中金黄金(600489):双轮驱动下出现投资机会

2008年09月21日 来源:上海证券报 作者:

近期,美国金融危机的出现使得美元打破了原先升值的预期,转而形成贬值的新预期。且为了提振低落的经济,在通胀压力已经开始缓解的情形下,美联储也有了降息的意图,美元的贬值新预期进而导致国际金价开始出现显著上涨。同时,全球金融动荡的局面也使得黄金再度开始显示其“金本位”的优势形成了新的上涨预期,这无疑对黄金股构成新的利好。同时,中金黄金再次收购集团矿业资产,在产能得到扩大,金价再次看好的双驱动下,使得该股新的投资机会也再次出现。

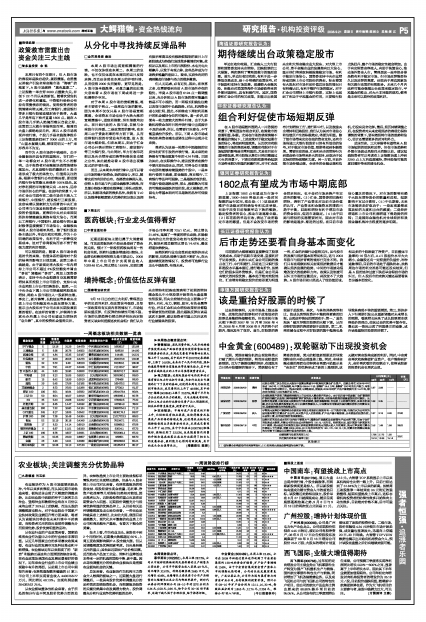

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) | ||

| 08年 | 09年 | 10年 | |||||

| 西南证券 | 2008/09/09 | 增持 | 近期公司第二次公告拟从大股东中国黄金集团手中收购相关黄金矿业资产。四家公司在2009 年中可形成1950 吨/日采选规模,年产黄金698.54千克、铁精矿24.4 万吨、铜精矿300 吨的生产能力,有助于增厚公司的业绩水平。完成近期这几项收购后,预期其2009年的矿产金产量将提升至15.27 吨,较2008年预期12.84 吨提升近20%。 | 1.87 | 2.68 | ---- | ----- |

| 国信证券 | 2008/09/09 | 推荐 | 公司收购资产表明了集团将持续向上市公司注入黄金资产的决心。由于四川省平武县银厂金矿普查探矿权和西藏江达县角日阿玛铁铜矿探矿权均处于普查阶段,不排除有较高的储量被发现的可能性。从投资的角度看,近期受美元反弹金价下跌的影响,股价跌幅较深,但估值上已经较为便宜,如果金价走稳,仍不失为优质的投资标的;加上后续的资源注入,中金黄金有可能成为国内最优竞争力的黄金公司,是需要持续关注的投资品种。 | 1.88 | 2.35 | ---- | ------ |

| 广发证券 | 2008/09/09 | 买入 | 尽管美元反弹仍可能影响金价波动而导致公司股价仍短期内有一定下跌的可能,但我们认为公司作为国内最有潜力的黄金矿业公司,未来资产注入前景明确、矿产金产量不断提高,具有较强的投资价值。从估值上看,公司当前股价明显被低估。 | 1.87 | 2.18 | 2.26 | 37.00 |

| 银河证券 | 2008/09/18 | 中性 | 虽然目前的克金成本在行业内处于较高水平,随着金矿规模和品位提高生产成本将下降,但由于金矿的收购成本提高,判断公司的克金成本将保持在120 元/克左右。经济基本面、固定基期与多基期的PPP 模型、美元低估的环境发生变化这些因素都说明美元兑欧元进入升值周期,美元汇率反转引黄金价格进入下行周期,预测2008、2009、2010 年的金均价为190、170、160 元/克,在黄金价格难以走强的大背景下可能会出现事件驱动的阶段性上涨。 | 1.56 | 1.49 | 1.58 | 28.62 |

| 业绩预测与估值的均值(元) | 1.795 | 2.175 | 1.92 | 32.81 | |||

| 目前股价的动态市盈率(倍) | 16.19 | 13.36 | 15.14 | ||||

| 风 险 提 示 | |||||||

| (1)国际黄金价格波动带来利润率变化;(2)如果美元走强会影响国际金峡下跌。 |