随着股指在上周绝地反击以及市场对行情延续度的关注程度提升,越来越多的资金开始对指数基金的配置比例、配置方向产生了较为浓厚的兴趣。就目前的数据显示,9月份将有9只指数基金(银华沪深300指数基金、国投瑞银沪深300指数分级基金、诺安中证100指数基金、海富通中证100指数、华宝中证100、南方中证500、交银上证180公司治理ETF联接基金、交银上证180公司治理ETF、华安上证180ETF联接)陆续发行,从而给相关成份股带来定向买盘,并助力市场企稳预期。

一、金融股为指数增仓的第一大目标

按照今年以来基金募集发行的平均额度33亿元,并以指数基金投资相关成份股的上限90%计算,我们得出每只指数基金投入相关指数成份股约为30亿元,并以此来测算基金增仓相关成份股的股数。

从测算结果我们可以看出,指数基金增仓量前十位中有六家为银行股,中国银行以5.75亿股居首,而前50名中金融板块占了三分之一。由于金融板块大都属于权重股,可见指数基金在建仓过程中对市场的影响可谓举足轻重。从测算中我们还可以发现,作为另一权重板块的房地产公司在前50大增仓股中只占两席:万科A(2822万股)、保利地产(1323万股),可见房地产板块今后对基金净值的影响可能并不如大家想象的那么大。

二、指数基金配置或更重行业

上面的测算是严格按照相关成份股在指数中的占比所得,但从以往经验来看,指数基金的配置一般并不是严格按照成份股在指数中的比例进行的,毕竟不少指数基金其实崇尚的是在被动中追求主动的操作思路。也就是说,表面看来指数基金是针对成份股配置,是被动投资,很难大幅超越相关指数升幅的。但由于指数中的成份股拥有不同的行业前景,所以如果选择符合行业发展前景的成份股进行重点重配,那么就可以取得相对积极的投资效果,即指数基金的净值提升会超越相关指数的升幅。

反观目前指数基金的配置来看,似乎也体现了这一点。比如新近发行的基金对中国平安等金融股的配置额度为1.77亿元,兴业银行、招商银行、交通银行等银行股也分别获得了1.446亿元、2.094亿元、2.004亿元的配置额度。相反,钢铁板块的武钢股份只有0.312亿元、包钢股份也只有0.138亿元。为何?其中的因素就是因为银行股、保险股等金融行业前景相对确定,而钢铁行业目前受钢材价格不振的压力预期,所以基金配置比例并不大。

三、市场在稳定中重心有所上移

有意思的是,体现在二级市场股价走势中就是金融股在指数基金积极买盘推动下股价重心在近期一度迅速上移,尤其是上周末的走势更是如此。而且,本周一中国平安等品种的涨升也是大盘在早盘一度跳上2900点的积极牵引力。

当然,同一板块内的不同品种的配置比例也存在着一定的差异。比如保险股中的中国平安基金配置了1.77亿元,但中国太保只有配置了0.081亿元,而中国太保、中国平安在指数权重中的比例分别为1.35%、2.95%。对此,有观点认为,中国平安的业绩弹性、业绩成长趋势更为乐观,故机构资金愿意多配置中国平安而不是中国太保。

如此走势其实折射出指数基金在指数被动投资中追求积极的方向,这也意味着A股市场目前的投资风格仍较为激进,这无疑会激发各路资金对未来市场趋势的一个相对乐观的看法。目前这一思路也迅速蔓延到短多资金中,故短线资金在近期也是围绕热门题材高举高打,在一定程度上聚集了市场人气,并牵引市场重心在震荡中上移。

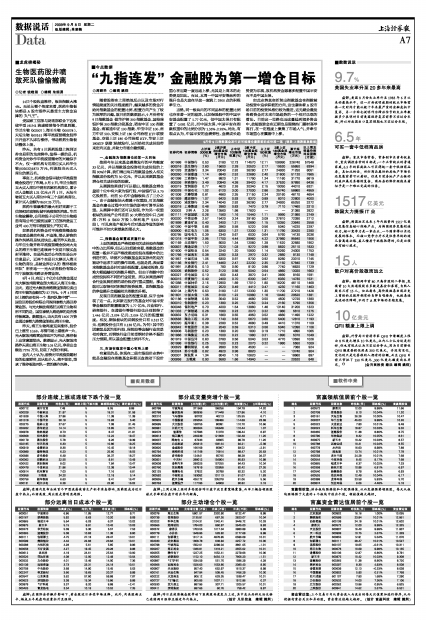

9月份9只指数基金发行后可能增仓量居前的成份股一览 (制表:上海聚源泉数据)

| 证券代码 | 证券简称 | 占沪深 | 2家沪深 | 占中证 | 3家中证 | 占上证 | 3家上证 | 累计拟 | 以上周五 300权重 300基金拟 100综指 100基金拟 180权重 180基金拟 增仓市值 收盘价相 (%) | 增仓市值 权重(%) 增仓市值 (%) 增仓市值 (万元) 对应股数

| 601988 | 中国银行 | 0.53 | 3180 | 12.73 | 114570 | 12.11 | 108990 | 226740 | 57548 |

| 600016 | 民生银行 | 2.60 | 15600 | 2.28 | 20520 | 2.17 | 19530 | 55650 | 8394 |

| 601328 | 交通银行 | 3.34 | 20040 | 2.92 | 26280 | 2.77 | 24930 | 71250 | 8051 |

| 600050 | 中国联通 | 1.14 | 6840 | 2.52 | 22680 | 2.40 | 21600 | 51120 | 7865 |

| 601398 | 工商银行 | 1.47 | 8820 | 1.31 | 11790 | 1.24 | 11160 | 31770 | 6619 |

| 600036 | 招商银行 | 3.49 | 20940 | 4.38 | 39420 | 4.17 | 37530 | 97890 | 6436 |

| 600019 | 宝钢股份 | 0.77 | 4620 | 2.26 | 20340 | 2.15 | 19350 | 44310 | 6321 |

| 600028 | 中国石化 | 1.02 | 6120 | 3.00 | 27000 | 2.86 | 25740 | 58860 | 4959 |

| 601006 | 大秦铁路 | 0.81 | 4860 | 2.35 | 21150 | 2.24 | 20160 | 46170 | 4654 |

| 601939 | 建设银行 | 1.07 | 6420 | 0.93 | 8370 | 0.89 | 8010 | 22800 | 4000 |

| 600000 | 浦发银行 | 2.34 | 14040 | 2.92 | 26280 | 2.77 | 24930 | 65250 | 3272 |

| 600018 | 上港集团 | 0.48 | 2880 | 0.83 | 7470 | 0.79 | 7110 | 17460 | 3210 |

| 000002 | 万科A | 2.26 | 13560 | 1.98 | 17820 | — | — | 31380 | 2822 |

| 601111 | 中国国航 | 0.26 | 1560 | 1.16 | 10440 | 1.11 | 9990 | 21990 | 2749 |

| 600030 | 中信证券 | 2.57 | 15420 | 3.24 | 29160 | 3.09 | 27810 | 72390 | 2712 |

| 601899 | 紫金矿业 | 0.40 | 2400 | 1.21 | 10890 | 1.15 | 10350 | 23640 | 2558 |

| 601390 | 中国中铁 | 0.66 | 3960 | 0.58 | 5220 | 0.56 | 5040 | 14220 | 2297 |

| 600900 | 长江电力 | 1.05 | 6300 | 1.37 | 12330 | 1.31 | 11790 | 30420 | 2280 |

| 600795 | 国电电力 | 0.39 | 2340 | 0.67 | 6030 | 0.64 | 5760 | 14130 | 2036 |

| 601318 | 中国平安 | 2.95 | 17700 | 4.44 | 39960 | 4.22 | 37980 | 95640 | 1906 |

| 601169 | 北京银行 | 1.50 | 9000 | 1.34 | 12060 | 1.28 | 11520 | 32580 | 1902 |

| 600837 | 海通证券 | 1.17 | 7020 | 1.03 | 9270 | 0.98 | 8820 | 25110 | 1833 |

| 601600 | 中国铝业 | 0.54 | 3240 | 1.20 | 10800 | 1.14 | 10260 | 24300 | 1753 |

| 601766 | 中国南车 | 0.38 | 2280 | 0.33 | 2970 | 0.32 | 2880 | 8130 | 1748 |

| 601857 | 中国石油 | 1.05 | 6300 | 0.97 | 8730 | 0.92 | 8280 | 23310 | 1745 |

| 601166 | 兴业银行 | 2.41 | 14460 | 2.47 | 22230 | 2.35 | 21150 | 57840 | 1739 |

| 601991 | 大唐发电 | 0.13 | 780 | 0.90 | 8100 | 0.86 | 7740 | 16620 | 1729 |

| 600005 | 武钢股份 | 0.52 | 3120 | 0.56 | 5040 | 0.54 | 4860 | 13020 | 1663 |

| 600027 | 华电国际 | 0.10 | 600 | 0.43 | 3870 | 0.41 | 3690 | 8160 | 1591 |

| 600015 | 华夏银行 | 0.40 | 2400 | 0.70 | 6300 | 0.67 | 6030 | 14730 | 1531 |

| 601088 | 中国神华 | 2.15 | 12900 | 1.89 | 17010 | 1.80 | 16200 | 46110 | 1468 |

| 600011 | 华能国际 | 0.42 | 2520 | 0.49 | 4410 | 0.47 | 4230 | 11160 | 1463 |

| 600104 | 上海汽车 | 0.53 | 3180 | 1.37 | 12330 | 1.30 | 11700 | 27210 | 1426 |

| 601601 | 中国太保 | 1.35 | 8100 | 1.22 | 10980 | 1.16 | 10440 | 29520 | 1381 |

| 601186 | 中国铁建 | 0.59 | 3540 | 0.52 | 4680 | 0.50 | 4500 | 12720 | 1380 |

| 600010 | 包钢股份 | 0.23 | 1380 | 0.25 | 2250 | 0.24 | 2160 | 5790 | 1356 |

| 600048 | 保利地产 | 0.70 | 4200 | 1.54 | 13860 | 1.46 | 13140 | 31200 | 1323 |

| 601333 | 广深铁路 | 0.26 | 1560 | 0.23 | 2070 | 0.22 | 1980 | 5610 | 1275 |

| 600832 | 东方明珠 | 0.31 | 1860 | 0.55 | 4950 | 0.52 | 4680 | 11490 | 1222 |

| 600583 | 海油工程 | 0.29 | 1740 | 0.63 | 5670 | 0.60 | 5400 | 12810 | 1193 |

| 600320 | 振华重工 | 0.38 | 2280 | 0.52 | 4680 | 0.49 | 4410 | 11370 | 1109 |

| 600642 | 申能股份 | 0.34 | 2040 | 0.59 | 5310 | 0.56 | 5040 | 12390 | 1106 |

| 600808 | 马钢股份 | 0.23 | 1380 | 0.20 | 1800 | 0.19 | 1710 | 4890 | 1065 |

| 601866 | 中海集运 | 0.25 | 1500 | 0.22 | 1980 | 0.21 | 1890 | 5370 | 1049 |

| 601919 | 中国远洋 | 0.63 | 3780 | 0.56 | 5040 | 0.53 | 4770 | 13590 | 1026 |

| 601998 | 中信银行 | 0.25 | 1500 | 0.23 | 2070 | 0.22 | 1980 | 5550 | 1009 |

| 000629 | 攀钢钢钒 | 0.48 | 2880 | 0.50 | 4500 | — | — | 7380 | 924 |

| 002024 | 苏宁电器 | 0.82 | 4920 | 0.98 | 8820 | — | — | 13740 | 904 |

| 000001 | 深发展A | 1.34 | 8040 | 1.18 | 10620 | — | — | 18660 | 897 |

| 000858 | 五粮液 | 0.93 | 5580 | 1.66 | 14940 | — | — | 20520 | 848 |