中国联通(600050):成长价值已经显现

2009年05月10日 来源:上海证券报 作者:

联通的3G业务将在5月17日开始商业性放号,宣告我国的通讯与信息行业正式进入升级状态,一石激起千层浪,包括众所关注的联通股价。3G时代的来临,对中国联通的意义是一举拉近了与其他两家通讯服务商原先的差距,并且,在某些领域反而具备了竞争优势。此外,中国联通是三大通讯服务商在A股市场中的“独苗”,必定会更加受到投资者的关爱。3G时代的来临,意味着虽然中国联通短期估值有些偏高,但长期的成长价值已经凸现,进行战略性投资已是一个好时机。

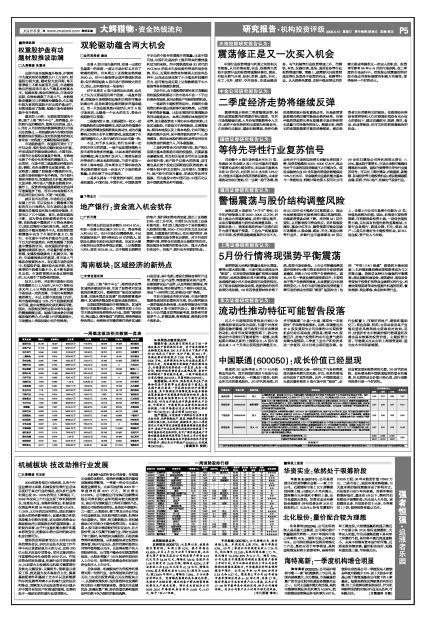

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值(元) | ||

| 09年 | 10年 | 11年 | |||||

| 国金证券 | 2009/05/06 | 买入 | 从垄断属性看,新联通WCDMA 传输快捷性与终端品种齐全的技术优势决定了公司在竞争初期具有优势。预计,09-11年新联通移动业务收入分别为677 亿元、758 亿元、905 亿元,同比增速分别为2.50%、11.90%和19.45%。 | 0.23 | 0.27 | 0.35 | 7.67 |

| 招商证券 | 2009/05/05 | 强烈推荐 | 联通ARPU 值下降空间有限,未来有望U 型反转。在5月份联通3G业务试商用后,WCDMA 网络的高速数据业务,iPhone 等明星终端的引入,低价山寨智能手机大规模进入市场,都可能使得WCDMA 网络用户数超过预期,并有望成为股价的催化剂;对公司基本面的担忧在3G运营开始之后也会逐步消除。公司具备“由弱变强”的长期投资价值,应享有通信行业最高估值。 | 0.27 | 0.28 | 0.37 | 8.10 |

| 中信证券 | 2009/05/05 | 买入 | 3G时代联通竞争力将得到根本提升,WCDMA是中国联通的未来,也是中国3G的未来,因此,可以看好联通的长期价值成长。对比中国移动,联通享有WCDMA产业链的显著优势,享有全业务资源格局、最高的3G下载速率等。随着基站数明显提升,以3G网络布局的全国推进,联通和移动的网络质量差距将逐步缩小。在增值业务带动中高端用户增多的推动下,移动业务有望迎来“价量齐升”的新时代。 | 0.25 | 0.26 | 0.33 | 8.50 |

| 安信证券 | 2009/05/02 | 买入-B | 联通5万3G基站已陆续完成建设和割接,5月17日联通将在首批55个开通3G业务的城市对友好用户限量放号启动试商用,根据用户反馈和网络及服务的完善情况,联通最晚会在9月1日大规模放号试商用。年底前,全国284个开通3G业务的城市将全部进入正式商用。联通成立了旗下3家核心3G业务公司,将于5月17日开始提供手机上网、手机音乐、手机电视、手机搜索和可视电话等应用。移动位置服务和移动支付等应用也在积极筹备中,这一模式的创新使中国3G需求将会爆发式增长。 | 0.27 | 0.37 | 0.76 | 11.06 |

| 业绩预测与估值的均值(元) | 0.255 | 0.295 | 0.453 | 8.83 | |||

| 目前股价的动态市盈率(倍) | 26.31 | 22.74 | 14.81 | ||||

| 风 险 提 示 | |||||||

| (1)宽带业务和固定增值业务受制于移动宽带业务的交叉替代与过度竞争而出现增速减缓;(2)联通的基站数在郊区和农村地区的网络覆盖较中移动差距还较大;(3)行业的竞争过度与不利政策的风险。 |