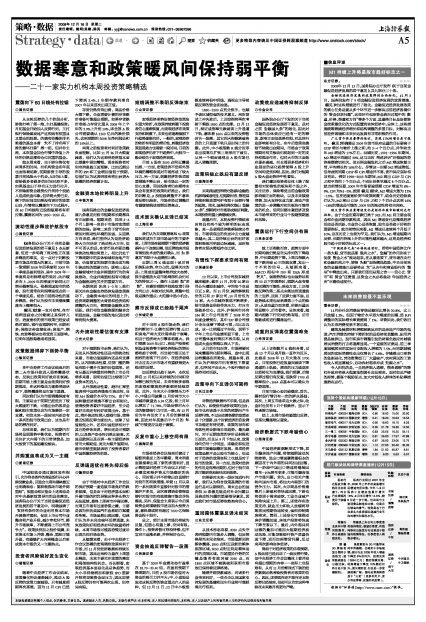

| 板块 | 市场表现 | 调研结论 | 评级/ | 关注个股 |

| 医药 | 医药行在医改方案临近出台刺激下,昨日行业表现再度居于涨幅前列。 | 医药行业经过2007年全年、2008年上半年的高速增长后增速有所回落:今年1-9月医药工业增加值累计增长18%,9月单月增长14.6%,较8月进一步下滑。但和其它主要消费品制造业比较,仍显示出较高的景气,特别是各子行业龙头大多表现出超越行业平均的增长和盈利水平。 | 长城 | 桐君阁 业 | 证券 鱼跃医疗

| 传媒 | 传媒行业具有不错的防御性,昨日表现依然良好。 | 传媒类上市公司三季度盈利保持稳定,展望四季度,有线网络和出版发行行业受益于较强的防御特征,四季度收入将稳步增长。 | 国信 | 粤传媒 业 | 证券 博瑞传播

| 通信 | 随着3G牌照发放日期的日益临近,通信股表现也日趋活跃,昨日处于涨幅前列。 | 虽然重组与3G可能带来两年阵痛期,但将好于市场预期。预计行业2009年收入增速下降至9%后回升;投资见顶(2834亿元)随后持续回落;利润增速下降至10%随后回升。就长期而言,行业进一步发展前景广阔,国内运营商将得益于“三更”(更多的用户、更少的运营商、更温和的监管)。 | 国海 | 中兴通讯 业 | 证券 中卫国脉