思源电气(002028):机构逆势增持 后市值得期待

2008年08月17日 来源:上海证券报 作者:

在经济增长滑落、市场需求低落的情形下,大多数机构投资者的配置策略重点已经开始转向那些刚性需求的产业,其中的核心重点是灾后重建和铁路建设、电网投资等瓶颈产业。以灾后重建、电网投资复合条件作为标准,思源电气无疑是重点中的重点,因此,以被诸多机构投资者看好。

透过盘中行情也可以明显发现,自6月份以来机构投资者对该股逆势增持的行为是非常明显的。这预示着该股行情可能好戏才刚开始。

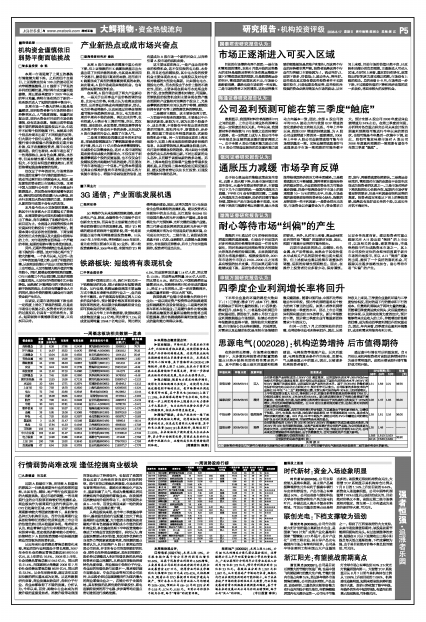

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) | ||

| 08年 | 09年 | 10年 | |||||

| 安信证券 | 2008/08/14 | 买入 | 公司多项新产品研制成功:126kV GIS通过鉴定,达到国际先进水平;35kV60Mvar油浸式并联电抗器通过鉴定,部分指标达到或超过了国际先进的技术水平;363kV 和550kV 隔离开关通过鉴定,达到国际同类产品的先进水平。基于IEC61850的微机继电保护和变电站自动化正在研制之中,预计明年可以推出。公司积累的多种技术和产品将在09年至“十二五”期间释放业绩,主营业务可保持每年30%以上的持续增长。 | 1.21 | 1.59 | 2.21 | 39.70 |

| 国泰君安 | 2008/08/15 | 增持 | 上半年实现营业收入6.2亿,净利润1.4亿,扣除非经常性损益后的净利润7769万,分别同比增长38.05%,176.08%和68.44%。新业务高增长弥补了传统业务增速下滑的影响。电容器、电抗器、油色谱等业务的增长带动归于其他类的业务实现了137%的增长,并且毛利率能够保持稳定。在GIS 成为主要利润贡献之前,这些业务对利润的贡献比例会显著增加。 | 1.08 | 1.47 | 1.94 | 35.00 |

| 中投证券 | 2008/08/15 | 强烈推荐 | 三大主业中消弧线圈、高压开关的增长符合预期,而互感器由于停标影响较大,业绩低于预期。另外,电容器、电抗器、油色谱在线监测仪08 年增速将超过100%,逐步成为例如贡献的重要力量。GIS 产品09 年中期投产、清能公司的SVG 和曦能公司的继电保护及自动化系统进展顺利,市场销售是未来的重点。 | 1.28 | 1.51 | 2.16 | 36.00 |

| 国信证券 | 2008/08/15 | 推荐 | 公司研发的包括126kV 的GIS 和363kV、550kV 的隔离开关成功通过技术鉴定,而252kV 的GIS 也有望获得突破。这些产品将显著扩充公司的产品线,为公司换来更大的成长空间。公司仍然持有平高电气股权7,908万股,市场公允价值约6.6亿元,公司未来还会继续减持平高的股权,由于其数额巨大,会对当期收益产生重大影响。 | 1.25 | 1.48 | ---- | ----- |

| 业绩预测与估值的均值(元) | 1.205 | 1.513 | 2.103 | 36.90 | |||

| 目前股价的动态市盈率(倍) | 22.14 | 17.63 | 12.69 | ||||

| 风 险 提 示 | |||||||

| (1)原材料价格变动与下游行业需求变化是影响公司业绩的重要因素;(2)持有巨额平高电气股权收益高低受到二级市场价格变化的影响。 |