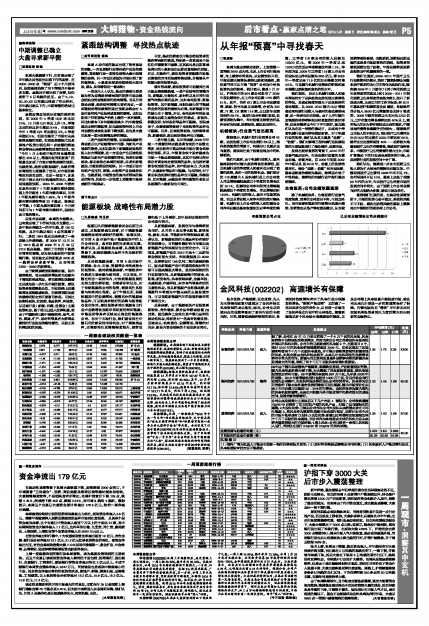

评级机构 评级日期 股票评级 投资要点 EPS预测(元) 估值

(元)

09年 10年 11年

安信证券 2010/01/26 买入 据了解,公司在09年12月份又销售了一个5万千瓦的风电场,风电场销售不但带来投资收益增加,同时也确定公司之前建设风电场时没有确认的风机利润。公司目前已经建成的风电场2个,在建项目6个,预计2010年的风电场销售规模将超过2009年。自治区规划了达坂城和哈密两个千万千瓦级风电基地,并可能出台政策要使用新疆本地的风机,如果全部由金风科技来供货,未来几年金风科技的业绩增长将有非常大的空间。新疆与西北联网及直流外送将解决制约新疆风电发展最大的问题,确保了两个千万千瓦级风电场能如期建设。 1.25 1.72 2.29 43.00

银河证券 2010/01/26 推荐 09年由于国内风电整机产能提高,规模效应显现,产业配套更加完善,国内风电机组价格大幅下降,大大降低了风电场投资成本,使风电场投资更加有利可图。09年新增风电装机897万千瓦,几乎是2008年的两倍。2010年新增装机预计会超过1000万千瓦,并且市场会向行业领先公司集中,对金风科技这样的龙头公司非常有利。风电作为在目前条件下除水电外最有优势的清洁可再生能源,国内市场预计在未来3年内仍然可以维持20-30%的年增长。金风科技作为国内领先的风电机组制造商,未来在开拓国内外市场过程中仍然有很大的成长空间,发展前景依然看好。 1.22 1.44 1.88 40.00

渤海证券 2010/01/26 买入 公司未来发展潜力主要来自以下几个方面:1.国际化:公司收购德国VENSYS后拥有了自主知识产权的风机产品,扫除了迈向国际化的道路;2.大股东优势:三峡总公司作为公司大股东未来将重点放在可再生能源上,把风电作为重要的战略目标来进行规划,这将对公司今后的市场开拓形成有力支持;3.区位优势:新疆已在哈密和达坂城规划两个千万千瓦级的风电基地,而公司作为本地重点支持的风机企业未来将有望获得更大的市场份额;4.海上风电:公司已经有一台海上风机投入运行,同时还在进行2.5MW和3.0MW的风机试验。 1.24 1.43 1.69 37.00

业绩预测与估值的均值(元) 1.237 1.53 1.953 40.00

目前股价的动态市盈率(倍) 25.38 20.52 16.08

风 险 提 示

(1)海外厂商大批进入可能会引发新一轮的价格和技术竞争;(2)原材料价格波动影响公司毛利率;(3)风机被列入产能过剩行业后,风电场建设审批方面可能趋紧。