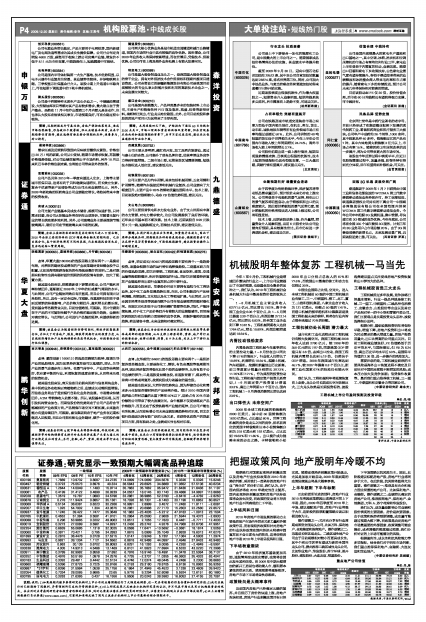

| 申银万国 | 创元科技(000551) | 隧道股份(600820) | 森洋投资 | 公司电瓷业务增长稳定,产品主要用于电网铁塔,国内新建电厂及电网改造等需求为其成长性提供保障。公司已公布定向增发4600万股,募资用于收购上游公司完善产业链,增发价不低于8.11元为市价支撑,中期趋势向上,短线震荡中可吸纳。 公司两大核心优势业务是城市轨道交通隧道和越江公路隧道,在国内市场同行业中具有较强的竞争优势。因世博会,公司2009年业务收入将保持较高增速,而在世博后,凭借技术、经验优势,公司仍可在上海及海外业务拓展上有较大发展空间。

长电科技(600584) 特变电工(600089)

公司是国内半导体封装第一大生产基地,技术优势明显,以电子元器件行业复苏为背景,其业绩弹性较佳,并涉物联网主题,三季报显示社保基金已介入。该股中期上升通道中平稳向上,可在短期下调通道中的下轨中择机吸纳。 公司是重大装备制造业龙头之一,是我国重大装备制造业的骨干企业,拥有对外经济技术合作经营权和国家外援项目建设资质。公司合资设立的新疆新能源股份有限公司是我国目前规模较大的专业从事太阳能开发和利用的高新技术企业之一,未来发展空间较大。

狮头股份(600539) 紫江企业(600210)

公司是中西部特种水泥生产龙头企业之一,中俄输油管建设、大型储油库项目等都对其产品有较多需求,最大看点在于资产整合,虽然在11月中旬作出澄清三个月内暂无具体动作,但也承认大股东在洽谈相关事宜,市场预期良好,可在企稳过程中吸纳。 公司是国内规模最大、产品种类最齐全的包装材料上市公司,主营生产和销售各种PET瓶及瓶坯、瓶盖、标签等新型材料,垄断特征突出,行业龙头地位稳固。此外,公司目前控股和参股的房地产项目已为其带来了丰厚利润。

申万组合:近期新股发行节奏过快,房地产调控政策突至,造成市场恐慌抛售,形态破位个股普跌,但从业绩基本面看,未来中期趋势仍有期待,建议选择有潜在整合预期的品种,适量参与,耐心持有。

| 策略:近期新股发行节奏过快,房地产调控政策突至,造成市场恐慌抛售,形态破位个股普跌,但从业绩基本面看,未来中期趋势仍有期待,建议选择有潜在整合预期的品种,适量参与,耐心持有。 | 策略:本周连续四天下跌,沪综指向下逼近60日均线和3100点关口,市场心理面和资金面面临双重考验,但在宏观基本面向好和通胀预期的背景下,后市不宜过度悲观,建议关注受益通胀的行业和个股。 |

| 证券通 | 星湖科技(600866) | 西藏发展(000752) | 九鼎德盛 | 需求旺盛及反倾销导致国内呈味核苷酸供应紧张,价格创出20万/吨的新高,公司从中受益,随着市场需求恢复,苏氨酸价格强势坚挺,对公司业绩贡献将出乎市场所料,另外10月以来利巴韦林价格急剧走高,也将给公司带来意外的惊喜。 公司主要从事啤酒、藏红花开发、加工及酒店旅游业,通过与嘉士伯的合资,公司提升了现有品牌价值,使其啤酒业务竞争力得到明显增强。二级市场上看,近期该股区域震荡调整,短线技术指标进入低位区,建议逢低关注。

双鹭药业(002038) 杭钢股份(600126)

公司产品贝科2010年一季度有望进入北京、上海等主要城市医保目录,这将有利于贝科继续快速增长,而长效立生素、复合干扰素等新产品储备将成为公司未来业绩增长点,另外,2009年新收购的医药商业公司业绩稳定增长,将给其带来丰富的投资收益。 公司主要产品为汽车用钢,其余包括机械用钢、五金用钢和矿用钢等。随着汽车强劲反弹和机械行业复苏,公司业绩有了大幅度回升,主要产品中69%的钢材质量达国际水平。技术上看,目前该股绝对涨幅较小,动态PB估值优势明显,建议关注。

南玻A(000012) 文山电力(600995)

公司光复产业链基本完成技术储备,规模可快速扩张,只待需求回暖,而公司太阳能业务将在明年出现转折,可随着光复行业的增长获取更多地利润。另外,公司玻璃业务主要是围绕节能玻璃展开,看好公司在节能玻璃未来市场的拓展。 公司主要经营供电和水力发电业务,由于文山州拥有丰富的水力资源,对电力需求较大,为公司发展提供了良好的环境,近年来公司基本面不断改善。技术上看,近期该股自9.99元跌至8元一线,短线跌幅过大,面临技术反弹,建议逢低关注。

| 策略:全球主要经济体的经济复苏过程均已进入V型右侧,2010年全球主要经济体的GDP增速都会触及前期均值,之后出现分化,各个经济体将有不同的表现,而在短期扰动消失后,复苏迅速转入繁荣周期。 | 策略:本周沪深大盘收出长阴线,但量能并末放大,因此下周部分超跌品种、预期较佳品种面临表现机会,稳健投资者可关注反弹中是否有量能配合,可逢低短期操作,建议投资者操作上回避绩差股。 |

| 华夏大盘 | 皖维高新(600063)、星湖科技(600866)、片仔癀(600436) | 华泰股份(600308)、湖北宜化(000422)和恒瑞医药(600276) | 华安成长 |

点评:华夏大盘(160305)的选股思路主要有两个:一是提前布局,对潜在的题材股或潜在的产业政策题材受益概念股予以配置,比如说海南旅游岛板块的布局就是最好的说明;二是对既拥有防御性也拥有题材溢价预期的医药股情有独钟,加大了配置力度。 点评:华安成长(160407)的选股思路主要有两个:一是趋势投资。该基金根据市场的运行特征选择强势股。二是基本面方向的价值选股思路,即关注钢铁、工程机械、食品饮料、建筑、交通运输等涨幅较落后、相对估值较低的行业。同时关注随着经济复苏产业链延伸而出现行业复苏拐点的中游行业。

就其重仓股来说,皖维高新受下游需求推动,公司产能利用率持续回升,逐渐接近2008年上半年的旺盛景气周期的水平。与此同时,公司产业链协同效应有所显现,而且公司拥有国元证券股权,所以,具有一定安全边际,可跟踪。而星湖科技则在于受到反倾销的积极影响,产品价格大幅回升,盈利增长前景乐观,受到基金等各路资金关注,目前估值略低,可跟踪。而片仔癀则在于产品的不可复制性赋予产品价格的稳定涨升趋势,业绩相对确定增长。与此同时,公司进行产品链的延伸,有望获得新的进展。 就其重仓股来说,华泰股份目前主要拥有造纸与化工两块业务,其中化工业务发展趋势乐观,而且,公司积极进行产品结构调整,向铜版纸、文化纸以及化工等领域扩展。与此同时,公司还因非经常性损益等因素而赋予公司年报业绩预喜的题材催化剂。而湖北宜化则在于公司拥有磷矿资源等优势,同时,产能持续拓展,对于化工产品价格回升有着较大的业绩敏感性。而恒瑞医药则因为在仿制药方面独特的竞争优势,把握肿瘤药的发展趋势,药品储备丰富,未来业绩相对确定增长。

| 策略:该基金认为随着经济形势明朗化,将逐步提高股票仓位,并加大了对房地产、煤炭、钢铁等周期行业的投资力度,从区域经济增长和产业结构调整的角度寻找机会,对投资组合进行优化调整。 | 策略:该基金认为全球性的流动性泛滥将极大程度带来整体或局部的通胀预期,从而支撑上游原材料、资源、地产等行业的投资机会,故将以投资、消费、出口为主线,关注上中下游行业的轮动机会。 |

| 鹏华创新 | 南天信息(000948)、荣信股份(000123)、嘉宝集团(600622) | 大西洋(600558)、金牛能源(000937)和北京银行(601169) | 友邦盛世 |

点评: 鹏华创新(160613)的选股思路较为独特,强调先导产业的选股视角,因为如果经济复苏是可以延续的,那么,先导产业的景气会逐步向上传导。在景气传导中,产业竞争结构较好、供应紧平衡的行业,利润恢复的速度会更快,从而带来乐观的投资机会。 点评:友邦盛世(164601)的选股思路主要有两个:一是经济复苏受益概念股,主要是指化工、钢铁、有色金属股等强周期性品种,因此经济复苏将强化此类个股的业绩弹性,从而有助于公司业绩的弹升;二是通胀受益概念股,在通胀背景下,煤炭等大宗商口价格或将复苏,故煤炭股成为该基金的重仓股。

就其重仓股来说,南天信息目前拥有医药与信息两块业务,其中医药业务在收购云南植物药之后,业绩成长动能明显增强。而信息业务则由于受到银行自助化业务的发展,市场需求持续回升,ATM等销售收入前景不错。所以,该股基本面乐观,从而引发机构资金加仓。而荣信股份的优势则在于公司产品符合节能减排的产业政策方向,产品销售市场空间不断拓展,未来盈利能力有望持续回升,可跟踪。嘉宝集团则在于地产业务在近期相继进入回报期,而且公司拥有核电业务题材,赋予一定的股价催化剂。 就其重仓股来说,大西洋的优势突出,因为焊接自动化和需求多元化促使焊接材料的产品结构升级。预计2010年国内普通焊条占焊材总量的比重下降至50%以下,这给占有20%市场份额的公司带来了较大发展空间。金牛能源不仅受益煤炭产品价格涨升,而且还在于投资铁路等产业链的延伸,且公司产能也有所拓展,从而意味着公司未来业绩发展趋势相对乐观。而北京银行则是因为拥有较广泛的人脉关系,在获得优质资产的贷款项目方面,拥有独到之处,业绩成长性也相对乐观。

| 策略:该基金判断A股市场未来将整体趋稳,科技创新、低碳经济等对结构调整有支持并对未来经济发展产生重大意义的行业将是关注的重点;另外,金融、地产、资源、制造业等行业也值得关注。 | 策略:该基金认为经济数据表明,国内经济依旧在复苏的轨道中前进,未来出口有望接替投资拉动经济增长,故仍保持相对积极的投资思路,重点投资品种为煤炭股、金融股等经济增长受益品种。 |