈率为当前价/(1季度每股净利×4);