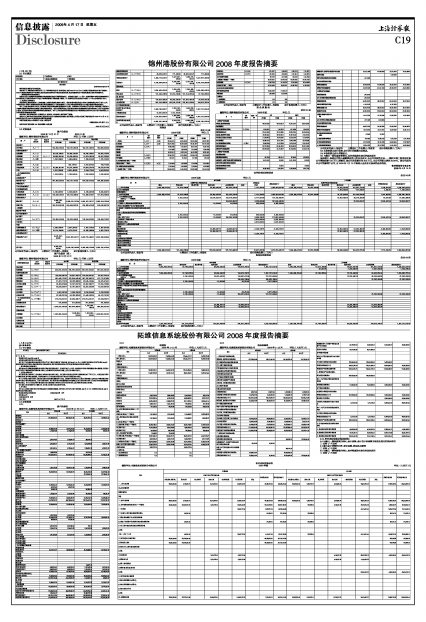

拓维信息系统股份有限公司2008年度报告摘要

2009年04月17日 来源:上海证券报 作者:

(上接C18版)

§9 财务报告

9.1 审计意见

■

9.2 财务报表

9.2.1

资产负债表

编制单位:拓维信息系统股份有限公司 2008年12月31日 单位:(人民币)元

■

9.2.2

利润表

编制单位:拓维信息系统股份有限公司 2008年1-12月 单位:(人民币)元

■

9.2.3

现金流量表

编制单位:拓维信息系统股份有限公司 2008年1-12月 单位:(人民币)元

■

■

9.2.4所有者权益变动表(见附表)

9.3 与最近一期年度报告相比,会计政策、会计估计和核算方法发生变化的具体说明

□ 适用 √ 不适用

9.4 重大会计差错的内容、更正金额、原因及其影响

□ 适用 √ 不适用

9.5 与最近一期年度报告相比,合并范围发生变化的具体说明

□ 适用 √ 不适用

| 项目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 59,865,833.00 | 2,105,205.13 | 12,760,912.22 | 90,023,967.97 | 29,489,735.28 | 194,245,653.60 | 59,865,833.00 | 1,582,219.79 | 8,614,890.24 | 54,801,951.69 | 21,995,692.56 | 146,860,587.28 |

| 加:会计政策变更 | ||||||||||||

| 前期差错更正 | ||||||||||||

| 其他 | ||||||||||||

| 二、本年年初余额 | 59,865,833.00 | 2,105,205.13 | 12,760,912.22 | 90,023,967.97 | 29,489,735.28 | 194,245,653.60 | 59,865,833.00 | 1,582,219.79 | 8,614,890.24 | 54,801,951.69 | 21,995,692.56 | 146,860,587.28 |

| 三、本年增减变动金额(减少以“-”号填列) | 20,000,000.00 | 270,867,930.36 | 2,693,125.34 | 75,669,602.22 | -22,263,198.56 | 346,967,459.36 | 522,985.34 | 4,146,021.98 | 35,222,016.28 | 7,494,042.72 | 47,385,066.32 | |

| (一)净利润 | 78,362,727.56 | 5,855,277.24 | 84,218,004.80 | 63,314,371.46 | 14,296,275.54 | 77,610,647.00 | ||||||

| (二)直接计入所有者权益的利得和损失 | 662,930.36 | 310,394.70 | 973,325.06 | 522,985.34 | 453,261.76 | 976,247.10 | ||||||

| 1.可供出售金融资产公允价值变动净额 | ||||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | 662,930.36 | 310,394.70 | 973,325.06 | 522,985.34 | 453,261.76 | 976,247.10 | ||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||||||||

| 4.其他 | ||||||||||||

| 上述(一)和(二)小计 | 662,930.36 | 78,362,727.56 | 6,165,671.94 | 85,191,329.86 | 522,985.34 | 63,314,371.46 | 14,749,537.30 | 78,586,894.10 | ||||

| (三)所有者投入和减少资本 | 20,000,000.00 | 270,205,000.00 | -28,428,870.50 | 261,776,129.50 | -355,494.58 | -355,494.58 | ||||||

| 1.所有者投入资本 | 20,000,000.00 | 270,205,000.00 | -28,428,870.50 | 261,776,129.50 | -355,494.58 | -355,494.58 | ||||||

| 2.股份支付计入所有者权益的金额 | ||||||||||||

| 3.其他 | ||||||||||||

| (四)利润分配 | 2,693,125.34 | -2,693,125.34 | 4,146,021.98 | -28,092,355.18 | -6,900,000.00 | -30,846,333.20 | ||||||

| 1.提取盈余公积 | 2,693,125.34 | -2,693,125.34 | 4,146,021.98 | -4,146,021.98 | ||||||||

| 2.提取一般风险准备 | ||||||||||||

| 3.对所有者(或股东)的分配 | ||||||||||||

| 4.其他 | -23,946,333.20 | -6,900,000.00 | -30,846,333.20 | |||||||||

| (五)所有者权益内部结转 | ||||||||||||

| 1.资本公积转增资本(或股本) | ||||||||||||

| 2.盈余公积转增资本(或股本) | ||||||||||||

| 3.盈余公积弥补亏损 | ||||||||||||

| 4.其他 | ||||||||||||

| 四、本期期末余额 | 79,865,833.00 | 272,973,135.49 | 15,454,037.56 | 165,693,570.19 | 7,226,536.72 | 541,213,112.96 | 59,865,833.00 | 2,105,205.13 | 12,760,912.22 | 90,023,967.97 | 29,489,735.28 | 194,245,653.60 |

所有者权益变动表

编制单位:拓维信息系统股份有限公司 2008年度 单位:(人民币)元