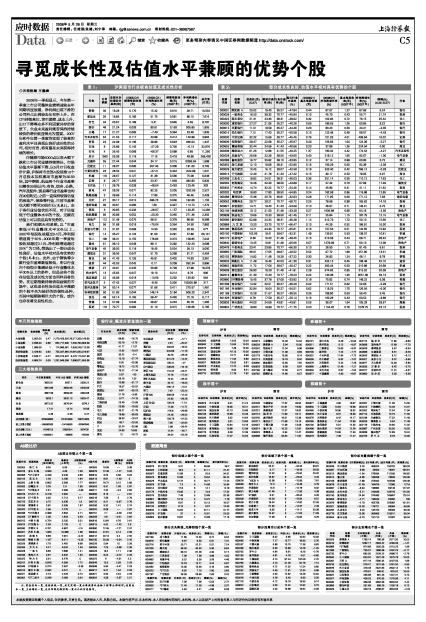

2008年一季报显示,今年第一季度上市公司整体业绩增速较去年同期明显放缓,净利润出现下滑的公司所占比例较去年有所上升。在CPI持续高位、货币紧缩、成本上升、出口下降等众多不利因素共存的背景下,企业未来盈利能否保持持续较快的增长就显得尤为重要。2007年和今年第一季度均实现了较高的盈利水平且表现出良好成长性的公司,相对而言,将有望在未来获得持续的增长。

伴随着市场6000点以来大幅下跌和上市公司业绩持续增长,市场估值水平逐渐下降,以5月27日收盘价计算,沪深两市全部A股前推12个月总股本加权滚动市盈率为26.59倍,其中钢铁、航运两个行业市盈率已落在20倍以内;有色、综合、公路、汽车及配件、贸易等行业市盈率也均在20倍附近;之前一直保持较高估值的房地产、保险等行业,目前市盈率也大幅下降至30倍左右(见表1)。由于各行业估值状况不同,对于估值低于行业整体水平的个股,无疑在估值上可以说是具有优势的。

我们根据天相系统,以“市盈率低于行业整体水平30%以上、2007年每股收益超过0.4元、净利润增速高于40%、2008年第一季度每股收益超过0.1元、净利润增速超过25%”为口径,筛选出了一部分成长性良好、估值水平相对具有优势的个股(见表2)。此外,由于钢铁等少数行业市盈率数值极低,所以行业内个股很少能满足低于行业整体水平30%以上的条件,但是这些个股在估值及成长性方面也同样具备优势。在近期指数持续表现疲弱的市场中,这些成长性及估值水平兼顾的个股不失为较好的防御性品种,而其中短期跌幅巨大的个股,或许也存在着交易性机会。

表1: 沪深股市行业板块估值及成长性分析

| 行业 | 公司家数 | 总股本加权滚动市盈率(倍) | (2008.Q1) | (2008.Q1) | 摊薄每股收益(元) | 净利润增长率(%) | 总市值 摊薄每股收益(元) | 净利润增长率(%) (2007年) (2007年) (亿元)

| 钢铁 | 46 | 18.28 | 0.170 | 15.42 | 0.616 | 28.71 | 10,534 |

| 航运业 | 26 | 19.84 | 0.183 | 51.75 | 0.591 | 98.15 | 7,616 |

| 有色 | 44 | 20.67 | 0.169 | 5.31 | 0.665 | 6.55 | 9,797 |

| 综合 | 48 | 21.24 | 0.033 | 90.61 | 0.163 | 305.85 | 1,955 |

| 公路 | 17 | 21.27 | 0.085 | -7.40 | 0.364 | 23.48 | 1,835 |

| 汽车及配件 | 64 | 21.55 | 0.117 | 43.98 | 0.414 | 140.99 | 3,962 |

| 贸易 | 22 | 22.08 | 0.136 | 29.96 | 0.623 | 336.04 | 1,347 |

| 石油 | 8 | 25.89 | 0.145 | -27.29 | 0.726 | -0.13 | 32,876 |

| 石化 | 4 | 26.45 | 0.069 | -68.37 | 0.599 | 6.85 | 11,250 |

| 总计 | 1560 | 26.59 | 0.118 | 17.16 | 0.419 | 49.86 | 269,428 |

| 元器件 | 55 | 27.44 | 0.044 | 34.17 | 0.215 | 10286.55 | 1,699 |

| 民航业 | 11 | 28.07 | 0.095 | 557.46 | 0.308 | 191.60 | 3,705 |

| 计算机硬件 | 23 | 28.53 | 0.041 | -37.21 | 0.344 | 1442.99 | 1,031 |

| 机械 | 119 | 28.67 | 0.127 | 31.38 | 0.536 | 75.08 | 6,648 |

| 证券 | 8 | 28.77 | 0.305 | 23.37 | 1.849 | 484.93 | 5,834 |

| 日用品 | 11 | 28.78 | 0.028 | -49.64 | 0.453 | 123.46 | 303 |

| 家电 | 47 | 29.33 | 0.071 | 92.25 | 0.205 | 1332.85 | 2,527 |

| 铁路运输 | 3 | 29.69 | 0.114 | 17.86 | 0.375 | 46.46 | 2,429 |

| 化纤 | 27 | 30.17 | 0.015 | 496.73 | 0.046 | 192.68 | 1,155 |

| 造纸包装 | 36 | 30.81 | 0.080 | 1.60 | 0.327 | 114.74 | 1,472 |

| 保险 | 3 | 30.85 | 0.234 | -28.07 | 1.157 | 120.35 | 14,236 |

| 纺织服装 | 66 | 30.99 | 0.052 | -20.33 | 0.265 | 271.36 | 2,302 |

| 房地产 | 112 | 31.48 | 0.075 | 68.51 | 0.378 | 98.66 | 8,588 |

| 电力 | 56 | 31.69 | 0.019 | -75.04 | 0.354 | 24.50 | 7,982 |

| 交通与仓储 | 12 | 31.87 | 0.068 | 14.50 | 0.320 | 33.29 | 677 |

| 银行 | 14 | 35.27 | 0.122 | 91.00 | 0.291 | 57.86 | 66,101 |

| 化工 | 108 | 38.31 | 0.155 | 178.93 | 0.374 | 169.85 | 7,044 |

| 建材 | 61 | 39.10 | 0.049 | 89.11 | 0.292 | 132.43 | 3,099 |

| 电气设备 | 45 | 39.50 | 0.118 | 18.45 | 0.524 | 28.13 | 3,000 |

| 建筑业 | 31 | 39.56 | 0.047 | 51.70 | 0.268 | 91.71 | 4,454 |

| 商业 | 56 | 41.43 | 0.126 | 45.81 | 0.402 | 74.93 | 3,381 |

| 通信 | 44 | 42.53 | 0.042 | 0.17 | 0.209 | 352.34 | 3,996 |

| 煤炭 | 27 | 43.91 | 0.245 | 50.96 | 0.729 | 27.98 | 18,279 |

| 供水供气 | 13 | 45.62 | 0.047 | 19.10 | 0.214 | 9.76 | 906 |

| 酒店旅游 | 22 | 46.68 | 0.018 | -13.06 | 0.252 | 135.82 | 664 |

| 信托及其它 | 4 | 47.42 | 0.027 | -8.55 | 0.326 | 153325.88 | 317 |

| 软件及服务 | 34 | 50.14 | 0.077 | 51.66 | 0.411 | 275.57 | 1,491 |

| 农林牧副渔 | 50 | 51.93 | 0.044 | 148.14 | 0.194 | 506.20 | 2,347 |

| 食品 | 48 | 52.14 | 0.165 | 59.47 | 0.426 | 72.18 | 6,117 |

| 传媒 | 16 | 57.09 | 0.046 | 28.87 | 0.224 | 65.78 | 1,285 |

| 医药 | 119 | 70.77 | 0.092 | 41.10 | 0.315 | 166.68 | 5,185 |

表2: 部分成长性良好、估值水平相对具有优势的个股

| 股票 | 股票 | 收盘价(元)(5.27) | 滚动市盈率(倍) | 行业市盈率(倍) | 高出行业市盈率(%) | (2008Q1) | (2008Q1) | 基本每股收益(元) | 净利润增长率(%) | 涨幅(%) | 行业 |

| 000001 | 深发展A | 25.02 | 18.40 | 35.27 | -47.84 | 0.44 | 87.67 | 1.27 | 87.68 | 6.24 | 银行 |

| 000028 | 一致药业 | 18.20 | 38.32 | 70.77 | -45.84 | 0.13 | 45.70 | 0.43 | 55.71 | 21.74 | 医药 |

| 000422 | 湖北宜化 | 21.31 | 23.36 | 38.31 | -39.02 | 0.32 | 162.94 | 0.72 | 76.15 | 25.42 | 化工 |

| 600000 | 浦发银行 | 27.27 | 21.06 | 35.27 | -40.28 | 0.65 | 186.55 | 1.26 | 63.85 | 9.22 | 银行 |

| 600015 | 华夏银行 | 11.51 | 19.59 | 35.27 | -44.46 | 0.20 | 80.43 | 0.50 | 44.21 | -2.05 | 银行 |

| 600016 | 民生银行 | 7.12 | 17.43 | 35.27 | -50.59 | 0.13 | 122.48 | 0.48 | 68.57 | -4.43 | 银行 |

| 600030 | 中信证券 | 32.32 | 15.69 | 28.77 | -45.45 | 0.76 | 101.03 | 4.01 | 408.84 | 16.02 | 证券 |

| 600036 | 招商银行 | 29.47 | 22.69 | 35.27 | -35.67 | 0.43 | 156.66 | 1.04 | 124.36 | -5.27 | 银行 |

| 600655 | 豫园商城 | 32.44 | 24.58 | 41.43 | -40.66 | 0.23 | 37.88 | 1.26 | 224.54 | 0.00 | 商业 |

| 000338 | 潍柴动力 | 61.26 | 12.88 | 21.55 | -40.25 | 1.37 | 180.32 | 4.42 | 172.54 | -4.27 | 汽车及配件 |

| 002028 | 思源电气 | 26.68 | 22.28 | 39.50 | -43.60 | 0.43 | 319.12 | 1.65 | 82.07 | -1.00 | 电气设备 |

| 002088 | 鲁阳股份 | 16.77 | 25.82 | 39.10 | -33.95 | 0.12 | 37.14 | 0.99 | 63.06 | 0.72 | 建材 |

| 600352 | 浙江龙盛 | 12.10 | 18.08 | 38.31 | -52.80 | 0.16 | 106.29 | 0.65 | 82.38 | -2.58 | 化工 |

| 600029 | 南方航空 | 10.45 | 16.12 | 28.07 | -42.59 | 0.18 | 523.40 | 0.42 | 786.12 | -0.29 | 民航业 |

| 000516 | 开元控股 | 12.40 | 21.78 | 41.43 | -47.42 | 0.15 | 30.17 | 0.53 | 79.56 | 6.07 | 商业 |

| 600409 | 三友化工 | 19.82 | 24.51 | 38.31 | -36.03 | 0.36 | 251.14 | 0.55 | 110.12 | 17.63 | 化工 |

| 002062 | 宏润建设 | 16.28 | 22.20 | 39.56 | -43.89 | 0.17 | 27.42 | 0.70 | 67.69 | 17.29 | 建筑业 |

| 600332 | 广州药业 | 14.74 | 32.22 | 70.77 | -54.46 | 0.14 | 45.96 | 0.41 | 41.11 | 21.62 | 医药 |

| 600202 | 哈空调 | 19.80 | 17.80 | 39.50 | -54.95 | 0.24 | 182.59 | 0.96 | 118.98 | 12.95 | 电气设备 |

| 000488 | 晨鸣纸业 | 15.38 | 20.76 | 30.81 | -32.63 | 0.28 | 171.95 | 0.60 | 171.12 | 7.93 | 造纸包装 |

| 600062 | 双鹤药业 | 29.77 | 29.21 | 70.77 | -58.72 | 0.25 | 79.68 | 0.99 | 165.62 | 14.19 | 医药 |

| 600827 | 友谊股份 | 14.71 | 19.43 | 41.43 | -53.09 | 0.13 | 48.67 | 0.71 | 146.61 | 6.75 | 商业 |

| 002146 | 荣盛发展 | 10.12 | 21.00 | 31.48 | -33.29 | 0.27 | 1636.98 | 0.80 | 64.18 | -2.50 | 房地产 |

| 000939 | 凯迪电力 | 13.66 | 15.23 | 39.50 | -61.45 | 0.11 | 25.84 | 1.15 | 187.75 | 12.15 | 电气设备 |

| 600596 | 新安股份 | 62.99 | 24.34 | 38.31 | -36.48 | 1.14 | 312.73 | 1.72 | 50.10 | 15.60 | 化工 |

| 000989 | 九 芝 堂 | 13.20 | 23.73 | 70.77 | -66.47 | 0.13 | 44.29 | 0.52 | 186.81 | 16.30 | 医药 |

| 600196 | 复星医药 | 14.71 | 24.34 | 70.77 | -65.61 | 0.16 | 157.53 | 0.51 | 142.65 | 15.92 | 医药 |

| 600150 | 中国船舶 | 102.06 | 19.41 | 28.67 | -32.31 | 1.49 | 135.91 | 5.53 | 139.57 | 10.81 | 机械 |

| 600173 | 卧龙地产 | 9.36 | 16.23 | 31.48 | -48.45 | 0.15 | 315.59 | 0.44 | 69.71 | 28.22 | 房地产 |

| 600840 | 新湖创业 | 13.45 | 10.81 | 31.48 | -65.66 | 0.57 | 1479.09 | 0.71 | 63.16 | 12.08 | 房地产 |

| 600479 | 千金药业 | 23.41 | 23.85 | 70.77 | -66.30 | 0.13 | 28.50 | 1.15 | 91.45 | 6.61 | 医药 |

| 600685 | 广船国际 | 36.01 | 17.05 | 28.67 | -40.52 | 0.52 | 67.72 | 1.90 | 251.60 | 13.31 | 机械 |

| 600102 | 莱钢股份 | 14.92 | 11.48 | 18.28 | -37.22 | 0.30 | 26.93 | 1.24 | 48.11 | 9.79 | 钢铁 |

| 000032 | 深桑达A | 11.49 | 16.46 | 42.53 | -61.30 | 0.31 | 422.13 | 0.45 | 108.48 | 22.10 | 通信 |

| 600862 | 南通科技 | 11.72 | 17.06 | 28.67 | -40.47 | 0.22 | 260.44 | 0.53 | 210.88 | 24.68 | 机械 |

| 000609 | 绵世股份 | 26.93 | 18.29 | 31.48 | -41.91 | 2.29 | 674.92 | 0.95 | 315.52 | 32.09 | 房地产 |

| 002019 | 鑫富药业 | 21.30 | 15.40 | 70.77 | -78.23 | 0.22 | 133.38 | 1.26 | 2651.38 | 33.13 | 医药 |

| 600880 | DR博瑞传 | 15.45 | 37.78 | 57.09 | -33.82 | 0.18 | 70.92 | 0.74 | 149.22 | 6.39 | 传媒 |

| 601009 | 南京银行 | 14.32 | 22.51 | 35.27 | -36.20 | 0.22 | 171.51 | 0.62 | 52.95 | -5.29 | 银行 |

| 601166 | 兴业银行 | 32.94 | 16.04 | 35.27 | -54.51 | 0.62 | 119.25 | 1.75 | 126.04 | -6.30 | 银行 |

| 601169 | 北京银行 | 15.29 | 21.67 | 35.27 | -38.55 | 0.26 | 189.80 | 0.63 | 56.43 | 3.45 | 银行 |

| 601328 | 交通银行 | 8.78 | 17.59 | 35.27 | -50.14 | 0.16 | 100.28 | 0.43 | 63.52 | -9.86 | 银行 |

| 000933 | 神火股份 | 44.00 | 24.68 | 43.91 | -43.81 | 0.55 | 36.07 | 1.64 | 105.33 | 28.67 | 煤炭 |

| 000952 | 广济药业 | 19.80 | 19.99 | 70.77 | -71.75 | 0.23 | 1144.20 | 0.78 | 1079.75 | 23.13 | 医药 |