借助于股改的机会,使得三九医药这个医药行业的巨无霸彻底摆脱了历史债务问题的包袱而重新焕发青春,并借助华润医药的大平台重新进入成长的轨道中。

同时,作为OCT医药的行业龙头,三九医药已经成为机构投资者资产配置方案中必须关注的重点公司,这决定着该公司的估值水平很难出现超低的状态。这也意味着随着后期机构投资者对其加大配置力度,该股较长时间内可能会出现抗跌,在滞涨的行情局势下,该股的防御性特点比较突出。

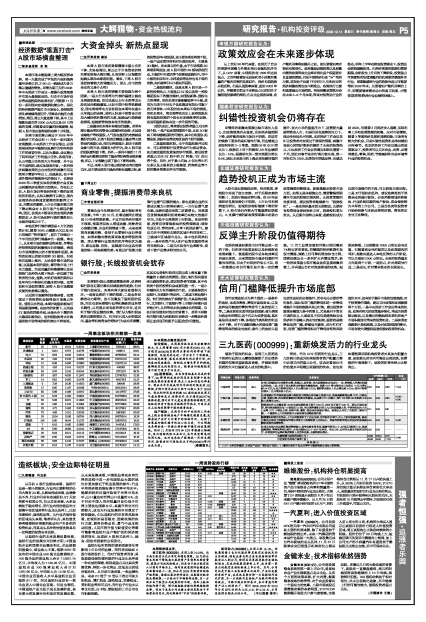

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) | ||

| 08年 | 09年 | 10年 | |||||

| 中信证券 | 2008/12/09 | 买入 | 公司已经摆脱历史问题的束缚,发展迈入新阶段。两大因素助推公司成长:一是,销售投入的增加和模式的转变;二是,来自于四大制药业务模块的健康发展。预测OCT事业部未来三年将从14亿元增长到24亿亿元;处方药事业部从2亿元增长到5亿元;普药事业部从2亿元增长到5亿元;现代中药事业部从1亿元增长到3亿元。 | 0.50 | 0.65 | 0.80 | 17.54 |

| 申银万国 | 2008/12/05 | 增持 | 公司被确定为华润医药品牌中药制造与销售业务的核心发展平台,发展战略聚焦品牌OTC、中药处方药、免煎中药、抗生素及普药四大制药业务模块,以品牌OTC 为核心,预计08年和09年制药主业收入各增长20%。 | 0.50 | 0.65 | 0.80 | 16.30~ 16.90 |

| 国金证券 | 2008/12/05 | 买入 | 控股股东作出业绩承诺:2008年度每股收益不低于0.50元,2009年不低于0.65 元,若达不到此承诺,将向流通股股东每10股追送0.3 股。经过债务重组后的三九已经是健康之身,今明两年四大主业(品牌OTC、中药处方药、免煎中药、普药)都会呈现恢复性增长。医药巨头存在了再发第二春的可能,一个健康的三九在医药股中具备很高的战略配置价值。 | 0.51 | 0.65 | 0.81 | ----- |

| 东海证券 | 2008/12/10 | 增持 | 随着重组和清欠的完成,上市公司彻底卸下了历史包袱,在华润的引领下,步入了新的发展阶段。股改方案充分体现了控股股东带领公司致力于发展制药主业的决心,相信华润将带给公司更好的发展战略和更高的运营效率。 | 0.52 | 0.67 | 0.75 | 15.30 |

| 海通证券 | 2008/12/04 | 买入 | 公司具有强大的品牌和渠道管理能力,竞争优势非常明显,随着华润的入主,公司回归制药主业,发展战略清晰,管理效率得以提升,公司业绩拐点已于2007年呈现。未来几年,公司在大股东华润的支持下,有望发挥在品牌和渠道管理上的竞争优势,业绩将较快增长。 | 0.50 | 0.65 | ---- | ----- |

| 业绩预测与估值的均值(元) | 0.506 | 0.654 | 0.79 | 16.48 | |||

| 目前股价的动态市盈率(倍) | 26.90 | 20.81 | 17.23 | ||||

| 风 险 提 示 | |||||||

| (1)OCT业务竞争激烈,公司新产品推广情况低于预期;(2)重要注射剂不良反应事件可能影响到公司处方药销售。 |