吉林华微电子股份有限公司

第三届董事会第二十九次会议

决议公告

本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。

吉林华微电子股份有限公司董事会于2009年3月16日以发出召开第三届董事会第二十九次会议通知,分别以送达、发送电子邮件及电话通知的方式通知了各位董事。根据《公司章程》和公司《董事会议事规则》的有关规定,公司董事会于2009年3月26 日召开了第三届董事会第二十九次会议,会议应到董事9名,实到董事9名。公司监事及高级管理人员列席了会议。会议符合《公司法》、《公司章程》、《董事会议事规则》的有关规定。会议审议并一致通过了如下决议:

一、审议通过了《2008年度董事会工作报告》。

同意9票,反对0票,弃权0票。

二、审议通过了《2008年度公司财务决算报告》。

同意9票,反对0票,弃权0票。

三、审议通过了《2008年度报告》及其摘要。

同意9票,反对0票,弃权0票。

《吉林华微电子股份有限公司2008年年度报告及摘要》详见上海证券交易所网站(http://www.sse.com.cn)

四、审议通过了《2008年度利润分配预案》。

同意9票,反对0票,弃权0票。

经上海众华沪银会计师事务所有限公司审计,2008 年度公司实现归属于母公司股东的净利润55,850,317.63元;公司(母公司数)的净利润43,059,366.18元,按照《公司章程》的规定,提取法定盈余公积金4,305,936.62元;加上年度初未分配利润433,322,133.49元,累计可供股东分配的利润为484,866,514.50元。

公司董事会决定 2008 年度不进行现金分配,不进行资本公积金转增股本。

2009 年将是公司极富挑战性,也是充满机遇的一年,面对复杂多变且异常艰难的宏观经济环境,公司将投入大量资金加快新型功率半导体器件项目的产业化进程,使之成为公司新的效益增长点;同时,加大研发经费的投入,继续开发有市场前景的新项目,为实现公司健康可持续发展提供技术和产品储备。因此公司 2009 年资金需求量较大,为了保证公司度过难关、更好地经营、发展,拟2009 年不进行现金分配,不进行资本公积金转增股本。

五、审议通过了《关于续聘上海众华沪银会计师事务所为公司审计机构的议案》。

同意9票,反对0票,弃权0票。

鉴于上海众华沪银会计师事务所有限公司作为公司聘请的1999年度至2008年度审计机构,对审计工作勤勉尽责,坚持公允、客观的态度进行独立审计,是一家执业经验丰富、资质信誉良好的审计机构,根据公司董事会审计委员会的提名,拟续聘上海众华沪银会计师事务所有限公司为本公司2009年度财务报告审计服务机构,对本公司会计报表进行审计,期限为一年。

六、审议通过了《关于公司2009年度银行授信额度的提案,并授权公司董事长在额度内签署有关贷款协议的议案》。

同意9票,反对0票,弃权0票。

根据公司2009年生产经营和持续发展的需要,决定公司2009年度向工商银行、农业银行、建设银行、吉林银行、浦发银行等金融机构申请总额不超过75,000万元的银行贷款授信额度,年度短期贷款累计在该总额以内不再逐项提请董事会审批,授权董事长全权负责审批事宜。

七、审议通过了《关于为相关控股子公司提供担保的议案》。

同意9票,反对0票,弃权0票。

八、审议通过了《公司2008年度计提资产减值准备的议案》。

同意9票,反对0票,弃权0票。

根据《企业会计准则》的有关规定及公司实际情况,公司2008年度对存在减值迹象的资产进行了资产减值准备的计提,计提的主要项目有:

1、公司对母公司及下属子公司的应收款项进行了帐龄及可回收情况的分析,对应收款项按帐龄及个别认定的方法进行了坏帐准备的计提,本期共计计提坏帐准备21,720,718.60元;

2、公司对母公司及下属子公司的存货进行了分析,并对当前存货价值与存货的可变现净值进行了比较,对于存货帐面价值低于可变现净值的存货进行了存货跌价准备的计提,本期共计计提存货跌价准备10,879,576.75元;

3、公司对商誉进行了估值,本期根据估值情况对商誉计提商誉减值准备5,584,283.47元。

公司累计计提资产减值准备情况如下:

单位:元

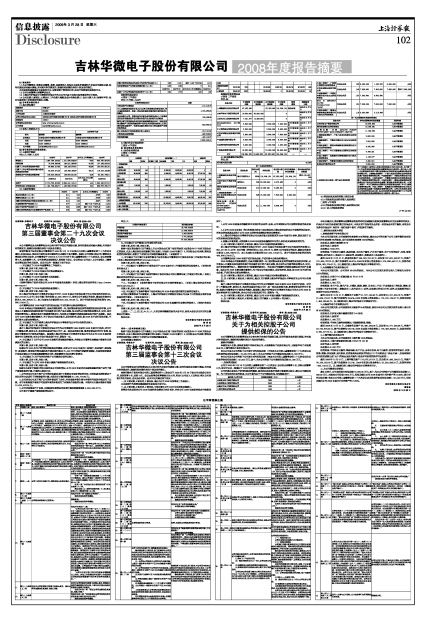

■

九、审议通过了关于修改《公司章程》的议案。

同意9票,反对0票,弃权0票。

根据中国证监会颁布《关于修改上市公司现金分红若干规定的决定》(证监会令57号)有关现金分红的规定,以及上海证券交易所新修订的《股票上市规则(2008年修订)》,同时结合公司决策、管理及经营的实际情况,特制订了对现行公司章程的修改意见。(详见附件1)

十、审议通过了关于修订《吉林华微电子股份有限公司董事会审计委员会年报工作规程》的议案。(详见上海证券交易所网站www.sse.com.cn)

同意9票,反对0票,弃权0票。

十一、审议通过了《董事会审计委员会关于2008年度审计工作履职情况的总结报告》。(详细内容见年报全文)

同意9票,反对0票,弃权0票。

十二、审议通过了关于修订《吉林华微电子股份有限公司独立董事年报工作制度》的议案。(详见上海证券交易所网站www.sse.com.cn)

同意9票,反对0票,弃权0票。

十三、审议通过了《吉林华微电子股份有限公司内部控制制度》。(详见上海证券交易所网站www.sse.com.cn)

同意9票,反对0票,弃权0票。

十四、审议通过了《吉林华微电子股份有限公司2008年度内部控制的自我评估报告》。

公司独立董事发表了同意意见,上海众华沪银会计师事务所有限公司出具了内控制度自我评估报告核实评价意见。(详见年报全文)

同意9票,反对0票,弃权0票。

十五、审议通过了《吉林华微电子股份有限公司2008年度履行社会责任的报告》。(详细内容见年报全文)

同意9票,反对0票,弃权0票。

上述第一、二、三、四、五、六、七、八、九项议案均需提交股东大会审议,股东大会会议召开时间由董事会另行通知。

特此公告。

吉林华微电子股份有限公司

董 事 会

2009年3月26日

附件一:《公司章程修正案》

根据中国证监会颁布《关于修改上市公司现金分红若干规定的决定》(证监会令57号)有关现金分红的规定,以及上海证券交易所新修订的《股票上市规则(2008年修订)》,同时结合公司决策、管理及经营的实际情况,特制订了对现行公司章程的修改意见。

公司章程修正案(附后)

证券简称:华微电子 证券代码:600360 编号:临 2009-005

吉林华微电子股份有限公司

第三届监事会第十三次会议

决议公告

本公司监事会及全体监事保证本公告内容不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。

吉林华微电子股份有限公司第三届监事会第十三次会议于2009年3月26日在公司本部会议室召开,应到监事3名,实到3名。会议由监事会监事费杨先生主持,符合《公司法》、《证券法》和《公司章程》的有关规定,会议合法有效。会议审议并通过如下决议:

一、以3票同意,0票反对,0票弃权,通过《公司2008年监事会工作报告》。

本议案将作为监事会提案提交年度股东大会审议。

二、以3票同意,0票反对,0票弃权,审核同意《公司2008年年报告及摘要》。

监事会全体成员对公司2008年度经营业绩表示充分肯定,并对公司2008年度报告发表审核意见如下:

1、公司2008年度报告的编制和审议程序符合法律、法规、公司章程和公司内部管理制度的各项规定;

2、《公司2008年年报》的内容和格式符合中国证监会和上海证券交易所及公司章程的相关规定,所包含的信息真实反映了公司2008年的经营业绩和财务状况等事项;

3、上海众华沪银会计师事务所有限公司出具标准无保留意见的2008 年度审计报告,真实反映了公司的财务状况和经营成果;

4、在提出本意见前,未发现参与2008年年度报告编制和审议的人员有违反保密规定的行为。

三、以3票同意,0票反对,0票弃权,通过《2008年度利润分配预案》。

经上海众华沪银会计师事务所有限公司审计,2008 年度公司实现归属于母公司股东的净利润55,850,317.63元;公司(母公司数)的净利润43,059,366.18元,按照《公司章程》的规定,提取法定盈余公积金4,305,936.62元;加上年度初未分配利润433,322,133.49元,累计可供股东分配的利润为484,866,514.50元。

公司董事会决定 2008 年度不进行现金分配,不进行资本公积金转增股本。

2009 年将是公司极富挑战性,也是充满机遇的一年,面对复杂多变且异常艰难的宏观经济环境,公司将投入大量资金加快新型功率半导体器件项目的产业化进程,使之成为公司新的效益增长点;同时,加大研发经费的投入,继续开发有市场前景的新项目,为实现公司健康可持续发展提供技术和产品储备。因此公司 2009 年资金需求量较大,为了保证公司度过难关、更好地经营、发展,拟2009 年不进行现金分配,不进行资本公积金转增股本。

四、以3票同意,0票反对,0票弃权,通过《2008年度公司财务决算报告》。

五、以3票同意,0票反对,0票弃权,通过《关于续聘上海众华沪银会计师事务所为公司审计机构的议案》。

鉴于上海众华沪银会计师事务所有限公司作为公司聘请的1999年度至2008年度审计机构,对审计工作勤勉尽责,坚持公允、客观的态度进行独立审计,是一家执业经验丰富、资质信誉良好的审计机构,根据公司董事会审计委员会的提名,拟续聘上海众华沪银会计师事务所有限公司为本公司2009年度财务报告审计服务机构,对本公司会计报表进行审计,期限为一年。

六、以3票同意,0票反对,0票弃权,通过《公司2008年度计提资产减值准备的议案》。

七、以3票同意,0票反对,0票弃权,通过《关于修改<公司章程>的议案》。

特此公告。

吉林华微电子股份有限公司

监 事 会

2009年3月26日

证券简称:华微电子 证券代码:600360 编号:临 2009-006

吉林华微电子股份有限公司

关于为相关控股子公司

提供担保的公告

本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。

重要内容提要:

●被担保人名称:吉林麦吉柯半导体有限公司、大连海微电子经贸有限公司、无锡吉华电子有限责任公司、上海华微电子股份有限公司;

●本公司及本公司控股子公司累计对外担保总额(不包含本公司第三届董事会第二十九次会议决议批准的各项担保金额):19,900万元;其中,为本公司控股子公司提供担保总额12,900万元;

●本公司及本公司控股子公司累计对外担保总额(包含本公司第三届董事会第二十九次会议决议批准的各项担保金额):32,000万元;其中,为本公司控股子公司提供担保总额25,000万元。

一、担保情况概述

公司于2009年3月26日召开第三届董事会第二十九次会议,会议应出席董事9名,实际出席董事9名,会议审议并一致通过了2008年度为子公司提供担保的议案。

公司所属企业因生产经营和发展的需要,拟向相关商业银行贷款与签署相关协议,需本公司提供担保。为了支持这些企业的发展,本公司拟为以下子公司提供担保,担保额度如下:

■

本决议通过后,授权董事长在董事会批准的对外担保额度内组织实施董事会有关担保事项的决议,代表公司与有关商业银行签订担保合同。本决议项下担保可以合并在一份担保合同项下提供,也可分拆为多份担保合同(包括同一银行或多个银行)并在其项下提供。

二、被担保企业基本情况

1、吉林麦吉柯半导体有限公司

与本公司关联关系:公司直接持有麦吉柯92%的股权,通过本公司的全资子公司上海华微科技有限公司持有麦吉柯8%的股权,合计实益拥有麦吉柯100%的股权。

注册地点:吉林市深圳街99号

法定代表人:赵东军

注册资本:7000万元

经营范围:半导体分立器件、集成电路、电力电子器件、汽车电子器件、电子元件的设计、开发、制造与销售;技术进出口、贸易出口(国家法律、法规禁止、限制进出口商品除外)。

截至2008年12月31日,麦吉柯总资产299,823,701.42元、总负债167,922,903.67元、净资产131,900,797.75元、资产负债率为56.01%;2008年实现主营业务收入219,686,443.11元,实现净利润35,363,775.47元。以上数据已经上海众华沪银会计师事务所审计。

2、大连海微电子经贸有限公司

与本公司关联关系:公司持有96.43%的股权,与本公司无关联关系的自然人王善斌先生持有3.57%的股权。

注册地点:大连市中山区鲁迅路35号19-B号

法定代表人:秦平

注册资本:2,800万元

经营范围:电子产品、通讯产品、计算机、粮油、建材、五金化工产品(不含危险品)的批发、零售;项目投资(不含专项审批)、货物进出口、技术进出口(法律、法规禁止的项目出外;法律、法规限制的项目取得许可证后方可经营)。

截至2008年12月31日,海微电子总资产51,167,140.40元、总负债20,157,930.19元、净资产31,009,210.21元、资产负债率为39.40%;2008年实现主营业务收入115,720,125.97 元,实现净利润1,458,060.49元。以上数据已经上海众华沪银会计师事务所审计。

3、无锡吉华电子有限责任公司

与本公司关联关系:公司直接持有无锡吉华55%的股权,其他与本公司无关联关系的自然人累计持有45%的股权。

注册地点:江苏省无锡市蠡园开发区3-5地块

法定代表人:赵东军

注册资本:1,000万元

经营范围:半导体元器件封装测试;引线框架制造、销售。

截至2008年12月31日,无锡吉华总资产56,495,263.08元、总负债32,771,393.08元、净资产23,723,870.00元、资产负债率为58.01%;2008年实现主营业务收入118,458,849.82元,实现净利润9,780,371.73元。以上数据已经上海众华沪银会计师事务所审计。

4、上海华微科技有限公司

与本公司关联关系:公司直接持有上海华微100%的股权。

注册地点:上海市浦东新区张江路1196/2号101室

法定代表人:张华群

注册资本:8,000万元

经营范围:半导体分立器件、集成电路、电子产品、自动化仪表、电子元器件、应用软件的设计、开发、制造、销售;实业投资、国内贸易,经营各类商品和技术的进出口(不另附进出口商品目录),但国家限定公司经营或禁止进口出口的商品及技术除外(涉及许可经营的凭许可证经营)。

截至2008年12月31日,上海华微总资产113,675,917.31元、总负债35,480,994.13元、净资产78,194,923.18 元、资产负债率为31.21%; 2008年实现主营业务收入22,020,999.10元,实现净利润-433,102.22元。以上数据已经上海众华沪银会计师事务所审计。

三、本公司提供担保情况:

截止公告日,公司实际发生担保总额19,900.00万元;其中,为本公司控股子公司提供担保总额12,900.00万元,对其他公司担保7000万元,担保总额占公司2008年度审计后净资产的13.43%;累计对外担保总额(包含本公司第三届董事会第二十九次会议决议批准的各项担保金额):32,000万元,担保总额占公司2008年度审计后净资产的21.60%。

吉林华微电子股份有限公司

董事会

2009年3月26日

公司章程修正案

| 24. | 第一百一十八条第四款第(九)项 | 罢免独立董事; | 向股东大会提议罢免独立董事; |

| 25. | 第一百二十四条第三款 | 在其后补充“公司设立信息披露事务部门,由董事会秘书负责管理,进行相关信息披露事务。” | |

| 26. | 第一百二十五条第二款 | 高级管理人员应当遵守法律、行政法规、部门规章和本章程的规定,履行诚信和勤勉的义务。本章程第九十七条关于董事的忠实义务和第九十八条(四)~(六)关于勤勉义务的规定,同时适用于高级管理人员。 | 高级管理人员应当遵守法律、行政法规、部门规章和本章程的规定,履行诚信和勤勉的义务。本章程第九十七条关于董事的忠实义务和第九十八条(四)至(八)关于勤勉义务的规定,同时适用于高级管理人员。 |

| 27. | 第一百三十三条第一款 | 公司设董事会秘书,对董事会负责。董事会秘书负责公司股东大会和董事会会议的筹备、文件保管以及公司股东资料管理,办理信息披露事务等事宜(包括但不限于:制订并执行公司信息披露制度、接待来访、回答咨询、联系股东,向投资者提供公司公开披露的资料等)。 | 公司设董事会秘书,对董事会负责。董事会秘书负责管理本公司信息披露事务部门,负责公司股东大会和董事会会议的筹备、文件保管以及公司股东资料管理等事宜(包括但不限于:制订并执行公司信息披露制度、接待来访、回答咨询、联系股东,向投资者提供公司公开披露的资料,负责公司信息对外公布,关注媒体报道并主动求证报道的真实性,组织公司董事、监事、高管进行相关法律法规培训等) |

| 28. | 第一百三十三条第四款第(3)项 | 在其后补充一项“应取得上海证券交易所颁发的《董事会秘书资格证书》。” | |

| 29. | 第一百三十三条第五款第(2)项 | 在其后补充一项“负责将定期报告草案送达公司的董事、监事、高级管理人员审阅;” 该款其他各项序号顺推。 | |

| 30. | 第一百三十三条第五款第(3)项 | 负责公司信息披露事务,保证公司信息披露的及时、准确、合法、真实和完整; | 负责公司信息对外公布,协调公司信息披露事务,组织制定公司信息披露事务管理制度,保证公司信息披露的及时、公平、准确、合法、真实和完整; 在其后补充一项“负责公司信息披露的保密工作,在未公开重大信息泄露时,及时向上海证券交易所报告并披露;” 该款其他各项序号顺推。 |

| 31. | 第一百三十三条第五款第(5)项 | 使公司董事、监事、高级管理人员明确他们应当担负的责任、应当遵守的国家有关法律、法规、政策、本章程及股票上市的证券交易所有关规定; | 组织公司董事、监事、高级管理人员进行相关法律、行政法规等的培训,使前述人员明确他们应当担负的责任、应当遵守的国家有关法律、法规、政策、本章程及股票上市的证券交易所有关规定; |

| 32. | 第一百三十三条第五款第(8)项 | 处理公司与证券管理部门、股票上市的证券交易所及投资人之间的有关事宜; | 处理公司与证券管理部门、股票上市的证券交易所、投资人及媒体等之间的有关事宜; 在其后补充三款“关注媒体报道并主动求证报道的真实性,督促公司董事会及时回复上海证券交易所问询; 负责公司股权管理事务,并负责披露公司董事、监事、高级管理人员持股变动情况; 负责向上海证券交易所进行相关事项的备案工作;” 该款其他各项序号顺推。 |

| 33. | 第一百三十三条第七款 | 在其后补充“董事会秘书被解聘或者辞职后,在未履行报告和公告义务,或未完成离任审查、档案移交等手续前,仍应承担董事会秘书的责任。” | |

| 34. | 第一百四十一条 | 监事不得利用其关联关系损害公司利益,若给公司造成损失的,应当承担赔偿责任。 | 监事应当将其与公司存在的关联关系及其变化情况及时告知公司。监事不得利用其关联关系损害公司利益,若给公司造成损失的,应当承担赔偿责任。 |

| 35. | 第一百四十四条第(一)项 | 应当对董事会编制的公司定期报告进行审核并提出书面审核意见; | 应当对董事会编制的公司定期报告进行审核并提出书面审核意见,说明定期报告编制和审核程序是否符合相关规定,内容是否真实、准确、完整; |

| 36. | 第一百五十五条 | 公司利润分配政策为:公司交纳所得税后的利润,按下列顺序分配: | 公司利润分配政策为: (1) 弥补上一年度的亏损; (一) 利润分配方式 (2) 提取利润的百分之十列入公司法定公积金; 公司采取现金或股票方式分配股利。 (3) 根据股东大会的决定提取任意公积金; (二) 利润分配原则 (4) 按照股东持有的股份比例分配并支付股东股利。 公司制订利润分配政策应关注并重视对投资者的合理投资回报,保持利润分配政策的连续性和稳定性,并符合法律、法规的相关规定。 公司法定公积金累计额为公司注册资本的百分之五十以上的,可以不再提取。公司的法定公积金不足以弥补以前年度亏损的,在依照前款规定提取法定公积金之前,应当先用当年利润弥补亏损。 | 除非因存在合理及充分的理由,董事会认为不宜进行利润分配且获股东大会批准,或者依据法律、行政法规、部门规章、交易所规范性文件及本章程规定公司不具备分配条件,否则在不影响公司正常经营、适度发展的前提下,公司原则上应向股东分配现金股利。

| 13. | 第一百零四条第二款第(二)项第(2)分项 | 具有本章程规定的独立性,即不具备本条下款所列的妨碍或可能妨碍其进行独立客观判断的关系及情形; | 具有本章程规定的独立性,即不具备本条第(四)项所列的妨碍或可能妨碍其进行独立客观判断的关系及情形; |

| 14. | 第一百零四条第二款第(二)项 | 在其后补充一项“独立董事提名人应当就下列情况对独立董事候选人进行核实并做出说明:(1)曾任职独立董事期间,未亲自出席董事会会议的;(2)曾任职独立董事期间,发表的独立意见经证实明显与事实不符的;(3)已在五家以上公司担任董事(独立董事)或高级管理人员的;(4)所任职的中介机构最近一年为该上市公司及其控股股东提供财务、法律、咨询等服务的;(5)最近三年受到本所公开谴责或二次以上通报批评的;(6)最近三年受到中国证监会及其他有关部门行政处罚的;(7)影响独立董事忠实勤勉和独立履行职责的其他情形。” 该款其他各项序号顺推。 | |

| 15. | 第一百零四条第二款第(六)项第三段 | 在其后补充“并应当在公告中表明有关独立董事的议案以上海证券交易所审核无异议为前提。对于上海证券交易所提出异议的独立董事候选人,董事会应当在股东大会上对该独立董事候选人被本所提出异议的情况作出说明,并表明不将其作为独立董事候选人提交股东大会表决。” | |

| 16. | 第一百零四条第二款第(六)项第五段 | 在其后补充一段“独立董事任职期间出现本条(三)的(1)至(4)项情形的,公司董事会应当及时向上海证券交易所报告;出现影响独立董事独立性和本条(三)的(5)(6)项情形的,公司董事会应当及时召开股东大会,并提请予以更换相关独立董事。” | |

| 17. | 第一百零四条第二款第(七)项 | 在其后补充一项“独立董事除具有《公司法》和其他相关法律、法规以及本章程赋予董事的职权外,还具有以下特别职权: 公司重大关联交易或总额高于300万元的关联交易、聘用或解聘会计师事务所,应由二分之一以上独立董事同意后,方可提交董事会讨论。独立董事向董事会提请召开临时股东大会、提议召开董事会会议和在股东大会召开前公开向股东征集投票权,应由二分之一以上独立董事同意。经二分之一以上独立董事同意后,独立董事方可独立聘请外部审计机构和咨询机构,对公司的具体事项进行审计和咨询,相关费用由公司承担。 如上述提议未被采纳或上述职权不能正常行使,公司应将有关情况予以披露。” 该款其他各项序号顺推。 | |

| 18. | 第一百零四条第二款第(八)项第(3)分项 | 在其后补充“公司股权激励计划;” 本项其他各分项序号顺推。 | |

| 19. | 第一百零四条第二款第(八)项第(4)分项 | 在其后补充“公司以集中竞价交易方式回购股份; 公司年度累计和当期对外担保情况; 公司关联方以资抵债方案;” 本项其他各分项序号顺推。 | |

| 20. | 第一百零四条第二款第(八)项第(6)分项 | 本章程规定的其它事项。 | 法律、法规及本章程规定的其它事项。 |

| 21. | 第一百零七条第(二十一)项 | 在其后补充“核查股票交易异常波动的对象、方式和结果;” 该条其他各项序号顺推。 | |

| 22. | 第一百零八条第一款 | 在其后增加一款“公司董事会应当确保公司按时披露定期报告。因故无法形成董事会审议定期报告的决议的,公司应当以董事会公告的形式对外披露相关情况,说明无法形成董事会决议的原因和存在的风险。不得披露未经董事会审议通过的定期报告。” | |

| 23. | 第一百一十条第(二)项 | 公司下列对外担保行为,须经董事会审议通过: | 依据法律、行政法规、部门规章、对公司具有约束力的证券市场业务准则和规范性文件以及本《公司章程》规定须由股东大会批准的对外担保事项,必须经董事会审议通过后,方可提交股东大会审批。 除依据法律、行政法规、部门规章和对公司具有约束力的证券市场业务准则和规范性文件以及股东大会决议应当由股东大会批准的对外担保以外的任何对外担保事项,均应由董事会审批。就具体而言,包括: 除依据法律、行政法规、部门规章、对公司具有约束力的证券市场业务准则和规范性文件以及本《公司章程》规定须由股东大会批准的对外担保以外的任何对外担保事项,须由董事会审批。 |

| 序号 | 涉及之条款项 | 修改前内容 | 修改后内容 |

| 1. | 目录第八章 | 财务、会计和审计 | 财务、会计制度、利润分配和审计 |

| 2. | 第二十八条第二款 | 在其后补充“上述人员任职期间拟买卖本公司股份的,应当按照相关规定提前报上海证券交易所备案;所持本公司股份发生变动的,应当及时向公司报告并由公司依据中国证监会的有关规章及交易所有关业务规则履行信息披露程序。” | |

| 3. | 第二十九条第一款 | 公司董事、监事、高级管理人员、持有本公司股份5%以上的股东,将其持有的本公司股票在买入后6个月内卖出,或者在卖出后6个月内又买入,由此所得收益归本公司所有,本公司董事会将收回其所得收益。但是,证券公司因包销购入售后剩余股票而持有5%以上股份的,卖出该股票不受6个月时间限制。 | 公司董事、监事、高级管理人员、持有本公司股份5%以上的股东,将其持有的本公司股票在买入后6个月内卖出,或者在卖出后6个月内又买入,由此所得收益归本公司所有,本公司董事会将收回其所得收益并及时披露相关情况。但是,证券公司因包销购入售后剩余股票而持有5%以上股份的,卖出该股票不受6个月时间限制。 |

| 4. | 第三十八条 | 持有公司5%以上有表决权股份的股东,将其持有的股份进行质押的,应当自该事实发生当日,向公司作出书面报告。 | 持有公司5%以上有表决权股份的股东,将其持有的股份进行质押的,应当于该事实发生当日,向公司作出书面报告。 在其后补充一款“持有公司5%以上有表决权股份的股东及其一致行动人、实际控制人应当及时将其与公司存在的关联关系及其变化情况告知公司。” |

| 5. | 第四十条第一款第(七)项 | 在其后补充一项“对公司以集中竞价交易方式回购股份做出决议;” 该款其他各项序号顺推。 | |

| 6. | 第四十条第二款 | 本条前款第(十三)项所述购买或者出售重大资产,不包括购买原材料、燃料和动力,以及出售产品、商品等与日常经营相关的资产购买或者出售行为,但资产置换中涉及到的此类资产购买或者出售行为仍包括在内。 | 本条前款第(十四)项所述购买或者出售重大资产,不包括购买原材料、燃料和动力,以及出售产品、商品等与日常经营相关的资产购买或者出售行为,但资产置换中涉及到的此类资产购买或者出售行为仍包括在内。 |

| 7. | 第四十一条 | 公司下列对外担保行为,须经股东大会审议通过。 | 公司下列对外担保行为,须经董事会审议通过后提交股东大会审议通过: 补充一项“按照担保金额连续十二个月内累计计算原则,超过公司最近一期经审计净资产的50%,且绝对金额超过5000万元以上;”作为本条第(六)项。 补充一项“ 对其他关联方提供的担保”作为本条第(八)项。 原本条第(五)项序号变更为第(七)项,原本条第(六)项变更为第(五)项。 |

| 8. | 第七十七条第(六)项 | 在其后补充一项“回购本公司股份”。 该条其他各项序号顺推。 | |

| 9. | 第七十九条第二款第(一)项 | 公司增加或者减少注册资本; | 删除该项。 该款其他各项序号顺推。 |

| 10. | 第七十九条第十款 | 在其后补充如下二款: “公司与关联方进行第一百九十二条第(七)2至7项所列日常关联交易时,按照下述规定进行披露和履行相应审议程序:1、已经股东大会或者董事会审议通过且正在执行的日常关联交易协议,如果执行过程中主要条款未发生重大变化的,公司应当在年度报告和中期报告中按要求披露各协议的实际履行情况,并说明是否符合协议的规定;如果协议在执行过程中主要条款发生重大变化或者协议期满需要续签的,公司应当将新修订或者续签的日常关联交易协议,根据协议涉及的总交易金额依据本章程之规定分别提交董事会或者股东大会审议,协议没有具体总交易金额的,应当提交股东大会审议;2、首次发生的日常关联交易,公司应当与关联方订立书面协议并及时披露,根据协议涉及的总交易金额依据本章程之规定分别提交董事会或者股东大会审议,协议没有具体总交易金额的,应当提交股东大会审议;该协议经审议通过并披露后,根据其进行的日常关联交易按照前项规定办理;3、每年新发生的各类日常关联交易数量较多,需要经常订立新的日常关联交易协议等,难以按照前项规定将每份协议提交董事会或者股东大会审议的,公司可以在披露上一年度报告之前,按类别对本公司当年度将发生的日常关联交易总金额进行合理预计,根据预计结果提交董事会或者股东大会审议并披露;对于预计范围内的日常关联交易,公司应当在年度报告和中期报告中予以分类汇总披露。公司实际执行中超出预计总金额的,应当根据超出量重新提请董事会或者股东大会审议并披露。” “公司与关联方签订的关联交易协议期限超过三年的,应每三年根据证券交易所上市规则和本章程的规定重新履行相关审议程序和披露义务。” | |

| 11. | 第九十八条第(五)项 | 应当对公司定期报告签署书面确认意见。保证公司所披露的信息真实、准确、完整; | 应当对公司定期报告签署书面确认意见,明确表示是否同意定期报告的内容,不得以任何理由拒绝对定期报告签署书面意见; 在其后补充一项“保证公司所披露的信息真实、准确、完整;” |

| 12. | 第九十八条第(六)项 | 在其后补充一项“应当将其与公司存在的关联关系及其变化情况及时告知公司;” 该条其他各项序号顺推。 |

| 37. | 第一百九十二条第(五)项第3分项 | 本条第(六)1项所列法人的董事、监事和高级管理人员; | 本条第(六)1项所列法人或其他组织的董事、监事和高级管理人员; |

| 38. | 第一百九十二条第(六)项 | 关联法人,是指具有以下情形之一的法人: | 关联法人,是指具有以下情形之一的法人或其他组织: 1、 直接或者间接控制公司的法人; 5、 直接或者间接控制公司的法人或其他组织; 2、 由上述第(六)1项法人直接或者间接控制的除公司及其控股子公司以外的法人; 6、 由上述第(六)1项法人直接或者间接控制的除公司及其控股子公司以外的法人或其他组织; 3、 由上述第(五)项所列的关联自然人直接或者间接控制的,或者由关联自然人担任董事、高级管理人员的除公司及其控股子公司以外的法人; 7、 由上述第(五)项所列的关联自然人直接或者间接控制的,或者由关联自然人担任董事、高级管理人员的除公司及其控股子公司以外的法人或其他组织; 4、 持有公司5%以上股份的法人; 8、 持有公司5%以上股份的法人或其他组织; 法律、行政法规、本章程规定的或股东大会根据实质重于形式的原则认定的其他与公司有特殊关联关系,可能导致公司利益对其倾斜的法人。 | 9、 法律、行政法规、本章程规定的或股东大会根据实质重于形式的原则认定的其他与公司有特殊关联关系,可能导致公司利益对其倾斜的法人或其他组织。

| 39. | 第一百九十二条第(七)项第5分项 | 在其后补充一分项“在关联方财务公司存贷款;” 该项其他各分项的序号顺推。 | |

| 40. | 第一百九十二条第(十一)项 | “重大交易”是指以公司或公司控股子公司为一方当事人发生的达到下列标准之一的交易(受赠现金资产除外): | “重大交易”是指以公司或公司控股子公司为一方当事人发生的达到下列标准之一的交易(受赠现金资产、单纯减免公司义务的债务除外): |

| 41. | 第一百九十二条第(十二)项 | “特别重大交易”是指以公司或公司的控股子公司为一方当事人发生的达到下列标准之一的交易(受赠现金资产除外): | “特别重大交易”是指以公司或公司的控股子公司为一方当事人发生的达到下列标准之一的交易(受赠现金资产、单纯减免公司义务的债务除外): |

| 42. | 第一百九十三条第(四)项 | 公司在连续十二个月内发生的交易标的相关的同类关联交易,应当按照累计计算的原则及第一百九十二条第(八)项及第(九)项所列标准认定是否属于“重大关联交易”或“特别重大关联交易”;已经按照本章程的规定履行相应的审批程序的关联交易部分,不再纳入相关的累计计算范围。 | 公司在连续十二个月内发生的与同一关联方进行的交易或与不同关联方进行的交易标的相关的同类关联交易,应当按照累计计算的原则及第一百九十二条第(八)项及第(九)项所列标准认定是否属于“重大关联交易”或“特别重大关联交易”;已经按照本章程的规定履行相应的审批程序的关联交易部分,不再纳入相关的累计计算范围。 在其后补充一段“上述同一关联方,包括与该关联方受同一法人或其他组织或者自然人直接或间接控制的,或相互存在股权控制关系;以及由同一关联自然人担任董事或高级管理人员的法人或其他组织。” |

| 43. | 第一百九十三条第(五)项 | 公司与关联方首次进行第一百九十二条第(七)2项至第(七)5项所列与日常经营相关的关联交易时,应当按照实际发生的关联交易金额或者以相关标的为基础预计的当年全年累计发生的同类关联交易总金额,并依照第一百九十二条第(八)项及第(九)项所列标准认定是否属于“重大关联交易”或“特别重大关联交易”;公司在以后年度与该关联方持续进行前述关联交易的,应当最迟于披露上一年度的年度报告时,以相关标的为基础对当年全年累计发生的同类关联交易总金额进行合理预计,并依照第一百九十二条第(八)项及第(九)项所列标准进行认定;对于上述预计总金额范围内的关联交易,如果在执行过程中其定价依据、成交价格和付款方式等主要交易条件未发生重大变化的,公司可以免于另行按“重大关联交易” 或“特别重大关联交易”再次履行审批程序;关联交易超出预计总金额、或者虽未超出预计总金额但主要交易条件发生重大变化的,公司应当重新预计当年全年累计发生的同类关联交易总额,并按本章程规定履行相应的审批程序。 | 公司与关联方因一方参与公开招标、公开拍卖等行为所导致的关联交易,公司可以向有权的机构申请豁免按照关联交易的方式进行审议和披露。 |

| 44. | 第一百九十三条第(六)项第4分项 | 任何一方参与公开招标、公开拍卖等行为所导致的关联交易。 | 删除该分项。 |