因我国经济正在从复苏开始走向扩张,受房地产、汽车、家电等耐用消费品行业景气度高涨的拉动,也伴随着PPI(工业品出产价格指数)的快速回升,处于中上游的钢铁等原材料行业已经开始进入新的增长周期。以宝钢、武钢等产品涨价为标志,整个钢铁行业目前正处于复苏的拐点阶段,行业中的优势公司在当前是机构投资者年终调仓的配置重点。虽然作为滞后复苏的行业,钢铁类公司2009年的业绩水平仍比较差,但目前行情开始演绎的是2010年的预期,根据诸多机构调研预测的业绩,武钢在钢铁行业中居于优势地位,明年的业绩将获得迅猛增长,因此被机构投资者列为行业配置的重点。

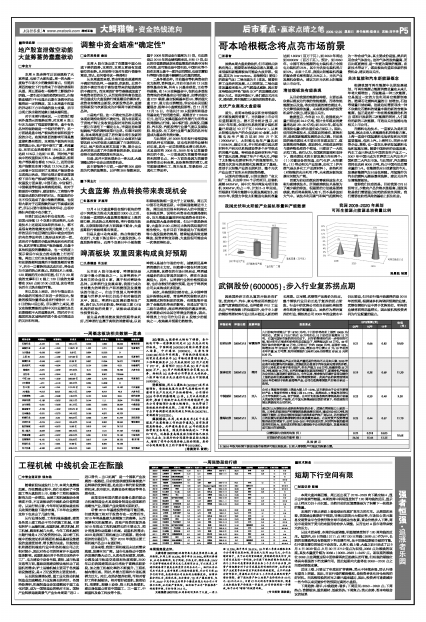

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) | ||

| 09年 | 10年 | 11年 | |||||

| 招商证券 | 2009/12/15 | 审慎推荐 | 九月份取向硅钢出厂价18792 元/吨,十月份价格有所上涨到19005 元/吨左右。武钢11 月出口约在10万吨左右,12月份估计能增至12 万吨,在国内国际市场的共同拉动下,后市销售情况有进一步转好的可能,预计明年在需求和价格的双双驱动下,销售能达到35万吨。09年预计取向硅钢产量30万吨,目前出厂价约19000 元/吨,若涨价20%,将增加09年EPS0.07元,涨价30%,增加09年业绩0.11 元;10 年若按全年产量36万吨算,取向硅钢涨价20%和30%分别增加EPS0.13 元和0.20 元。 | 0.21 | 0.66 | 0.85 | 10.00 |

| 国泰君安 | 2009/11/23 | 增持 | 今年以来武钢拳头产品无论是产量还是价格均不太尽如人意,2010年这些不利因素均有所减弱。武钢还充分受益于汽车及家电需求的井喷,其中三冷轧项目将于明年投产,年生产能力110万吨,热镀锌卷35万吨,冷轧板卷75万吨。在汽车销量连创新高的情况下,新增冷轧产能将为公司注入盈利提升新的动力。今年以来,需求较为旺盛并且带动钢价上涨的品种主要是螺纹钢、长材等建筑钢材,此类产品的供需面情况2010年仍将好于热轧板卷等产品,公司在收购鄂钢资产后将分享这一收益。 | 0.19 | 0.58 | 0.69 | 11.50 |

| 中银国际 | 2009/11/12 | 买入 | 公司3季度净利润较上季度大幅上升125%,这主要是由于公司主要钢材产品 3季度价格较2季度上涨12-17%。虽然如此,3 季度净利润仅占全年预测的5.4%,低于预期。公司计划配股收购的鄂钢是湖北省最大的建筑用钢生产基地,在中国大规模基建投资的背景下,相信建筑用钢比例提高对公司有利。 | 0.25 | 0.39 | 0.40 | 9.50 |

| 渤海证券 | 2009/11/11 | 买入 | 通过对三大钢铁巨头诸多财务指标的分析,武钢在管理能力上更胜一筹。三冷轧的顺利投产和鄂钢的收购是潜在利好,通过对公司三冷轧的调研了解到:目前公司轿车面版已获得多家汽车厂商认证,另外钢铁行业的回暖为配股收购鄂钢的成功实施奠定基础。在固定资产投资增速维持高位的背景下,公司2010-2011年仍具成长性,同时汽车板的盈利改善空间巨大、良好成本控制能力都能给予公司相应溢价,其盈利表现或可超出市场预期。 | 0.23 | 0.44 | 0.67 | 11.70 |

| 业绩预测与估值的均值(元) | 0.22 | 0.518 | 0.653 | 10.68 | |||

| 目前股价的动态市盈率(倍) | 36.36 | 15.44 | 12.25 | ||||

| 风 险 提 示 | |||||||

| (1)2010年取向硅钢下游变压器市场需求可能比较低迷;(2)注入鄂钢资产可能反而拖累业绩。 |