长安汽车(000625):具备防御与增长双重属性

2009年09月06日 来源:上海证券报 作者:

我国的汽车工业在实现技术国产化、产能规模化、产品系列化之后正处于“黄金岁月”,其中乘用车的需求正处于大爆发阶段。目前乘用车市场的半壁江山基本上由一汽、二汽、上汽和长安汽车四大巨头占据,其中长安汽车又占据了受到政策高度扶持的小排量乘用车将近1/3的市场份额,是名副其实的小排量乘用车的行业老大。一方面市场需求的高度繁荣,另一方面政策对小排量乘用车的特别优惠,使得公司盈利在今年出现迅猛增长。后续农村市场需求的开启,以及更进一步优惠政策可能实施,将会给公司带来超预期增长的潜力。因此,虽然长安汽车在整车行业股中不是最优异的,但是业绩弹性与超预期潜力最大,目前的估值水平也是相对低廉的。从而使该股具备了防御与增长的双重投资属性得到了机构投资者的高度关注。

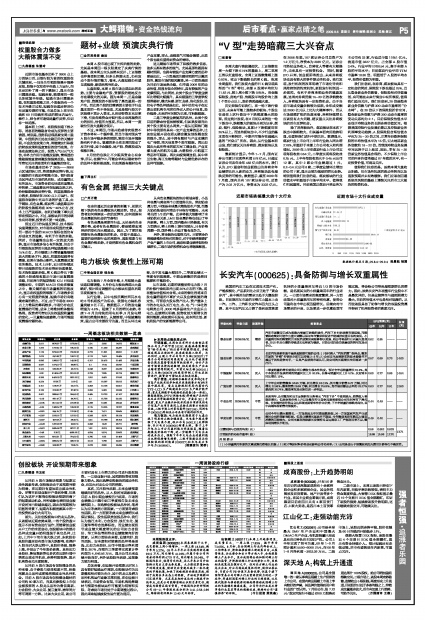

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值(元) | ||

| 09年 | 10年 | 11年 | |||||

| 联合证券 | 2009/08/31 | 增持 | 汽车市场繁荣已成为刺激内需最可依赖的途径,汽车下乡补贴政策有望延续,而购置税政策则可能作出重大调整以保证车市繁荣和促进节能减排双重目标的实现。小排量乘用车的购置税完全取消政策如果能够得以实施,则公司将是行业内最大受益者,2010年后业绩的持续成长也将更为确定。目前公司仍是估值最低的乘用车龙头企业。 | 0.62 | 0.85 | ---- | ----- |

| 国金证券 | 2009/08/30 | 买入 | 长安汽车是轿车股中最具超预期可能的公司:1)农村跨入“汽车消费”临界点,微车市场的“井喷”行情至少还可以持续2-3年;2)公司自主品牌轿车的技术储备并不落后于其他竞争对手,一旦其产品获得市场认可,则公司的长期增长空间将进一步打开。 | 0.57 | 0.69 | 0.73 | 14.00 |

| 中银国际 | 2009/08/31 | 买入 | 二季度销量的增长使得公司业绩发生根本性转变。预计全年总销量增长61.9%,其中本部合并报表范畴的销量同比上升92.8%,长福马销量同比上升52%、长安铃木同比增长19%。 | 0.60 | 0.77 | 0.86 | 14.54 |

| 广发证券 | 2009/08/31 | 买入 | 上半年公司销售微车34.95万辆,同比增长63.13%;其中微卡销售6.27万辆,同比增长22.98%;微客销售28.69万辆,同比增长75.66%,其市场份额由去年的25.27%提高到30.74%,微型客车龙头地位进一步巩固。 | 0.63 | 0.77 | 0.91 | 12.60 |

| 中金公司 | 2009/08/31 | 中性 | 未来两年,公司微车和自主品牌轿车业务将从“汽车下乡”中受益较大,销售收入将稳定增长;但原材料价格上升以及微车行业竞争加剧将使得公司毛利率有下滑风险。长安福特则凭借马自达和福克斯轿车性价比优势,下半年销量仍将维持高位,且中高端车型销售有望复苏。 | 0.44 | 0.49 | --- | --- |

| 平安证券 | 2009/08/31 | 中性 | 公司今年业绩大幅增长,一方面是因去年同期基数较低,另一方面国家汽车产业政策对公司经营影响积极。但其业绩增长基础并不稳固,今年微型客货车购买力透支消费的可能较大,公司主要利润来源长安福特马自达南京工厂产能利用率不足,整体利润增长不明显。 | 0.49 | 0.40 | --- | --- |

| 业绩预测与估值的均值(元) | 0.56 | 0.662 | 0.833 | 13.71 | |||

| 目前股价的动态市盈率(倍) | 18.89 | 15.98 | 12.70 | ||||

| 风 险 提 示 | |||||||

| (1)小排量乘用车新的优惠政策仍然难以把握;(2)刚才等原材料价格变动影响公司毛利率;(3)公司是否出于谨慎原则加大费用计提存在不确定性。 |