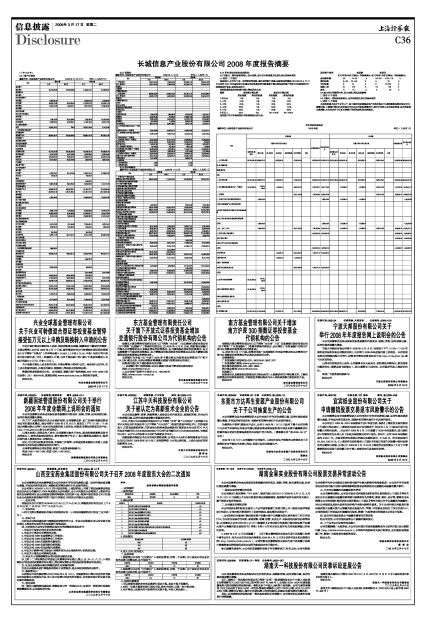

9.2.1 资产负债表

编制单位:长城信息产业股份有限公司 2008年12月31日 单位:(人民币)元

| 项目 | 期末余额 | 年初余额 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 流动资产: | ||||

| 货币资金 | 421,134,096.30 | 205,348,408.65 | 274,866,614.17 | 151,530,389.41 |

| 结算备付金 | ||||

| 拆出资金 | ||||

| 交易性金融资产 | ||||

| 应收票据 | 14,305,081.73 | 19,566,916.52 | 3,718,682.00 | |

| 应收账款 | 184,284,729.89 | 43,204,824.62 | 272,920,379.32 | 123,503,871.18 |

| 预付款项 | 54,495,146.83 | 6,096,692.11 | 53,817,592.50 | 22,286,400.35 |

| 应收保费 | ||||

| 应收分保账款 | ||||

| 应收分保合同准备金 | ||||

| 应收利息 | ||||

| 应收股利 | 1,549,729.59 | 24,141,998.37 | 1,549,729.59 | 24,141,998.37 |

| 其他应收款 | 12,639,238.76 | 21,699,934.17 | 37,138,778.62 | 55,391,310.95 |

| 买入返售金融资产 | ||||

| 存货 | 179,956,437.07 | 228.13 | 230,027,740.64 | 6,711,559.60 |

| 一年内到期的非流动资产 | ||||

| 其他流动资产 | ||||

| 流动资产合计 | 868,364,460.17 | 300,492,086.05 | 889,887,751.36 | 387,284,211.86 |

| 非流动资产: | ||||

| 发放贷款及垫款 | ||||

| 可供出售金融资产 | ||||

| 持有至到期投资 | ||||

| 长期应收款 | ||||

| 长期股权投资 | 315,776,352.38 | 681,780,596.35 | 334,148,567.70 | 722,089,681.44 |

| 投资性房地产 | 14,579,542.00 | 14,579,542.00 | 14,942,548.00 | 14,942,548.00 |

| 固定资产 | 102,190,834.16 | 52,340,812.95 | 154,900,476.56 | 103,462,790.34 |

| 在建工程 | 54,514,435.07 | 52,362,254.68 | 7,963,354.43 | 4,859,520.00 |

| 工程物资 | ||||

| 固定资产清理 | ||||

| 生产性生物资产 | ||||

| 油气资产 | ||||

| 无形资产 | 47,930,535.01 | 43,114,252.60 | 118,452,705.14 | 111,984,872.30 |

| 开发支出 | 795,200.73 | 244,927.19 | ||

| 商誉 | ||||

| 长期待摊费用 | 1,140,690.10 | |||

| 递延所得税资产 | 22,802,491.88 | 24,851,936.13 | 35,620,453.65 | 17,077,271.92 |

| 其他非流动资产 | ||||

| 非流动资产合计 | 558,589,391.23 | 869,029,394.71 | 667,413,722.77 | 974,416,684.00 |

| 资产总计 | 1,426,953,851.40 | 1,169,521,480.76 | 1,557,301,474.13 | 1,361,700,895.86 |

| 流动负债: | ||||

| 短期借款 | 17,800,000.00 | 120,800,000.00 | 90,000,000.00 | |

| 向中央银行借款 | ||||

| 吸收存款及同业存放 | ||||

| 拆入资金 | ||||

| 交易性金融负债 | ||||

| 应付票据 | 13,868,114.00 | 2,728,850.00 | 30,000,000.00 | 46,591,359.47 |

| 应付账款 | 164,200,180.87 | 16,762,856.59 | 219,139,351.71 | 40,476,758.52 |

| 预收款项 | 9,012,767.00 | 2,848,567.90 | 130,688,583.39 | 117,427,654.07 |

| 卖出回购金融资产款 | ||||

| 应付手续费及佣金 | ||||

| 应付职工薪酬 | 19,475,024.52 | 5,357,466.96 | 22,786,636.76 | 4,392,426.16 |

| 应交税费 | 8,046,982.10 | -1,042,485.47 | 1,142,056.61 | 585,958.56 |

| 应付利息 | ||||

| 应付股利 | 381,532.00 | 381,532.00 | ||

| 其他应付款 | 46,923,717.39 | 118,179,561.12 | 83,715,764.35 | 185,028,100.39 |

| 应付分保账款 | ||||

| 保险合同准备金 | ||||

| 代理买卖证券款 | ||||

| 代理承销证券款 | ||||

| 一年内到期的非流动负债 | 2,880,033.97 | |||

| 其他流动负债 | ||||

| 流动负债合计 | 282,588,351.85 | 144,834,817.10 | 608,653,924.82 | 484,502,257.17 |

| 非流动负债: | ||||

| 长期借款 | 2,668,231.33 | |||

| 应付债券 | ||||

| 长期应付款 | ||||

| 专项应付款 | 19,400,000.00 | 450,000.00 | ||

| 预计负债 | ||||

| 递延所得税负债 | 2,075,798.28 | 2,075,798.28 | ||

| 其他非流动负债 | 158,560,800.00 | 158,560,800.00 | 2,120,000.00 | |

| 非流动负债合计 | 177,960,800.00 | 158,560,800.00 | 7,314,029.61 | 2,075,798.28 |

| 负债合计 | 460,549,151.85 | 303,395,617.10 | 615,967,954.43 | 486,578,055.45 |

| 所有者权益(或股东权益): | ||||

| 实收资本(或股本) | 375,562,170.00 | 375,562,170.00 | 250,374,780.00 | 250,374,780.00 |

| 资本公积 | 421,703,569.08 | 422,838,943.76 | 548,380,237.13 | 548,026,333.76 |

| 减:库存股 | ||||

| 盈余公积 | 61,913,991.10 | 35,808,553.48 | 60,309,940.97 | 34,204,503.35 |

| 一般风险准备 | ||||

| 未分配利润 | 64,171,683.31 | 31,916,196.42 | 27,336,055.40 | 42,517,223.30 |

| 外币报表折算差额 | ||||

| 归属于母公司所有者权益合计 | 923,351,413.49 | 866,125,863.66 | 886,401,013.50 | 875,122,840.41 |

| 少数股东权益 | 43,053,286.06 | 54,932,506.20 | ||

| 所有者权益合计 | 966,404,699.55 | 866,125,863.66 | 941,333,519.70 | 875,122,840.41 |

| 负债和所有者权益总计 | 1,426,953,851.40 | 1,169,521,480.76 | 1,557,301,474.13 | 1,361,700,895.86 |

9.2.2 利润表

编制单位:长城信息产业股份有限公司 2008年1-12月 单位:(人民币)元

| 项目 | 本期金额 | 上期金额 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、营业总收入 | 776,875,565.05 | 73,403,054.58 | 769,540,017.01 | 220,815,074.92 |

| 其中:营业收入 | 776,875,565.05 | 73,403,054.58 | 769,540,017.01 | 220,815,074.92 |

| 利息收入 | ||||

| 已赚保费 | ||||

| 手续费及佣金收入 | ||||

| 二、营业总成本 | 805,860,500.42 | 164,783,614.25 | 720,141,121.73 | 247,373,583.59 |

| 其中:营业成本 | 618,481,752.23 | 62,695,084.23 | 594,939,958.50 | 204,675,075.21 |

| 利息支出 | ||||

| 手续费及佣金支出 | ||||

| 退保金 | ||||

| 赔付支出净额 | ||||

| 提取保险合同准备金净额 | ||||

| 保单红利支出 | ||||

| 分保费用 | ||||

| 营业税金及附加 | 2,348,679.39 | 1,380,486.03 | 3,975,030.09 | 2,367,616.74 |

| 销售费用 | 54,238,451.80 | 227,833.02 | 52,698,919.39 | 4,057,530.96 |

| 管理费用 | 79,985,678.00 | 34,545,409.30 | 54,129,370.20 | 27,234,049.53 |

| 财务费用 | 1,878,328.65 | 11,602.80 | 8,430,697.99 | 2,764,844.03 |

| 资产减值损失 | 48,927,610.35 | 65,923,198.87 | 5,967,145.56 | 6,274,467.12 |

| 加:公允价值变动收益(损失以“-”号填列) | ||||

| 投资收益(损失以“-”号填列) | 14,506,198.94 | 60,229,407.75 | 16,492,994.28 | 10,773,417.77 |

| 其中:对联营企业和合营企业的投资收益 | -17,992,215.32 | -17,992,215.32 | 19,357,062.18 | 19,241,565.69 |

| 汇兑收益(损失以“-”号填列) | ||||

| 三、营业利润(亏损以“-”号填列) | -14,478,736.43 | -31,151,151.92 | 65,891,889.56 | -15,785,090.90 |

| 加:营业外收入 | 104,710,914.00 | 39,446,970.82 | 23,456,332.22 | 753,818.84 |

| 减:营业外支出 | 3,633,617.99 | 2,105,780.14 | 17,780,602.07 | 4,975,592.12 |

| 其中:非流动资产处置损失 | 579,578.63 | 146,106.91 | 143,910.49 | 12,280.00 |

| 四、利润总额(亏损总额以“-”号填列) | 86,598,559.58 | 6,190,038.76 | 71,567,619.71 | -20,006,864.18 |

| 减:所得税费用 | 19,694,039.74 | -9,850,462.49 | 6,737,564.38 | -1,627,858.68 |

| 五、净利润(净亏损以“-”号填列) | 66,904,519.84 | 16,040,501.25 | 64,830,055.33 | -18,379,005.50 |

| 归属于母公司所有者的净利润 | 63,477,156.04 | 16,040,501.25 | 56,331,574.02 | -18,379,005.50 |

| 少数股东损益 | 3,427,363.80 | 8,498,481.31 | ||

| 六、每股收益: | ||||

| (一)基本每股收益 | 0.1690 | 0.1500 | ||

| (二)稀释每股收益 | 0.1690 | 0.1500 | ||

9.2.3 现金流量表

编制单位:长城信息产业股份有限公司 2008年1-12月 单位:(人民币)元

| 项目 | 本期金额 | 上期金额 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、经营活动产生的现金流量: | ||||

| 销售商品、提供劳务收到的现金 | 882,647,036.99 | 111,653,311.83 | 753,708,480.95 | 243,254,762.21 |

| 客户存款和同业存放款项净增加额 | ||||

| 向中央银行借款净增加额 | ||||

| 向其他金融机构拆入资金净增加额 | ||||

| 收到原保险合同保费取得的现金 | ||||

| 收到再保险业务现金净额 | ||||

| 保户储金及投资款净增加额 | ||||

| 处置交易性金融资产净增加额 | ||||

| 收取利息、手续费及佣金的现金 | ||||

| 拆入资金净增加额 | ||||

| 回购业务资金净增加额 | ||||

| 收到的税费返还 | 6,858,934.61 | 3,231,960.38 | 1,390,149.03 | |

| 收到其他与经营活动有关的现金 | 108,541,190.98 | 105,814,197.35 | 43,036,788.37 | 22,722,635.21 |

| 经营活动现金流入小计 | 998,047,162.58 | 217,467,509.18 | 799,977,229.70 | 267,367,546.45 |

| 购买商品、接受劳务支付的现金 | 676,989,031.43 | 101,086,453.06 | 584,517,263.40 | 198,221,332.78 |

| 客户贷款及垫款净增加额 | ||||

| 存放中央银行和同业款项净增加额 | ||||

| 支付原保险合同赔付款项的现金 | ||||

| 支付利息、手续费及佣金的现金 | ||||

| 支付保单红利的现金 | ||||

| 支付给职工以及为职工支付的现金 | 80,116,234.35 | 15,294,647.99 | 68,353,715.71 | 15,467,559.49 |

| 支付的各项税费 | 48,483,305.79 | 26,889,194.96 | 46,007,958.99 | 26,299,704.28 |

| 支付其他与经营活动有关的现金 | 80,639,243.13 | 146,563,308.44 | 131,427,341.10 | 31,487,862.10 |

| 经营活动现金流出小计 | 886,227,814.70 | 289,833,604.45 | 830,306,279.20 | 271,476,458.65 |

| 经营活动产生的现金流量净额 | 111,819,347.88 | -72,366,095.27 | -30,329,049.50 | -4,108,912.20 |

| 二、投资活动产生的现金流量: | ||||

| 收回投资收到的现金 | 1,664,500.00 | |||

| 取得投资收益收到的现金 | 32,000,000.00 | 66,871,518.57 | 17,208,062.50 | 32,152,420.85 |

| 处置固定资产、无形资产和其他长期资产收回的现金净额 | 39,482,652.39 | 39,416,113.39 | 111,048,747.51 | 113,330,909.51 |

| 处置子公司及其他营业单位收到的现金净额 | 27,611,690.24 | |||

| 收到其他与投资活动有关的现金 | 158,560,800.00 | 158,560,800.00 | ||

| 投资活动现金流入小计 | 230,043,452.39 | 292,460,122.20 | 129,921,310.01 | 145,483,330.36 |

| 购建固定资产、无形资产和其他长期资产支付的现金 | 53,540,254.34 | 41,117,012.76 | 53,923,782.82 | 45,191,719.95 |

| 投资支付的现金 | ||||

| 质押贷款净增加额 | ||||

| 取得子公司及其他营业单位支付的现金净额 | 8,343,288.18 | 8,343,288.18 | 82,773,506.24 | 231,273,506.24 |

| 支付其他与投资活动有关的现金 | 1,131,849.23 | |||

| 投资活动现金流出小计 | 61,883,542.52 | 49,460,300.94 | 137,829,138.29 | 276,465,226.19 |

| 投资活动产生的现金流量净额 | 168,159,909.87 | 242,999,821.26 | -7,907,828.28 | -130,981,895.83 |

| 三、筹资活动产生的现金流量: | ||||

| 吸收投资收到的现金 | ||||

| 其中:子公司吸收少数股东投资收到的现金 | ||||

| 取得借款收到的现金 | 12,000,000.00 | 138,770,000.00 | 110,000,000.00 | |

| 发行债券收到的现金 | ||||

| 收到其他与筹资活动有关的现金 | 132,320,600.00 | |||

| 筹资活动现金流入小计 | 12,000,000.00 | 138,770,000.00 | 242,320,600.00 | |

| 偿还债务支付的现金 | 115,000,000.00 | 90,000,000.00 | 88,520,000.00 | 55,000,000.00 |

| 分配股利、利润或偿付利息支付的现金 | 30,583,757.41 | 26,815,706.75 | 10,161,181.86 | 3,628,959.25 |

| 其中:子公司支付给少数股东的股利、利润 | ||||

| 支付其他与筹资活动有关的现金 | 20,000,000.00 | |||

| 筹资活动现金流出小计 | 145,583,757.41 | 116,815,706.75 | 98,681,181.86 | 78,628,959.25 |

| 筹资活动产生的现金流量净额 | -133,583,757.41 | -116,815,706.75 | 40,088,818.14 | 163,691,640.75 |

| 四、汇率变动对现金及现金等价物的影响 | -128,018.21 | |||

| 五、现金及现金等价物净增加额 | 146,267,482.13 | 53,818,019.24 | 1,851,940.36 | 28,600,832.72 |

| 加:期初现金及现金等价物余额 | 274,866,614.17 | 151,530,389.41 | 273,014,673.81 | 122,929,556.69 |

| 六、期末现金及现金等价物余额 | 421,134,096.30 | 205,348,408.65 | 274,866,614.17 | 151,530,389.41 |

9.2.4 所有者权益变动表(见附表)

9.3 与最近一期年度报告相比,会计政策、会计估计和核算方法发生变化的具体说明

√ 适用 □ 不适用

报告期内,公司为了进一步控制经营风险,提升运营资产质量,根据发展的需要,经2008 年4 月17 日召开的2007 年年度股东大会通过对应收款项的坏账准备计提比率和固定资产的折旧年限和预计净残值率进行变更,具体变更如下:

应收账款和其他应收款计提比例变更对比表:

账龄 变更前计提比例 变更后计提比例

应收账款 其他应收款 应收账款 其他应收款

1年以内 5% 5% 5% 5%

1-2年 10% 5% 10% 10%

2-3年 20% 5% 30% 30%

3-4年 30% 5% 50% 50%

4-5年 30% 5% 60% 60%

5年以上 30% 5% 80-100% 80-100%

固定资产折旧年限和预计净残值率变化对比表:

固定资产类别 变更前 变更后

折旧年限 年折旧率(%) 净残值率(%) 折旧年限 年折旧率(%) 净残值率(%)

房屋建筑物 40 8-20 4 20-50 4.75-1.9 5

通用设备 8-20 12-4.8 4 5 19 5

专用设备 8 12 4 8 11.875 5

运输工具 10 9.6 4 10 9.5 5

其他 8 12 4 5 19 5

9.4 重大会计差错的内容、更正金额、原因及其影响

□ 适用 √ 不适用

9.5 与最近一期年度报告相比,合并范围发生变化的具体说明

√ 适用 □ 不适用

本报告期减少合并子公司三个,其中湖南长城泰富房地产开发有限公司、深圳泰富投资有限公司已清算注销,上海湘计浦江科技有限公司已由公司组织清算完毕,期末不再纳入合并报表范围,合并期初数未做调整,本年仅合并了年初至清算日的利润表和现金流量表。

| 项目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 250,374,780.00 | 548,380,237.13 | 60,309,940.97 | 27,336,055.40 | 54,932,506.20 | 941,333,519.70 | 250,374,780.00 | 545,966,357.00 | 60,962,824.72 | -28,995,518.62 | 56,360,008.86 | 884,668,451.96 |

| 加:会计政策变更 | ||||||||||||

| 前期差错更正 | ||||||||||||

| 其他 | ||||||||||||

| 二、本年年初余额 | 250,374,780.00 | 548,380,237.13 | 60,309,940.97 | 27,336,055.40 | 54,932,506.20 | 941,333,519.70 | 250,374,780.00 | 545,966,357.00 | 60,962,824.72 | -28,995,518.62 | 56,360,008.86 | 884,668,451.96 |

| 三、本年增减变动金额(减少以“-”号填列) | 125,187,390.00 | -126,676,668.05 | 1,604,050.13 | 36,835,627.91 | -11,879,220.14 | 25,071,179.85 | 2,413,880.13 | -652,883.75 | 56,331,574.02 | -1,427,502.66 | 56,665,067.74 | |

| (一)净利润 | 63,477,156.04 | 3,427,363.80 | 66,904,519.84 | 56,331,574.02 | 8,498,481.31 | 64,830,055.33 | ||||||

| (二)直接计入所有者权益的利得和损失 | -1,489,278.05 | -1,489,278.05 | 2,413,880.13 | -652,883.75 | 1,760,996.38 | |||||||

| 1.可供出售金融资产公允价值变动净额 | ||||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | ||||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||||||||

| 4.其他 | -1,489,278.05 | -1,489,278.05 | 2,413,880.13 | -652,883.75 | 1,760,996.38 | |||||||

| 上述(一)和(二)小计 | -1,489,278.05 | 63,477,156.04 | 3,427,363.80 | 65,415,241.79 | 2,413,880.13 | -652,883.75 | 56,331,574.02 | 8,498,481.31 | 66,591,051.71 | |||

| (三)所有者投入和减少资本 | -13,973,852.18 | -13,973,852.18 | -9,925,983.97 | -9,925,983.97 | ||||||||

| 1.所有者投入资本 | -4,520,000.00 | -4,520,000.00 | ||||||||||

| 2.股份支付计入所有者权益的金额 | ||||||||||||

| 3.其他 | -13,973,852.18 | -13,973,852.18 | -5,405,983.97 | -5,405,983.97 | ||||||||

| (四)利润分配 | 1,604,050.13 | -26,641,528.13 | -1,332,731.76 | -26,370,209.76 | ||||||||

| 1.提取盈余公积 | 1,604,050.13 | -1,604,050.13 | ||||||||||

| 2.提取一般风险准备 | ||||||||||||

| 3.对所有者(或股东)的分配 | -25,037,478.00 | -1,332,731.76 | -26,370,209.76 | |||||||||

| 4.其他 | ||||||||||||

| (五)所有者权益内部结转 | 125,187,390.00 | -125,187,390.00 | ||||||||||

| 1.资本公积转增资本(或股本) | 125,187,390.00 | -125,187,390.00 | ||||||||||

| 2.盈余公积转增资本(或股本) | ||||||||||||

| 3.盈余公积弥补亏损 | ||||||||||||

| 4.其他 | ||||||||||||

| 四、本期期末余额 | 375,562,170.00 | 421,703,569.08 | 61,913,991.10 | 64,171,683.31 | 43,053,286.06 | 966,404,699.55 | 250,374,780.00 | 548,380,237.13 | 60,309,940.97 | 27,336,055.40 | 54,932,506.20 | 941,333,519.70 |

编制单位:长城信息产业股份有限公司 2008年度 单位:(人民币)元

所有者权益变动表