由于旅游、股权投资、房地产是公司的三大主营,中青旅的经营在去年全球金融危机中遭受影响比较明显。即使如此,该公司去年的业绩下滑程度比大多数公司要好得多。

今年,除了入境游仍有影响外,股市的回升将会使去年的浮动亏损得以冲回,而房地产市场的火爆将使公司的盈利能力大幅增强。更重要的是,明年世博会的举行,将使该公司的旅游业务、会展业务迎来增长的黄金期。因此,尽管机构投资者给予该公司的估值还比较谨慎,但无论是已有业绩给予现有估值水平的防御性,还是世博赐予的增长机会,该公司目前是明显被市场低估。

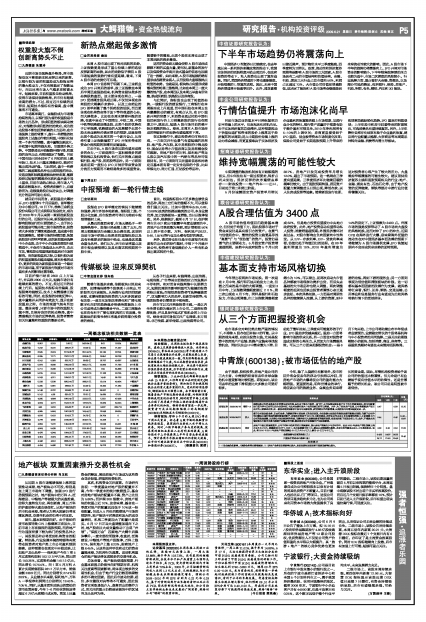

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) | ||

| 09年 | 10年 | 11年 | |||||

| 安信证券 | 2009/06/18 | 增持-A | 旅游服务之外的业务在今年的增长更加明确,去年由于资本市场的一度下行,公司投资股票业务产生了巨大的减值损失,而今年随着股市回升浮亏已经可以完全实现冲回,至此对业绩有较大干扰的风险已经可以解除。另外,为了应对房产低迷,公司将慈溪房产项目分拆为三期滚动开发,这一新变动将使得新项目在今年贡献利润,成为预期之外的新增量,从而使得今年增长幅度更进一步。 | 0.47 | 0.58 | 12.15 | |

| 国金证券 | 2009/06/07 | 买入 | 鉴于公司在会奖业务、自由行业务、乌镇景区等主营业务上的良好表现,全年旅游主业部分的盈利贡献可能超出预期;乌镇子公司作为已能独立运行发展的景区资源型资产,有望充分受益于2010 年上海世博会,并符合公司未来5 年内培育和控股2~3 家旅游上市公司的发展战略,从完善公司治理结构的考虑,乌镇存在引入战略投资者的强烈预期,在适当时机下实现分拆上市;此外,不排除未来借助资本市场平台参与旅游产业整合的可能,藉此将对公司估值提升产生积极影响。 | 0.44 | 0.46 | 12.61~13.87 | |

| 凯基证券 | 2009/06/02 | 持有 | 房地产市场近期逐渐复苏,公司于郑州与杭州的项目销售顺利,预计房地产销售至少与去年持平。因此2009 年房地产营收预测上调25%至6.9 亿元。慈溪新项目已于5 月开工,地点在慈溪市区中心,意味未来销售潜力雄厚。此项目应可提供未来2-3 年盈利机会。因此,将2010 与2011 年房地产营收预测由3.5 亿元与2.4 亿元上修至4.5 亿元与6 亿元。 | 0.39 | 0.43 | 0.53 | 11.82 |

| 业绩预测与估值的均值(元) | 0.433 | 0.497 | 0.523 | 12.40 | |||

| 目前股价的动态市盈率(倍) | 24.71 | 21.53 | 20.46 | ||||

| 风 险 提 示 | |||||||

| (1)受金融危机影响,入境游业务增长潜能减弱;(2)房地产业务受政策影响比较大,股权投资收益受股票市场波动影响比较大。 |