| 其他流动资产 | ||||

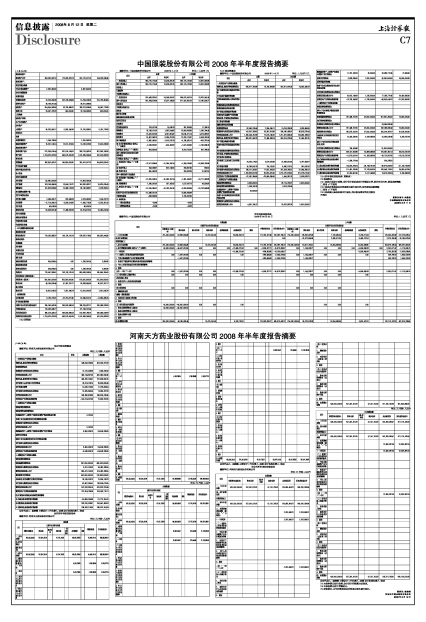

| 流动资产合计 | 903,620,837.19 | 176,063,676.78 | 831,119,571.25 | 184,209,936.45 |

| 非流动资产: | ||||

| 发放贷款及垫款 | ||||

| 可供出售金融资产 | 2,528,400.00 | 5,987,400.00 | ||

| 持有至到期投资 | ||||

| 长期应收款 | ||||

| 长期股权投资 | 10,203,308.36 | 252,798,364.64 | 10,203,308.36 | 251,798,364.64 |

| 投资性房地产 | 26,198,214.44 | 26,671,368.94 | ||

| 固定资产 | 254,945,360.08 | 33,725,886.37 | 263,372,808.66 | 34,587,773.86 |

| 在建工程 | 25,597,273.29 | 400,000.00 | 16,754,083.35 | 400,000.00 |

| 工程物资 | ||||

| 固定资产清理 | ||||

| 生产性生物资产 | ||||

| 油气资产 | ||||

| 无形资产 | 35,200,552.17 | 8,080,040.86 | 21,275,889.01 | 8,181,778.88 |

| 开发支出 | ||||

| 商誉 | ||||

| 长期待摊费用 | 1,345,725.56 | 1,351,050.18 | ||

| 递延所得税资产 | 15,231,141.54 | 12,011,873.04 | 15,163,573.68 | 12,341,828.86 |

| 其他非流动资产 | ||||

| 非流动资产合计 | 371,249,975.44 | 307,016,164.91 | 360,779,482.18 | 307,309,746.24 |

| 资产总计 | 1,274,870,812.63 | 483,079,841.69 | 1,191,899,053.43 | 491,519,682.69 |

| 流动负债: | ||||

| 短期借款 | 382,842,421.91 | 159,900,000.00 | 381,512,517.23 | 164,800,000.00 |

| 向中央银行借款 | ||||

| 吸收存款及同业存放 | ||||

| 拆入资金 | ||||

| 交易性金融负债 | ||||

| 应付票据 | 40,940,000.00 | 15,558,234.04 | ||

| 应付账款 | 162,188,956.95 | 13,584,710.27 | 152,382,832.77 | 10,620,925.43 |

| 预收款项 | 151,620,694.56 | 10,468,116.08 | 89,149,569.91 | 3,976,959.53 |

| 卖出回购金融资产款 | ||||

| 应付手续费及佣金 | ||||

| 应付职工薪酬 | 2,584,831.21 | 892,446.63 | 3,223,400.62 | 1,184,237.23 |

| 应交税费 | -11,719,306.14 | -3,058,014.65 | -1,450,776.09 | -3,223,201.42 |

| 应付利息 | 86,526.00 | 86,526.00 | ||

| 其他应付款 | 50,508,561.48 | 11,388,902.83 | 39,104,872.42 | 13,494,023.43 |

| 应付分保账款 | ||||

| 保险合同准备金 | ||||

| 代理买卖证券款 | ||||

| 代理承销证券款 | ||||

| 一年内到期的非流动负债 | ||||

| 其他流动负债 | ||||

| 流动负债合计 | 779,052,685.97 | 193,176,161.16 | 679,567,176.90 | 190,852,944.20 |

| 非流动负债: | ||||

| 长期借款 | ||||

| 应付债券 | ||||

| 长期应付款 | ||||

| 专项应付款 | ||||

| 预计负债 | ||||

| 递延所得税负债 | 504,694.54 | 0.00 | 1,339,081.34 | 2,805.80 |

| 其他非流动负债 | ||||

| 非流动负债合计 | 504,694.54 | 0.00 | 1,339,081.34 | 2,805.80 |

| 负债合计 | 779,557,380.51 | 193,176,161.16 | 680,906,258.24 | 190,855,750.00 |

| 所有者权益(或股东权益): | ||||

| 实收资本(或股本) | 258,000,000.00 | 258,000,000.00 | 215,000,000.00 | 215,000,000.00 |

| 资本公积 | 48,165,830.45 | 47,307,257.17 | 92,663,644.39 | 90,307,257.17 |

| 减:库存股 | ||||

| 盈余公积 | 10,921,041.59 | 7,321,040.76 | 10,921,041.59 | 7,321,040.76 |

| 一般风险准备 | ||||

| 未分配利润 | 8,163,720.31 | -22,724,617.40 | 20,649,941.73 | -11,964,365.24 |

| 外币报表折算差额 | ||||

| 归属于母公司所有者权益合计 | 325,250,592.35 | 289,903,680.53 | 339,234,627.71 | 300,663,932.69 |

| 少数股东权益 | 170,062,839.77 | 171,758,167.48 | ||

| 所有者权益合计 | 495,313,432.12 | 289,903,680.53 | 510,992,795.19 | 300,663,932.69 |

| 负债和所有者权益总计 | 1,274,870,812.63 | 483,079,841.69 | 1,191,899,053.43 | 491,519,682.69 |

7.2.2 利润表

编制单位:中国服装股份有限公司 2008年1-6月 单位:(人民币)元

| 项目 | 本期 | 上年同期 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、营业总收入 | 964,775,715.46 | 13,325,881.75 | 859,174,192.46 | 13,661,069.89 |

| 其中:营业收入 | 964,775,715.46 | 13,325,881.75 | 859,174,192.46 | 13,661,069.89 |

| 利息收入 | ||||

| 已赚保费 | ||||

| 手续费及佣金收入 | ||||

| 二、营业总成本 | 975,468,323.47 | 24,056,691.87 | 865,821,552.19 | 23,978,941.45 |

| 其中:营业成本 | 921,644,516.64 | 13,237,165.58 | 817,421,861.23 | 12,180,506.77 |

| 利息支出 | ||||

| 手续费及佣金支出 | ||||

| 退保金 | ||||

| 赔付支出净额 | ||||

| 提取保险合同准备金净额 | ||||

| 保单红利支出 | ||||

| 分保费用 | ||||

| 营业税金及附加 | 376,417.39 | 14,035.73 | 267,903.49 | 17,756.10 |

| 销售费用 | 25,189,191.32 | 1,932,544.62 | 22,909,956.36 | 1,298,794.45 |

| 管理费用 | 20,481,591.93 | 4,231,664.37 | 18,045,077.14 | 4,575,969.91 |

| 财务费用 | 10,467,056.70 | 6,254,313.70 | 12,313,174.07 | 6,558,152.06 |

| 资产减值损失 | -2,690,450.51 | -1,613,032.13 | -5,136,420.10 | -652,237.84 |

| 加:公允价值变动收益(损失以“-”号填列) | -2,539,620.97 | -304,432.02 | -1,531,558.30 | -1,156,608.30 |

| 投资收益(损失以“-”号填列) | 654,530.45 | 6,819,752.20 | 807,769.90 | |

| 其中:对联营企业和合营企业的投资收益 | ||||

| 汇兑收益(损失以“-”号填列) | ||||

| 三、营业利润(亏损以“-”号填列) | -12,577,698.53 | -11,035,242.14 | -1,359,165.83 | -10,666,709.96 |

| 加:营业外收入 | 943,065.67 | 602,140.00 | 258,657.85 | 960.00 |

| 减:营业外支出 | 455,400.29 | 200,832.93 | 51,587.00 | |

| 其中:非流动资产处置损失 | ||||

| 四、利润总额(亏损总额以“-”号填列) | -12,090,033.15 | -10,433,102.14 | -1,301,340.91 | -10,717,336.96 |

| 减:所得税费用 | 1,095,051.92 | 327,150.02 | 1,527,297.73 | 45,509.92 |

| 五、净利润(净亏损以“-”号填列) | -13,185,085.07 | -10,760,252.16 | -2,828,638.64 | -10,762,846.88 |

| 归属于母公司所有者的净利润 | -12,486,221.42 | -5,558,940.99 | ||

| 少数股东损益 | -698,863.65 | 2,730,302.35 | ||

| 六、每股收益: | ||||

| (一)基本每股收益 | -0.048 | -0.026 | ||

| (二)稀释每股收益 | -0.048 | -0.026 | ||

7.2.3 现金流量表

编制单位:中国服装股份有限公司 2008年1-6月 单位:(人民币)元

| 项目 | 本期 | 上年同期 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、经营活动产生的现金流量: | ||||

| 销售商品、提供劳务收到的现金 | 955,977,759.99 | 16,730,888.56 | 902,671,919.33 | 14,343,430.23 |

| 客户存款和同业存放款项净增加额 | ||||

| 向中央银行借款净增加额 | ||||

| 向其他金融机构拆入资金净增加额 | ||||

| 收到原保险合同保费取得的现金 | ||||

| 收到再保险业务现金净额 | ||||

| 保户储金及投资款净增加额 | ||||

| 处置交易性金融资产净增加额 | ||||

| 收取利息、手续费及佣金的现金 | ||||

| 拆入资金净增加额 | ||||

| 回购业务资金净增加额 | ||||

| 收到的税费返还 | 62,859,703.48 | 2,255,340.11 | 74,753,238.39 | 3,926,859.96 |

| 收到其他与经营活动有关的现金 | 147,507,289.52 | 53,387,916.93 | 234,196,428.61 | 86,623,876.44 |

| 经营活动现金流入小计 | 1,166,344,752.99 | 72,374,145.60 | 1,211,621,586.33 | 104,894,166.63 |

| 购买商品、接受劳务支付的现金 | 969,097,408.78 | 12,466,636.94 | 958,314,378.85 | 37,455,391.25 |

| 客户贷款及垫款净增加额 | ||||

| 存放中央银行和同业款项净增加额 | ||||

| 支付原保险合同赔付款项的现金 | ||||

| 支付利息、手续费及佣金的现金 | ||||

| 支付保单红利的现金 | ||||

| 支付给职工以及为职工支付的现金 | 24,230,174.50 | 5,076,282.63 | 21,863,031.44 | 4,787,563.87 |

| 支付的各项税费 | 15,266,500.79 | 724,135.61 | 8,960,120.74 | 991,820.18 |

| 支付其他与经营活动有关的现金 | 185,211,923.51 | 77,557,436.22 | 221,029,793.51 | 57,843,298.12 |

| 经营活动现金流出小计 | 1,193,806,007.58 | 95,824,491.40 | 1,210,167,324.54 | 101,078,073.42 |

| 经营活动产生的现金流量净额 | -27,461,254.59 | -23,450,345.80 | 1,454,261.79 | 3,816,093.21 |

| 二、投资活动产生的现金流量: | ||||

| 收回投资收到的现金 | 3,608,052.84 | 26,714,702.67 | 2,500,000.00 | |

| 取得投资收益收到的现金 | 1,038,241.33 | 3,578,129.56 | ||

| 处置固定资产、无形资产和其他长期资产收回的现金净额 | 35,500.00 | |||

| 处置子公司及其他营业单位收到的现金净额 | ||||

| 收到其他与投资活动有关的现金 | ||||

| 投资活动现金流入小计 | 4,681,794.17 | 30,292,832.23 | 2,500,000.00 | |

| 购建固定资产、无形资产和其他长期资产支付的现金 | 11,781,318.09 | 25,950.00 | 33,886,772.45 | 79,580.00 |

| 投资支付的现金 | 6,633,825.00 | 1,200,000.00 | 43,350,000.00 | 24,350,000.00 |

| 质押贷款净增加额 | ||||

| 取得子公司及其他营业单位支付的现金净额 | ||||

| 支付其他与投资活动有关的现金 | ||||

| 投资活动现金流出小计 | 18,415,143.09 | 1,225,950.00 | 77,236,772.45 | 24,429,580.00 |

| 投资活动产生的现金流量净额 | -13,733,348.92 | -1,225,950.00 | -46,943,940.22 | -21,929,580.00 |

| 三、筹资活动产生的现金流量: | ||||

| 吸收投资收到的现金 | ||||

| 其中:子公司吸收少数股东投资收到的现金 | ||||

| 取得借款收到的现金 | 197,436,757.60 | 52,600,000.00 | 207,681,200.00 | 73,800,000.00 |

| 发行债券收到的现金 | ||||

| 收到其他与筹资活动有关的现金 | 24,585,699.48 | |||

| 筹资活动现金流入小计 | 197,436,757.60 | 52,600,000.00 | 232,266,899.48 | 73,800,000.00 |

| 偿还债务支付的现金 | 195,675,413.20 | 57,500,000.00 | 255,918,927.67 | 81,530,000.00 |

| 分配股利、利润或偿付利息支付的现金 | 13,323,320.80 | 6,169,885.56 | 10,063,029.46 | 5,280,257.09 |

| 其中:子公司支付给少数股东的股利、利润 | ||||

| 支付其他与筹资活动有关的现金 | 108,524.69 | 10,000,000.00 | ||

| 筹资活动现金流出小计 | 209,107,258.69 | 63,669,885.56 | 275,981,957.13 | 86,810,257.09 |

| 筹资活动产生的现金流量净额 | -11,670,501.09 | -11,069,885.56 | -43,715,057.65 | -13,010,257.09 |

| 四、汇率变动对现金及现金等价物的影响 | -1,339,273.44 | 234,226.50 | ||

| 五、现金及现金等价物净增加额 | -54,204,378.04 | -35,746,181.36 | -88,970,509.58 | -31,123,743.88 |

| 加:期初现金及现金等价物余额 | 111,461,235.39 | 37,763,640.25 | 163,546,713.52 | 34,880,412.84 |

| 六、期末现金及现金等价物余额 | 57,256,857.35 | 2,017,458.89 | 74,576,203.94 | 3,756,668.96 |

7.2.4 所有者权益变动表(见附表)

7.3 报表附注

7.3.1 如果出现会计政策、会计估计变更或会计差错更正的,说明有关内容、原因及影响数

□ 适用 √ 不适用

7.3.2 如果财务报表合并范围发生重大变化的,说明原因及影响数

□ 适用 √ 不适用

7.3.3 如果被出具非标准审计报告,列示涉及事项的有关附注

不适用

董事长签字:冯德虎

中国服装股份有限公司

2008年8月11日

所有者权益变动表

编制单位:中国服装股份有限公司 2008年06月30日 单位:(人民币)元

| 项目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 215,000,000.00 | 92,663,644.39 | 10,921,041.59 | 20,649,941.73 | 171,758,167.48 | 510,992,795.19 | 215,000,000.00 | 126,290,397.89 | 7,723,495.54 | 6,759,571.08 | 161,503,361.96 | 517,276,826.47 | ||||||

| 加:会计政策变更 | 0.00 | -31,672,655.38 | 2,630,571.30 | 8,480,797.52 | 2,375,764.48 | -18,185,522.08 | ||||||||||||

| 前期差错更正 | ||||||||||||||||||

| 二、本年年初余额 | 215,000,000.00 | 92,663,644.39 | 10,921,041.59 | 20,649,941.73 | 171,758,167.48 | 510,992,795.19 | 215,000,000.00 | 94,617,742.51 | 10,354,066.84 | 15,240,368.60 | 163,879,126.44 | 499,091,304.39 | ||||||

| 三、本年增减变动金额(减少以“-”号填列) | 43,000,000.00 | -44,497,813.94 | 0.00 | 0.00 | 0.00 | -12,486,221.42 | 0.00 | -1,695,327.71 | -15,679,363.07 | 0.00 | 1,144,333.77 | 0.00 | 0.00 | 0.00 | -5,558,940.99 | 0.00 | 3,240,071.47 | -1,174,535.75 |

| (一)净利润 | -12,486,221.42 | -698,863.65 | -13,185,085.07 | -5,558,940.99 | 2,730,302.35 | -2,828,638.64 | ||||||||||||

| (二)直接计入所有者权益的利得和损失 | 0.00 | -1,497,813.94 | 0.00 | 0.00 | 0.00 | -996,464.06 | -2,494,278.00 | 0.00 | 1,144,333.77 | 0.00 | 0.00 | 0.00 | 509,769.12 | 1,654,102.89 | ||||

| 1.可供出售金融资产公允价值变动净额 | -1,497,813.94 | -996,464.06 | -2,494,278.00 | 1,144,333.77 | 509,769.12 | 1,654,102.89 | ||||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | ||||||||||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||||||||||||||

| 4.其他 | ||||||||||||||||||

| 上述(一)和(二)小计 | 0.00 | -1,497,813.94 | 0.00 | 0.00 | -12,486,221.42 | -1,695,327.71 | -15,679,363.07 | 0.00 | 1,144,333.77 | 0.00 | 0.00 | -5,558,940.99 | 3,240,071.47 | -1,174,535.75 | ||||

| (三)所有者投入和减少资本 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||

| 1.所有者投入资本 | ||||||||||||||||||

| 2.股份支付计入所有者权益的金额 | ||||||||||||||||||

| 3.其他 | ||||||||||||||||||

| (四)利润分配 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 1.提取盈余公积 | ||||||||||||||||||

| 2.提取一般风险准备 | ||||||||||||||||||

| 3.对所有者(或股东)的分配 | ||||||||||||||||||

| 4.其他 | ||||||||||||||||||

| (五)所有者权益内部结转 | 43,000,000.00 | -43,000,000.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||

| 1.资本公积转增资本(或股本) | 43,000,000.00 | -43,000,000.00 | ||||||||||||||||

| 2.盈余公积转增资本(或股本) | ||||||||||||||||||

| 3.盈余公积弥补亏损 | ||||||||||||||||||

| 4.其他 | ||||||||||||||||||

| 四、本期期末余额 | 258,000,000.00 | 48,165,830.45 | 10,921,041.59 | 8,163,720.31 | 170,062,839.77 | 495,313,432.12 | 215,000,000.00 | 95,762,076.28 | 10,354,066.84 | 9,681,427.61 | 167,119,197.91 | 497,916,768.64 |