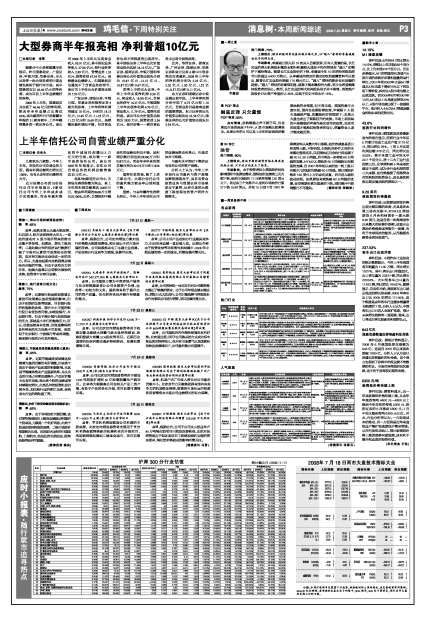

| 指标名称 | 上证指数 | 深证指数 | 指标名称 | 上证指数 | 深证指数 |

| 移动平均线 MA(5) | 2777.01 ↓ | 816.54 ↓ | 指数平滑异同平均线 DIF | -440.53 ↑ | -118.91 ↓ MA MA(10) 3061.42 ↓ 916.09 ↓ MACD(12,26,9) MACD | -401.47 ↓ -99.41 ↓

| 动向指标 +DI | 12.87 ↓ | 12.19 ↓ DMI(10) -DI 33.89 ↓ 35.60 ↓ ADX | 45.50 ↓ 51.60 ↓

| 相对强弱指标 RSI(5) | 30.34 ↓ | 31.58 ↓ | 人气指标 BR(26) | 79.03 ↑ | 89.55 ↓ RSI RSI(10) | 29.11 ↑ 31.57 ↓ AR(26) 86.47 ↑ 92.38 ↑

| 简易波动指标 EMV | -670.81 ↓ | -168.91 ↓ EMVMA | -798.16 ↑ -256.95 ↑|||

| 随机指标 % K | 19.12 ↑ | 20.21 ↓ KDJ(9,3,3) % D 21.70 ↓ 23.39 ↓ % J | 13.94 ↑ 13.85 ↑ |||

| 心理线 PSY(10) | 20 -- | 40 -- PSY PSY(20) | 25 -- 35 --|||

| 超买超卖 CCI(14) | -85.32 ↑ | -78.52 ↓ | 震荡量指标 OSC(10) | -283.05 ↑ | -91.41 ↓ ROC(12) | -21.91 ↓ -22.08 ↓ OSC MA(5) -366.21 ↑ -117.13 ↑

| 乖离率 BIAS(6) | -0.50 ↑ | 0.19 ↓ | 平均差 DMA(10,50) | -329.72 ↓ | -329.72 ↓ MA(5) | -7.35 ↑ -8.07 ↑ MA(5) -294.17 ↓ -294.17 ↓

| 威廉指标 W%R | 81.42 ↓ | 82.53 ↓ | 成交量比率 VR(25) | 36.13 ↑ | 60.15 ↑ VR MA(5) | 35.13 ↓ 52.86 ↓

| 小结:本周沪深两市呈震荡下行态势,两指数回到5周均线处,成交量较前有所萎缩。MACD红柱缩短,各项指标也基本处于回落中,WR超买,RSI处于弱势区,预计后市大盘有反弹上行的可能。 |