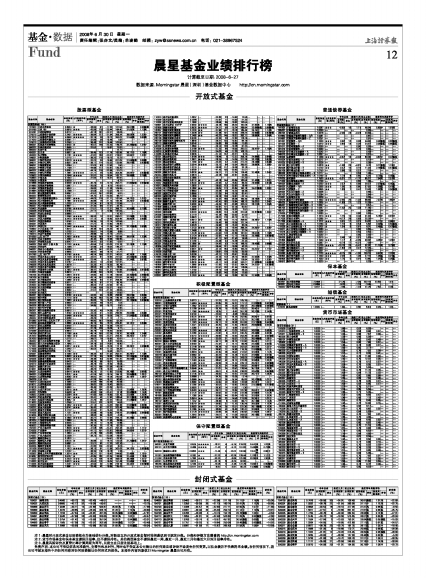

晨星基金业绩排行榜

2008年06月30日 来源:上海证券报 作者:

计算截至日期:2008-6-27

数据来源:Morningstar晨星(深圳)基金数据中心 http://cn.morningstar.com

开放式基金

股票型基金

| 基金代码 | 基金名称 | 单位净值(元) | 5月晨星评级(两年) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 股票型基金(195) | |||||||||||

| 161903 | 万家公用事业 | 0.6534 | ★ | -36.95 | 91 | -17.30 | 107.54 | 29.97 | 低 | 0.98 | 偏低 |

| 519180 | 万家180 | 0.6615 | ★★★ | -43.99 | 175 | -20.44 | 164.40 | 37.05 | 高 | 1.13 | 高 |

| 519181 | 万家和谐增长 | 0.6112 | -- | -42.16 | 161 | -22.21 | 26.06 | -- | -- | -- | -- |

| 375010 | 上投摩根中国优势 | 2.2401 | ★★★★ | -38.84 | 127 | -21.84 | 356.34 | 38.59 | 高 | 1.03 | 中 |

| 377010 | 上投摩根阿尔法 | 4.3940 | ★★★★★ | -32.19 | 28 | -16.13 | 353.03 | 31.55 | 低 | 0.80 | 低 |

| 377020 | 上投摩根内需动力 | 0.9361 | -- | -32.98 | 36 | -15.48 | 1.92 | -- | -- | -- | -- |

| 378010 | 上投摩根成长先锋 | 2.0250 | -- | -38.46 | 122 | -19.49 | 102.50 | -- | -- | -- | -- |

| 580001 | 东吴嘉禾优势精选 | 0.6230 | ★ | -40.57 | 146 | -22.20 | 146.24 | 32.38 | 偏低 | 1.04 | 中 |

| 580002 | 东吴价值成长 | 1.6585 | -- | -22.52 | 1 | -16.67 | 73.82 | -- | -- | -- | -- |

| 580003 | 东吴行业 | 0.8729 | -- | -- | -- | -- | -12.71 | -- | -- | -- | -- |

| 400001 | 东方龙 | 0.6627 | ★ | -39.45 | 133 | -17.79 | 163.98 | 36.17 | 中 | 1.16 | 高 |

| 400003 | 东方精选 | 0.7161 | ★★★★ | -41.87 | 160 | -23.01 | 218.87 | 34.95 | 中 | 1.03 | 中 |

| 166001 | 中欧新趋势 | 1.0110 | -- | -38.20 | 115 | -18.13 | 13.23 | -- | -- | -- | -- |

| 398001 | 中海优质成长 | 0.6276 | ★★★★ | -33.22 | 39 | -15.95 | 201.09 | 31.59 | 偏低 | 0.88 | 低 |

| 398011 | 中海分红增利 | 0.6521 | ★★ | -38.17 | 114 | -20.33 | 133.88 | 28.91 | 低 | 0.93 | 偏低 |

| 398021 | 中海能源策略 | 1.0094 | -- | -37.02 | 93 | -17.50 | 7.50 | -- | -- | -- | -- |

| 590001 | 中邮核心优选 | 1.1158 | -- | -44.69 | 177 | -22.87 | 125.25 | -- | -- | -- | -- |

| 590002 | 中邮核心成长 | 0.6293 | -- | -44.74 | 178 | -22.88 | -37.07 | -- | -- | -- | -- |

| 288002 | 中信红利精选 | 1.7961 | ★★★★★ | -31.71 | 26 | -13.90 | 304.36 | 34.94 | 中 | 0.93 | 偏低 |

| 163803 | 中银持续增长 | 0.7846 | ★★★★ | -32.97 | 35 | -19.54 | 163.72 | 29.66 | 低 | 0.76 | 低 |

| 163804 | 中银收益 | 0.7333 | -- | -31.92 | 27 | -15.07 | 62.61 | -- | -- | -- | -- |

| 163805 | 中银策略 | 0.9328 | -- | -- | -- | -- | -6.72 | -- | -- | -- | -- |

| 519688 | 交银施罗德精选 | 0.9339 | ★★★★ | -30.75 | 23 | -10.10 | 252.21 | 31.85 | 偏低 | 0.93 | 偏低 |

| 519690 | 交银施罗德稳健 | 1.5997 | -- | -25.09 | 5 | -6.70 | 142.62 | -- | -- | -- | -- |

| 519692 | 交银施罗德成长 | 1.9643 | -- | -29.83 | 20 | -11.36 | 109.99 | -- | -- | -- | -- |

| 519694 | 交银施罗德蓝筹 | 0.7288 | -- | -32.59 | 32 | -13.52 | -26.11 | -- | -- | -- | -- |

| 610001 | 信达澳银领先增长 | 0.9357 | -- | -41.57 | 157 | -22.82 | 5.91 | -- | -- | -- | -- |

| 550002 | 信诚精萃成长 | 0.7002 | -- | -34.70 | 57 | -20.30 | 69.21 | -- | -- | -- | -- |

| 360001 | 光大保德信量化核心 | 0.8391 | ★★★ | -44.03 | 176 | -21.71 | 167.94 | 34.72 | 中 | 1.07 | 中 |

| 360005 | 光大保德信红利 | 2.1661 | ★★★★★ | -35.88 | 76 | -21.10 | 182.46 | 34.25 | 中 | 0.92 | 偏低 |

| 360006 | 光大保德信新增长 | 1.0230 | -- | -37.24 | 97 | -19.72 | 112.96 | -- | -- | -- | -- |

| 360007 | 光大保德信优势 | 0.6621 | -- | -37.30 | 99 | -17.07 | -33.79 | -- | -- | -- | -- |

| 163402 | 兴业趋势 | 0.9765 | ★★★★★ | -27.51 | 10 | -12.31 | 386.72 | 30.95 | 低 | 0.72 | 低 |

| 340006 | 兴业全球视野 | 2.6184 | -- | -27.11 | 7 | -12.89 | 161.84 | -- | -- | -- | -- |

| 340007 | 兴业社会责任 | 0.8990 | -- | -- | -- | -- | -10.10 | -- | -- | -- | -- |

| 000001 | 华夏成长 | 1.2250 | ★★★★ | -28.20 | 12 | -13.37 | 280.07 | 31.29 | 低 | 0.77 | 低 |

| 000011 | 华夏大盘精选 | 5.2470 | ★★★★★ | -27.12 | 8 | -19.95 | 504.49 | 36.85 | 高 | 0.80 | 低 |

| 000021 | 华夏优势增长 | 1.8150 | -- | -29.35 | 18 | -13.74 | 100.58 | -- | -- | -- | -- |

| 000031 | 华夏复兴 | 0.7360 | -- | -27.27 | 9 | -12.80 | -26.40 | -- | -- | -- | -- |

| 002011 | 华夏红利 | 2.3440 | ★★★★★ | -25.06 | 4 | -11.08 | 340.17 | 32.70 | 偏低 | 0.80 | 低 |

| 159902 | 中小企业板ETF | 1.8010 | -- | -39.48 | 134 | -25.30 | 80.10 | -- | -- | -- | -- |

| 160311 | 华夏蓝筹核心 | 1.0130 | -- | -28.61 | 14 | -13.86 | 6.89 | -- | -- | -- | -- |

| 160314 | 华夏行业精选 | 0.7210 | -- | -28.68 | 15 | -13.13 | -27.01 | -- | -- | -- | -- |

| 510050 | 上证50ETF | 2.2630 | ★★★ | -45.56 | 183 | -19.41 | 182.66 | 39.81 | 高 | 1.23 | 高 |

| 519029 | 华夏平稳增长 | 1.4490 | -- | -35.40 | 66 | -19.99 | 159.69 | -- | -- | -- | -- |

| 630001 | 华商领先企业 | 0.9247 | -- | -34.41 | 52 | -17.82 | -0.81 | -- | -- | -- | -- |

| 040002 | 华安MSCI中国A股 | 0.7720 | ★★★ | -43.94 | 174 | -23.02 | 212.76 | 37.76 | 高 | 1.13 | 高 |

| 040005 | 华安宏利 | 2.1396 | -- | -32.66 | 34 | -18.02 | 149.37 | -- | -- | -- | -- |

| 040007 | 华安中小盘成长 | 0.9399 | -- | -40.72 | 147 | -23.32 | -2.46 | -- | -- | -- | -- |

| 040008 | 华安策略优选 | 0.6645 | -- | -36.67 | 86 | -18.14 | -31.21 | -- | -- | -- | -- |

| 510180 | 上证180ETF | 6.3790 | ★★★ | -46.24 | 186 | -22.07 | 140.53 | 40.38 | 高 | 1.26 | 高 |

| 240004 | 华宝兴业动力组合 | 0.7238 | ★★★★ | -34.91 | 61 | -19.84 | 231.53 | 32.05 | 偏低 | 0.82 | 低 |

| 240005 | 华宝兴业多策略增长 | 0.5607 | ★★★★★ | -23.44 | 2 | -15.77 | 253.89 | 31.34 | 低 | 0.67 | 低 |

| 240008 | 华宝兴业收益增长 | 2.5167 | -- | -35.67 | 70 | -20.93 | 151.67 | -- | -- | -- | -- |

| 240009 | 华宝兴业先进成长 | 1.9076 | -- | -33.33 | 41 | -19.30 | 90.76 | -- | -- | -- | -- |

| 240010 | 华宝兴业行业精选 | 0.8311 | -- | -36.94 | 90 | -19.11 | -16.89 | -- | -- | -- | -- |

| 410001 | 华富竞争力优选 | 0.7622 | ★★★ | -38.41 | 120 | -21.37 | 161.88 | 32.58 | 偏低 | 0.91 | 偏低 |

| 410003 | 华富成长趋势 | 0.6910 | -- | -40.86 | 150 | -19.23 | -12.00 | -- | -- | -- | -- |

| 160105 | 南方积极配置 | 1.0824 | ★★★ | -34.80 | 60 | -17.79 | 190.58 | 33.45 | 偏低 | 0.99 | 偏低 |

| 160106 | 南方高增长 | 1.4126 | ★★★ | -43.14 | 167 | -26.90 | 227.97 | 34.74 | 中 | 1.12 | 中 |

| 202001 | 南方稳健成长 | 1.0669 | ★★★ | -36.56 | 84 | -17.37 | 256.38 | 32.98 | 偏低 | 0.96 | 偏低 |

| 202002 | 南方稳健成长贰号 | 0.9211 | -- | -36.72 | 87 | -17.71 | 95.76 | -- | -- | -- | -- |

| 202003 | 南方绩优成长 | 1.6339 | -- | -38.00 | 112 | -22.53 | 87.16 | -- | -- | -- | -- |

| 202005 | 南方成份精选 | 0.8939 | -- | -37.86 | 109 | -20.37 | -9.50 | -- | -- | -- | -- |

| 202007 | 南方隆元 | 0.6580 | -- | -37.57 | 104 | -21.20 | -36.58 | -- | -- | -- | -- |

| 202009 | 南方盛元 | 0.8750 | -- | -- | -- | -12.50 | -12.50 | -- | -- | -- | -- |

| 050001 | 博时价值增长 | 0.6780 | ★★★★ | -34.62 | 55 | -15.88 | 258.98 | 28.81 | 低 | 0.82 | 低 |

| 050002 | 博时裕富 | 0.7710 | ★★ | -45.28 | 182 | -23.28 | 145.18 | 38.30 | 高 | 1.23 | 高 |

| 050004 | 博时精选股票 | 1.3963 | ★★★★ | -35.83 | 75 | -15.40 | 235.97 | 33.13 | 偏低 | 0.93 | 偏低 |

| 050008 | 博时第三产业 | 0.9930 | -- | -33.93 | 48 | -15.27 | 1.04 | -- | -- | -- | -- |

| 050009 | 博时新兴成长 | 0.7300 | -- | -34.65 | 56 | -15.12 | -3.50 | -- | -- | -- | -- |

| 050010 | 博时特许价值 | 0.9710 | -- | -- | -- | -- | -2.90 | -- | -- | -- | -- |

| 050201 | 博时价值增长贰号 | 0.6610 | -- | -33.30 | 40 | -14.38 | 87.31 | -- | -- | -- | -- |

| 160505 | 博时主题行业 | 1.6750 | ★★★★★ | -34.34 | 51 | -13.53 | 299.66 | 29.82 | 低 | 0.80 | 低 |

| 460001 | 友邦华泰盛世中国 | 0.6466 | ★★★★ | -36.09 | 80 | -18.08 | 226.27 | 31.84 | 偏低 | 0.92 | 偏低 |

| 460002 | 友邦华泰积极成长 | 0.9289 | -- | -28.25 | 13 | -11.74 | -7.11 | -- | -- | -- | -- |

| 510880 | 友邦华泰上证红利ETF | 2.3240 | -- | -49.90 | 187 | -26.83 | 52.29 | -- | -- | -- | -- |

| 070006 | 嘉实服务增值行业 | 2.6680 | ★★★★★ | -35.15 | 65 | -16.70 | 209.40 | 34.10 | 中 | 0.84 | 低 |

| 070010 | 嘉实主题精选 | 0.9200 | -- | -35.05 | 63 | -15.36 | 124.23 | -- | -- | -- | -- |

| 070011 | 嘉实策略增长 | 0.9440 | -- | -37.78 | 108 | -16.09 | 9.77 | -- | -- | -- | -- |

| 070099 | 嘉实优质企业 | 0.6610 | -- | -35.76 | 73 | -18.40 | -33.90 | -- | -- | -- | -- |

| 160706 | 嘉实沪深300 | 0.7280 | ★★ | -45.14 | 180 | -23.29 | 178.70 | 38.26 | 高 | 1.24 | 高 |

| 257020 | 德盛精选股票 | 0.7950 | ★★ | -39.59 | 135 | -24.21 | 209.25 | 36.25 | 中 | 1.07 | 中 |

| 257030 | 德盛优势股票 | 1.0170 | -- | -36.07 | 79 | -15.63 | 10.61 | -- | -- | -- | -- |

| 450002 | 富兰克林国海弹性市值 | 1.7451 | -- | -24.73 | 3 | -6.67 | 194.56 | -- | -- | -- | -- |

| 450003 | 富兰克林国海潜力组合 | 1.1640 | -- | -34.16 | 50 | -14.81 | 16.40 | -- | -- | -- | -- |

| 121003 | 国投瑞银核心企业 | 0.8612 | ★★★ | -34.76 | 59 | -16.29 | 113.18 | 36.39 | 中 | 0.96 | 偏低 |

| 121005 | 国投瑞银创新动力 | 1.0442 | -- | -35.02 | 62 | -17.72 | 94.39 | -- | -- | -- | -- |

| 121008 | 国投瑞银成长优选 | 0.7187 | -- | -- | -- | -15.56 | -33.01 | -- | -- | -- | -- |

| 020001 | 国泰金鹰增长 | 0.7090 | ★★ | -36.32 | 82 | -21.52 | 253.41 | 35.28 | 中 | 1.13 | 高 |

| 020003 | 国泰金龙行业精选 | 0.6930 | ★★★★ | -37.18 | 95 | -19.88 | 239.89 | 32.24 | 偏低 | 0.91 | 偏低 |

| 020005 | 国泰金马稳健 | 0.6790 | ★★★ | -36.48 | 83 | -20.68 | 197.20 | 29.94 | 低 | 0.87 | 低 |

| 020009 | 国泰金鹏蓝筹价值 | 0.8470 | -- | -36.79 | 88 | -18.01 | 75.62 | -- | -- | -- | -- |

| 020010 | 国泰金牛创新成长 | 0.8000 | -- | -38.79 | 125 | -19.35 | -16.53 | -- | -- | -- | -- |

| 020011 | 国泰沪深300 | 0.5690 | -- | -43.27 | 168 | -22.59 | -43.04 | -- | -- | -- | -- |

| 519021 | 国泰金鼎价值 | 0.8870 | -- | -38.23 | 116 | -19.00 | -4.09 | -- | -- | -- | -- |

| 090001 | 大成价值增长 | 0.6414 | ★★★ | -35.73 | 72 | -17.63 | 273.85 | 29.76 | 低 | 0.82 | 低 |

| 090003 | 大成蓝筹稳健 | 0.6727 | ★★ | -41.24 | 153 | -18.14 | 194.12 | 33.95 | 偏低 | 1.03 | 中 |

| 090004 | 大成精选增值 | 0.8082 | ★★ | -39.87 | 141 | -18.78 | 240.82 | 35.18 | 中 | 1.06 | 中 |

| 090006 | 大成2020 | 0.5900 | -- | -41.29 | 154 | -18.17 | 90.90 | -- | -- | -- | -- |

| 160910 | 大成创新成长 | 0.7580 | -- | -42.84 | 166 | -20.46 | -25.93 | -- | -- | -- | -- |

| 519017 | 大成积极成长 | 0.8380 | -- | -39.67 | 136 | -19.42 | 89.81 | -- | -- | -- | -- |

| 519019 | 大成景阳 | 0.5950 | -- | -39.45 | 132 | -20.35 | -35.91 | -- | -- | -- | -- |

| 519300 | 大成沪深300 | 0.9515 | ★★ | -45.73 | 184 | -23.12 | 112.51 | 37.86 | 高 | 1.25 | 高 |

| 420001 | 天弘精选 | 0.5506 | ★ | -40.83 | 149 | -23.41 | 73.16 | 32.96 | 偏低 | 1.14 | 高 |

| 163503 | 天治核心成长 | 0.5394 | ★★ | -41.63 | 158 | -19.95 | 132.15 | 37.56 | 高 | 1.20 | 高 |

| 350002 | 天治品质优选 | 0.7441 | ★★★ | -33.47 | 43 | -17.92 | 166.54 | 32.37 | 偏低 | 0.91 | 偏低 |

| 213002 | 宝盈泛沿海区域 | 0.6567 | ★ | -37.25 | 98 | -22.02 | 163.54 | 31.56 | 偏低 | 1.06 | 中 |

| 213003 | 宝盈策略增长 | 1.0259 | -- | -37.51 | 103 | -18.22 | 14.52 | -- | -- | -- | -- |

| 100020 | 富国天益价值 | 0.7842 | ★★★★ | -31.14 | 24 | -14.02 | 390.30 | 31.82 | 偏低 | 0.83 | 低 |

| 100022 | 富国天瑞强势 | 0.6141 | ★★★ | -35.42 | 67 | -22.37 | 203.46 | 29.52 | 低 | 0.89 | 偏低 |

| 100026 | 富国天合稳健 | 0.7172 | -- | -32.55 | 31 | -15.44 | 72.39 | -- | -- | -- | -- |

| 161005 | 富国天惠成长 | 1.1721 | ★★★ | -33.86 | 46 | -15.85 | 218.41 | 32.08 | 偏低 | 0.94 | 偏低 |

| 519035 | 富国天博创新主题 | 0.7110 | -- | -36.93 | 89 | -18.00 | -0.26 | -- | -- | -- | -- |

| 481001 | 工银瑞信核心价值 | 0.7650 | ★★★★ | -30.21 | 21 | -12.94 | 244.77 | 30.36 | 低 | 0.88 | 低 |

| 481004 | 工银瑞信稳健成长 | 1.3999 | -- | -29.75 | 19 | -11.58 | 39.99 | -- | -- | -- | -- |

| 481006 | 工银瑞信红利 | 0.8335 | -- | -29.12 | 17 | -15.29 | -13.68 | -- | -- | -- | -- |

| 483003 | 工银瑞信精选平衡 | 0.7958 | -- | -30.35 | 22 | -12.16 | 82.22 | -- | -- | -- | -- |

| 162703 | 广发小盘成长 | 1.6546 | ★★★ | -41.56 | 156 | -24.41 | 252.42 | 34.47 | 中 | 1.11 | 中 |

| 270005 | 广发聚丰 | 0.6130 | ★★★ | -41.17 | 151 | -22.97 | 269.88 | 34.83 | 中 | 1.07 | 中 |

| 270006 | 广发策略优选 | 1.7804 | -- | -41.79 | 159 | -24.93 | 106.88 | -- | -- | -- | -- |

| 270007 | 广发大盘成长 | 0.7308 | -- | -39.73 | 137 | -23.08 | -26.92 | -- | -- | -- | -- |

| 150003 | 建信优势动力 | 0.7670 | -- | -- | -- | -24.51 | -23.30 | -- | -- | -- | -- |

| 530001 | 建信恒久价值 | 0.8775 | ★ | -35.88 | 77 | -16.12 | 123.02 | 31.75 | 偏低 | 1.04 | 中 |

| 530003 | 建信优选成长 | 0.8681 | -- | -37.01 | 92 | -17.20 | 100.70 | -- | -- | -- | -- |

| 530005 | 建信优化配置 | 0.7341 | -- | -37.62 | 105 | -22.50 | 8.07 | -- | -- | -- | -- |

| 161706 | 招商优质成长 | 1.1973 | ★★★★ | -36.13 | 81 | -17.88 | 302.61 | 34.12 | 中 | 0.92 | 偏低 |

| 217009 | 招商核心价值 | 1.0732 | -- | -38.35 | 119 | -18.16 | 7.32 | -- | -- | -- | -- |

| 163302 | 摩根士丹利华鑫资源优选 | 1.3014 | ★★ | -39.31 | 131 | -18.42 | 244.80 | 37.48 | 高 | 1.10 | 中 |

| 519087 | 新世纪优选分红 | 0.5707 | ★ | -42.65 | 163 | -23.35 | 138.99 | 37.44 | 高 | 1.18 | 高 |

| 110002 | 易方达策略成长 | 3.2470 | ★★★ | -37.73 | 106 | -19.46 | 359.04 | 38.36 | 高 | 1.07 | 中 |

| 110003 | 易方达50 | 0.8273 | ★★★ | -43.53 | 170 | -19.04 | 151.43 | 37.96 | 高 | 1.16 | 高 |

| 110005 | 易方达积极成长 | 1.0731 | ★★★ | -32.55 | 30 | -17.88 | 279.15 | 34.44 | 中 | 0.97 | 偏低 |

| 110009 | 易方达价值精选 | 1.6891 | -- | -33.46 | 42 | -18.65 | 135.41 | -- | -- | -- | -- |

| 110010 | 易方达价值成长 | 1.0837 | -- | -32.63 | 33 | -14.92 | 12.58 | -- | -- | -- | -- |

| 110029 | 易方达科讯 | 0.7086 | -- | -27.81 | 11 | -14.50 | -21.33 | -- | -- | -- | -- |

| 112002 | 易方达策略成长贰号 | 1.1890 | -- | -36.59 | 85 | -18.82 | 120.54 | -- | -- | -- | -- |

| 159901 | 易方达深证100ETF | 2.9350 | ★★★★ | -45.76 | 185 | -28.22 | 187.08 | 41.80 | 高 | 1.18 | 高 |

| 162605 | 景顺长城鼎益 | 0.9530 | ★★★★ | -34.71 | 58 | -15.24 | 268.84 | 33.69 | 偏低 | 0.98 | 偏低 |

| 162607 | 景顺长城资源垄断 | 0.7200 | ★★ | -37.98 | 111 | -16.76 | 165.49 | 35.15 | 中 | 1.17 | 高 |

| 260101 | 景顺长城优选股票 | 1.0036 | ★★ | -37.38 | 101 | -19.42 | 228.24 | 30.95 | 低 | 0.97 | 偏低 |

| 260104 | 景顺长城内需增长 | 2.7480 | ★★ | -40.22 | 145 | -16.37 | 283.77 | 36.89 | 高 | 1.24 | 高 |

| 260108 | 景顺长城新兴成长 | 0.9790 | -- | -32.34 | 29 | -12.82 | 118.79 | -- | -- | -- | -- |

| 260109 | 景顺长城内需增长贰号 | 1.6940 | -- | -39.21 | 130 | -15.97 | 84.19 | -- | -- | -- | -- |

| 260110 | 景顺长城精选 | 0.8240 | -- | -35.63 | 69 | -16.68 | -17.60 | -- | -- | -- | -- |

| 540002 | 汇丰晋信龙腾 | 1.3650 | -- | -39.74 | 138 | -19.26 | 81.32 | -- | -- | -- | -- |

| 519008 | 汇添富优势精选 | 2.3189 | ★★★ | -37.23 | 96 | -18.55 | 297.07 | 35.41 | 中 | 1.15 | 高 |

| 519018 | 汇添富均衡增长 | 0.7200 | -- | -34.02 | 49 | -17.03 | 106.73 | -- | -- | -- | -- |

| 519068 | 汇添富成长焦点 | 0.9935 | -- | -37.74 | 107 | -20.21 | 9.20 | -- | -- | -- | -- |

| 162201 | 泰达荷银成长 | 1.6196 | ★★★ | -26.49 | 6 | -13.37 | 256.78 | 24.69 | 低 | 0.64 | 低 |

| 162202 | 泰达荷银周期 | 1.3921 | ★★★ | -28.75 | 16 | -14.35 | 277.29 | 30.10 | 低 | 0.87 | 低 |

| 162203 | 泰达荷银稳定 | 1.1280 | ★★ | -33.02 | 37 | -14.94 | 217.22 | 28.79 | 低 | 0.84 | 低 |

| 162204 | 泰达荷银行业精选 | 3.5344 | ★★★★ | -35.13 | 64 | -15.54 | 285.92 | 36.89 | 高 | 1.08 | 中 |

| 162208 | 泰达荷银首选企业 | 1.2710 | -- | -38.26 | 117 | -19.28 | 32.76 | -- | -- | -- | -- |

| 162209 | 泰达荷银市值优选 | 0.6299 | -- | -41.43 | 155 | -20.80 | -37.01 | -- | -- | -- | -- |

| 290002 | 泰信先行策略 | 0.6230 | ★★ | -35.71 | 71 | -17.34 | 179.46 | 37.46 | 高 | 1.04 | 中 |

| 290004 | 泰信优质生活 | 0.9616 | -- | -40.76 | 148 | -22.81 | 34.68 | -- | -- | -- | -- |

| 519110 | 浦银安盛价值成长 | 0.7880 | -- | -- | -- | -- | -21.20 | -- | -- | -- | -- |

| 519005 | 海富通股票 | 0.6110 | ★ | -40.16 | 144 | -20.65 | 162.59 | 31.43 | 低 | 1.02 | 中 |

| 519007 | 海富通强化回报 | 0.6700 | ★★★ | -33.93 | 47 | -16.87 | 88.30 | 29.93 | 低 | 0.81 | 低 |

| 519013 | 海富通风格优势 | 1.0820 | -- | -38.50 | 123 | -20.62 | 76.49 | -- | -- | -- | -- |

| 310328 | 申万巴黎新动力 | 0.7682 | ★★ | -38.05 | 113 | -20.65 | 192.76 | 34.01 | 偏低 | 1.06 | 中 |

| 310358 | 申万巴黎新经济 | 0.6853 | -- | -33.06 | 38 | -15.24 | 59.48 | -- | -- | -- | -- |

| 560002 | 益民红利成长 | 0.6855 | -- | -37.05 | 94 | -19.75 | 67.41 | -- | -- | -- | -- |

| 560003 | 益民创新优势 | 0.7669 | -- | -39.78 | 139 | -19.81 | -22.14 | -- | -- | -- | -- |

| 161604 | 融通深证100 | 1.1080 | ★★★ | -43.32 | 169 | -26.38 | 185.45 | 39.19 | 高 | 1.17 | 高 |

| 161606 | 融通行业景气 | 0.7830 | ★★★ | -42.47 | 162 | -19.94 | 166.70 | 35.02 | 中 | 1.04 | 中 |

| 161607 | 融通巨潮100 | 0.9080 | ★★ | -45.25 | 181 | -20.96 | 200.04 | 38.77 | 高 | 1.25 | 高 |

| 161609 | 融通动力先锋 | 1.3090 | -- | -43.61 | 171 | -22.75 | 67.87 | -- | -- | -- | -- |

| 161610 | 融通领先成长 | 0.8990 | -- | -39.00 | 128 | -19.32 | 2.57 | -- | -- | -- | -- |

| 320003 | 诺安股票 | 0.8703 | ★★★★ | -38.60 | 124 | -15.36 | 227.58 | 32.61 | 偏低 | 1.05 | 中 |

| 320005 | 诺安价值增长 | 0.7119 | -- | -42.78 | 165 | -20.53 | 41.50 | -- | -- | -- | -- |

| 570001 | 诺德价值优势 | 0.8923 | -- | -38.27 | 118 | -20.12 | -10.77 | -- | -- | -- | -- |

| 180003 | 银华-道琼斯88 | 0.8513 | ★★ | -37.36 | 100 | -14.10 | 259.80 | 35.46 | 中 | 1.14 | 高 |

| 180010 | 银华优质增长 | 1.4919 | -- | -35.43 | 68 | -16.35 | 127.74 | -- | -- | -- | -- |

| 180012 | 银华富裕主题 | 0.8026 | -- | -35.98 | 78 | -16.40 | 60.08 | -- | -- | -- | -- |

| 519001 | 银华核心价值 | 1.0133 | ★★★ | -35.78 | 74 | -16.44 | 289.34 | 34.25 | 中 | 1.03 | 中 |

| 162006 | 长城久富核心成长 | 1.2488 | -- | -31.36 | 25 | -15.10 | 31.24 | -- | -- | -- | -- |

| 200002 | 长城久泰300 | 1.0746 | ★★★ | -44.94 | 179 | -22.85 | 181.97 | 38.57 | 高 | 1.19 | 高 |

| 200006 | 长城消费增值 | 0.7134 | ★★★★ | -33.62 | 44 | -17.12 | 119.05 | 30.28 | 低 | 0.92 | 偏低 |

| 200007 | 长城安心回报 | 0.6190 | -- | -41.17 | 152 | -21.50 | 79.96 | -- | -- | -- | -- |

| 200008 | 长城品牌优选 | 0.7760 | -- | -34.48 | 54 | -15.26 | -22.40 | -- | -- | -- | -- |

| 080001 | 长盛成长价值 | 0.7680 | ★ | -34.42 | 53 | -14.19 | 196.20 | 26.43 | 低 | 0.88 | 低 |

| 160805 | 长盛同智优势成长 | 0.8202 | -- | -38.44 | 121 | -18.09 | 40.32 | -- | -- | -- | -- |

| 510081 | 长盛动态精选 | 0.9331 | ★★ | -42.74 | 164 | -18.63 | 184.23 | 34.27 | 中 | 1.11 | 中 |

| 519039 | 长盛同德 | 0.6654 | -- | -38.81 | 126 | -18.25 | -35.95 | -- | -- | -- | -- |

| 519100 | 长盛中证100 | 0.8769 | -- | -43.77 | 173 | -20.51 | 32.58 | -- | -- | -- | -- |

| 519994 | 长信金利趋势 | 0.6987 | ★★ | -43.70 | 172 | -26.13 | 96.62 | 37.50 | 高 | 1.23 | 高 |

| 519996 | 长信银利精选 | 0.6429 | ★★★ | -39.96 | 142 | -21.36 | 179.84 | 35.70 | 中 | 1.03 | 中 |

| 160603 | 鹏华普天收益 | 0.6330 | ★★★ | -40.11 | 143 | -23.92 | 242.01 | 31.86 | 偏低 | 0.99 | 偏低 |

| 160605 | 鹏华中国50 | 1.3860 | ★★★★ | -37.93 | 110 | -22.57 | 264.24 | 34.37 | 中 | 0.97 | 偏低 |

| 160607 | 鹏华价值优势 | 0.6780 | -- | -37.51 | 102 | -21.44 | 116.89 | -- | -- | -- | -- |

| 160610 | 鹏华动力增长 | 1.2150 | -- | -39.15 | 129 | -26.58 | 29.44 | -- | -- | -- | -- |

| 160611 | 鹏华优质治理 | 0.8720 | -- | -39.82 | 140 | -23.04 | -12.80 | -- | -- | -- | -- |

| 206001 | 鹏华行业成长 | 0.7253 | ★★★ | -33.74 | 45 | -18.88 | 197.25 | 27.94 | 低 | 0.85 | 低 |

积极配置型基金

| 基金代码 | 基金名称 | 单位净值(元) | 5月晨星评级(两年) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 积极配置型基金(44) | |||||||||||

| 373010 | 上投摩根双息平衡 | 0.8213 | -- | -31.22 | 22 | -17.01 | 105.19 | -- | -- | -- | -- |

| 288001 | 中信经典配置 | 1.5924 | ★★★★ | -32.65 | 30 | -15.37 | 171.17 | 27.63 | 偏低 | 0.93 | 偏低 |

| 163801 | 中银中国精选 | 1.2652 | ★★★★ | -32.01 | 26 | -14.02 | 208.12 | 28.04 | 偏低 | 0.96 | 偏低 |

| 550001 | 信诚四季红 | 0.7798 | ★★★ | -29.78 | 15 | -13.06 | 103.07 | 28.40 | 中 | 1.02 | 中 |

| 002001 | 华夏回报 | 1.1350 | ★★★★★ | -16.25 | 1 | -6.43 | 351.78 | 26.70 | 低 | 0.74 | 低 |

| 002021 | 华夏回报贰号 | 0.9150 | -- | -23.84 | 3 | -8.96 | 126.94 | -- | -- | -- | -- |

| 040001 | 华安创新 | 0.6770 | ★★★ | -32.10 | 27 | -19.79 | 252.65 | 28.95 | 中 | 0.92 | 低 |

| 040004 | 华安宝利配置 | 0.8220 | ★★★★ | -25.98 | 5 | -14.29 | 273.21 | 25.31 | 低 | 0.72 | 低 |

| 240001 | 宝康消费品 | 1.1023 | ★★★★ | -29.17 | 12 | -18.26 | 251.93 | 27.21 | 偏低 | 0.94 | 偏低 |

| 240002 | 宝康灵活配置 | 1.3071 | ★★★★★ | -30.25 | 20 | -17.35 | 249.02 | 26.85 | 偏低 | 0.84 | 低 |

| 050007 | 博时平衡配置 | 1.0360 | -- | -18.10 | 2 | -5.99 | 113.41 | -- | -- | -- | -- |

| 070001 | 嘉实成长收益 | 0.7020 | ★★★★ | -36.26 | 41 | -17.03 | 242.57 | 26.62 | 低 | 0.86 | 低 |

| 070002 | 嘉实增长 | 3.2360 | ★★★★ | -27.80 | 8 | -10.91 | 330.75 | 26.49 | 低 | 0.83 | 低 |

| 070003 | 嘉实稳健 | 0.9710 | ★★★★★ | -29.89 | 16 | -13.84 | 253.29 | 30.48 | 高 | 0.93 | 偏低 |

| 255010 | 德盛稳健 | 1.6100 | ★★ | -33.09 | 31 | -15.52 | 127.32 | 28.04 | 偏低 | 1.06 | 中 |

| 257010 | 德盛小盘精选 | 0.7360 | ★★★ | -34.11 | 36 | -18.13 | 137.92 | 29.43 | 中 | 1.01 | 中 |

| 450001 | 富兰克林国海收益 | 0.9403 | ★ | -27.42 | 7 | -14.17 | 98.26 | 23.30 | 低 | 0.90 | 低 |

| 121002 | 国投瑞银景气行业 | 0.7148 | ★★★ | -28.78 | 10 | -10.81 | 202.02 | 29.61 | 高 | 1.03 | 中 |

| 350001 | 天治财富增长 | 0.7034 | ★ | -29.90 | 17 | -14.36 | 119.79 | 27.93 | 偏低 | 1.01 | 中 |

| 213001 | 宝盈鸿利收益 | 0.6818 | ★★ | -32.35 | 28 | -18.50 | 212.97 | 32.08 | 高 | 1.17 | 高 |

| 100016 | 富国天源平衡 | 0.8853 | ★ | -30.23 | 19 | -14.76 | 110.27 | 22.99 | 低 | 0.91 | 低 |

| 270001 | 广发聚富 | 1.0735 | ★★★ | -33.66 | 33 | -19.07 | 306.03 | 27.96 | 偏低 | 0.96 | 偏低 |

| 270002 | 广发稳健增长 | 1.2453 | ★★★ | -36.50 | 42 | -19.12 | 272.28 | 32.86 | 高 | 1.23 | 高 |

| 217001 | 招商安泰股票 | 0.7493 | ★★★ | -29.99 | 18 | -13.75 | 229.13 | 28.25 | 中 | 0.98 | 偏低 |

| 217005 | 招商先锋基金 | 0.6926 | ★★★★ | -33.70 | 34 | -14.68 | 194.87 | 28.68 | 中 | 0.95 | 偏低 |

| 233001 | 摩根士丹利华鑫基础行业 | 0.8549 | ★★ | -31.61 | 24 | -10.50 | 128.94 | 35.12 | 高 | 1.28 | 高 |

| 110001 | 易方达平稳增长 | 1.3820 | ★★ | -28.07 | 9 | -13.64 | 238.63 | 26.50 | 低 | 0.95 | 偏低 |

| 260103 | 景顺长城动力平衡 | 0.7145 | ★★★ | -29.05 | 11 | -12.97 | 231.93 | 28.21 | 中 | 1.06 | 高 |

| 540003 | 汇丰晋信动态策略 | 0.9686 | -- | -34.75 | 38 | -13.08 | -3.14 | -- | -- | -- | -- |

| 162207 | 泰达荷银效率优选 | 0.6899 | ★★ | -32.53 | 29 | -15.34 | 65.93 | 26.70 | 偏低 | 1.02 | 中 |

| 519003 | 海富通收益增长 | 0.6980 | ★★★ | -34.95 | 40 | -18.93 | 133.56 | 29.33 | 中 | 1.04 | 中 |

| 519011 | 海富通精选 | 0.7290 | ★★★ | -30.53 | 21 | -13.80 | 279.03 | 27.57 | 偏低 | 0.97 | 偏低 |

| 519015 | 海富通精选贰号 | 0.9870 | -- | -29.30 | 14 | -11.80 | -1.30 | -- | -- | -- | -- |

| 310308 | 申万巴黎盛利精选 | 0.8403 | ★★★★ | -29.27 | 13 | -13.89 | 181.38 | 29.52 | 中 | 0.94 | 偏低 |

| 161601 | 融通新蓝筹 | 0.7170 | ★★★ | -33.50 | 32 | -11.82 | 272.36 | 32.86 | 高 | 1.07 | 高 |

| 161605 | 融通蓝筹成长 | 1.1380 | ★★ | -39.95 | 44 | -20.64 | 163.15 | 32.93 | 高 | 1.33 | 高 |

| 320001 | 诺安平衡 | 0.6514 | ★★ | -31.49 | 23 | -14.56 | 213.08 | 29.38 | 中 | 1.02 | 中 |

| 162102 | 金鹰中小盘 | 1.1247 | ★ | -26.38 | 6 | -17.82 | 88.71 | 25.13 | 低 | 1.14 | 高 |

| 210001 | 金鹰成份股优选 | 0.6719 | ★★★ | -34.60 | 37 | -17.70 | 135.24 | 29.53 | 高 | 1.13 | 高 |

| 180001 | 银华优势企业 | 0.9533 | ★★ | -31.74 | 25 | -12.51 | 231.30 | 28.11 | 偏低 | 1.10 | 高 |

| 150103 | 银河银泰理财 | 0.7085 | ★★★ | -36.89 | 43 | -18.48 | 160.41 | 32.89 | 高 | 1.12 | 高 |

| 151001 | 银河银联稳健 | 0.7178 | ★★★★★ | -33.89 | 35 | -16.42 | 240.62 | 31.95 | 高 | 1.06 | 中 |

| 200001 | 长城久恒 | 1.2910 | ★★★ | -24.01 | 4 | -11.09 | 209.03 | 26.19 | 低 | 0.88 | 低 |

| 519993 | 长信增利动态策略 | 0.8642 | -- | -34.81 | 39 | -19.29 | 106.29 | -- | -- | -- | -- |

保守配置型基金

| 基金代码 | 基金名称 | 单位净值(元) | 5月晨星评级(两年) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 保守配置型基金(8) | |||||||||||

| 340001 | 兴业可转债 | 1.0575 | ★★★★★ | -16.31 | 4 | -5.75 | 219.03 | 24.41 | 高 | 1.22 | 高 |

| 202101 | 南方宝元债券 | 1.0489 | ★★★★ | -11.43 | 2 | -5.70 | 151.93 | 15.58 | 低 | 0.73 | 低 |

| 253010 | 德盛安心成长 | 0.8620 | ★★★ | -17.49 | 5 | -10.02 | 100.58 | 16.41 | 偏低 | 0.98 | 中 |

| 121001 | 国投瑞银融华债券 | 1.0787 | ★ | -21.23 | 8 | -10.29 | 129.44 | 17.26 | 中 | 1.17 | 中 |

| 217002 | 招商安泰平衡 | 1.7393 | ★★★ | -20.30 | 7 | -8.89 | 161.88 | 20.69 | 高 | 1.30 | 高 |

| 540001 | 汇丰晋信2016 | 1.8012 | -- | -20.18 | 6 | -8.25 | 92.80 | -- | -- | -- | -- |

| 162205 | 泰达荷银风险预算 | 1.2735 | ★★★ | -13.56 | 3 | -3.48 | 127.76 | 18.59 | 中 | 0.95 | 偏低 |

| 310318 | 申万巴黎盛利配置 | 0.9711 | ★★ | -8.97 | 1 | -3.81 | 80.72 | 14.38 | 低 | 0.65 | 低 |

普通债券基金

| 基金代码 | 基金名称 | 单位净值(元) | 5月晨星评级(两年) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 普通债券基金(51) | |||||||||||

| 161902 | 万家增强收益 | 1.0067 | ★★★ | -0.82 | 18 | 1.11 | 48.94 | 5.60 | 中 | 1.81 | 高 |

| 395001 | 中海稳健收益 | 1.0090 | -- | -- | -- | -- | 0.90 | -- | -- | -- | -- |

| 288102 | 中信稳定双利 | 1.0076 | -- | -2.00 | 24 | -0.24 | 23.83 | -- | -- | -- | -- |

| 519680 | 交银施罗德增利债券 - A/B | 1.0061 | -- | -- | -- | -- | 0.61 | -- | -- | -- | -- |

| 519682 | 交银施罗德增利债券 - C | 1.0051 | -- | -- | -- | -- | 0.51 | -- | -- | -- | -- |

| 001001 | 华夏债券 - A/B | 1.1000 | ★★★ | 0.82 | 12 | 0.36 | 44.80 | 3.43 | 偏低 | 0.62 | 偏低 |

| 001003 | 华夏债券 - C | 1.0910 | ★★★ | 0.64 | 14 | 0.28 | 24.97 | 3.39 | 偏低 | 0.65 | 偏低 |

| 001011 | 华夏希望债券 - A | 1.0090 | -- | -- | -- | 0.80 | 0.90 | -- | -- | -- | -- |

| 001013 | 华夏希望债券 - C | 1.0080 | -- | -- | -- | 0.70 | 0.80 | -- | -- | -- | -- |

| 040009 | 华安稳定收益债券 - A | 1.0043 | -- | -- | -- | -- | 0.43 | -- | -- | -- | -- |

| 040010 | 华安稳定收益债券 - B | 1.0037 | -- | -- | -- | -- | 0.37 | -- | -- | -- | -- |

| 240003 | 宝康债券 | 1.1448 | ★★★★ | -0.87 | 19 | -0.04 | 63.03 | 4.67 | 中 | 0.47 | 偏低 |

| 410004 | 华富收益增强 - A | 1.0012 | -- | -- | -- | -- | 0.12 | -- | -- | -- | -- |

| 410005 | 华富收益增强 - B | 1.0008 | -- | -- | -- | -- | 0.08 | -- | -- | -- | -- |

| 202102 | 南方多利增强 | 1.0676 | ★★ | -1.96 | 23 | -0.61 | 9.78 | 3.11 | 偏低 | 1.13 | 中 |

| 050006 | 博时稳定价值 - B | 1.0720 | ★★ | 0.47 | 15 | 0.19 | 11.34 | 2.16 | 偏低 | 0.51 | 偏低 |

| 050106 | 博时稳定价值 - A | 1.0750 | -- | 0.66 | 13 | 0.37 | 7.18 | -- | -- | -- | -- |

| 460003 | 友邦华泰金字塔稳本增利 - B | 1.0177 | -- | -- | -- | 0.53 | 1.49 | -- | -- | -- | -- |

| 519519 | 友邦华泰金字塔稳本增利 - A | 1.0190 | ★ | 1.74 | 6 | 0.60 | 5.29 | 0.72 | 低 | 0.45 | 低 |

| 070005 | 嘉实债券 | 1.1590 | ★★★★ | -5.31 | 27 | -1.70 | 65.37 | 7.54 | 高 | 2.57 | 高 |

| 121009 | 国投瑞银稳定增利 | 1.0138 | -- | -- | -- | 0.60 | 1.38 | -- | -- | -- | -- |

| 020002 | 国泰金龙债券 - A | 1.0230 | ★★★ | 2.37 | 1 | 0.89 | 29.37 | 2.07 | 偏低 | 0.40 | 低 |

| 090002 | 大成债券 - A/B | 1.0993 | ★★★ | 1.90 | 3 | 0.60 | 37.50 | 1.93 | 低 | 0.41 | 低 |

| 092002 | 大成债券 - C | 1.0855 | ★★ | 1.63 | 7 | 0.47 | 13.43 | 1.92 | 低 | 0.50 | 偏低 |

| 420002 | 天弘永利债券 - A | 1.0056 | -- | -- | -- | -- | 0.56 | -- | -- | -- | -- |

| 420102 | 天弘永利债券 - B | 1.0064 | -- | -- | -- | -- | 0.64 | -- | -- | -- | -- |

| 213007 | 宝盈增强收益 | 1.0028 | -- | -- | -- | -- | 0.28 | -- | -- | -- | -- |

| 100018 | 富国天利增长债券 | 1.1833 | ★★★★★ | -2.90 | 25 | -1.02 | 86.89 | 7.37 | 高 | 1.60 | 中 |

| 485005 | 工银瑞信增强收益债券 - B | 1.0895 | -- | -1.63 | 21 | 1.22 | 10.93 | -- | -- | -- | -- |

| 485007 | 工银瑞信信用添利债券 - B | 1.0057 | -- | -- | -- | -- | 0.57 | -- | -- | -- | -- |

| 485105 | 工银瑞信增强收益债券 - A | 1.0947 | -- | -1.42 | 20 | 1.33 | 11.45 | -- | -- | -- | -- |

| 485107 | 工银瑞信信用添利债券 - A | 1.0066 | -- | -- | -- | -- | 0.66 | -- | -- | -- | -- |

| 270009 | 广发增强债券 | 1.0060 | -- | -- | -- | 0.60 | 0.60 | -- | -- | -- | -- |

| 217003 | 招商安泰债券 - A | 1.1374 | ★★★ | 1.15 | 10 | 0.43 | 41.34 | 5.78 | 中 | 0.81 | 中 |

| 217008 | 招商安本增利 | 1.0965 | -- | -4.77 | 26 | 0.63 | 20.02 | -- | -- | -- | -- |

| 217203 | 招商安泰债券 - B | 1.1272 | ★★★ | 0.91 | 11 | 0.31 | 24.32 | 5.77 | 中 | 0.88 | 中 |

| 110007 | 易方达稳健收益 - A | 1.0184 | ★ | 1.19 | 9 | 0.54 | 5.62 | 0.42 | 低 | 0.50 | 偏低 |

| 110008 | 易方达稳健收益 - B | 1.0202 | ★ | 1.34 | 8 | 0.61 | 6.01 | 0.45 | 低 | 0.47 | 偏低 |

| 110017 | 易方达增强回报债券 - A | 1.0060 | -- | -- | -- | 0.60 | 0.60 | -- | -- | -- | -- |

| 110018 | 易方达增强回报债券 - B | 1.0050 | -- | -- | -- | 0.50 | 0.50 | -- | -- | -- | -- |

| 519078 | 汇添富增强收益 | 1.0090 | -- | -- | -- | 0.80 | 0.90 | -- | -- | -- | -- |

| 290003 | 泰信双息双利 | 1.0310 | -- | 0.46 | 16 | 0.61 | 5.63 | -- | -- | -- | -- |

| 161603 | 融通债券 | 1.1340 | ★★★ | 1.77 | 4 | -0.95 | 39.92 | 4.26 | 中 | 1.23 | 中 |

| 320004 | 诺安优化收益 | 1.0387 | -- | -0.74 | 17 | -0.31 | 7.93 | -- | -- | -- | -- |

| 151002 | 银河银联收益 | 1.5100 | ★★★★ | -10.76 | 29 | -5.47 | 92.92 | 11.10 | 高 | 3.73 | 高 |

| 519666 | 银河银信添利 - B | 1.0330 | -- | -1.64 | 22 | 0.37 | 12.28 | -- | -- | -- | -- |

| 519667 | 银河银信添利 - A | 1.0331 | -- | -- | -- | -- | -0.39 | -- | -- | -- | -- |

| 510080 | 长盛中信全债 | 1.2123 | ★★★★★ | -6.75 | 28 | -1.30 | 103.16 | 8.87 | 高 | 2.20 | 高 |

| 160602 | 鹏华普天债券 - A | 1.1230 | ★★★ | 2.28 | 2 | 1.08 | 27.18 | 1.05 | 低 | 0.01 | 低 |

| 160608 | 鹏华普天债券 - B | 1.1030 | ★★ | 1.75 | 5 | 0.91 | 13.65 | 1.01 | 低 | 0.05 | 低 |

| 160612 | 鹏华丰收 | 1.0020 | -- | -- | -- | -- | 0.20 | -- | -- | -- | -- |

保本基金

| 基金代码 | 基金名称 | 单位净值(元) | 5月晨星评级(两年) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 保本基金(3) | |||||||||||

| 202201 | 南方避险增值 | 2.0958 | -- | -21.75 | -- | -7.05 | 202.19 | 23.63 | -- | 1.51 | -- |

| 620001 | 宝石动力保本 | 0.9655 | -- | -9.22 | -- | -1.18 | -3.45 | -- | -- | -- | -- |

| 180002 | 银华保本增值 | 1.0071 | -- | -7.99 | -- | -1.33 | 41.76 | 7.67 | -- | 0.49 | -- |

短债基金

| 基金代码 | 基金名称 | 单位净值(元) | 5月晨星评级(两年) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 短债基金(1) | |||||||||||

| 070009 | 嘉实超短债 | 1.0005 | -- | 1.59 | -- | 0.69 | 6.94 | 0.56 | -- | 1.00 | -- |

货币市场基金

| 基金代码 | 基金名称 | 单位净值(元) | 5月晨星评级(两年) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 货币市场基金(51) | |||||||||||

| 519508 | 万家货币 | 1.0000 | -- | 1.66 | -- | 0.87 | 6.90 | -- | -- | -- | -- |

| 370010 | 上投摩根货币 - A | 1.0000 | -- | 1.26 | -- | 0.64 | 6.88 | 0.37 | -- | -- | -- |

| 370011 | 上投摩根货币 - B | 1.0000 | -- | 1.33 | -- | 0.68 | 7.67 | 0.38 | -- | -- | -- |

| 400005 | 东方金帐簿 | 1.0000 | -- | 1.33 | -- | 0.69 | 5.39 | -- | -- | -- | -- |

| 288101 | 中信现金优势 | 1.0000 | -- | 2.29 | -- | 1.30 | 9.42 | 0.48 | -- | -- | -- |

| 163802 | 中银货币 | 1.0000 | -- | 1.54 | -- | 0.80 | 7.89 | 0.37 | -- | -- | -- |

| 519588 | 交银施罗德货币 - A | 1.0000 | -- | 1.46 | -- | 0.74 | 6.46 | 0.27 | -- | -- | -- |

| 519589 | 交银施罗德货币 - B | 1.0000 | -- | 1.58 | -- | 0.80 | 3.77 | -- | -- | -- | -- |

| 360003 | 光大保德信货币 | 1.0000 | -- | 1.53 | -- | 0.78 | 7.52 | 0.26 | -- | -- | -- |

| 340005 | 兴业货币 | 1.0000 | -- | 1.37 | -- | 0.77 | 6.00 | 0.41 | -- | -- | -- |

| 003003 | 华夏现金增利 | 1.0000 | -- | 1.52 | -- | 0.78 | 11.88 | 0.39 | -- | -- | -- |

| 040003 | 华安现金富利 | 1.0000 | -- | 1.40 | -- | 0.75 | 12.22 | 0.35 | -- | -- | -- |

| 240006 | 华宝兴业现金宝 - A | 1.0000 | -- | 1.41 | -- | 0.73 | 8.10 | 0.37 | -- | -- | -- |

| 240007 | 华宝兴业现金宝 - B | 1.0000 | -- | 1.53 | -- | 0.79 | 8.95 | 0.37 | -- | -- | -- |

| 410002 | 华富货币 | 1.0000 | -- | 1.59 | -- | 0.79 | 5.94 | -- | -- | -- | -- |

| 202301 | 南方现金增利 | 1.0000 | -- | 1.44 | -- | 0.76 | 11.70 | 0.26 | -- | -- | -- |

| 050003 | 博时现金收益 | 1.0000 | -- | 1.63 | -- | 0.84 | 11.73 | 0.23 | -- | -- | -- |

| 070008 | 嘉实货币 | 1.0000 | -- | 1.49 | -- | 0.80 | 9.65 | 0.56 | -- | -- | -- |

| 020007 | 国泰货币 | 1.0000 | -- | 1.28 | -- | 0.63 | 7.53 | 0.46 | -- | -- | -- |

| 090005 | 大成货币 - A | 1.0000 | -- | 1.51 | -- | 0.76 | 8.05 | 0.27 | -- | -- | -- |

| 091005 | 大成货币 - B | 1.0000 | -- | 1.63 | -- | 0.82 | 8.85 | 0.27 | -- | -- | -- |

| 350004 | 天治天得利货币 | 1.0000 | -- | 1.37 | -- | 0.75 | 5.11 | -- | -- | -- | -- |

| 100025 | 富国天时货币 - A | 1.0000 | -- | 1.24 | -- | 0.65 | 5.59 | -- | -- | -- | -- |

| 100028 | 富国天时货币 - B | 1.0000 | -- | 1.36 | -- | 0.71 | 5.05 | -- | -- | -- | -- |

| 482002 | 工银瑞信货币 | 1.0000 | -- | 1.53 | -- | 0.80 | 6.58 | 0.47 | -- | -- | -- |

| 270004 | 广发货币 | 1.0000 | -- | 1.36 | -- | 0.69 | 7.73 | 0.43 | -- | -- | -- |

| 530002 | 建信货币 | 1.0000 | -- | 1.52 | -- | 0.79 | 6.49 | 0.35 | -- | -- | -- |

| 217004 | 招商现金增值 | 1.0000 | -- | 1.42 | -- | 0.72 | 10.99 | 0.15 | -- | -- | -- |

| 163303 | 摩根士丹利华鑫货币 | 1.0000 | -- | 1.26 | -- | 0.62 | 6.17 | -- | -- | -- | -- |

| 110006 | 易方达货币 - A | 1.0000 | -- | 1.41 | -- | 0.78 | 8.62 | 0.32 | -- | -- | -- |

| 110016 | 易方达货币 - B | 1.0000 | -- | 1.53 | -- | 0.84 | 5.83 | -- | -- | -- | -- |

| 260102 | 景顺长城货币 | 1.0000 | -- | 1.55 | -- | 0.78 | 7.60 | 0.31 | -- | -- | -- |

| 519517 | 汇添富货币 - B | 1.0000 | -- | 1.36 | -- | 0.70 | 4.38 | -- | -- | -- | -- |

| 519518 | 汇添富货币 - A | 1.0000 | -- | 1.24 | -- | 0.64 | 6.49 | 0.53 | -- | -- | -- |

| 162206 | 泰达荷银货币 | 1.0000 | -- | 1.19 | -- | 0.60 | 6.52 | 0.45 | -- | -- | -- |

| 290001 | 泰信天天收益 | 1.0000 | -- | 1.40 | -- | 0.70 | 11.19 | 0.26 | -- | -- | -- |

| 519505 | 海富通货币 - A | 1.0000 | -- | 1.61 | -- | 0.79 | 9.83 | 0.38 | -- | -- | -- |

| 519506 | 海富通货币 - B | 1.0000 | -- | 1.73 | -- | 0.85 | 6.52 | -- | -- | -- | -- |

| 310338 | 申万巴黎收益宝 | 1.0000 | -- | 1.16 | -- | 0.64 | 4.85 | -- | -- | -- | -- |

| 560001 | 益民货币 | 1.0000 | -- | 1.49 | -- | 0.81 | 6.04 | -- | -- | -- | -- |

| 161608 | 融通易支付 | 1.0000 | -- | 1.42 | -- | 0.72 | 6.58 | 0.33 | -- | -- | -- |

| 320002 | 诺安货币 | 1.0000 | -- | 1.42 | -- | 0.77 | 8.88 | 0.19 | -- | -- | -- |

| 180008 | 银华货币 - A | 1.0000 | -- | 1.28 | -- | 0.70 | 8.32 | 0.29 | -- | -- | -- |

| 180009 | 银华货币 - B | 1.0000 | -- | 1.40 | -- | 0.76 | 9.28 | 0.28 | -- | -- | -- |

| 150005 | 银河银富货币 - A | 1.0000 | -- | 1.51 | -- | 0.77 | 9.85 | 0.48 | -- | -- | -- |

| 150015 | 银河银富货币 - B | 1.0000 | -- | 1.63 | -- | 0.83 | 5.96 | -- | -- | -- | -- |

| 200003 | 长城货币 | 1.0000 | -- | 1.42 | -- | 0.75 | 7.82 | 0.31 | -- | -- | -- |

| 080011 | 长盛货币 | 1.0000 | -- | 1.52 | -- | 0.78 | 7.24 | 0.35 | -- | -- | -- |

| 519999 | 长信利息收益 | 1.0000 | -- | 1.56 | -- | 0.85 | 11.50 | 0.34 | -- | -- | -- |

| 160606 | 鹏华货币 - A | 1.0000 | -- | 1.49 | -- | 0.74 | 8.72 | 0.48 | -- | -- | -- |

| 160609 | 鹏华货币 - B | 1.0000 | -- | 1.61 | -- | 0.80 | 6.22 | -- | -- | -- | -- |

封闭式基金

| 基金代码 | 基金名称 | 单位净值(元) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | 折价率(%) | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 封闭式基金(33) | |||||||||||

| 150001 | 瑞福进取 | 0.4560 | -60.72 | 33 | -33.43 | -46.07 | -- | -- | -- | -- | 68.42 |

| 150002 | 大成优选 | 0.6690 | -42.77 | 32 | -18.06 | -30.87 | -- | -- | -- | -- | -13.75 |

| 184688 | 基金开元 | 1.0046 | -33.11 | 15 | -22.69 | 534.67 | 35.83 | 高 | 1.13 | 高 | -17.98 |

| 184689 | 基金普惠 | 1.4979 | -39.65 | 31 | -26.04 | 323.73 | 31.23 | 中 | 1.15 | 高 | -28.83 |

| 184690 | 基金同益 | 1.1618 | -37.34 | 24 | -23.81 | 431.35 | 30.65 | 偏低 | 0.96 | 偏低 | -27.61 |

| 184691 | 基金景宏 | 1.5043 | -37.89 | 26 | -20.90 | 320.85 | 36.32 | 高 | 1.02 | 中 | -29.47 |

| 184692 | 基金裕隆 | 1.0754 | -31.42 | 10 | -19.56 | 357.04 | 30.93 | 中 | 0.94 | 偏低 | -23.01 |

| 184693 | 基金普丰 | 1.1585 | -37.38 | 25 | -23.07 | 202.56 | 29.64 | 偏低 | 1.07 | 中 | -29.48 |

| 184698 | 基金天元 | 1.2669 | -33.93 | 17 | -20.86 | 357.53 | 31.83 | 高 | 0.93 | 偏低 | -26.04 |

| 基金代码 | 基金名称 | 单位净值(元) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | 折价率(%) | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 封闭式基金(33) | |||||||||||

| 184728 | 基金鸿阳 | 0.7476 | -39.58 | 30 | -24.91 | 106.48 | 30.61 | 偏低 | 1.31 | 高 | -22.69 |

| 500001 | 基金金泰 | 1.0032 | -36.76 | 22 | -21.54 | 363.96 | 31.11 | 中 | 1.12 | 高 | -22.75 |

| 500002 | 基金泰和 | 0.8809 | -33.54 | 16 | -18.13 | 477.46 | 31.37 | 高 | 0.86 | 低 | -8.50 |

| 500003 | 基金安信 | 1.5677 | -27.51 | 2 | -19.68 | 651.22 | 27.61 | 低 | 0.88 | 低 | -25.75 |

| 500005 | 基金汉盛 | 1.7705 | -30.78 | 8 | -20.09 | 362.54 | 26.08 | 低 | 0.72 | 低 | -27.31 |

| 500006 | 基金裕阳 | 1.5145 | -34.72 | 19 | -18.39 | 515.35 | 28.01 | 低 | 0.85 | 低 | -23.94 |

| 500008 | 基金兴华 | 1.1534 | -27.64 | 3 | -13.53 | 753.01 | 29.84 | 偏低 | 0.95 | 偏低 | -15.03 |

| 500009 | 基金安顺 | 1.3284 | -24.55 | 1 | -16.85 | 472.68 | 27.11 | 低 | 0.81 | 低 | -24.57 |

| 500011 | 基金金鑫 | 0.8677 | -36.78 | 23 | -23.74 | 181.75 | 28.17 | 低 | 1.05 | 中 | -18.40 |

| 500015 | 基金汉兴 | 1.4486 | -31.20 | 9 | -18.68 | 170.71 | 25.99 | 低 | 0.88 | 低 | -29.38 |

| 500018 | 基金兴和 | 1.1322 | -31.61 | 12 | -18.29 | 275.45 | 28.35 | 低 | 0.96 | 偏低 | -26.69 |

| 500025 | 基金汉鼎 | 1.3235 | -29.80 | 7 | -26.38 | 127.56 | 26.48 | 低 | 0.80 | 低 | -5.33 |

| 500038 | 基金通乾 | 1.3728 | -31.66 | 13 | -19.72 | 203.76 | 31.21 | 中 | 1.09 | 中 | -26.35 |

| 500056 | 基金科瑞 | 1.1177 | -35.66 | 21 | -23.56 | 249.80 | 31.16 | 中 | 1.14 | 高 | -26.64 |

| 500058 | 基金银丰 | 0.9270 | -34.99 | 20 | -21.31 | 194.95 | 30.79 | 中 | 1.06 | 中 | -23.73 |

| 基金代码 | 基金名称 | 单位净值(元) | 今年以来 | 最近三月 | 设立以来 | 最近两年风险评价 | 折价率(%) | ||||

| 总回报率(%) | 排名 | 总回报率(%) | 总回报率(%) | 波动幅度(%) | 评价 | 晨星风险系数 | 评价 | ||||

| 封闭式基金(33) | |||||||||||

| 184699 | 基金同盛 | 0.9400 | -38.21 | 27 | -22.08 | 211.16 | 31.11 | 中 | 1.15 | 高 | -25.00 |

| 184701 | 基金景福 | 1.2359 | -39.39 | 28 | -21.13 | 160.74 | 32.41 | 高 | 1.12 | 高 | -28.80 |

| 184703 | 基金金盛 | 1.2336 | -34.57 | 18 | -22.93 | 277.11 | 32.90 | 高 | 1.07 | 中 | -11.80 |

| 184705 | 基金裕泽 | 0.9397 | -39.48 | 29 | -25.28 | 250.10 | 31.14 | 中 | 1.10 | 高 | -18.91 |

| 184706 | 基金天华 | 0.9783 | -28.06 | 4 | -10.74 | 152.76 | 29.76 | 偏低 | 1.09 | 中 | -9.64 |

| 184712 | 基金科汇 | 1.3655 | -32.61 | 14 | -22.46 | 523.69 | 31.29 | 高 | 0.90 | 偏低 | -2.60 |

| 184713 | 基金科翔 | 1.8708 | -28.74 | 6 | -18.57 | 457.62 | 30.59 | 偏低 | 0.89 | 低 | -3.36 |

| 184721 | 基金丰和 | 0.7757 | -28.20 | 5 | -16.64 | 250.06 | 29.46 | 偏低 | 0.93 | 偏低 | -14.92 |

| 184722 | 基金久嘉 | 0.8367 | -31.59 | 11 | -15.67 | 265.40 | 31.59 | 高 | 1.08 | 中 | -19.56 |

注1:晨星对开放式基金以投资组合为基础进行分类,对新设立的开放式基金暂时按招募说明书规定分类。分类和评级方法请查阅http://cn.morningstar.com

注2:货币市场基金和保本基金提供回报率,但不提供排名。其他类型基金不提供最近一周、最近一月、最近三月和最近六月的回报率排名。

注3:晨星风险评价及夏普比率计算周期为两年,且建立在月度收益基础上。

免责声明:本公司不保证信息的准确性、完整性和及时性,同时也不保证本公司做出的任何建议或评论不会发生任何变更。过往业绩并不代表将来业绩。在任何情况下,我公司不就本报告中的任何内容对任何投资做出任何形式的担保。本报告内容的版权归Morningstar晨星公司所有。