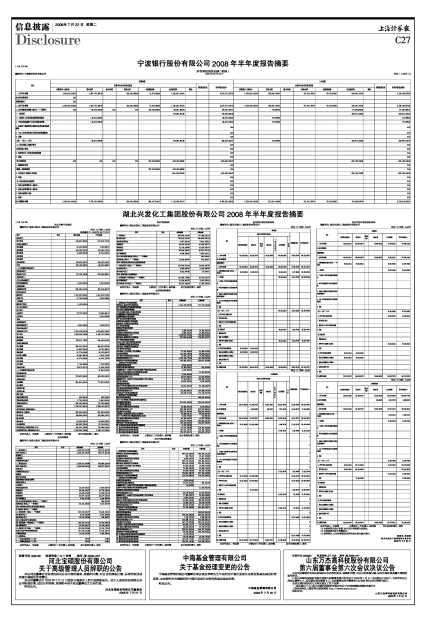

宁波银行股份有限公司2008年半年度报告摘要

2008年07月22日 来源:上海证券报 作者:

(上接C25版)

所有者权益变动表(附表)

编制单位:宁波银行股份有限公司 2008年06月30日 单位:(人民币)元

| 项目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合就计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 2,500,000,000.00 | 3,967,722,491.93 | 243,020,066.48 | 70,973,394.62 | 1,240,601,094.21 | 8,022,317,047.24 | 2,050,000,000.00 | 336,905,745.62 | 147,912,789.73 | 70,973,394.62 | 590,391,767.83 | 3,196,183,697.80 |

| 加:会计政策变更 | 0.00 | |||||||||||

| 前期差错更正 | 0.00 | |||||||||||

| 二、本年年初余额 | 2,500,000,000.00 | 3,967,722,491.93 | 243,020,066.48 | 70,973,394.62 | 1,240,601,094.21 | 8,022,317,047.24 | 2,050,000,000.00 | 336,905,745.62 | 147,912,789.73 | 70,973,394.62 | 590,391,767.83 | 3,196,183,697.80 |

| 三、本年增减变动金额(减少以“-”号填列) | 0.00 | -46,570,029.85 | 0.00 | 0.00 | 318,193,849.50 | -88,601,388.04 | 183,022,431.61 | 175,999.86 | 177,054,855.95 | 177,230,855.81 | ||

| (一)净利润 | 729,592,461.46 | 729,592,461.46 | 382,811,020.33 | 382,811,020.33 | ||||||||

| (二)直接计入所有者权益的利得和损失 | -46,570,029.85 | -46,570,029.85 | 175,999.86 | 175,999.86 | ||||||||

| 1.可供出售金融资产公允价值变动净额 | -46,570,029.85 | -46,570,029.85 | 175,999.86 | 175,999.86 | ||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | 0.00 | 0.00 | ||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | 0.00 | 0.00 | ||||||||||

| 4.其他 | 0.00 | 0.00 | ||||||||||

| 上述(一)和(二)小计 | -46,570,029.85 | 729,592,461.46 | 683,022,431.61 | 175,999.86 | 382,811,020.33 | 382,987,020.19 | ||||||

| (三)所有者投入和减少资本 | 0.00 | 0.00 | ||||||||||

| 1.所有者投入资本 | 0.00 | 0.00 | ||||||||||

| 2.股份支付计入所有者权益的金额 | 0.00 | 0.00 | ||||||||||

| 3.其他 | 0.00 | 0.00 | ||||||||||

| (四)利润分配 | 0.00 | 0.00 | 0.00 | 0.00 | 318,193,849.50 | -818,193,849.50 | -500,000,000.00 | -205,756,164.38 | -205,756,164.38 | |||

| 1.提取盈余公积 | 0.00 | 0.00 | ||||||||||

| 2.提取一般风险准备 | 318,193,849.50 | -318,193,849.50 | 0.00 | 0.00 | ||||||||

| 3.对所有者(或股东)的分配 | -500,000,000.00 | -500,000,000.00 | -205,756,164.38 | -205,756,164.38 | ||||||||

| 4.其他 | 0.00 | 0.00 | ||||||||||

| (五)所有者权益内部结转 | 0.00 | 0.00 | ||||||||||

| 1.资本公积转增资本(或股本) | 0.00 | 0.00 | ||||||||||

| 2.盈余公积转增资本(或股本) | 0.00 | 0.00 | ||||||||||

| 3.盈余公积弥补亏损 | 0.00 | 0.00 | ||||||||||

| 4.其他 | 0.00 | 0.00 | ||||||||||

| 四、本期期末余额 | 2,500,000,000.00 | 3,921,152,462.08 | 243,020,066.48 | 389,167,244.12 | 1,151,999,706.17 | 8,205,339,478.85 | 2,050,000,000.00 | 337,081,745.48 | 147,912,789.73 | 70,973,394.62 | 767,446,623.78 | 3,373,414,553.61 |