| 申银万国 | 中国中铁(601390) | 岳阳纸业(600963) | 森洋投资 | 该公司估值水平曾受到汇兑风险压制,目前澳元等货币反弹使公司一季报汇兑损失有所好转,估值有望出现恢复性上升。公司还在工程设计实力、订单获得等方面具有优势,面对铁路基建投资爆发性增长,公司收入成长性更为看好。该股目前刚刚启动上一台阶整理,中期潜力犹存,可跟进。 公司在国内上市公司中最早开展建设林纸一体化项目,另外公司自产浆品种丰富。公司所处的洞庭湖区有大面积的人工速生杨木和高产量的荻苇,原料就近采购极大地降低了成本。公司自身原料供应有保障,而且抗风险能力和应对成本压力的能力提高,增长前景广阔。

中山公用(000685) 上海电气(601727)

公司已通过资产重组,换股吸收合并了控股股东中山公用事业集团,实现了整体上市。公司目前持有15%广发证券股权,券商借壳上市事宜成为其催化剂。公司还是区域水务龙头,水价调整预期也对公司构成利好。该股近日结束楔形整理加速上涨,可等技术调整在通道中轨一带择机吸纳。 公司与西门子、ABB等国际制造商建立战略合作关系,换股吸收合并上电股份后成为集大型电力设备、机电一体化、重工、轨道交通设备、环保设备为一体的上市公司。公司募集资金20亿主要用于风电和核电项目的发展,未来将受益于新能源行业的快速发展。

万科A(000002) 保利地产(600048)

该公司销售额达到近5个月来高点,去库存状况良好,土地获取量明显增长。公司销售定价精准优势逐步体现,销售均价较行业整体率先出现提升。考虑到存货减值的转回以及价格的超预期,公司盈利有望超预期。该股中期上升通道已经形成,5日、10日均线一带可吸纳。 公司从一家广州区域性房地产开发企业迅速成长为一家全国性大型房地产集团公司,在全国范围内树立起了保利品牌声誉。2009年以来公司销售情况良好,可推货量不断增加,充分分享了全国不同区域的机会。公司在广州拥有丰富的优质土地储备和大量可结转货量,将充分受益于珠三角市场的率先反转。

| 策略:3000点关前多空双方暂时保持平衡,立足中线,可关注铁路、水务等防御性行业机会,低估值优势会吸引资金加盟;而房地产板块仍是未来成长性的确定者,可加大配置其中的龙头品种。 | 策略:大盘依旧在5日均线上方运行,且均线系统继续呈现多头发散排列,KDJ、MACD仍处在强势,但日K线再次收出十字星,短线变数加大。整体来看,新股发行在即,再加上3000点关口压力,短期大盘面临一定的调整压力。 |

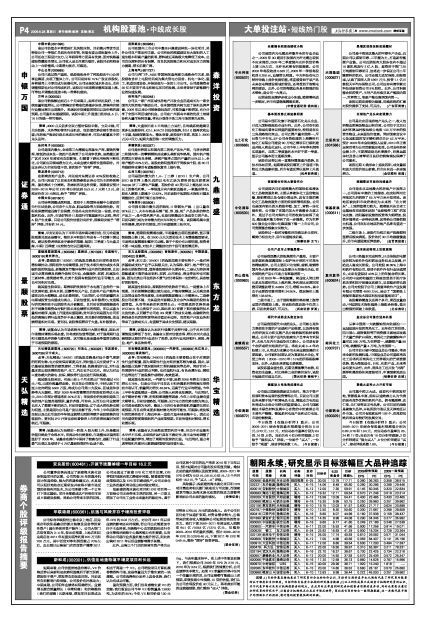

| 证券通 | 法拉电子(600563) | 承德钒钛(600357) | 九鼎德盛 | 公司是国内最大、全球第三大薄膜电容器生产商,高效的管理、较低的成本及一流的产品构筑了公司竞争优势。虽然搬迁新厂区对2009年营收有负面影响,但随着下游应用结构不断优化,公司新应用领域潜力巨大,未来业绩大幅增长值得期待。兴业证券认为目前估值不贵,首次给予“推荐”评级。 公司是世界第五和国内第二的钒产品生产商,与居世界第二和国内第一的攀钢钢钒形成寡头垄断竞争格局。国内钒产能的增加主要来自承钢,承钢产能将占国内产量的50%以上、全球产能的20%左右。该股走势明显滞后于同板块个股,在60日均线获得支撑后有望酝酿恢复性上扬行情。

锦龙股份(000712) 山西三维(000755)

在剥离房地产业务,并完成对东莞证券40%股权收购之后,公司已形成了以自来水和投资参股证券公司为主的经营格局,盈利模式十分清晰。考虑到各项业务贡献,国泰君安预计2009-2010年公司EPS将分别达到0.53元、1元和1.3元,合理定价在22元附近,给予“增持”评级。 公司是国内最大的1,4-丁二醇(BDO)生产商,公司BDO是世界上最先进的以电石乙炔为原料的低压淤浆床Reppe法丁二醇生产装置,若油价在40美元以上能达到35%以上的高毛利率。一季报显示有六家新进基金,一家基金增仓,股东人数较上期减少12.82%。目前该股中短期技术指标已基本调整到位,反弹行情正在孕育中。

中国太保(601601) 马钢股份(600808)

公司结构调整成效明显,受益于上海国际金融中心建设的先行先试优势,公司在个人年金、航运保险等方面取得优势。而标准保费增速远高于总保费,市场并未完全消化这一信息,存在套利机会。此外,市场好转后H股发行可能重新列入议程,将对A股产生支撑。目前公司股价估值仍有折价,国泰君安给予“增持”评级、目标价24元。 公司拥有国内最先进的热轧H型钢生产线(出口量在30%以上),火车车轮是马钢“板、型、线、轮”产品体系的特色产品之一,是中国名牌产品,也是马钢最具市场竞争力的产品,目前马钢已成为全球最大的火车车轮生产商。该股筹码集中度有所提高,绝对价位较低,后市有望继续上拓空间。

| 策略:平安证券认为下半年市场冲高动能仍在,但无论是复胀预期兑现还是落空,物价水平和股市均会有一个回落下探过程。建议投资者采取攻守兼备的策略,短期(三季度)与大盘共舞,中期(四季度)应控制仓位以回避风险。 | 策略:随着股指震荡加剧,市场量能出现明显萎缩,显示谨慎氛围占据上风。在3000点大关面前技术上有震荡整固要求,市场将反复震荡积蓄冲关动能。鉴于个股分化比较明显,投资者不要一味追涨,对技术上调整到位的个股可逢低博反弹。 |

| 景顺股票 | 景顺股票股票池:(600068)葛洲坝、(601328)交通银行、(600519)贵州茅台。 | 东方龙股票池:(000959)首钢股份、(600050)中国联通、(000402)金融街。 | 东方龙 | 点评:景顺股票(162601)的选股思路是关注那些受益内需持续拉动、国际竞争力持续增强、处于技术领先地位或技术突破阶段的制造业、新能源及节能环保等行业内的优势股票,比如城市必需消费及消费升级相关行业、金融服务、医药、机械及化工新材料、建筑建材等,此类个股拥有较强的行业引导能力,成长空间相对乐观。 点评:东方龙(164001)的选股思路主要有两个,一是对经济基础或支柱产业予以积极关注,认为保险、银行、地产等行业具备长期投资价值,值得逢低吸纳并长期持有。二是认为经济周期敏感度不高的食品饮料、医药、公用事业、商业等品种也可跟踪。因为此类公司在经济不景气时仍将保持一定的增长,具备较好的防御性。

就其重仓股来说,葛洲坝的优势在于水电施工业务的一体化优势明显,拥有水泥、民爆等相关产业,且这些产业产能均有望在近年大幅释放,成长前景明朗。与此同时,公司在新疆的水电领域投资也有望成为亮点。目前估值低,有补涨潜力;交通银行的优势则在于近期股性充分被激活,且目前信贷规模提速有利于刺激各路资金对银行股未来业绩增长的预期,所以买盘力量相对雄厚,短线上升通道有望延续;贵州茅台则是因为公司所处的高端白酒行业竞争并不是太激烈,而且提价预期渐强,故业绩增速相对乐观。更何况,该股表现滞后于大盘,有补涨要求。 就其重仓股来说,首钢股份的优势在于两点,一是整体上市预期。目前首钢集团搬迁较为成功,产能持续释放,从关联交易以及同业竞争等角度看,未来首钢集团整体上市概率大。二是参股公司前景不错,尤其是贵州首钢以及北京汽车集团的股权有望增值,从而带来新的利润增长点;中国联通的优势则是WCDMA有点类似于2.5G,因此在3G背景下拥有极强的技术先发优势,从而赋予公司在3G背景下的成长动能;金融街的优势则是自有房的租赁带来估值安全边际,而房地产开发业务则带来了业绩成长点,有望赋予其成长性预期,建议跟踪。

| 策略:该基金认为市场系统性风险已大部分释放,因此对市场维持谨慎乐观态度。但考虑到估值等因素,对于强周期行业和主题类品种的参与度有限,这可能也是该基金净值增长略低于市场预期的原因。 | 策略:该基金认为本次行情属于反弹行情,出于对后市的谨慎适当降低了仓位。该基金主要对估值合理、增长空间大或业绩预期比较好的行业进行了投资,这些行业包括银行、保险、商业、地产、食品饮料等。 |

| 天弘精选 | 天弘精选股票池:(600720)祁连山、(600325)华发股份、(600739)辽宁成大。 | 华宝精选股票池:(000800)一汽轿车、(600900)长江电力、(600000)浦发银行。 | 华宝精选 | 点评:天弘精选(164201)的选股思路是对处于景气周期的医药生物、电力设备保持高度关注,同时重点关注受益于4万亿基础设施投资的建筑建材、工程机械、铁路建设行业,对行业基本面出现改善的房地产、化工、汽车也予以关注。而认为对出口度依赖大的家电、纺织、钢铁等行业应进行风险规避。 点评:华宝精选(240010)的选股主要着眼点在于对周期性行业的配置,因为周期性行业对经济复苏较为敏感,因此,该基金重点选择了煤炭板块和工程机械板块等品种。同时针对一些周期性行业的拐点判断,也对造纸行业、有色金属行业、钢铁行业等进行了波段操作或增持,收效显著。

就其重仓股来说,祁连山前5个月水泥出厂均价超过410元/吨,出现价涨量增态势。而且在公司增发中,中材认购了祁连山定向增发5500万股,将成为公司第二大股东,区域竞争形势将大大缓和。预计2009年全面摊薄后的每股收益将达0.85元,2010年预计增速将在30%左右;华发股份的优势则是珠三角的地产业复苏超预期,量价齐涨,可持有,从而为公司业绩增长注入了源源不断的活力,目前估值较低;辽宁成大的优势也较为明显,主要是因为公司是广发证券影子股,今年上半年活跃的交投以及由此引发的半年报业绩增长预期将赋予该股较高的估值溢价。更何况IPO开闸也意味着借壳上市的券商批复时间的临近,可跟踪。 就其重仓股来说,一汽轿车不错,虽然2008年轿车市场仅增长6.78%,但该公司由于马自达6和奔腾系列等终端车型得到市场认可,销量同比增长48.84%,远高于行业平均增速。今年上半年有望延续这一趋势,公司渐入到黄金发展期。与此同时,由于钢材价格下降、所得税率调整等因素,今年上半年业绩有望大幅增长。目前估值略低,可跟踪;长江电力的优势也较为突出,公司现金流较为充沛,整体上市后仍有新的装机容量增长的乐观预期,而且有带来更多题材催化剂的可能性,可跟踪;浦发银行的优势则在于上海近年来一直在打造全球金融中心,因此公司有望获得更高倾斜的产业政策预期。目前估值相对较低,增长前景乐观。

| 策略:该基金认为虽然前一阶段A股大幅上升,但是整体估值仍然处于合理水平。而流动性仍然宽松,市场整体环境将明显好于2008年。该基金在操作中保持了较高仓位,超配了行业景气乐观以及受益于4万亿基础投资的行业或个股。 | 策略:该基金认为虽然政策面利好不断,但由于企业盈利水平并不乐观、未来经济运行具有不确定性,故主动性地调整了行业配置的弹性,增加了周期性股票的比重。与此同时,重点考虑季报和月度环比数据超预期的低估值行业。 |