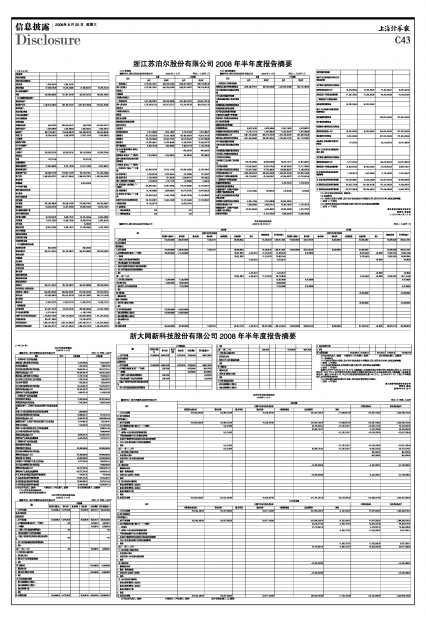

| 应收保费 | ||||

| 应收分保账款 | ||||

| 应收分保合同准备金 | ||||

| 应收利息 | 1,634,247.00 | 1,634,247.00 | ||

| 其他应收款 | 37,846,575.36 | 16,232,233.50 | 27,350,561.70 | 16,765,152.13 |

| 买入返售金融资产 | ||||

| 存货 | 447,686,866.85 | 151,367,297.86 | 423,691,037.52 | 169,623,156.58 |

| 一年内到期的非流动资产 | ||||

| 其他流动资产 | ||||

| 流动资产合计 | 1,749,814,349.93 | 536,165,241.91 | 1,627,801,203.48 | 519,341,264.30 |

| 非流动资产: | ||||

| 发放贷款及垫款 | ||||

| 可供出售金融资产 | ||||

| 持有至到期投资 | ||||

| 长期应收款 | ||||

| 长期股权投资 | 443,875.60 | 669,254,801.37 | 443,875.60 | 657,342,051.37 |

| 投资性房地产 | 1,533,989.08 | 1,533,989.08 | 1,640,230.41 | 1,640,230.41 |

| 固定资产 | 498,716,549.77 | 173,548,860.28 | 506,396,091.02 | 184,416,866.40 |

| 在建工程 | 30,284,616.20 | 6,445,532.96 | 13,922,115.26 | 2,296,680.04 |

| 工程物资 | ||||

| 固定资产清理 | ||||

| 生产性生物资产 | ||||

| 油气资产 | ||||

| 无形资产 | 193,935,522.08 | 56,088,367.10 | 195,181,555.06 | 56,383,020.45 |

| 开发支出 | ||||

| 商誉 | 122,071.40 | 122,071.40 | ||

| 长期待摊费用 | ||||

| 递延所得税资产 | 21,648,453.85 | 8,781,162.83 | 20,417,134.56 | 8,925,486.31 |

| 其他非流动资产 | ||||

| 非流动资产合计 | 746,685,077.98 | 915,652,713.62 | 738,123,073.31 | 911,004,334.98 |

| 资产总计 | 2,496,499,427.91 | 1,451,817,955.53 | 2,365,924,276.79 | 1,430,345,599.28 |

| 流动负债: | ||||

| 短期借款 | 8,000,000.00 | |||

| 向中央银行借款 | ||||

| 吸收存款及同业存放 | ||||

| 拆入资金 | ||||

| 交易性金融负债 | ||||

| 应付票据 | ||||

| 应付账款 | 352,085,685.86 | 169,548,273.95 | 370,956,978.01 | 194,745,649.07 |

| 预收款项 | 53,403,031.36 | 13,327,522.64 | 68,590,144.28 | 18,814,013.01 |

| 卖出回购金融资产款 | ||||

| 应付手续费及佣金 | ||||

| 应付职工薪酬 | 38,706,502.25 | 8,998,197.91 | 52,570,005.44 | 12,350,336.90 |

| 应交税费 | 17,675,176.83 | -2,596,737.50 | 26,908,287.42 | 5,098,407.00 |

| 应付利息 | 14,200.00 | |||

| 其他应付款 | 43,801,078.88 | 6,426,142.21 | 30,799,084.53 | 8,018,190.26 |

| 应付分保账款 | ||||

| 保险合同准备金 | ||||

| 代理买卖证券款 | ||||

| 代理承销证券款 | ||||

| 一年内到期的非流动负债 | ||||

| 其他流动负债 | 640,000.00 | 640,000.00 | ||

| 流动负债合计 | 506,311,475.18 | 195,703,399.21 | 558,478,699.68 | 239,026,596.24 |

| 非流动负债: | ||||

| 长期借款 | ||||

| 应付债券 | ||||

| 长期应付款 | ||||

| 专项应付款 | ||||

| 预计负债 | ||||

| 递延所得税负债 | ||||

| 其他非流动负债 | ||||

| 非流动负债合计 | ||||

| 负债合计 | 506,311,475.18 | 195,703,399.21 | 558,478,699.68 | 239,026,596.24 |

| 所有者权益(或股东权益): | ||||

| 实收资本(或股本) | 444,040,000.00 | 444,040,000.00 | 216,020,000.00 | 216,020,000.00 |

| 资本公积 | 827,363,286.33 | 825,047,870.36 | 1,002,087,926.33 | 999,772,510.36 |

| 减:库存股 | ||||

| 盈余公积 | 17,002,277.31 | 17,002,277.31 | 17,002,277.31 | 17,002,277.31 |

| 一般风险准备 | ||||

| 未分配利润 | 501,857,721.26 | -29,975,591.35 | 399,565,884.54 | -41,475,784.63 |

| 外币报表折算差额 | -5,372,491.10 | -1,336,132.30 | ||

| 归属于母公司所有者权益合计 | 1,784,890,793.80 | 1,256,114,556.32 | 1,633,339,955.88 | 1,191,319,003.04 |

| 少数股东权益 | 205,297,158.93 | 174,105,621.23 | ||

| 所有者权益合计 | 1,990,187,952.73 | 1,256,114,556.32 | 1,807,445,577.11 | 1,191,319,003.04 |

| 负债和所有者权益总计 | 2,496,499,427.91 | 1,451,817,955.53 | 2,365,924,276.79 | 1,430,345,599.28 |

7.2.2 利润表

编制单位:浙江苏泊尔股份有限公司 2008年1-6月 单位:(人民币)元

| 项目 | 本期 | 上年同期 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、营业总收入 | 1,770,090,740.11 | 464,704,613.05 | 1,343,067,096.12 | 636,114,967.41 |

| 其中:营业收入 | 1,770,090,740.11 | 464,704,613.05 | 1,343,067,096.12 | 636,114,967.41 |

| 利息收入 | ||||

| 已赚保费 | ||||

| 手续费及佣金收入 | ||||

| 二、营业总成本 | 1,617,965,283.12 | 453,169,395.96 | 1,222,402,675.70 | 594,251,761.74 |

| 其中:营业成本 | 1,278,392,611.24 | 391,477,827.17 | 973,161,667.58 | 459,078,511.70 |

| 利息支出 | ||||

| 手续费及佣金支出 | ||||

| 退保金 | ||||

| 赔付支出净额 | ||||

| 提取保险合同准备金净额 | ||||

| 保单红利支出 | ||||

| 分保费用 | ||||

| 营业税金及附加 | 4,757,380.09 | 2,915,139.87 | 3,776,975.54 | 3,273,464.27 |

| 销售费用 | 251,513,552.56 | 32,415,140.89 | 165,486,439.29 | 84,913,212.05 |

| 管理费用 | 88,724,436.45 | 36,188,772.00 | 58,575,355.19 | 31,287,264.99 |

| 财务费用 | -10,329,444.71 | -9,476,494.89 | 11,948,320.31 | 10,544,607.13 |

| 资产减值损失 | 4,906,747.49 | -350,989.08 | 9,453,917.79 | 5,154,701.60 |

| 加:公允价值变动收益(损失以“-”号填列) | -285,400.00 | -285,400.00 | ||

| 投资收益(损失以“-”号填列) | 1,674,895.00 | 1,674,895.00 | 205,985.00 | 205,985.00 |

| 其中:对联营企业和合营企业的投资收益 | ||||

| 汇兑收益(损失以“-”号填列) | ||||

| 三、营业利润(亏损以“-”号填列) | 153,800,351.99 | 13,210,112.09 | 120,585,005.42 | 41,783,790.67 |

| 加:营业外收入 | 2,919,831.42 | 2,318,155.00 | 827,628.65 | 731,225.97 |

| 减:营业外支出 | 2,114,160.30 | 131,208.29 | 1,538,697.72 | 792,414.52 |

| 其中:非流动资产处置损失 | -173,332.02 | -176,117.23 | -32,668.80 | 5,034.47 |

| 四、利润总额(亏损总额以“-”号填列) | 154,606,023.11 | 15,397,058.80 | 119,873,936.35 | 41,722,602.12 |

| 减:所得税费用 | 21,122,648.69 | 3,896,865.52 | 30,071,673.81 | 18,979,602.25 |

| 五、净利润(净亏损以“-”号填列) | 133,483,374.42 | 11,500,193.28 | 89,802,262.54 | 22,742,999.87 |

| 归属于母公司所有者的净利润 | 102,291,836.72 | 11,500,193.28 | 73,776,244.39 | 22,742,999.87 |

| 少数股东损益 | 31,191,537.70 | 16,026,018.15 | ||

| 六、每股收益: | ||||

| (一)基本每股收益 | 0.23 | 0.21 | ||

| (二)稀释每股收益 | 0.23 | 0.20 | ||

7.2.3 现金流量表

编制单位:浙江苏泊尔股份有限公司 2008年1-6月 单位:(人民币)元

| 项目 | 本期 | 上年同期 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、经营活动产生的现金流量: | ||||

| 销售商品、提供劳务收到的现金 | 1,863,345,979.12 | 458,258,058.38 | 1,352,935,924.66 | 644,110,460.95 |

| 客户存款和同业存放款项净增加额 | ||||

| 向中央银行借款净增加额 | ||||

| 向其他金融机构拆入资金净增加额 | ||||

| 收到原保险合同保费取得的现金 | ||||

| 收到再保险业务现金净额 | ||||

| 保户储金及投资款净增加额 | ||||

| 处置交易性金融资产净增加额 | ||||

| 收取利息、手续费及佣金的现金 | ||||

| 拆入资金净增加额 | ||||

| 回购业务资金净增加额 | ||||

| 收到的税费返还 | 6,803,741.63 | 5,829,949.56 | 11,507,745.78 | 9,473,669.12 |

| 收到其他与经营活动有关的现金 | 11,575,711.74 | 2,087,694.30 | 11,352,262.37 | 8,075,384.36 |

| 经营活动现金流入小计 | 1,881,725,432.49 | 466,175,702.24 | 1,375,795,932.81 | 661,659,514.43 |

| 购买商品、接受劳务支付的现金 | 1,561,338,640.68 | 396,990,941.94 | 1,185,965,787.52 | 557,713,096.95 |

| 客户贷款及垫款净增加额 | ||||

| 存放中央银行和同业款项净增加额 | ||||

| 支付原保险合同赔付款项的现金 | ||||

| 支付利息、手续费及佣金的现金 | ||||

| 支付保单红利的现金 | ||||

| 支付给职工以及为职工支付的现金 | 160,376,339.63 | 43,084,558.36 | 93,529,147.77 | 32,851,834.61 |

| 支付的各项税费 | 112,640,344.20 | 18,501,572.44 | 59,169,083.42 | 13,177,296.00 |

| 支付其他与经营活动有关的现金 | 172,582,700.65 | 27,755,483.21 | 124,656,856.37 | 71,196,878.32 |

| 经营活动现金流出小计 | 2,006,938,025.16 | 486,332,555.95 | 1,463,320,875.08 | 674,939,105.88 |

| 经营活动产生的现金流量净额 | -125,212,592.67 | -20,156,853.71 | -87,524,942.27 | -13,279,591.45 |

| 二、投资活动产生的现金流量: | ||||

| 收回投资收到的现金 | 2,709,755.79 | 2,709,755.79 | ||

| 取得投资收益收到的现金 | ||||

| 处置固定资产、无形资产和其他长期资产收回的现金净额 | 2,613,742.85 | 762,660.75 | 575,392.99 | 78,026.99 |

| 处置子公司及其他营业单位收到的现金净额 | ||||

| 收到其他与投资活动有关的现金 | 5,280,113.54 | 2,201,666.36 | 20,000,000.00 | |

| 投资活动现金流入小计 | 7,893,856.39 | 2,964,327.11 | 23,285,148.78 | 2,787,782.78 |

| 购建固定资产、无形资产和其他长期资产支付的现金 | 35,254,654.44 | 4,256,459.67 | 58,906,243.98 | 2,421,222.82 |

| 投资支付的现金 | 11,912,750.00 | 8,585,400.29 | 14,566,184.86 | |

| 质押贷款净增加额 | ||||

| 取得子公司及其他营业单位支付的现金净额 | ||||

| 支付其他与投资活动有关的现金 | ||||

| 投资活动现金流出小计 | 35,254,654.44 | 16,169,209.67 | 67,491,644.27 | 16,987,407.68 |

| 投资活动产生的现金流量净额 | -27,360,798.05 | -13,204,882.56 | -44,206,495.49 | -14,199,624.90 |

| 三、筹资活动产生的现金流量: | ||||

| 吸收投资收到的现金 | 40,920,000.00 | 40,920,000.00 | ||

| 其中:子公司吸收少数股东投资收到的现金 | ||||

| 取得借款收到的现金 | 334,000,000.00 | 327,000,000.00 | ||

| 发行债券收到的现金 | ||||

| 收到其他与筹资活动有关的现金 | ||||

| 筹资活动现金流入小计 | 40,920,000.00 | 40,920,000.00 | 334,000,000.00 | 327,000,000.00 |

| 偿还债务支付的现金 | 8,000,000.00 | 307,000,000.00 | 270,000,000.00 | |

| 分配股利、利润或偿付利息支付的现金 | 117,327.50 | 43,610,600.16 | 43,191,859.83 | |

| 其中:子公司支付给少数股东的股利、利润 | ||||

| 支付其他与筹资活动有关的现金 | ||||

| 筹资活动现金流出小计 | 8,117,327.50 | 350,610,600.16 | 313,191,859.83 | |

| 筹资活动产生的现金流量净额 | 32,802,672.50 | 40,920,000.00 | -16,610,600.16 | 13,808,140.17 |

| 四、汇率变动对现金及现金等价物的影响 | 1,736,331.75 | 7,447,080.63 | -2,725,482.33 | -2,412,584.70 |

| 五、现金及现金等价物净增加额 | -118,034,386.47 | 15,005,344.36 | -151,067,520.25 | -16,083,660.88 |

| 加:期初现金及现金等价物余额 | 792,955,770.86 | 220,230,301.85 | 372,912,485.28 | 70,583,983.19 |

| 六、期末现金及现金等价物余额 | 674,921,384.39 | 235,235,646.21 | 221,844,965.03 | 54,500,322.31 |

7.2.4 所有者权益变动表(见附表)

7.3 报表附注

7.3.1 如果出现会计政策、会计估计变更或会计差错更正的,说明有关内容、原因及影响数

□ 适用 √ 不适用

7.3.2 如果财务报表合并范围发生重大变化的,说明原因及影响数

□ 适用 √ 不适用

浙江苏泊尔股份有限公司

董事长:苏显泽

二〇〇八年八月二十日

| 项目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 216,020,000.00 | 1,002,087,926.33 | 17,002,277.31 | 399,565,884.54 | 174,105,621.23 | 1,808,781,709.41 | 176,020,000.00 | 322,212,601.97 | 48,840,603.50 | 212,904,568.01 | 133,596,353.03 | 893,574,126.51 | ||

| 加:会计政策变更 | ||||||||||||||

| 前期差错更正 | ||||||||||||||

| 二、本年年初余额 | 216,020,000.00 | 1,002,087,926.33 | 17,002,277.31 | 399,565,884.54 | 174,105,621.23 | 1,808,781,709.41 | 176,020,000.00 | 322,212,601.97 | 48,840,603.50 | 212,904,568.01 | 133,596,353.03 | 893,574,126.51 | ||

| 三、本年增减变动金额(减少以“-”号填列) | 228,020,000.00 | -174,724,640.00 | 102,291,836.72 | -5,372,491.10 | 31,191,537.70 | 181,406,243.32 | 6,187,680.00 | 38,572,244.39 | -90,788.26 | 16,026,018.15 | 60,695,154.28 | |||

| (一)净利润 | 102,291,836.72 | 31,191,537.70 | 133,483,374.42 | 73,776,244.39 | 16,026,018.15 | 89,802,262.54 | ||||||||

| (二)直接计入所有者权益的利得和损失 | -5,372,491.10 | -5,372,491.10 | -90,788.26 | -90,788.26 | ||||||||||

| 1.可供出售金融资产公允价值变动净额 | ||||||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | ||||||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||||||||||

| 4.其他 | -5,372,491.10 | -5,372,491.10 | -90,788.26 | -90,788.26 | ||||||||||

| 上述(一)和(二)小计 | 102,291,836.72 | -5,372,491.10 | 31,191,537.70 | 128,110,883.32 | 73,776,244.39 | -90,788.26 | 16,026,018.15 | 89,711,474.28 | ||||||

| (三)所有者投入和减少资本 | 12,000,000.00 | 41,295,360.00 | 53,295,360.00 | 6,187,680.00 | 6,187,680.00 | |||||||||

| 1.所有者投入资本 | 12,000,000.00 | 28,920,000.00 | 40,920,000.00 | |||||||||||

| 2.股份支付计入所有者权益的金额 | 12,375,360.00 | 12,375,360.00 | 6,187,680.00 | 6,187,680.00 | ||||||||||

| 3.其他 | ||||||||||||||

| (四)利润分配 | -35,204,000.00 | -35,204,000.00 | ||||||||||||

| 1.提取盈余公积 | ||||||||||||||

| 2.提取一般风险准备 | ||||||||||||||

| 3.对所有者(或股东)的分配 | -35,204,000.00 | -35,204,000.00 | ||||||||||||

| 4.其他 | ||||||||||||||

| (五)所有者权益内部结转 | 216,020,000.00 | -216,020,000.00 | ||||||||||||

| 1.资本公积转增资本(或股本) | 216,020,000.00 | -216,020,000.00 | ||||||||||||

| 2.盈余公积转增资本(或股本) | ||||||||||||||

| 3.盈余公积弥补亏损 | ||||||||||||||

| 4.其他 | ||||||||||||||

| 四、本期期末余额 | 444,040,000.00 | 827,363,286.33 | 17,002,277.31 | 501,857,721.26 | -5,372,491.10 | 205,297,158.93 | 1,990,187,952.73 | 176,020,000.00 | 328,400,281.97 | 48,840,603.50 | 251,476,812.40 | -90,788.26 | 149,622,371.18 | 954,269,280.79 |

所有者权益变动表

编制单位:浙江苏泊尔股份有限公司 2008年06月30日 单位:(人民币)元