银行股是目前市场的焦点之一,一方面是估值水平低廉,投资价值显著;另一方面是银监会对银行拨备率的新规,使市场担忧银行股潜在的再融资压力。但经营素质不同,并不是所有的银行股有再融资需求的。正常情况下,越是经营增长性好的银行再融资需求就越是低,北京银行即是其中的典型。该行得益于先天的政策优势,以及正处于外延式扩张时期,公司的经营也正处于稳健增长状态,且根据其资产质量至少三年内不存在再融资的需求。优异的资产质量、稳健的高速增长也使其在所有银行股中成为机构投资者众所关注,并因其质地优良而被一致看好的重点。

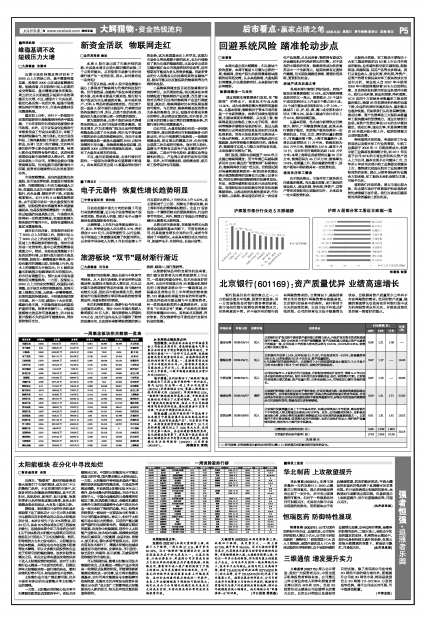

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) |

| 09年 | 10年 | 11年 |

| 国金证券 | 2009/09/14 | 买入 | 北京银行在扩张过程中提高资产盈利能力的潜力更大,外延扩张对资本的消耗是城商行中最低。预计公司未来3 年资产规模翻番,资产风险权重与贷款占资产比重提升的幅度一致,公司未来3 年的核心资本充足率为10.84%,10.02%和9.35%,依然无需补充核心资本。 | 0.96 | 1.21 | 1.49 | -- |

| 渤海证券 | 2009/09/11 | 买入 | 北京银行不良率1.14%,比年初低41个BP,不良形成率为-0.07%,拨备覆盖率200.41%,比年初提高20.18个百分点,资产质量稳定。 | 0.97 | 1.17 | -- | 19.40 | 6月起银行间市场利率回升,北京银行7、8月的活期存款也小幅回升,7、8月每个月的NIM都有7和8个BP的回升,异地分行发展良好。

| 中信证券 | 2009/09/11 | 买入 | 公司保持每年2-3家的分行开设速度,并依据当地情况开设支行,雨季3-5年内完成全国机构网点的布局。预计全年信用成本将维持低、低位,利润增长可期。北京银行利润增长模式稳健,资产质量可控,业务拓展潜力大,有望实现业绩可持续的增长。 | 0.97 | 1.19 | -- | 20.00 |

| 海通证券 | 2009/09/07 | 增持 | 北京银行的理财业务在业内处于领先地位,并且有望成为第二家获批的参股保险公司的银行。公司将长期受益与与政府部门和央企的良好的制度化的合作关系,并且这种合作关系在公司走向全国的进程中将发挥重要作用,异地分行的发展有望继续走在同类银行前列,稳健高成长进程将继续。 | 0.99 | 1.31 | 1.71 | 22.00 |

| 安信证券 | 2009/09/05 | 买入 | 北京银行贷款增量历来上下半年基本持平,如果这种情况在今年延续,意味着银行下半年的收入环比增速会显著高出行业平均。此外,公司基数相对较小,且积极拓展异地业务,异地业务的高速增长将继续成为公司未来的发展重要来源之一。北京银行不存在资金瓶颈,信贷增长没有外部限制,也存在异地扩张动力,银行资产质量情况稳定,较其他中小银行安全系数高。 | 0.91 | 1.31 | 1.61 | 19.22 |

| 业绩预测与估值的均值(元) | 0.96 | 1.238 | 1.603 | 20.16 |

| 目前股价的动态市盈率(倍) | 17.52 | 13.59 | 10.49 |

| 风 险 提 示 |

| (1)货币政策、利率政策变化影响公司经营业绩;(2)经济复苏状况影响到坏帐率的变化。 |