宇通客车是国内客车行业地位、竞争力、业绩水平最好的公司,但也是股价估值水平最低的公司。究其原因可能是上半年受国内外经济环境影响,业绩大幅度滑坡所导致的。但根据专业机构的调研信息,进入下半年后一方面行业出现迅速复苏,另一方面原先被抑制的产品需求得到集中爆发,促使公司业绩水平在下半年,尤其是第四季度出现迅猛回归,从而使其整体滞涨的行情估值优势开始得到体现。通过机构调研信息显示,基于该公司优越的竞争能力和技术储备,国内最具国产化技术优势、产销成本最低、也最能达到批量生产混合动力客车的企业不是其他,而是宇通客车。从而促使该股既具备了估值上的防御性优势,也符合了低碳经济投资主题,从而正在逐渐被机构投资者所重视。

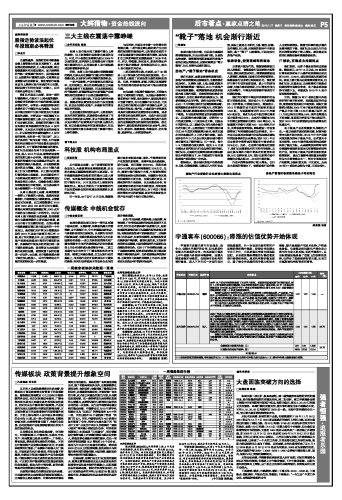

评级机构 评级日期 股票评级 投资要点 EPS预测(元) 估值

(元)

09年 10年 11年

申银万国 2010/01/14 增持 09年12月份公司客车销量创了历史单月新高,受经济的回暖及春节时间的推后,预计1月份客车的旺销仍能延续,而去年同期客车行业处于最低谷期,09年1季度公司销量仅为3796 辆,初步预计今年1 季度公司销量将同比增长90%左右(实际销量仍存超预期的可能),1季度业绩值得期待。 1.07 1.27 1.46 --

客车行业是充分竞争的行业,未来行业的竞争将主要体现在品牌、产品质量、产品技术、公司管理等方面,竞争实力差的企业将逐渐被淘汰。公司现在拥有领先的电泳级生产线、独立的实验和研发中心,在产品质量、技术及规模上均领先于竞争对手,现阶段宇通和金龙合计销量市场份额在50%左右,未来公司市场份额仍有较大提升空间。

对于在行业中具有绝对竞争优势、稳定现金分红的公司,不应给予低于市场平均水平的估值,目前股价已被低估。

东方证券 2009/12/31 买入 未来十年是大中型客车行业进入销量增长和销售结构显著改善同时并存的全新阶段,大中型客车行业依然是非常具有吸引力的成长性行业。铁路客运能力的提升总体上促进了公路客运行业的发展,由于铁路客运能力、运输效率的提升,创造了新增客运需求,这为公路客运创造了新增的大量的中短途客运需求。国家长期的经济增长将更加依赖于国内消费的增长,而中小城市的消费需求的增长显著快于大型中心城市,各种服务和商品的销售渠道将明显下沉,中小城市的商务活动更加趋于活跃,这将有力促进中短途客运需求的增长,这部分客运需求只能由公路客运来满足。海外市场复苏并快速成长已是大概率事件。 1.03 1.31 1.55 32.75

铁路出行的舒适性,中短途公路客运竞争的加剧,客观上促进了公路客运行业所用车辆向着大容量、更加舒适、更加节能环保的方向发展,这有利于宇通这样技术领先的公司。

业绩预测与估值的均值(元) 1.05 1.29 1.505 32.75

目前股价的动态市盈率(倍) 18.83 15.33 13.14

风 险 提 示

(1)宏观经济复苏进程缓慢,客流量回升乏力;(2)地方政府对公交车行业补贴力度无法加大;(3)原材料价格上涨幅度超出预期。